Hear NAB’s senior expert panellists discuss a range of topics to provide key insights to help you and your business prepare for the current property market climate.

Ethical investment was a hot issue at the KangaNews-NAB Fixed Income Beyond the Institutional Sector Summit in July. NAB’s Mark Todd and a panel of ethical investment industry leaders discussed how this market is developing in Australia.

Participants:

Richard Brandweiner, Partner, Leapfrog Investments

Daniel East, Chief Executive Officer, Grosvenor Pirie Management

Richard Lovell, Executive Director, Investments, Clean Energy Finance Corporation

Tom Wirth, General Manager, Balance-Sheet Strategy, National Australia Bank

Moderator, Mark Todd, Director, Capital Finance, National Australia Bank

Tom, NAB is changing the way it funds itself. How’s NAB rethinking what ethical investors want?

Wirth: We used to be deposit-based and with very small balance sheets; it was very hard to get credit. The opening of wholesale and financial markets allowed consumers and businesses to get credit. We used to fund long assets quite short. Some experiences overseas – the GFC and Basel III reform – prompted change. The last 10 years has been a journey of changing that structure – more retail deposits and more longer bonds.

We’re always looking at what our investors want. In terms of socially responsible bonds, it’s much more advanced in Europe and the US, but Australian and Asian investors are looking for those opportunities.

Richard Lovell and Richard Brandweiner, how are you investing and what have returns been like?

Lovell: The Clean Energy Finance Corporation was created to catalyse investment into the clean energy segment. Our mandate focuses on three areas – renewables, energy efficiency and low emission technology.

Since inception, we’ve put out over $4 billion associated with projects with value of $11 billion.

We have a portfolio average return target that is given in our mandate. We’re just below at the moment as we’re ramping up and taking on senior debt, but we haven’t lost any money.

Brandweiner: The way that capital is deployed will have ramifications for the next 40 years. Every investment has externalities. If you build a bridge or building you’re moving workers or changing productivity, so there are externalities that flow that have broader economic impact. When you deploy capital, externalities will flow back and affect other parts of the portfolio.

The world into which we retire will be a function of how capital is deployed. So investing in a way that explicitly targets certain social outcomes alongside generating a financial return seems logical.

Leapfrog Investments is a pioneer in profit with purpose. We invest in growing businesses in Africa and Asia that provide essential services to low income consumers. 70% of global economic growth will come from Africa and Asia. And we want to boost the livelihood of people living on less than $10 per day.

The commercial opportunity is also overwhelming. Leapfrog is trying to demonstrate that you can generate strong returns while achieving targeted and measured social outcomes.

Can you see any major risks associated with the rise of super funds focused on impact investment?

Brandweiner: The issue is whether putting a social lens comes with a compromise in returns that might lead to underperformance in retirement. The work we do is about finding investments where the purpose drives the return. If you’re providing underserved communities with insurance for the first time and make an immense difference to their lives they’ll keep buying it.

There’s also reflexivity to consider. Over time, as more people recognise where their clothes are being made and the value chain that has led to the products they look at, consumers will demand higher standards, which will flow back to ethical behavior driving return.

East We’re trying to take what’s being talked about here and apply it to superannuants – real users. We’re trying to match their values with the assets that the super fund is targeting through three products: Super Future – Australia’s first fossil fuel free super fund; Cruelty Free Fund – for investors who have an interest in ethical and other values (including the avoidance of cruelty to animals); and our own fund.

What we’re looking for is engagement. When superannuants understand they can effect change, they’re engaged with the product and are happy members.

Are there tangible examples of what Leapfrog is investing in?

Brandweiner: We’re looking for investment where purpose creates the return and there’s no trade off – but causality. AllLife Investments is an insurance business we bought into in Southern Africa offering insurance to people with HIV. These people can’t get home loans and they’re excluded from the financial services industry, so AllLife created a life insurance product alongside a healthcare program which required them to maintain their health – and every six months go to a clinic and give a blood sample and confirm they are following the programme. This lifted their life expectancy up to close to the rest of the population.

This was an untapped market: no one was providing product to that community, and AllLife did it profitably and made our investors a lot of money.

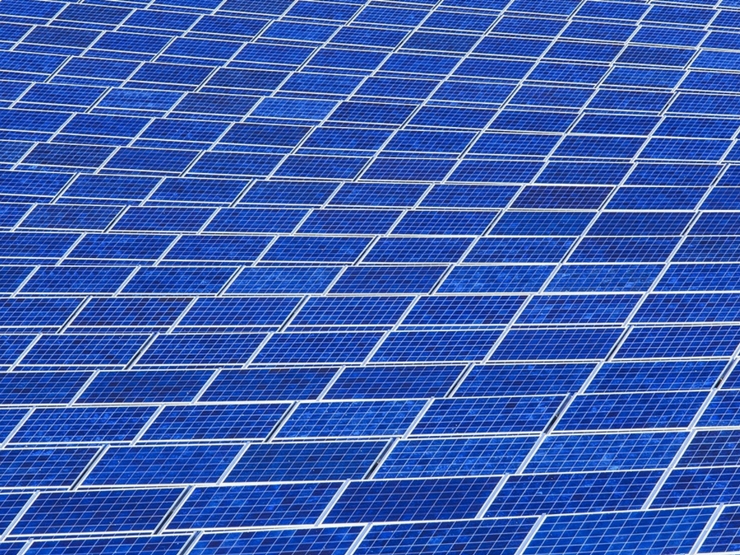

East: We have $350 million in asset under management and we’re targeting uncorrelated assets. Some of our successes include a series of solar farm projects. It has a 15-year duration, so it’s an asset that matches the natural liabilities of the super fund. It delivers a consistent return. It ticks the boxes of what we want to achieve socially and a return that’ll be stable for members.

How do you define and measure ethical investment?

Lovell: There’s a concept that ethical investment is about finding an ethical investment and piling on. Equally there’s an approach that can be taken to look at current investment and work out within that how to make it as ethical as you can within the confines of your mandate.

Brandweiner: Good impact investors spend a lot of time focused on measurement. There are two dimensions to measurement – outputs and outcomes. Outputs are easier to measure; outcomes are harder. The products and services we invest in serve 88 million consumers around the world that earn less than $10 a day. We measure that and we measure things around that to make sure the product is quality. What’s difficult to measure is what does that means for the communities and families over time. We need to get it right otherwise we won’t be able to demonstrates to investors that this is real.

Tom, in five years how do you see the distribution of your product, like green bonds, to investors unfolding and how will they price?

Wirth: It’ll be a bigger part of our book. The constraint to be worked on is the disciplines on reporting, eligibility and the credibility around the product.

In terms of return, right now our gender bond and green bond priced in line with vanilla product, so there was no disadvantage to the investment.

As the thinking develops and we bring in sustainability concepts, that’ll come into the risk reward calculation and returns may end up deviating rationally based on the right price for risk.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.