China’s growth beat expectations in Q1, but big question marks around its sustainability

Insight

The 2014 Australia-China Trade Report reveals China is Australia’s top dairy export market highlighting the considerable growth potential for Australian agribusiness in processed food as Chinese incomes rise.

NAB has proudly sponsored the 2014 Australia-China Trade Report which was developed by the University of Sydney and commissioned by the Australia China Business Council (ACBC). ACBC is one of Australia’s most respected industry bodies.

By combining desk research, case studies and a proprietary business survey of over 200 businesses that are already engaged with China, the report examines the benefits of the bi-lateral trade. This is the only report that quantifies the value Australia-China trade at a household level.

This excerpt from the report, examines manufacturing trade between the two countries.

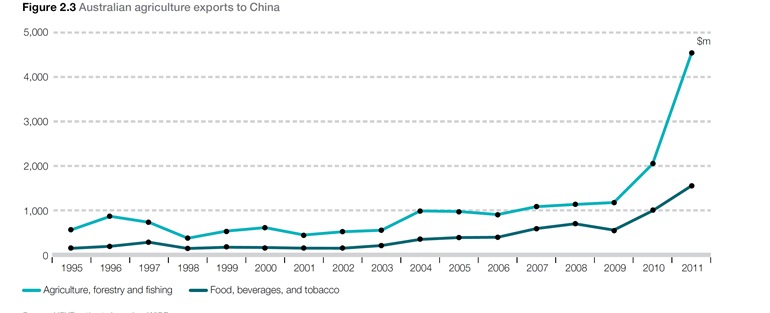

Export of agricultural and food products from Australia to China have risen dramatically since 2009, with China now the largest market for Australian agricultural and food products.

The export market for Australian dairy products is also set for strong growth. China is Australia’s top dairy export market with exports to Greater China (China, Hong Kong, Taiwan) increasing 40 per cent in 2013 to 2.1 million tonnes.

There is considerable growth potential for Australian agribusiness in processed food as Chinese income rises. Seventy-four per cent of agribusiness exports to China are in the agriculture, forestry and fishing subsector compared to 26 per cent in the food, beverage and tobacco subsector, reflecting Chinese demand for fresh Australian produce. In contrast, Australian exports to Japan and Korea are dominated by processed food while agriculture, forestry and fishing claim a smaller share of exports (Figure 2.4). Demand for Australian processed food is likely to increase as Chinese disposable income levels approach those in Japan and Korea.

Exports from the agriculture, forestry and fishing sub-sectors are destined primarily for processing. Certain raw agricultural materials, such as cotton, go into the textile supply chain (11%) where products are sold both domestically and internationally. Australian premium quality beef products mainly go into China’s hotel and restaurant supply chains before reaching end customers.

Exports from the food, beverages and tobacco sub-sectors usually go directly to the consumer market (62%), while smaller quantities go to hotels and restaurants (7%) and further processing (14%).

Comparison with New Zealand food exports shows that New Zealand has a better penetration of Chinese consumer markets (Table 2.3) and occupies a stronger position in the higher value consumption segment of the domestic Chinese market. Despite differences in agricultural industry structure, the strong position of New Zealand in the consumer segment points to untapped market opportunities for Australian exporters.

In view of its growing demand for clean and safe food, China is set to remain the top export destination for Australian agricultural exports. A growing middle class in China will boost demand for animal exports and exports for processed products in the food and beverage sector. Australian agricultural exporters face positive prospects in Chinese consumer and producer markets.

An encouraging development is Chinese plans to invest in the Australian agricultural sector, such as the recent announcement by the Beijing Agricultural Investment Fund to invest $3 billion in an agribusiness supply chain stretching from Australian farms to Chinese consumers. This degree of transnational supply chain integration necessarily involves significant infrastructure investment at both ends of the chain, as well as major challenges in operations management.

The commitment of Chinese investors to building up infrastructure in Australia and the challenges they face is well illustrated by the Ord River Project by Shanghai real estate investor Shanghai Zhongfu. The challenge for Shanghai Zhongfu was to integrate off-take from its planned Australian operation into the long supply chain of China’s domestic market.

Shanghai Zhongfu’s familiarity with China’s domestic market was crucial in making the investment decision. Originally Shanghai Zhongfu was planning to grow sugar cane, but then settled on sweet sorghum as a more suitable crop for the immediate future. Locally grown sorghum will first be processed in a sugar mill that Shanghai Zhongfu is building for AUD $250 million. It will then be shipped to China for further processing into ethanol and bio-fuel. In addition, Shanghai Zhongfu is introducing the cultivation of chia seeds which have been approved for food consumption in China. The Ord River region is one of the places suitable for the cultivation of chia seeds. Demand in China for this type of health food is strong.

More than a third of Zhongfu’s investment in the Ord River project will be in infrastructure. This includes construction of thermal power plants, railways and port expansion. Poor infrastructure has restricted the growth of local businesses as local products cannot be exported because the lack of rail and port infrastructure. Building local infrastructure will benefit Zhongfu as well as the local economy.

Findings from the Australia-China Business Survey provide a snapshot of the opportunities respondents see for Australian agribusiness in China.

NAB Sponsored 2014 Australia-China Trade Report Commissioned by The Australia China Business Council (ACBC). Pages 22 – 27.

More from NAB:

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.