20 October 2025

December 8, 2025

Business Pulse: December 2025

Whatever the size of your business, there are many opportunities today to streamline, and take control of, your finances.

By Julie Rynski

A lot of business owners think specialist financing is beyond their reach – that it’s for large corporations only.

But in reality, it’s available to many small and medium-sized businesses too.

Today, sophisticated financial tools are more accessible than ever, giving small and medium sized businesses the chance to create greater stability by hedging against interest rate or foreign exchange fluctuations.

Take interest rates. While they’re largely beyond your control, how your business manages interest exposure can be a real opportunity – providing certainty to plan for the long-term.

If all your loans and accounts sit with one provider, it can make it easier to take a holistic view of your financial position – and potentially save on costs.

I encourage you to discuss with your business banker how a conversation with a specialist banker can help your business move forward. Your banker can connect you with specialists in Transactional Banking, Trade & Working Capital, Foreign Exchange, Interest Rate Risk Management and Equipment Finance who will work as one team to provide expert advice, innovative solutions and safe and secure ways to protect your business.

Strength in streamlining

The same applies to managing your business finances more generally. Smaller businesses can suffer from scattered processes and multiple relationships, without the benefit of a dedicated team to manage it all.

Again, they may be missing out on important opportunities.

Even if your banking needs aren’t complex, having everything under one roof can make a real difference. It not only simplifies your processes but also gives you greater clarity and control.

And with a dedicated relationship manager overseeing the lot and connecting you to the right specialists in line with your needs, you’re in an optimal position to focus on what matters most – whether that’s getting on running your business day-to-day or pursuing your next phase of growth.

Behind the numbers

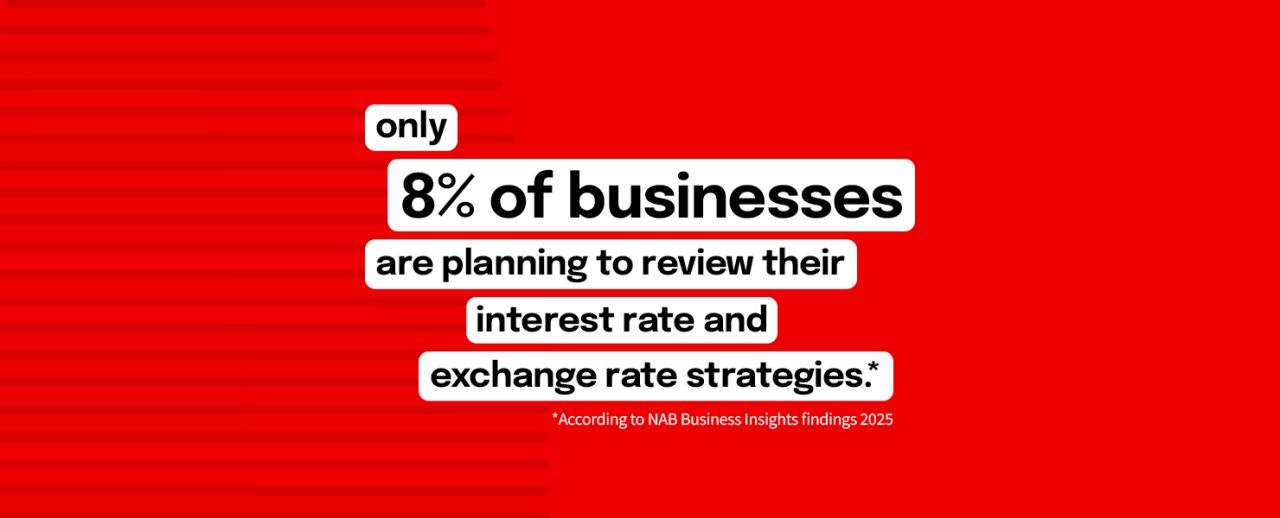

Only a small number of businesses are taking a proactive approach to their finances, according to NAB’s latest research. Just 8% are focused on their interest rate or exchange rate strategies, 29% are reviewing cash flow and working capital, and 13% are looking to improve payment cycles. Yet around two in five say cash flow and profitability are keeping them up at night. Talking to a specialist could help change that. It’s one of the simplest ways to gain greater certainty and control over your finances.

Did you know?

Fixed Income makes up 1% of SMSFs Asset Allocation versus 19% of Professionally Managed Super Fund asset allocation, according to ASFA.

Watch the latest Monthly Business Insights webinar on fixed income, a key asset class for investors seeking income and stability in a shifting interest rate environment. This session offers insights into how fixed income can support portfolio diversification and long-term financial goals.

Confidence, with caution

Economic conditions may not have been the easiest to navigate this year, but NAB’s latest quarterly survey shows business conditions and confidence are both in positive territory for the first time since 2022.

It ties in with other positive indicators. Forward orders rose in the third quarter and our transactions data points to a solid rise in spending.

However, the two-speed economy remains. Victoria continues to lag in both confidence and conditions – reflecting conversations we’re hearing on the ground. South Australia also stands out as the only state still in negative territory for business confidence.

The information contained in this article is believed to be reliable as at 8 December 2025 and is intended to be of a general nature only. It is not intended to be relied on as advice. It has been prepared without taking into account any person’s objectives, financial situation, or needs. Before acting on the information in this article, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial, taxation or other professional advice before acting on any information in this article.

©2025 National Australia Bank Limited ABN 12 004 937 AFSL and Australian Credit Licence 230686.