Industry participants are exploring a range of different approaches to support Australia’s infrastructure needs as the economy faces into a higher inflationary environment.

Article

Industry participants are exploring a range of different approaches to support Australia’s infrastructure needs as the economy faces into a higher inflationary environment.

Article

The NAB board member and Queensland University of Technology chancellor reveals what drives her passion for social change and equity as special guest at the inaugural NAB Women in Funds and Infrastructure networking event.

Article

A series of NAB-led deals involving major telcos and private capital from infrastructure investors points the way to effectively monetising undervalued assets for growth.

Article

Federal Budget 2023 delivered a $4.2bn surplus, and focused heavily on relief – targeting energy bills and the cost of healthcare in a big way.

Insight

Investors head Down Under with NAB to meet local issuers keen to engage with a uniquely stable, long-term funding source amid volatile times.

NAB’s first sustainability-linked foreign exchange (FX) derivative aligns environmental, social and governance (ESG) targets with financial risk management for a major London-listed infrastructure investment company.

A landmark $1.8 billion green sustainability-linked loan sets ambitious targets for reducing energy and water usage for a major fleet of city trains and maintenance centre.

Growth in sustainable financing continues to exceed market expectation.

Webinar

As part of NAB’s Bank for Transition interview series we speak to Associate Professor Rae Dufty-Jones and Dr Neil Perry from Western Sydney University on the future of building sustainable communities and how government is listening.

Our 10th biennial survey – the only survey of its kind to examine hedging techniques of Australian Super Funds – captures their shifting priorities in this rapidly changing landscape.

After the fanfare of the opening statements and commitments, the second week at Glasgow meant bridging divides to reach a consensus deal in extra time as the Paris 2015 ambitions start to take flight.

A new NAB report offers insights into how asset managers are incorporating sustainability metrics into their investing activities and what companies can do to develop best-in-class strategies.

A look at how industry leaders are changing their behaviours across the infrastructure cycle from investment to planning to delivery.

Digitalisation is enabling more aspects of our world to connect.

Hydrogen holds great promise in decarbonising hard-to-abate sectors in the transition to a low carbon economy, as Australia’s trading partners ramp up their commitments to net zero.

Companies that need to adapt and transition to lower carbon and more sustainable growth are tapping into a range of new sustainability-linked debt offerings to help finance this transition.

The banking sector has an important role to play in supporting industry through the economic recovery.

Over recent months, every organisation has had to adapt and innovate to find new ways of doing business.

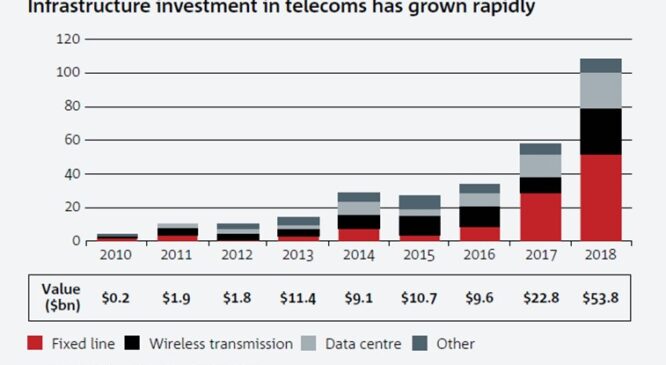

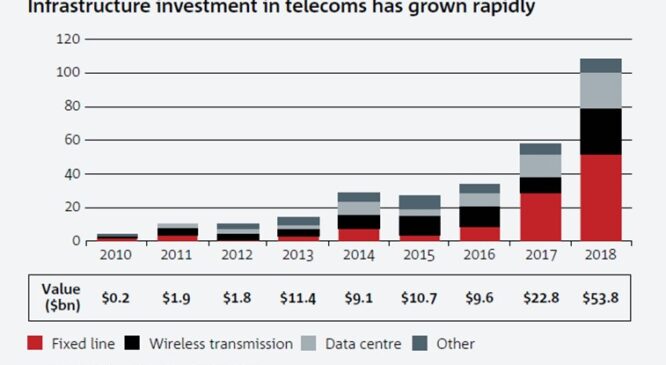

The COVID-19 pandemic is set to accelerate the shift to the digital economy, expanding the relatively new asset class of digital infrastructure.

No state or territory will be spared from COVID-19 economic fall-out.

Extracting maximum use from products and resources, by recycling and reusing as much as possible, will help move Australia closer to a circular economy that minimises waste.

The offshore wind industry is booming, with 22GW of installed capacity worldwide and the first project planned for Australia.

Janari Tonoike, head of NAB Japan Securities Limited, National Australia Bank’s (NAB) new Tokyo-based, wholly-owned subsidiary, showcases the long-standing relationship between Japan and Australia, and explains how the new entity can help investors and borrowers in both markets and beyond connect better in a challenging global business environment.

As the end of year approaches, we’d like to recognise how our corporate and institutional clients are making a difference, in Australia and around the world.

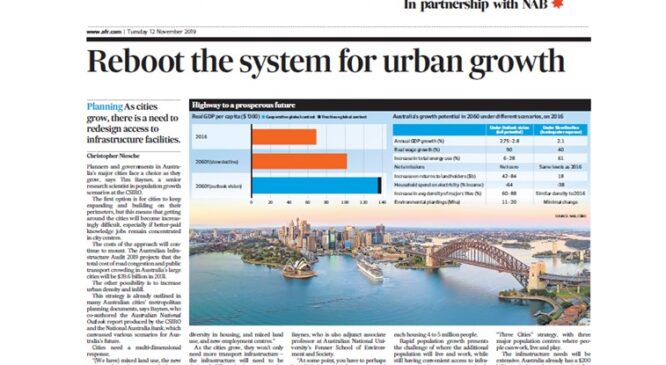

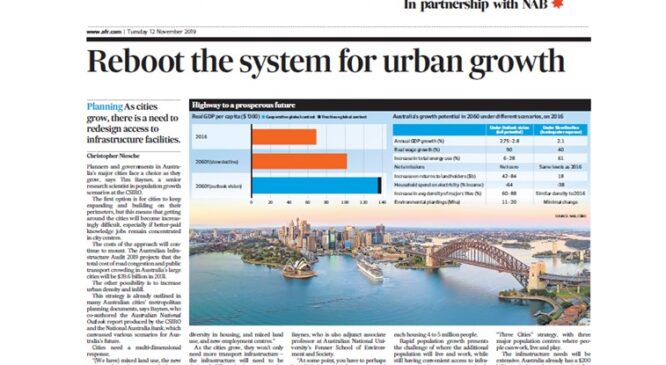

The AFR takes an in-depth look at Australia’s infrastructure outlook.

Now is an optimal time for Asian investors and contractors to explore Australia’s thriving infrastructure sector.

More Australians will be able to access affordable housing following a $2 billion commitment from NAB which will see more homes being built across the nation.

The Australian economy grew by 1.4% over the year to the June 2019, its weakest growth since 2009.

With the help of some big thinking and timely funding, Port of Melbourne has gone from strength to strength as they meet the needs of a growing Australian economy.

Global renewable energy owner, operator and developer, Pacific Hydro partnered with NAB to realise its renewable energy vision.

Treasury representatives from Associated British Ports, Peel Ports, NSW Ports and the Port of Tauranga recently met to explore and share their insights on the opportunities and challenges facing port owners and operators.

Amid an expensive market and an uncertain global economy, fund managers are cautioning discipline, though there are opportunities for investors to look outside traditional markets and work on assets.

A landmark PPP refinance meets the needs of investors for a low-risk investment as well as the needs of borrowers for longer-dated debt.

The Better Infrastructure Initiative recently launched a Customer Stewardship Roundtable series. Read the insights from the first event.

Panelists at NAB's annual DCM conference discussed the ideal confluence of demand and supply in the Asia Pacific (APAC) region, which is home to some of the worlds fastest growing economies.

Investing in infrastructure is a long-term trend that will continue to endure global economic challenges, generating healthy returns and diversification opportunities as investors enhance focus on environmental, social and governance (ESG) factors.

The rising global stature of Asian investors and their search for fresh avenues to deploy their expanding wealth is aiding the growth of new markets.

In a new CSIRO report, Australian energy productivity and low emission technologies offer affordable, reliable energy and create new opportunities and sources of comparative advantage if three key levers are implemented.

According to a new report by CSIRO, Australia will have well-connected, affordable capital and satellite cities that offer equal access to quality jobs, lifestyle amenities, education and health services if three levers are implemented.

Australia offers Asian investors portfolio diversification in a stable economic and political environment.

Deterioration in conditions in most states, with current momentum negative. Household sector weakness evident, investment still ok (outside mining), while agri. facing easing prices and needs rain. Housing sector downturn, population growth centred on the eastern states, agricultural prices easing.

NAB recently invited Treasury representatives from Heathrow, Changi, Sydney, Brisbane and Auckland airports to a virtual Global Round Table to discuss the opportunities and challenges of rapid growth in passenger traffic.

After 27 years of steady economic growth – a record unmatched by any other developed economy – some are asking whether Australia is overdue for a recession.

Global investors are increasingly allocating funds to infrastructure and many investors are implementing new methods and measures to both adapt to and lead a stewardship mandate into infrastructure investment.

As more local governments around Australia seek new ways to treat food waste, councils in southeast Melbourne have met the challenge of bulging landfill and increasing greenhouse emissions by composting household organic waste on an industrial scale.

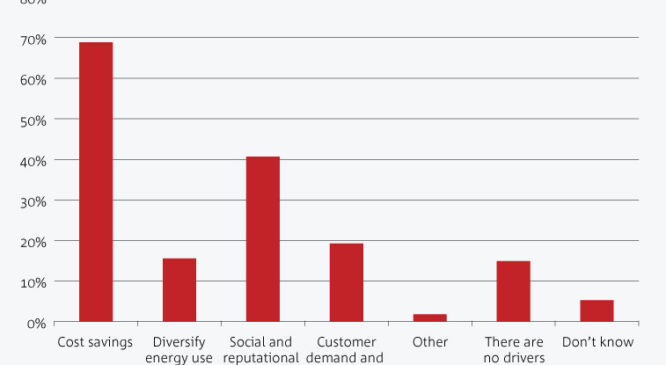

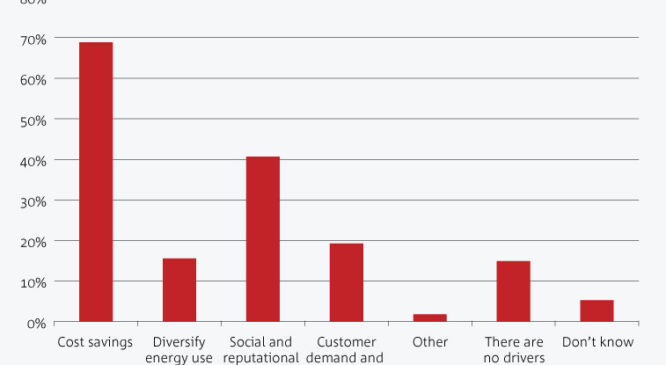

Where do Australian businesses stand on renewable energy usage?

There’s growing awareness across industry, government and the community that we need to improve the way we design, build and operate the buildings in which we heal.

Australia’s energy landscape is undergoing a significant transformation which includes the increased penetration of renewable energy technologies.

As electricity prices continue to rise and domestic gas supply across eastern Australia tightens, Cooper Energy is one company that’s thinking big so it can be a significant part of the solution.

New infrastructure is a fundamental piece of Western Sydney’s growth plans.

Pioneered by City of Melbourne, participants of the Melbourne Renewable Energy Project combined their renewable energy demand to support a new renewable energy development.

Macquarie saw demand for long tenors and appetite for socially responsible investments.

Conditions are expected to remain strong for corporate and institutional level borrowers in Australia in 2019.

As 2018 draws to a close, we’d like to share some of the achievements of our Corporate and Institutional clients over the past year.

Australia’s superannuation funds should seriously consider infrastructure investment opportunities that help build the nation, NAB Chief Customer Officer of Consumer Banking, and former Premier of New South Wales, Mike Baird, says.

Population growth has become an important issue for the economy and associated politics.

Infrastructure may be complex but that is never a reason for tolerating under performance and insensitivity to customers.

Customer stewardship matters because infrastructure is an intimate part of nearly every aspect of our lives, therefore quality of services and astute long-term investment decisions have never been more important

Customer stewardship means putting the customer at the centre of our infrastructure.

Using blockchain to boost green investment: How to create trust, transparency and liquidity for green infrastructure opportunities.

Business should recognise the powerful role it can play in ensuring Australia has the right infrastructure, in the right places; infrastructure that’s affordable, reliable and sustainable.

The Victorian economy has been one of Australia’s fastest growing this year. Given the scope of construction projects now ramping up it's likely transport infrastructure spending will continue to contribute strongly to Victorian growth over the next year.

Growing interest from investors has underpinned the rapid development of the renewables sector, a key industry conference has been told.

Representatives from Australia’s infrastructure sector discuss how they’re responding to the risks associated with climate change.

The digital economy has given rise to its own infrastructure needs, and investors are paying attention.

As the current phase of privatisations approaches its conclusion in Australia, local infrastructure investors are looking to international markets for investment opportunities. At the same time, global capital that was drawn to the Australian market by the deep pipeline continues to actively pursue Australian deals. This has created significant competition in Australia and seen infrastructure investors increasingly focus on a broader class of assets.

Globally, the finance sector is directing ever-greater amounts of capital to address social and environmental challenges. Australia has more work to do on this front.

New research released today by NAB shows electricity and roads have the biggest impact on our daily lives - affecting almost 1 in 2 people (either positively or negatively).

Participants at the 2018 Asian Debt Capital Market conference discuss some of the key megatrends bringing depth and dynamism to Debt Capital Markets in the Asia-Pacific region.

Political risks and uncertainty may be on the rise. But a recent tour of Asia for the NAB Asian Debt Capital Markets Conference reminded NAB Global Head of Research Peter Jolly of the many causes for optimism about Australia’s economy.

At NAB’s 2018 Asian Debt Capital Markets Conference, experts, issuers and investors zeroed in on the forces that will build connections and foster future opportunities.

Major Australian organisations are now directly investing in large-scale renewable energy projects through the new NAB Low Carbon Shared Portfolio, the first of its kind in Australia.

The Low-Carbon Shared Portfolio is the first of its kind in Australia.

The world’s first sustainability bond from a university is funding a better future for students and for vulnerable communities.

Part-privatisation was the catalyst for an epic US private placement deal for Australian utility Ausgrid.

Breaking into the Australian renewable energy market with a new mode of financing was a great challenge and a golden opportunity for Goldwind. Three deals later, the company’s aiming to power one million Australian homes.

The launch of the green-loan principles (GLPs) presents an opportunity for another evolutionary step in sustainable funding. By standardising and codifying what qualifies as green bank lending, the GLPs could make sustainable finance relevant to a wider cohort of borrowers according to David Jenkins, director, sustainable capital markets at NAB.

A new debt market is evolving that could help give mid-sized Australian companies that don’t have a credit rating more options to secure debt funding from investors.

NAB and Asiamoney's latest poll on Asian and European investors’ appetite for Australian debt tells a story of consistency and stability as the region presents a safe option amid turbulence - while also offering sustainable opportunities.

This week NAB's 100th green energy project provides funding for the Crowlands Wind Farm project in Western Victoria.

Ports and airports, toll roads and tunnels. These are just some examples of infrastructure sold into the US Private Placement (USPP) market over the last several years.

NAB has debuted several innovative green and social bonds in recent years. In this article we go behind the scenes to find out how a new, green investment product reaches the market.

As the cost of healthcare continues to rise, state and federal government budgets are facing a growing challenge of balancing the competing needs of health-care expenditure with other areas of spending such as schools and roads.

In a wide-ranging state-of-the-market perspective, Steve Lambert, Executive General Manager, Corporate Finance at NAB, attributes Australian transaction breakthroughs in 2017 to long-term positive trends on the demand side.

Population growth remains very strong – QLD strengthening.

Reduced government funding and a growing population are forcing local councils to find alternative funding for public assets and community projects. NAB has already started filling the gap, with new mechanisms opening up funding sources usually closed to small lenders.

Mike Baird, NAB’s Chief Customer Officer-Corporate and Institutional Banking talks to the opportunities the infrastructure market offers and how our clients can benefit from Australia’s infrastructure investment.

This fourth in a series of Policy Outlook papers, by The Better Infrastructure Initiative and The University of Sydney’s John Grill Centre for Project Leadership, addresses the pressing issue of how to create customer-led infrastructure and the long term benefits it brings to stakeholders.

It’s among the top three challenges facing us all according to the World Economic Forum – climate change adaptation. But there are challenges to financing such investments in Australia. How can we ensure critical infrastructure is resilient for a changing climate, integrating physical risk into investment practices?

After the recent investor jitters triggered by the failure of some Public Private Partnership (PPP) toll roads, it looks like a new wave of infrastructure PPPs, kick-started by Federal and State Government investment, are making a strong comeback.

Any examination of the Asia-Pacific region’s capital requirements, whether by a government, issuer or investor, must begin with the acknowledgement that demographic and financial pressures mean countries can no longer ‘go it alone.’

There’s a fine balance between risk and reward in major infrastructure projects. Understanding the opportunities and challenges is equally important, as is securing the right kind of funding.

We’re already living in smart cities. The challenge facing Australia is how to ensure our cities deliver the best possible living and working environments in the future.

NAB Chairman, Dr Ken Henry shares his vision for how we can address Australia’s infrastructure needs, as our population grows.

This paper calls for customer-led infrastructure and specifically identifies examples of the 'DIY protagonist - those individuals, businesses and communities who have identified a need for specific infrastructure and have made it happen.

Asian investors are poised to play a key role in helping to manage Australia’s current stock of infrastructure, and planning and funding it for the years to come.

Socially responsible investing (SRI) means integrating non-financial factors – such as ethical, social or environmental concerns – into the investment process with the aim of earning both a financial return and a moral ‘return’.

Given the success of PPPs and privatisations at the Federal and State Government levels, why are local governments not in the spotlight?

The Federal Government is committed to accelerating economic infrastructure investment in Northern Australia. Up to $5bn in concessional loans to accelerate that investment - are available.

Research by NAB shows Australians don’t think about infrastructure projects as just concrete, bricks and mortar, but rather as the services or conveniences that are derived from them. The role of the customer, and their satisfaction, has been a weakness in the infrastructure governance settings for some time.

Impact investing (sometimes also referred to as mission-related investing) is an investment strategy where an investor proactively makes investments that can generate both financial returns, as well as intentional social or environmental returns for the community.

Australia and Canada are both running infrastructure deficits and require significant investment to continue to foster economic activity and maintain core social services. NAB’s Chief Customer Officer (Acting) - Corporate & Institutional Banking discusses the key area of infrastructure that Australia needs to do better: funding.

Mornington Peninsula Shire is investing an estimated $9.5 million in emissions reduction projects over the next five years as part of a far-reaching plan to generate a cleaner and greener environment as well as operational savings.

Conversations about the role infrastructure plays often begins from the perspective of what we don’t yet have, what doesn’t work well, and how much more money we need to deliver better outcomes. NAB believes we are better served by reframing that conversation into one which first acknowledges the wealth of the existing infrastructure framework.

North Sydney Council has turned to some different financial strategies to create a more flexible funding structure that’s helped drive a series of multi-million dollar infrastructure projects.

This is the sixth in a series of reports prepared by the Australian Centre for Financial Studies for National Australia Bank aimed at explaining the potential role of corporate bonds in retail investor portfolios and promoting growth of the corporate bond market.

Infrastructure Partnerships Australia estimates that $700 billion of funding is needed over the next decade to finance the long term infrastructure investments – the nation building – we need to secure our future. We look at the building blocks that are falling into place.

The infrastructure sector was one of the big winners in the Federal Budget, with the share of infrastructure spending rising in both dollar terms and as a share of government spending. This should go some way in helping to fill the void left by retreating mining investment.

NAB’s Sector Insight reports utilise our expertise across a range of industry sectors to explore current issues, present forward looking views and opportunities for growth and progression. Our reports also include some perspectives from respected industry leaders in each edition. Welcome to our 2012 publication of Sector Insights: Transport & Logistics. In this edition, we […]

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.