Global markets were relatively stable overnight ahead of tonight’s key risk event of US CPI.

Global markets were relatively stable overnight ahead of tonight’s key risk event of US CPI.

Lower US bond yields and softer US dollar lift AUD back above 0.64

Reaction to the Israel-Hamas conflict triggers a spike in energy prices while German Bunds lead a rally in European bonds with US Treasury futures also pointing to a decline in US Treasury yields. Not all the initial moves have been sustained. The USD is little changed, AUD is up, after being down with Fed speakers favouring holding rather than hiking rates, helping US equities rally while European shares fall.

Stronger than expected payrolls data initially saw yields sharply higher, equities lower, and the USD stronger, though with the unemployment rate steady and earnings growth moderating, those moves were retraced.

The bond sell-off that dominated the early part of the week has been put on pause. Why? NAB’s Taylor Nugent says there are a number of factors, but it’s tomorrow’s non-farm payrolls that will really set the direction for early next week.

A better-than-expected US JOLT report provided rattled markets. US Treasuries led a rise in core global bond yields, equities traded lower and the USD was stronger. USD/JPY gapped lower ( official intervention?) and AUD was the notable underperformer.

The sell-off in global bonds continued with fresh cycle highs being set for longer-term yields. The

The BoE is the latest to put rates on hold. But are they done? JBWere’s Sally Auld says its not safe to assume it’s over for any central bank.

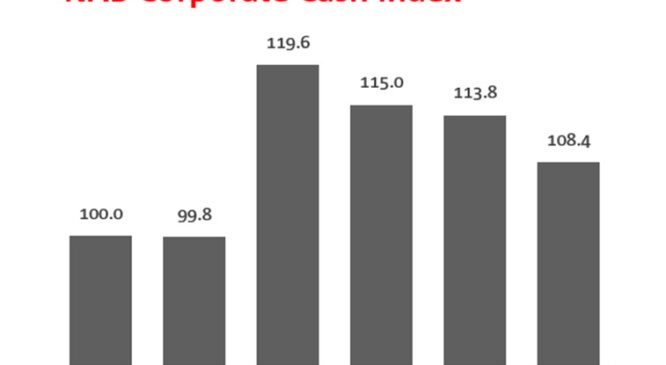

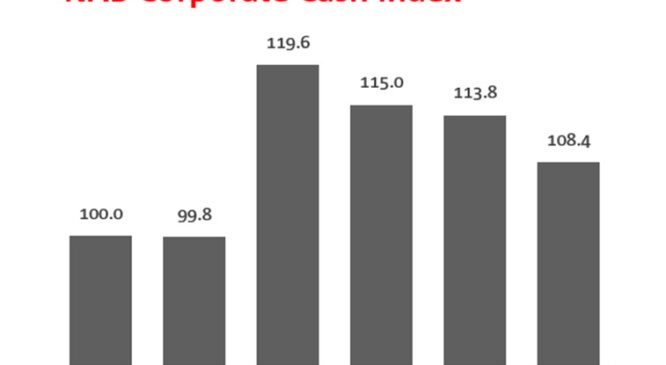

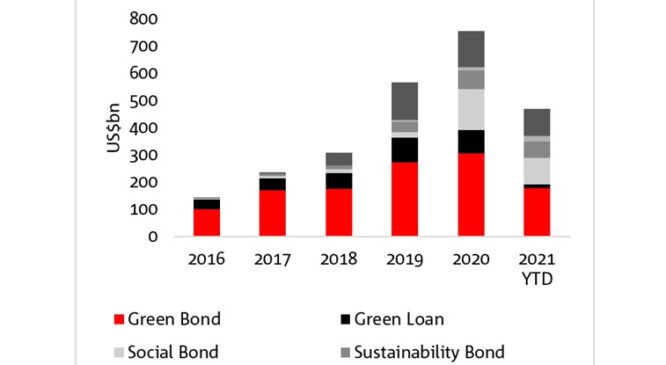

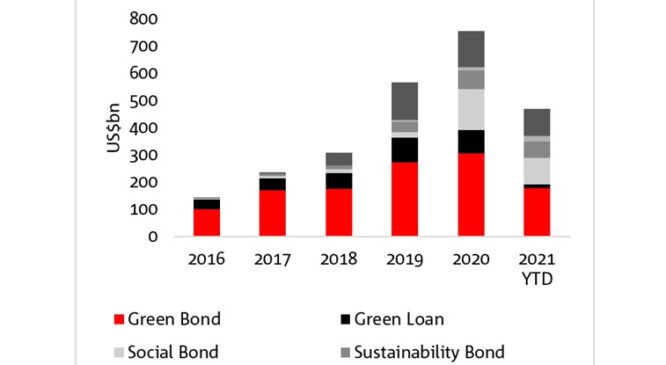

Transition targets underpinned by science-based standards are helping to drive opportunities for issuers and investors globally as sustainable finance markets continue to evolve.

Todays podcast ECB opts to hike, but taken as dovish with guidance read as a peak in rates Euro -0.8% and European yields are lower US Retail Sales data stronger in August, though offset by revisions AU Employment bounced in August Coming up: China Activity & MLF rate, NZ Manufacturing PMI, US UMich confidence […]

This week we delve into the latest national accounts figures on consumer spending to try to assess just how weak consumer spending is.

It was a subdued market reaction to the highly anticipated US CPI print.

Ahead of US CPI tonight, oil prices have ratcheted higher as OPEC+ cuts continue to bite

Todays podcast Tesla leads gains within in US equities Core global yields tick higher USD broadly weaker with JPY and CNY the notable movers JPY gains following Ueda’s interview suggesting openness to policy move this year CNY gains on PBoC strong fix, push against speculators and better data AUD and NZD benefit from spill over […]

US equities manage a marginal gain on Friday, but lower over the week and yields edge higher.

A rise in Services activity last month confirms the US economy still sits firmly on top of the world

In this Weekly, we take stock of progress rebalancing labour markets in the US and Australia, finding significant progress has been made on a range of indicators even without a sizeable lift in unemployment rates

A softer Caixin Services PMI soured the mood yesterday, with the USD broadly stronger and the AUD the worst G10 performer

It has been a quiet start to the week in Europe and the US with the latter out celebrating Labor Day. US equity futures closed little changed while US Treasury futures are pointing to some small upside pressure on yields.

Neither the Fed nor President Biden could have scripted Friday’s US payrolls report any better had they tried

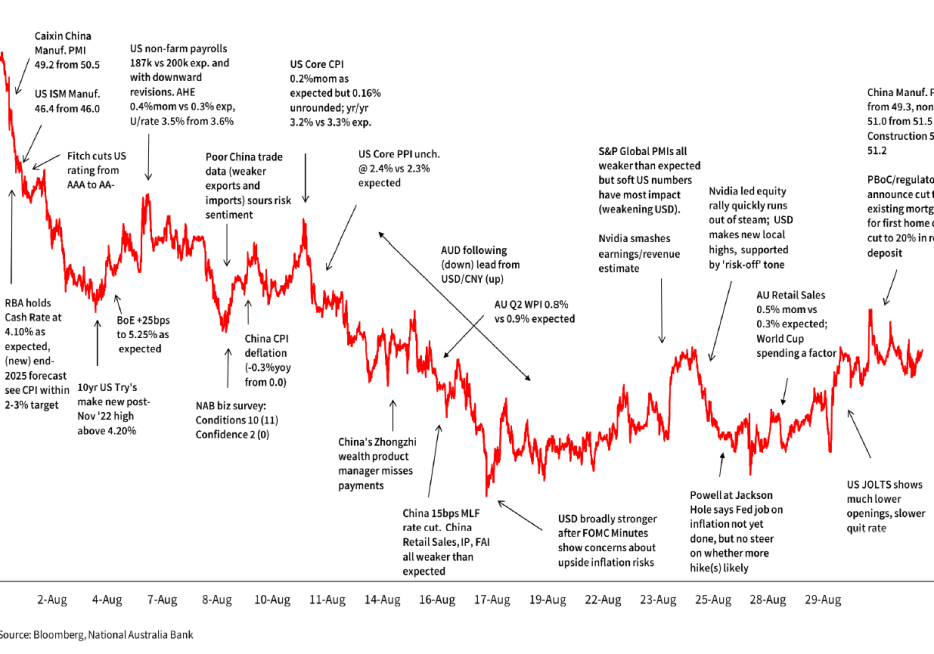

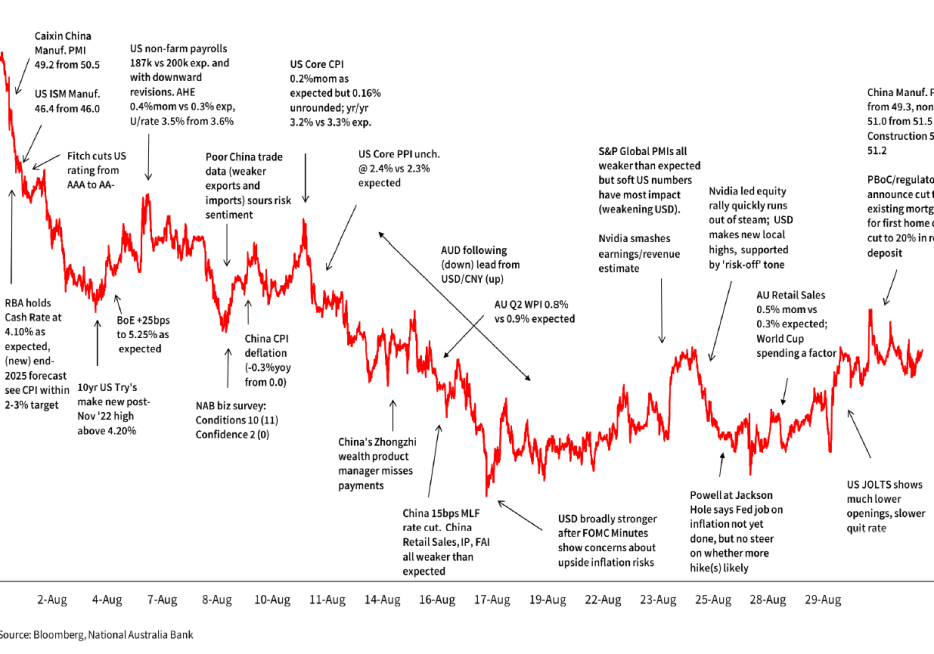

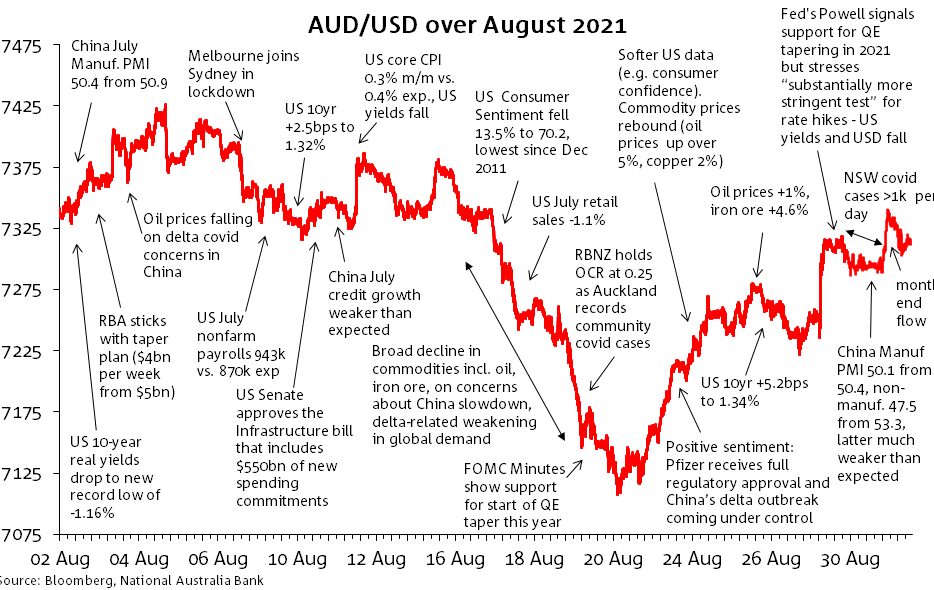

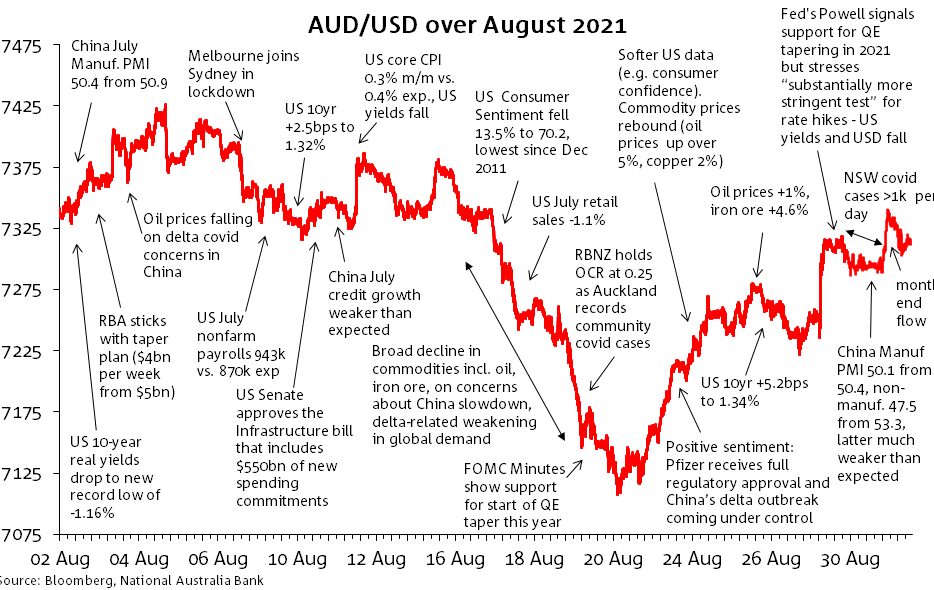

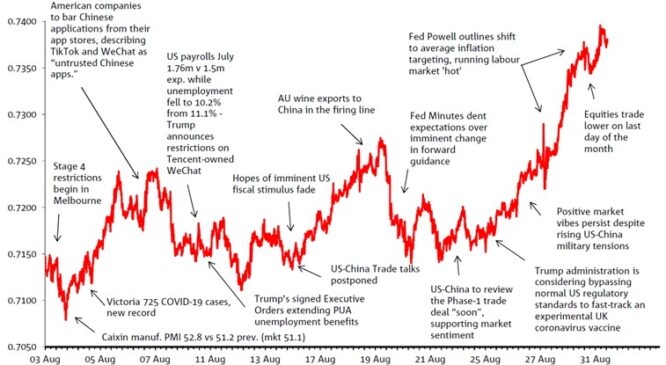

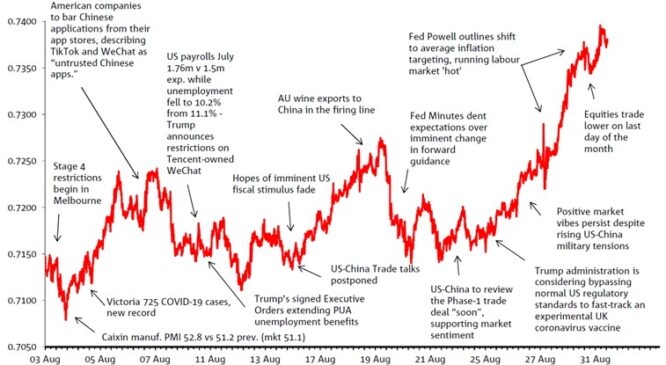

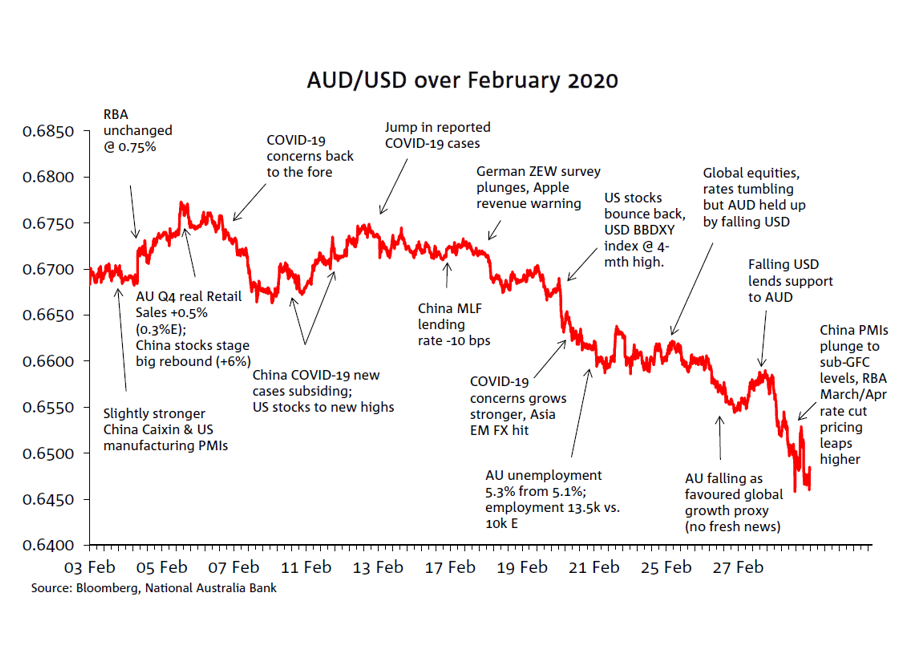

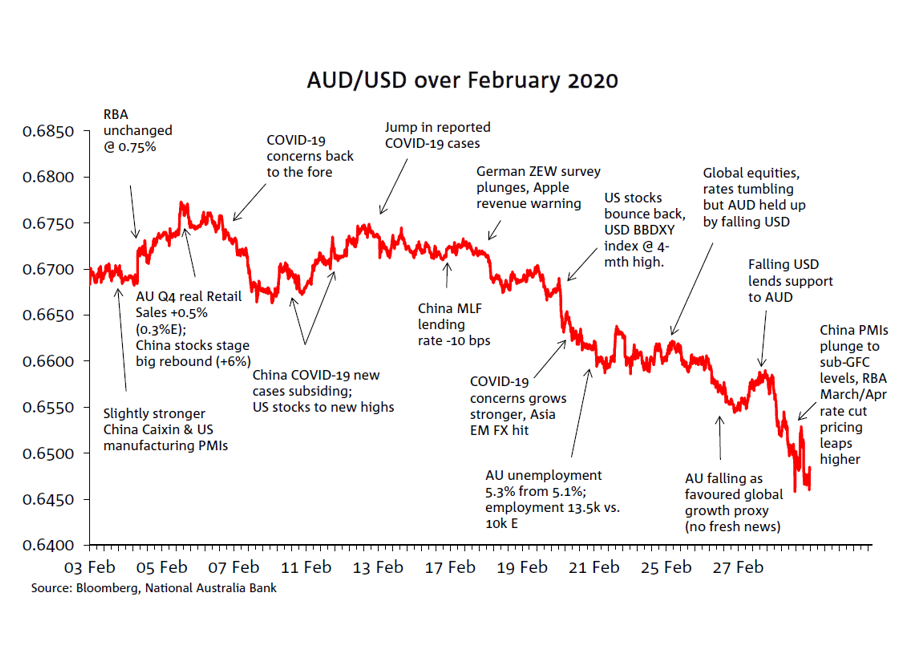

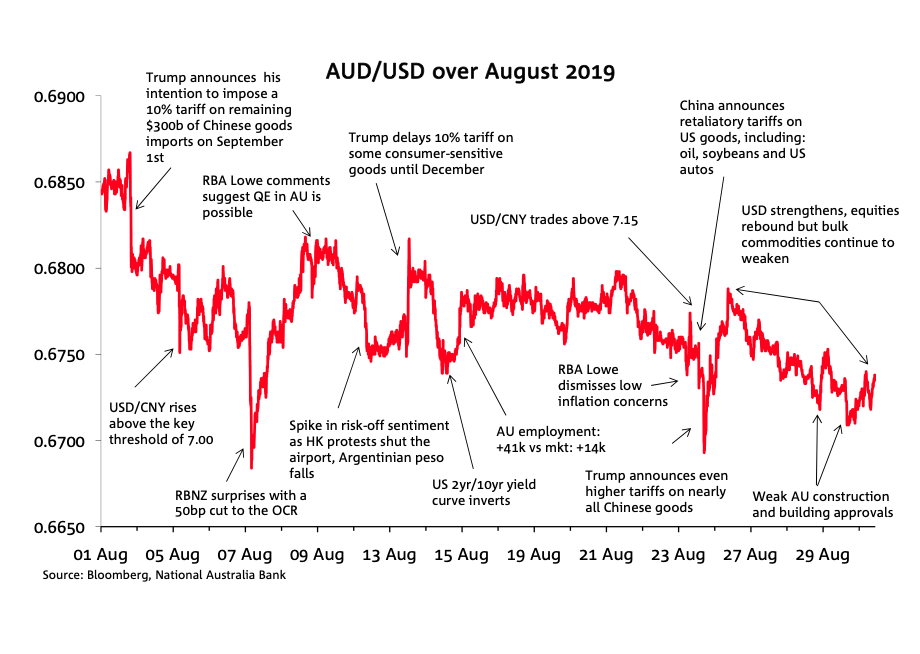

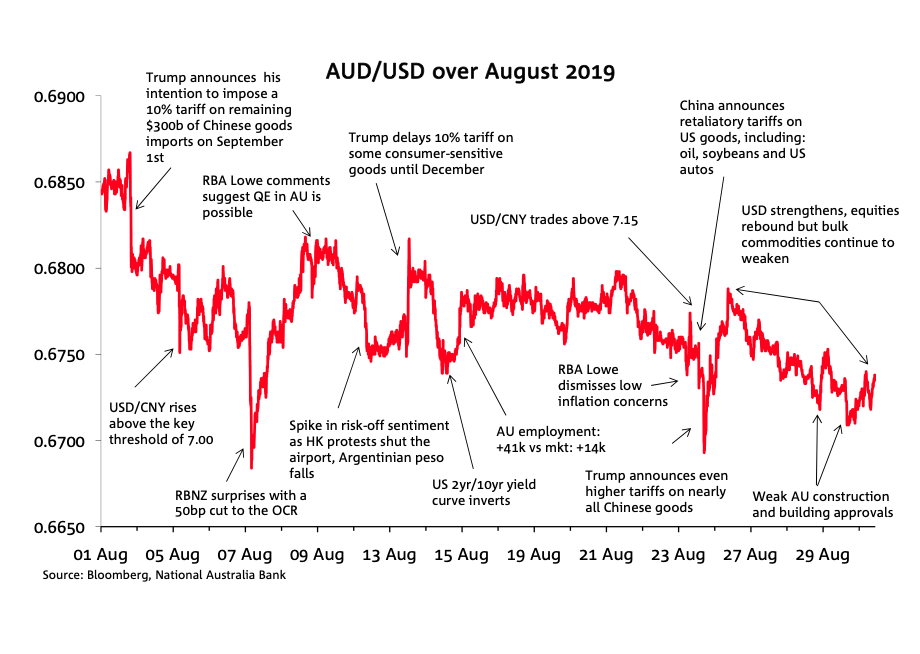

The AUD have an ‘average’ August in terms of its monthly hi-lo range, albeit it fell to a near 10-month beneath 64 cents

Overnight, the BoE’s Pill references ‘Matterhorn’ versus ‘Table Top Mountain’ approaches to monetary policy

US equities extend their positive run to a fourth consecutive day with softer US economic data fuelling expectations of a Fed on hold over coming months. UST yields edged lower while European yields rose following stronger than expected German and Spanish inflation data releases. The USD lost ground against EU pairs while the AUD is little changed.

Softer US consumer confidence and a JOLTs report suggesting ongoing rebalancing in the labour market saw the US dollar and US yields lower, while equities were higher.

Powell affirmed the Fed will ‘keep at it’ on inflation, but what else happened at Jackson Hole? In the weekly, we pull out some of the key insights, including on the outlook for government debt and the ‘friendshoring’ dynamic.

Aussie retail sales were stronger than expected in July, but World Cup fever was a factor says NAB’s Ray Attrill

Fed Chair Powell’s speech at Jackson Hole did not break new ground. US equities closed the day in positive territory with both the S&P 500 and the NASDAQ recording their first positive week since July. The UST curve flatten with front end yields ticking higher while the USD closed a tad stronger.

Caution prevails in front of Jackson Hole; stocks down, bond yields back up, AUD back lower

Yields were generally lower globally as PMI data came in softer than expectations, with deterioration most pronounced in German Services. The AUD was stronger, as were US equities, with tech leading once again ahead of much anticipated earnings from Nvidia.

US equities traded in and out of positive territory, essentially marking time ahead of NVIDIA’s reporting tomorrow and Fed Chair Powell’s speech on Friday. It was also a quiet FX session while in rates 10y UST yields printed a fresh 16-year high before consolidating.

US yields resumed their grind higher to start the new week, though there was little news to speak of, while US equities where higher.

Yields lower on Friday, but still close to recent cycle highs

It’s been onwards and upwards for global bond yields overnight, and AUD has spent time below 64 cents

Todays podcast FOMC Minutes show concern about upside risks to inflation US yields higher led by 5bp rise in 10yr Equities were lower, S&P500 -0.8% with declines late in the session Asia equities weighed by China concerns AUD -0.5% against a broadly stronger dollar at 0.6421 Coming up: AU Employment, NZ PPI, JN Machinery Orders, […]

Recent US CPI prints have shown good progress on disinflation. In this Weekly, we look at where those gains have occurred, and what to be careful of when drawing implications for Australia

A stark contrast Tuesday between strong US retail sales and very weak China data

US equities started the new week on a positive note, notwithstanding a negative lead from Asia. Core global yields have continued their ascendancy while the USD is broadly stronger with negative China sentiment weighing on the AUD and NZD

US Core CPI just 0.160% m/m and 3m annualised rate now 3.1%

Carbon markets have a role to play in the transition to a net zero economy, especially when seeking to meet and beat Australia’s interim targets this decade.

Ahead of the July US CPI release tonight US equities closed on the back foot. Oil prices extend recent gains while LNG prices surge following news Australian workers vote to strike. Quiet night in FX land.

Risk appetite has been weighed over the past 24 hours by a trio of soft China data, a surprise ‘windfall’ tax on bank profits in Italy, and a downgrade of a number of small and mid-sized banks by Moody’s.

We examine the aggregate and disaggregated measures of capacity utilisation in the NAB Business Surveys in greater detail in this week’s Australian Markets Weekly.

Northern hemisphere summer holidays and a lack of data has seen markets treading water ahead of US CPI figures on Thursday.

Bond sell-off reverses on softer US payrolls

The RBA has continued to keep borrowers on their toes in deciding not to raise the official Cash Rate at the July meeting, leaving the target rate at 4.10%. In the statement of the meeting they noted “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”.

BoE lifts Bank Rate by 25bps to 5.25% as expected, to limited market reaction. US payrolls tonight

Yields rise, US 10yr hits 4.12% before easing back to 4.08%, highest since Nov 2022

The US Treasury curve bear steepened following news the US government will increase its bond issuance by more than previously thought. US equities recorded small declines and the USD is stronger across the board with the AUD the notable underperformer, RBA on hold and underwhelming China data not helpful.

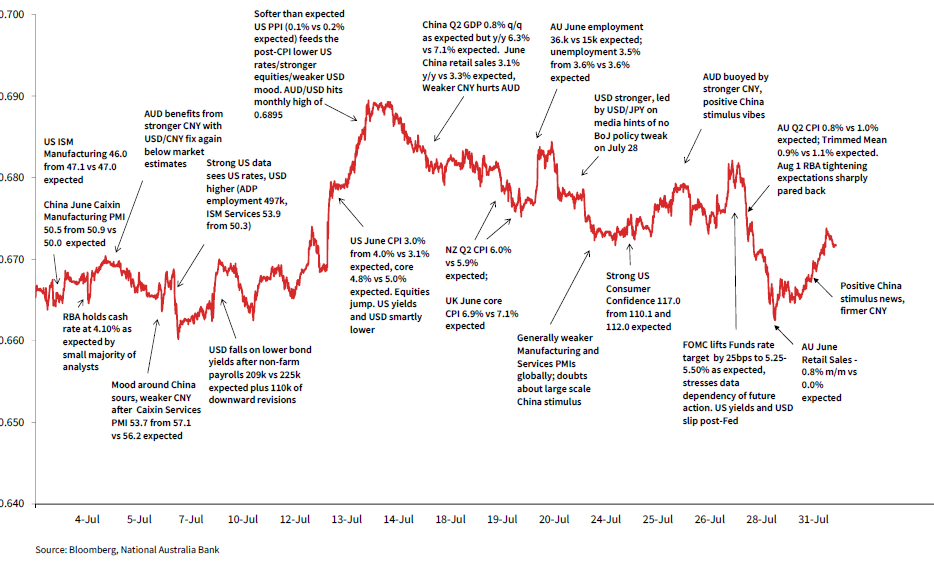

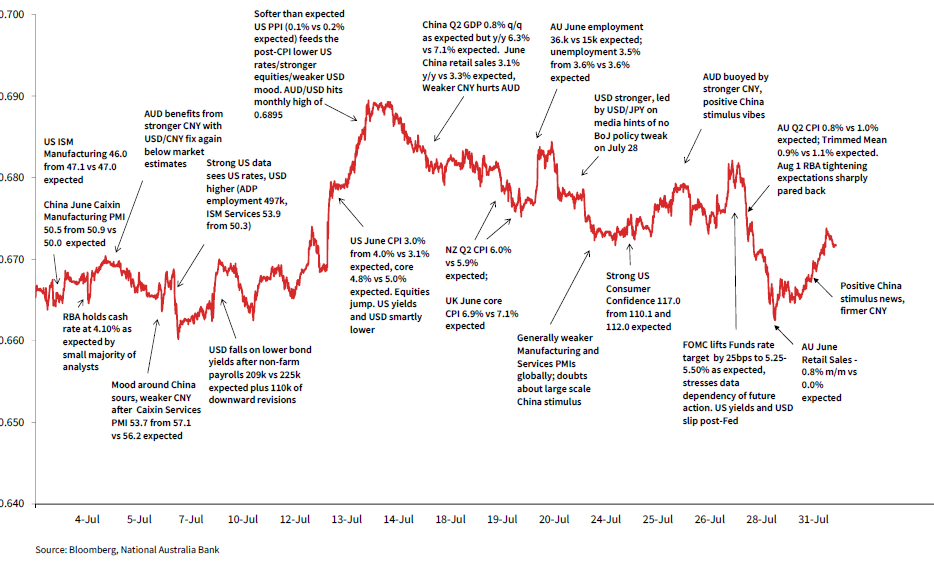

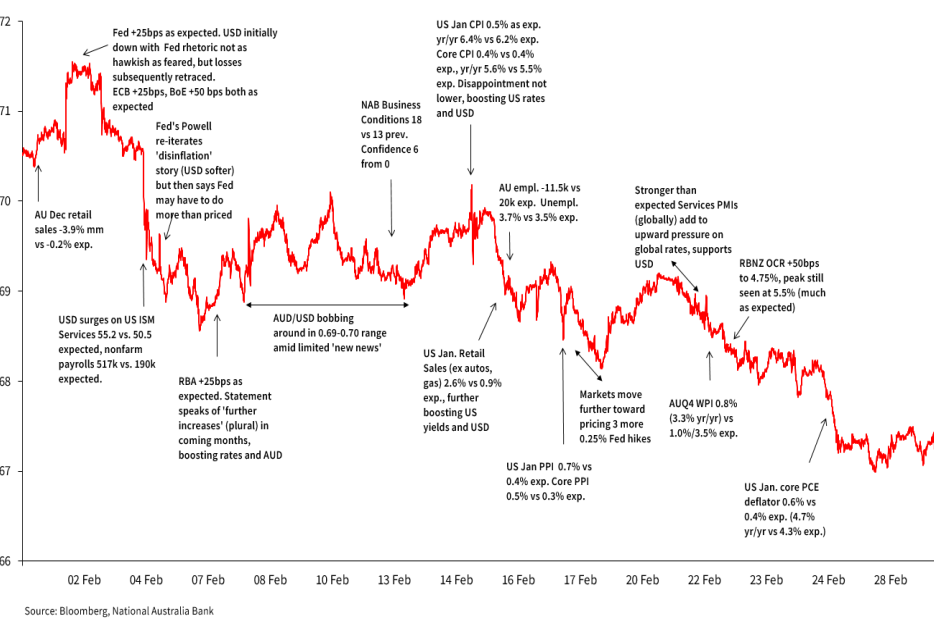

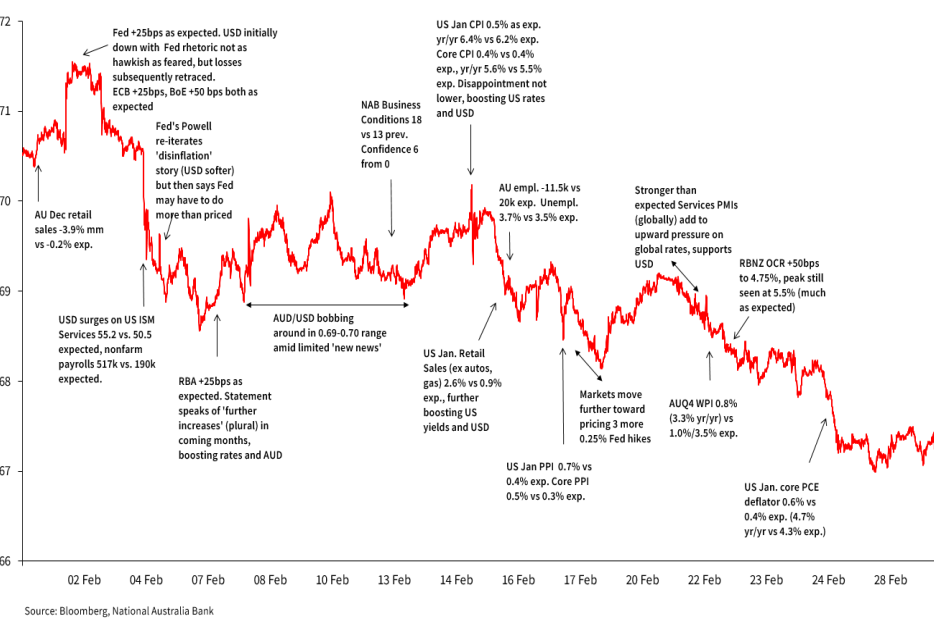

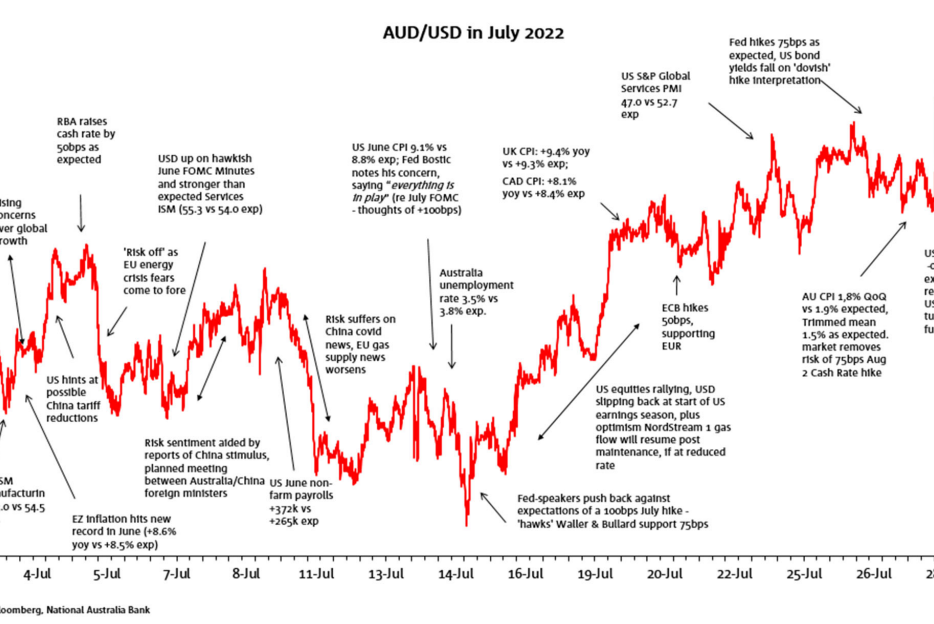

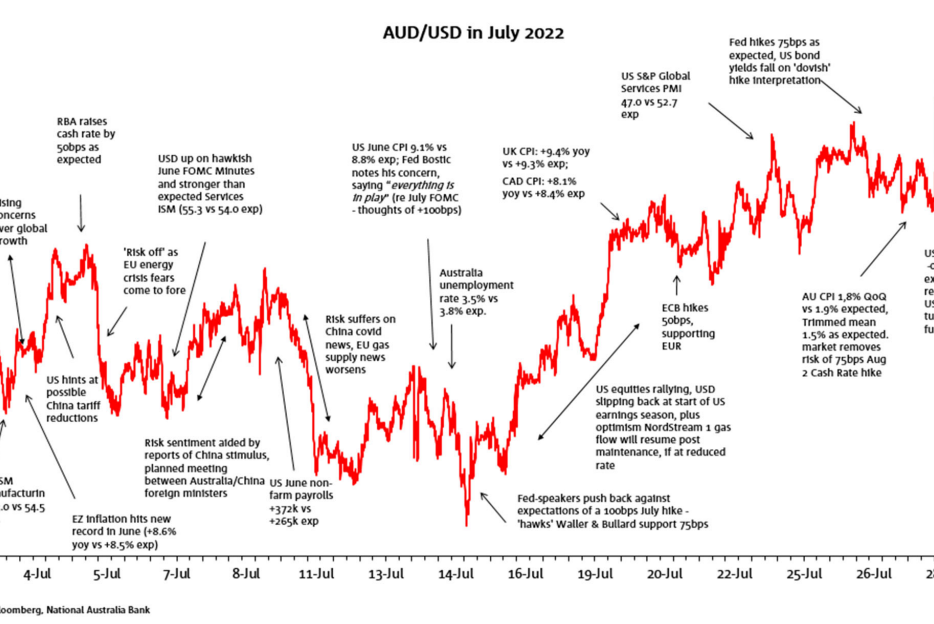

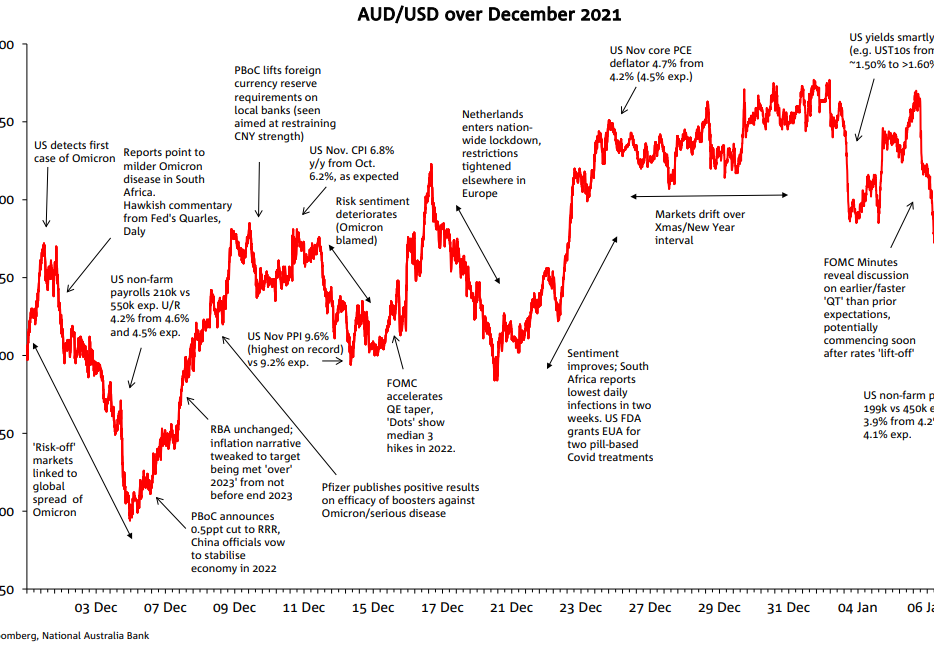

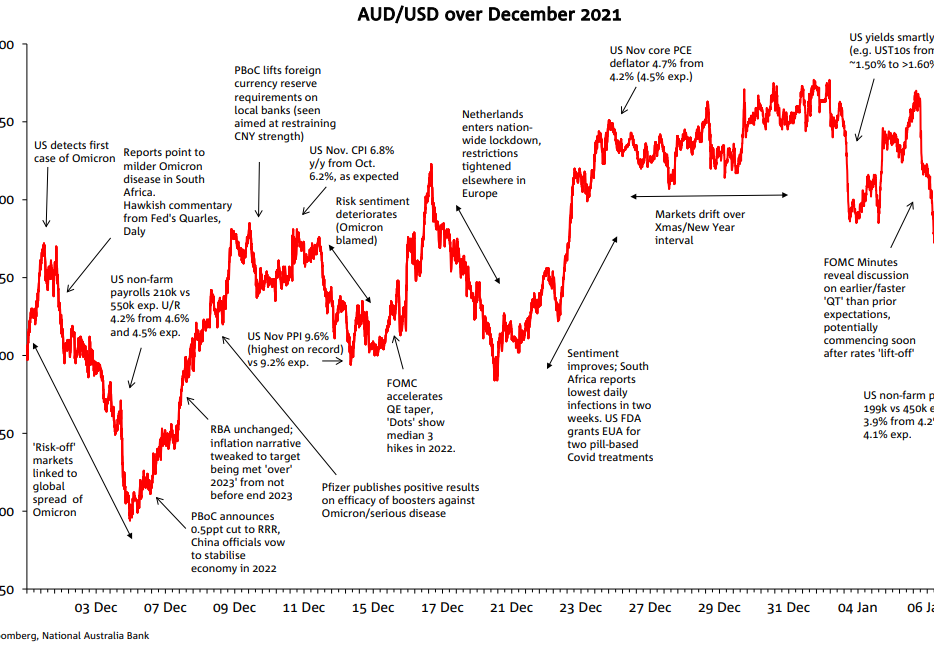

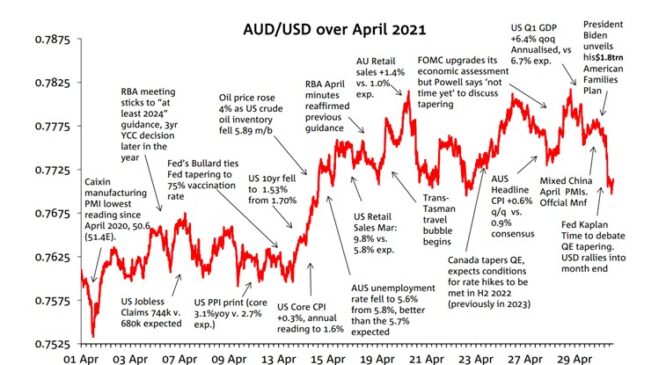

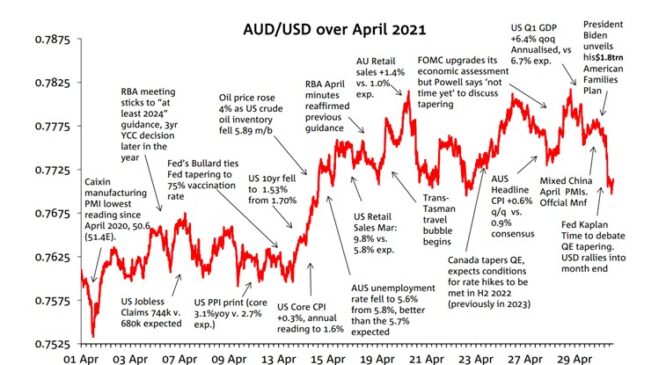

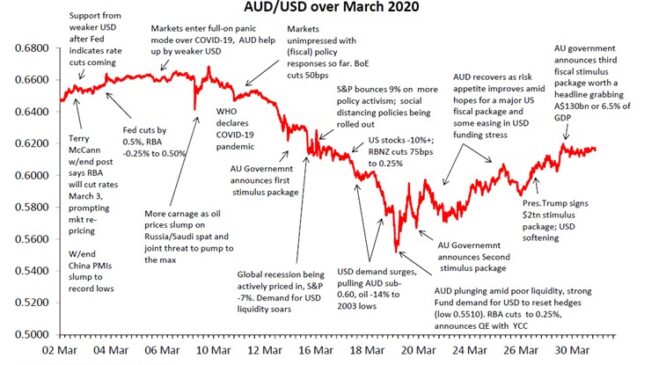

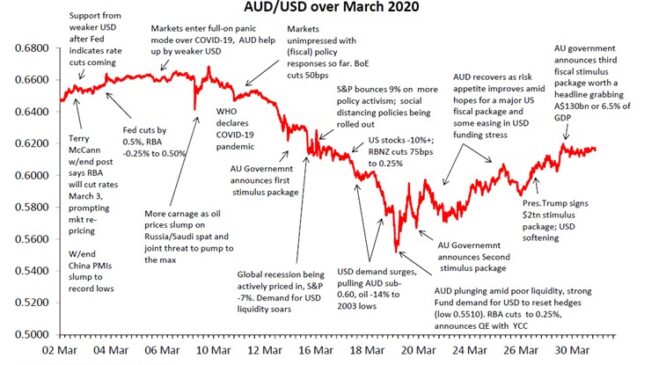

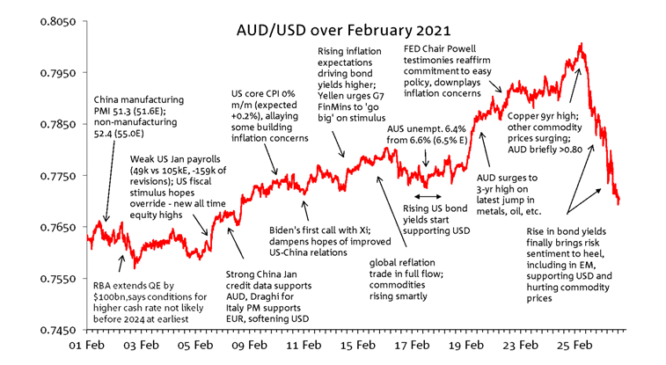

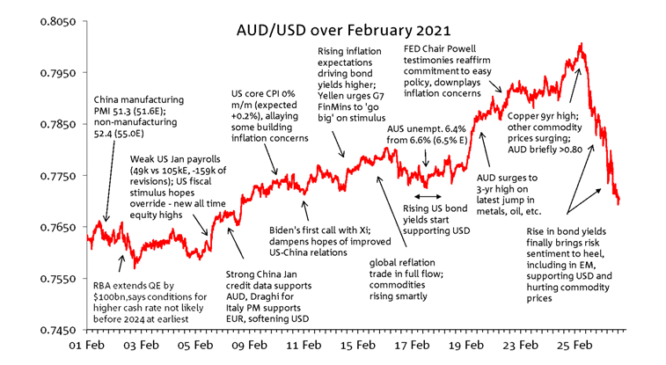

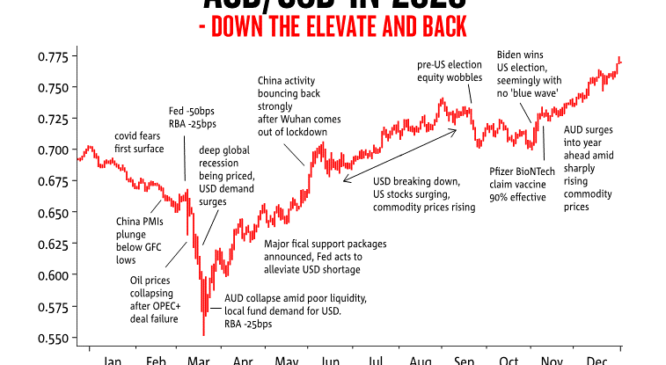

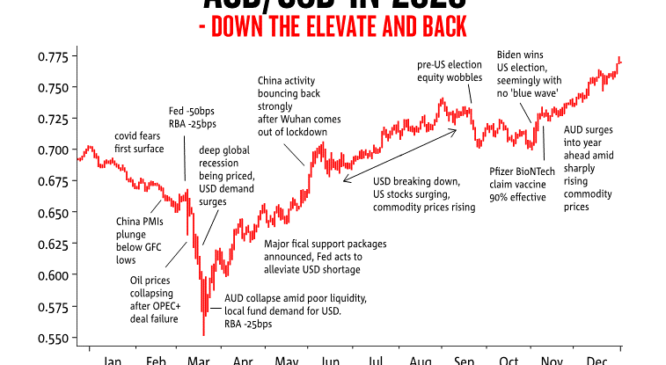

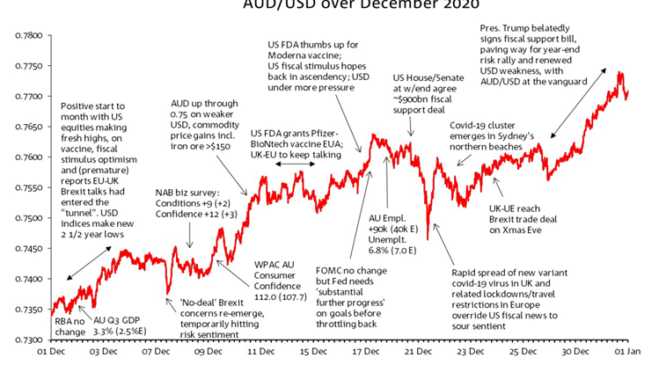

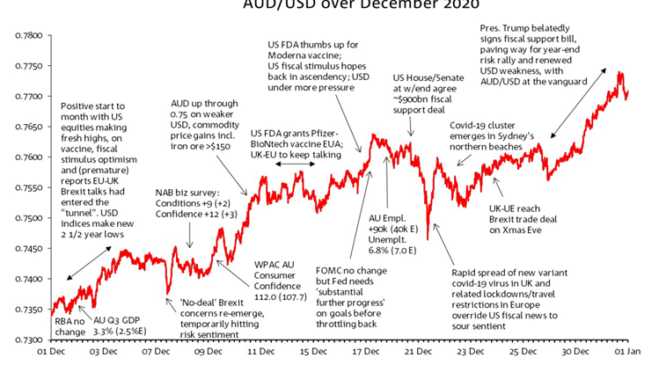

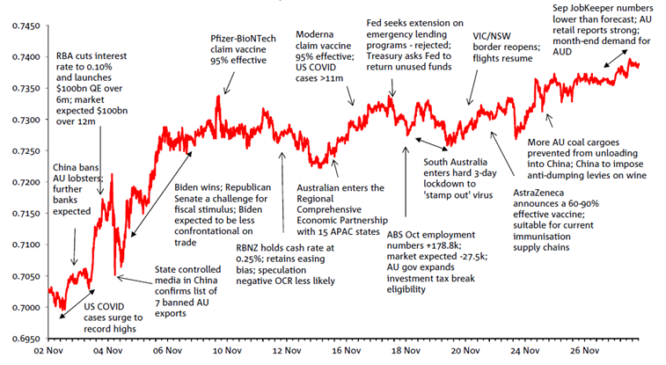

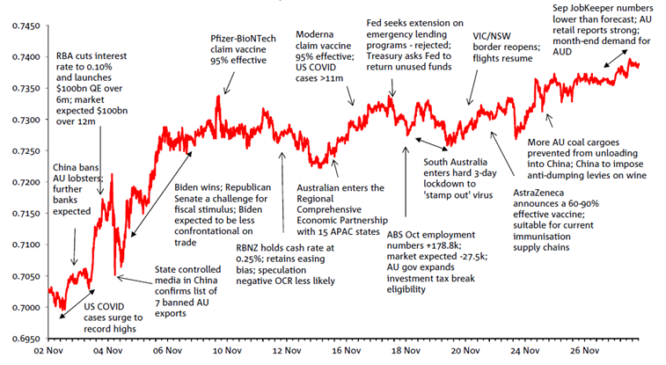

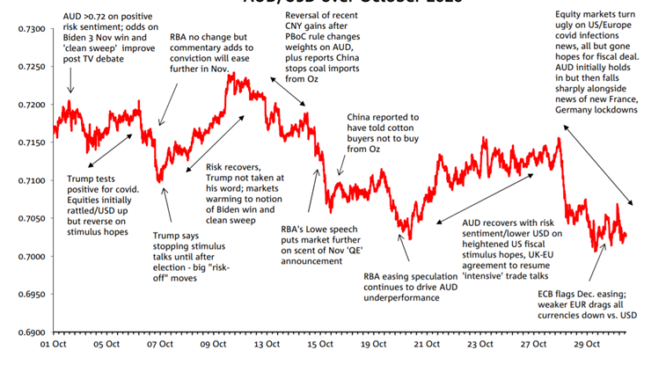

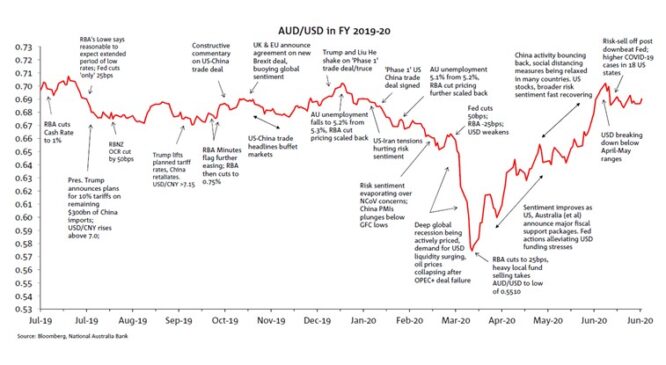

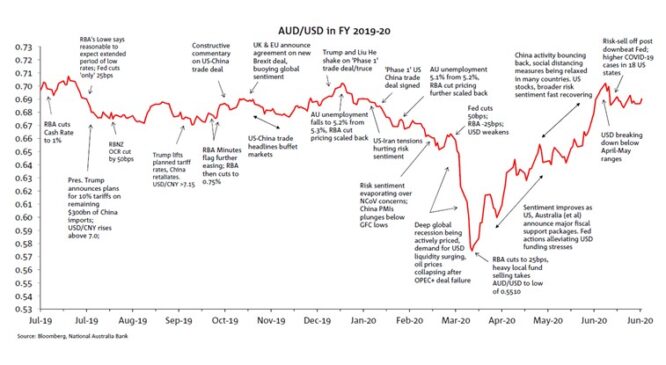

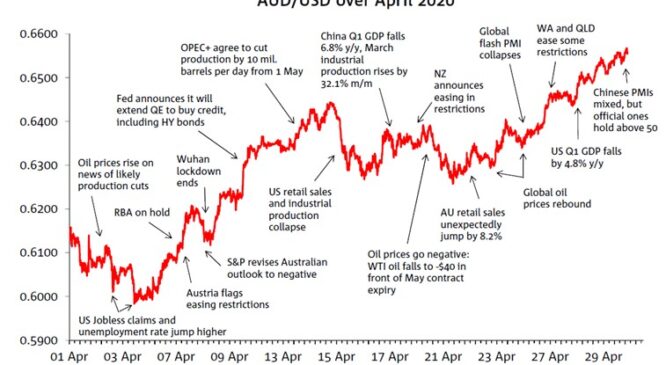

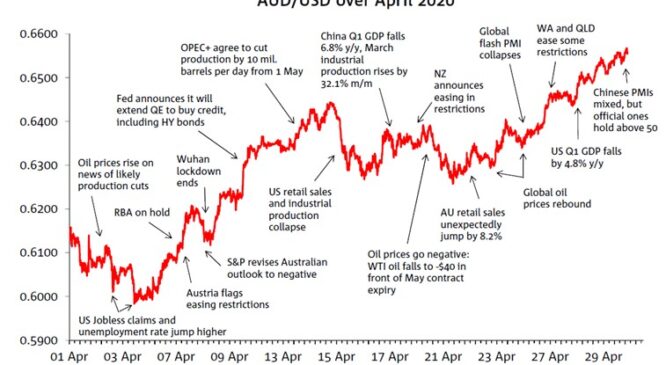

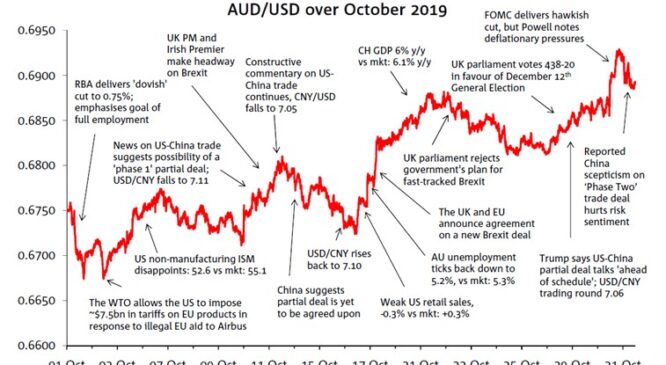

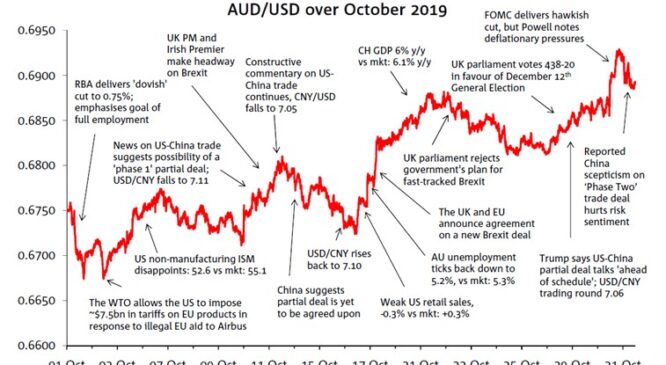

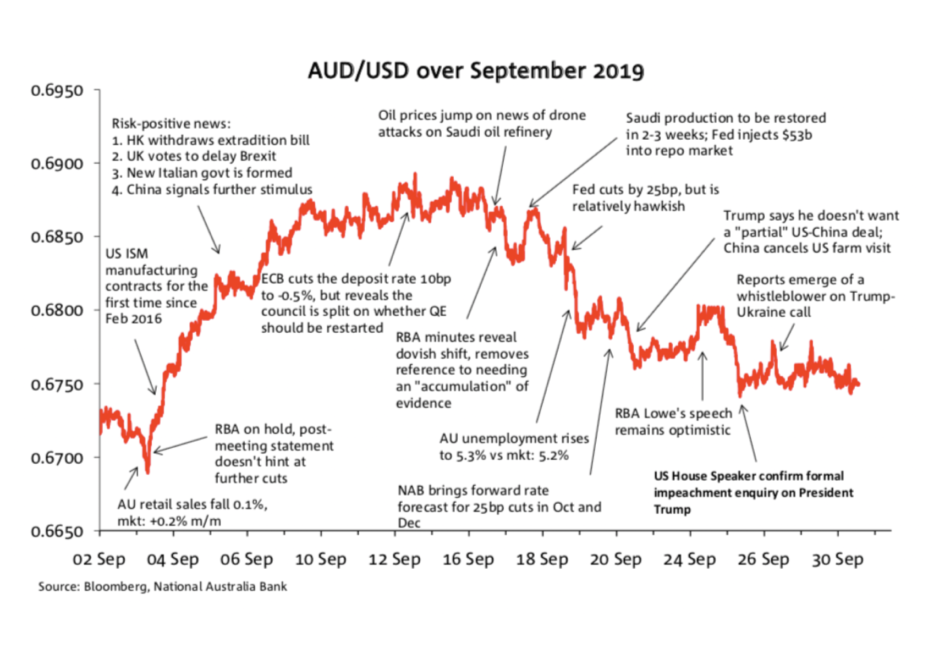

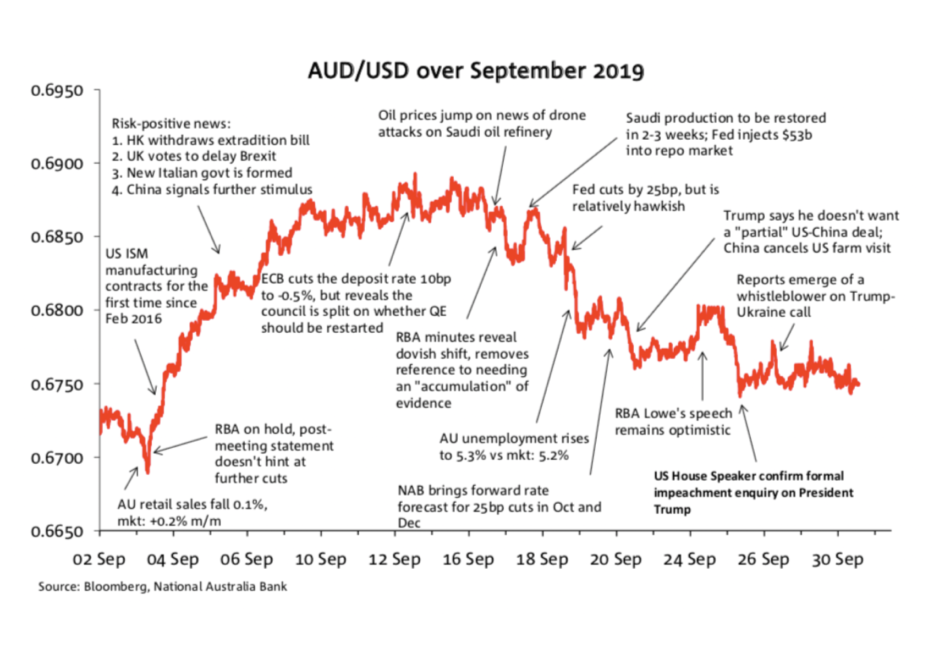

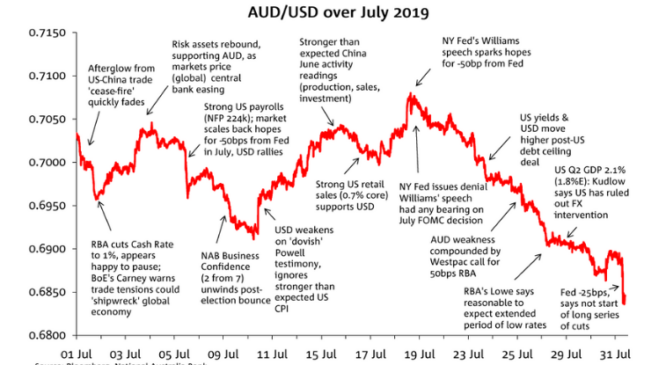

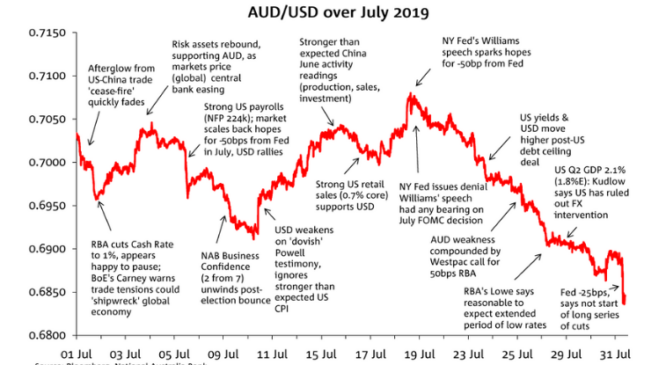

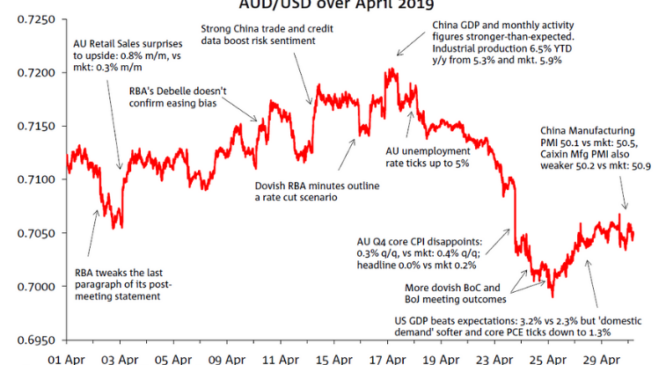

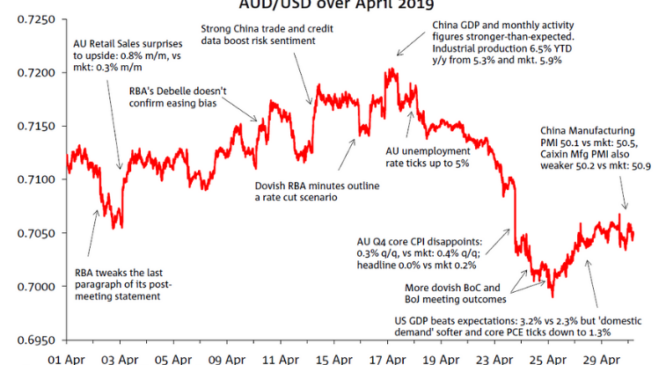

US, China and local inflation news drove much of the AUD volatility in July

Markets were generally quiet to start to week ahead of key risk events later in the week (BoE Thursday, US ISM Services Thursday, US Payrolls Friday).

Friday’s BoJ announcements made a bigger initial impression on global bond markets than FX

Not much reaction to the ECB, says NAB’s David de Garis, but a big reaction in currencies and Treasurys to the latest US GDP numbers. With a lot of European data today and early next week, things could stay quite ‘whippy’.

Calling a US recession has been a bit like “Waiting for Godot”, the title of the 1953 play by Samuel Beckett.

The US FOMC hiked rates by 25bps to 5.25-5.50% as universally expected.

AUD approaches 0.68, buoyed by China stimulus news and RMB gains

Weak European PMIs have seen yields fall, though moves in US Treasuries retraced latter in the day.

US yields higher with Jobless Claims lower than expected

Central bankers globally seem to have switched to a more measured tone recently. Overnight tapas

Payrolls failed to deliver the upside surprise feared following strong data earlier in the week, seeing some pullback in the USD and short-end yields on Friday.

The RBA met yesterday and held rates steady. Other than that, it was a very quiet 24 hours characterised by thin trading alongside the US 4 July holiday.

A quiet night overnight given shortened pre-holiday trade in the US ahead of Independence Day today.

This week we consider tomorrow’s RBA board meeting, but also US data releases that are likely to be more relevant for how the US economy and labour markets develop over the next 6-12 months.

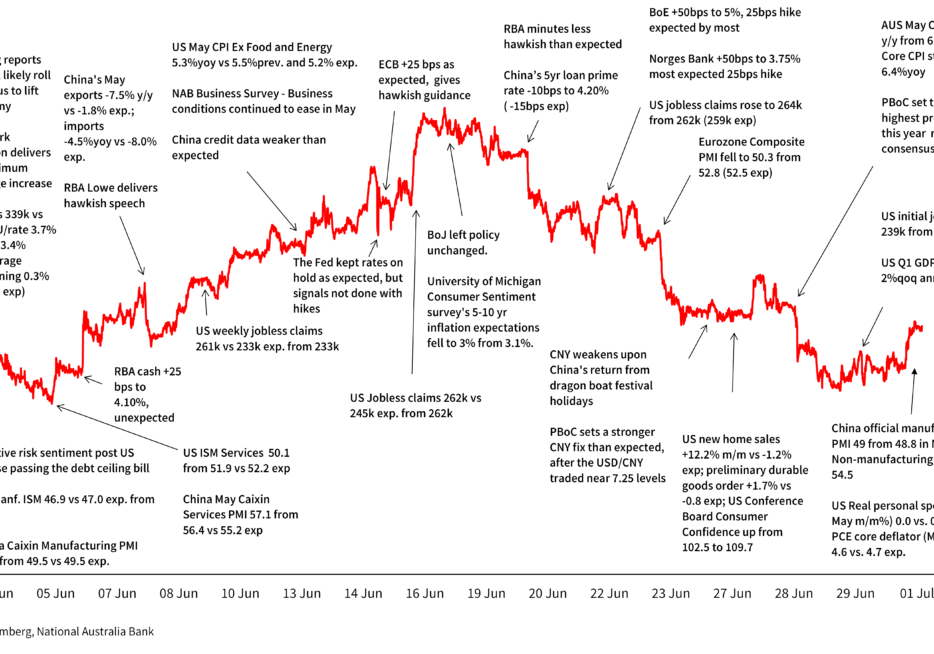

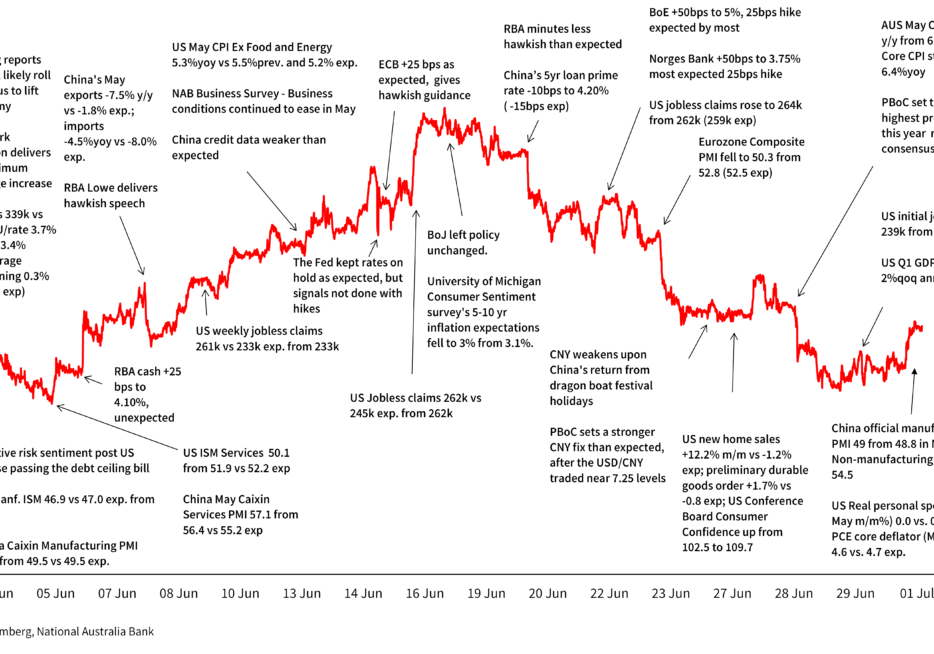

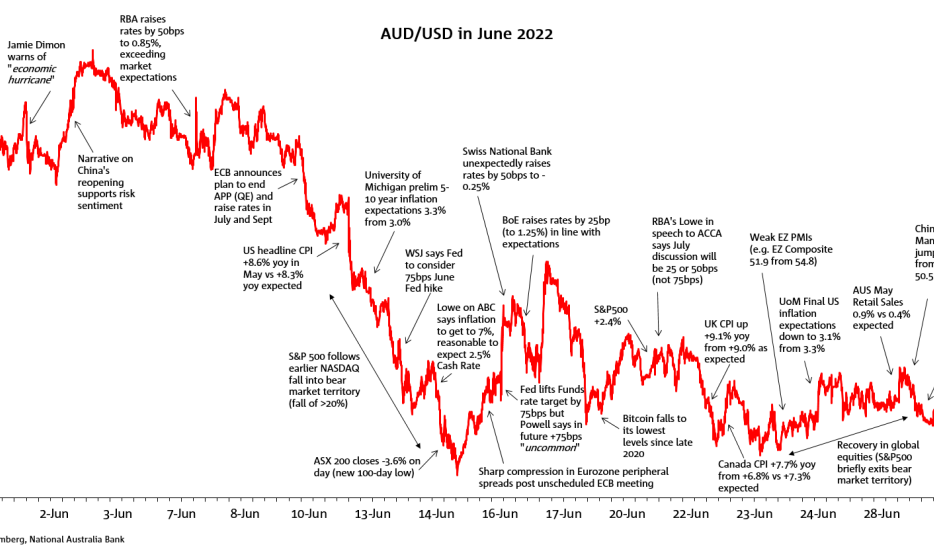

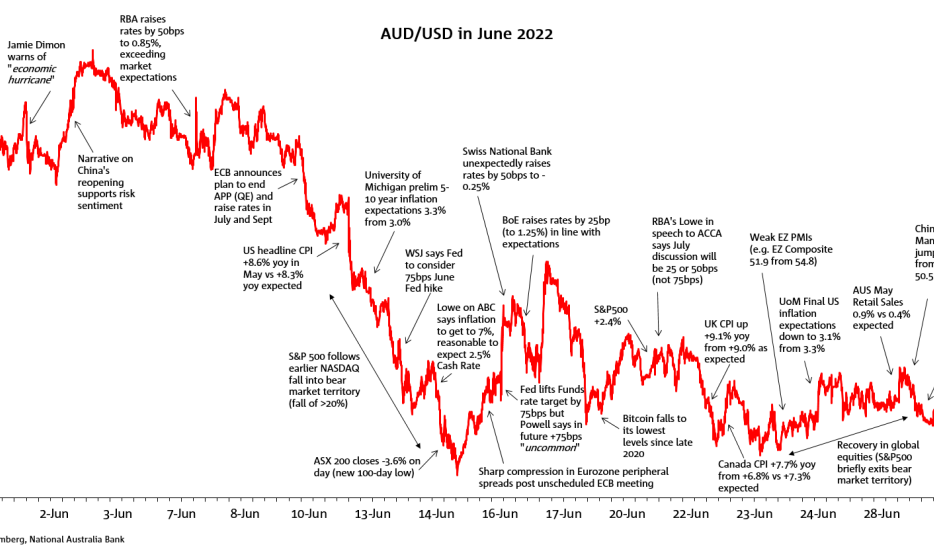

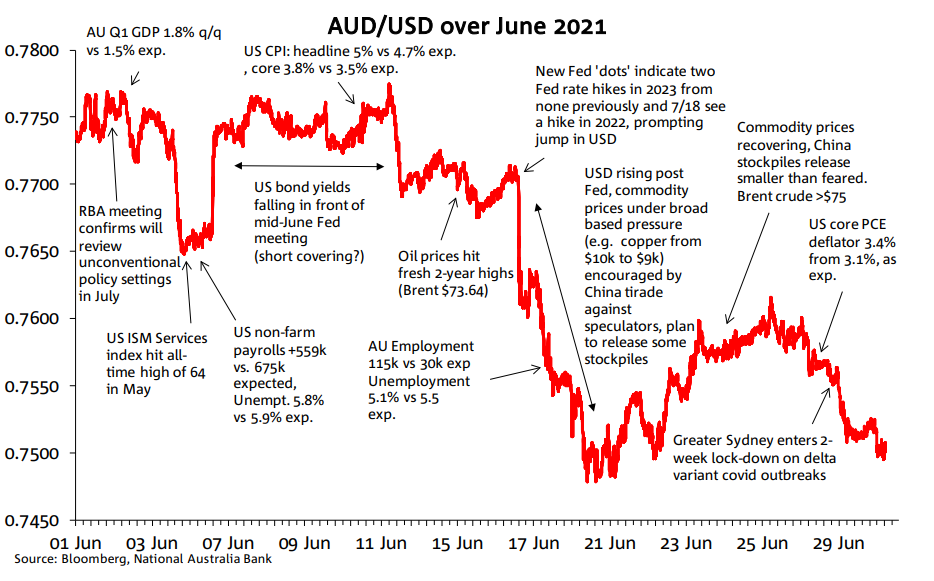

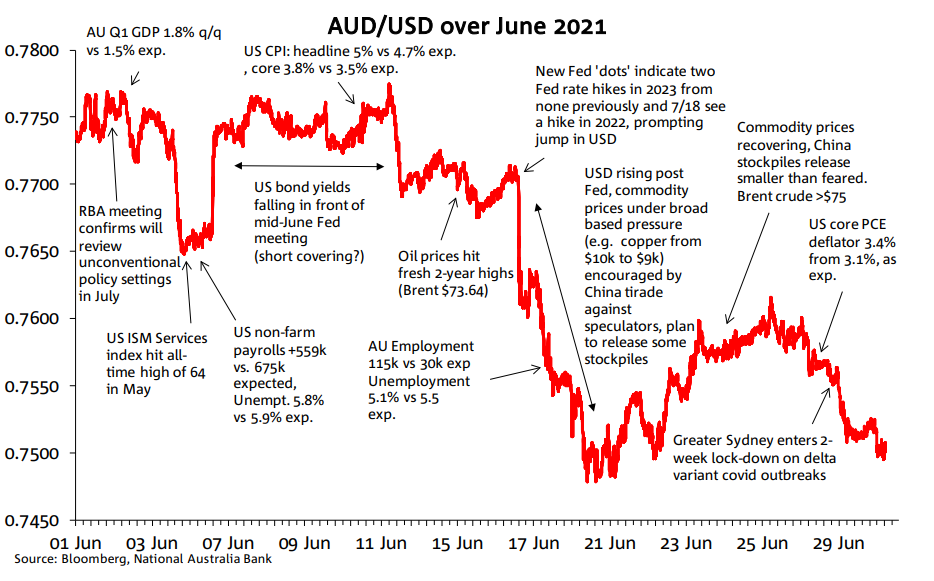

The AUD/USD price action in June was a story of two halves. Soft US data and a cash rate hike by the RBA helped propel the currency to an intra-month high of 69c, but then concerns over China’s growth outlook and better than expected US data releases weighed in the second half of the month.

Friday capped a risk positive end to the week and the month of June with softer US economic data releases treated as good news. Weaker US consumer spending and inflation boosted US equities with gains over 1%, US Treasury yields traded lower after the data release and the USD closed the week broadly weaker.

The string of positive US data surprises continued overnight with a big drop in Jobless claims and a decent upward revision to Q1 GDP. US Treasuries led a jump in core global bond yields and US equities closed in the green, unperturbed by the move up in yields. Positive US data surprises help the USD reverse earlier losses, but the AUD/USD held its ground aided by yesterday’s stronger than expected retail sales figures.

Fed, ECB, BoE heads reiterate hawkish views; BoJ reiterates dovish stance

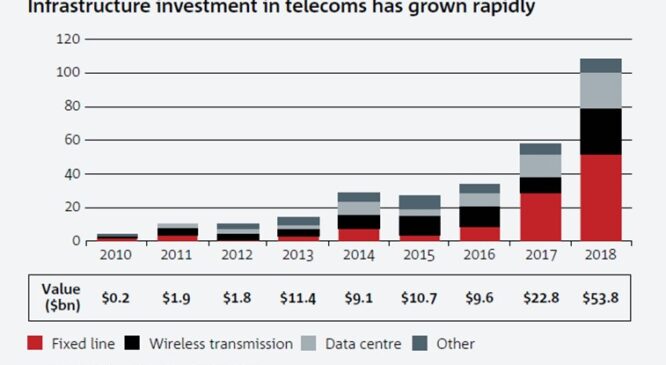

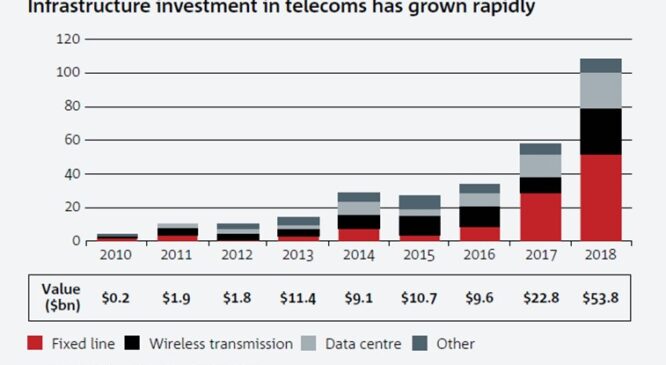

A series of NAB-led deals involving major telcos and private capital from infrastructure investors points the way to effectively monetising undervalued assets for growth.

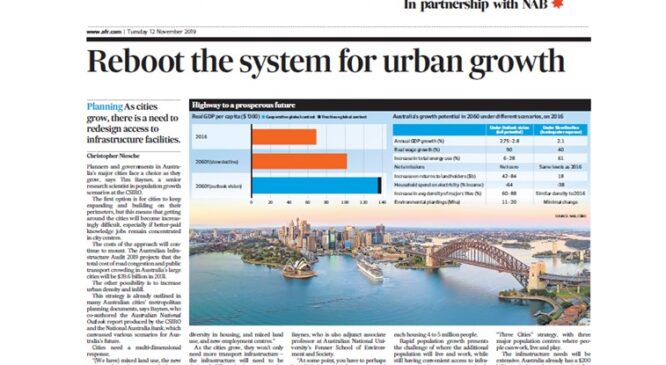

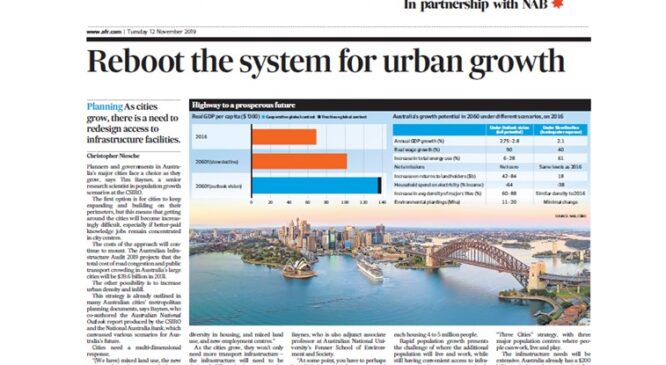

Article

Better than expected US data releases and hawkish ECB talk are two main macro themes from the price actions overnight. US equities embraced the positive vibes from Asia and then better than expected US data releases provided an additional tail wind. In contrast, European equities were little changed with hawkish ECB talk dampening the mood. The belly of the curve led a rise in UST yields while the USD lost a bit of ground.

This week we examine some possible budget assumptions for Australian growth, inflation, wages, interest rates and the $A for 2023-24 as well as the context, thinking behind and risks to the forecasts

Quiet start to week with no market fall-out from weekend Russia news. Weaker Yuan a focus.

PMIs on Friday showed Eurozone output growth close to stalling, seeing Europe lead yields lower and the euro fall.

The BoE surprises market with 50bps, Norges Bank less so with its 50bps. SNB opts for a ‘hawkish' 25bps

Powell added little new information in House testimony, but the US dollar was weaker and equities were lower. UK CPI data surprised higher ahead of the BoE later today

Australia’s population growth has surged over the past year. The surprise has been how quickly it has rebounded after borders were re-opened from November 2021.

Soft risk sentiment overall last night which was mostly China driven.

European equity markets have started the new week on the back foot following a negative lead from Asia. Investors are seemingly disappointed by the lack of new news on China’s stimulus, US equities are closed for a holiday with futures contracts pointing to small dips for the S&P 500 and NASDAQ 100.

AUD ends a big if short local week at the top of the G10 currency pile, AUD/USD +2% w/w

US equities have pushed on yet again, shrugging off a string of soft US data releases. The ECB hiked its deposit rate as expected, lifted its inflation forecast and delivered a hawkish guidance. Core European yields climb on the back ECB news with the euro gaining over 1% while soft US data triggers a decline in UST yields with the USD weaker across the board.

In today’s Weekly, we delve into Australia’s productivity and labour cost data given the RBA’s recent focus on these metrics, and explain why timely signals on the inflation outlook may be better found elsewhere.

Fed pauses as expected but ‘dot plot’ adds two, not one, more rate rises to 2023

US CPI was in line with expectations, adding to confidence the FOMC will skip at tomorrow’s meeting even as yields pushed higher. Strong UK labour market saw UK yields surge.

After closing modestly higher on Friday, US equities have started the new week with modest gains, led by big tech. 10y UK Gilts, up 10bps to 4.33%, are the notable movers within core global bond yields on the back of hawkish BoE talk. The USD is a tad higher with AUD retaining its upward trend that has been in place since the start of the month. Oil prices tumble on supply-demand dynamics and another downgrade by GS.

Jump in US jobless claims supports lowers US yields and US$; S&P500 back in bull market

![Markets Today – My [Hikes] Will Go On](https://business.nab.com.au/wp-content/uploads/2023/08/todays-market-update-chart-934x654.png)

The BoC shocked markets overnight, hiking by 25bps to 4.75%.

![Markets Today – My [Hikes] Will Go On](https://business.nab.com.au/wp-content/uploads/2023/08/todays-market-update-chart-934x654.png)

The growing wave of digital transformation in finance is helping solve today’s key corporate treasury challenges by leveraging the latest developments in data analytics, artificial intelligence and machine learning

In our latest Weekly, Taylor Nugent explores the impact of pandemic swings in population and housing demand to explain the current acute rental market tightness and rapidly increasing rents, as well as when these pressure may ease

It has been a quiet 24 hours in markets with generally small market movements, while the Australian dollar held onto its gains following yesterday RBA rate hike, 0.8% higher against the US dollar.

Markets go into today’s RBA decision ascribing a roughly 65% chance to a pause

A combination of a US debt ceiling resolution alongside a mixed US jobs report, still favouring a June Fed pause, and news that China may be considering further support to its beleaguered property sector boosted risk sentiment (VIX sub-15), major equity indices closed the week with solid gain.

A positive night for risk sentiment with equities up (S&P500 +1.0%; Eurostoxx50 +0.9%), USD down (DXY -0.7%), and yields lower (US 10yr -3.8bps to 3.60% and 2yr -6.4bps to 4.34%).

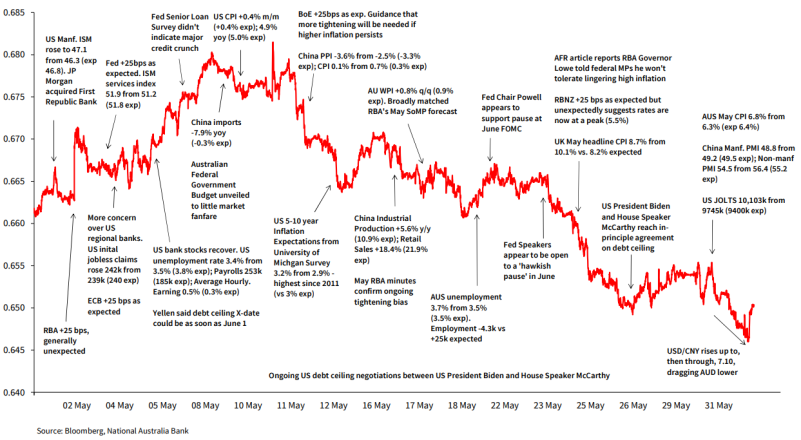

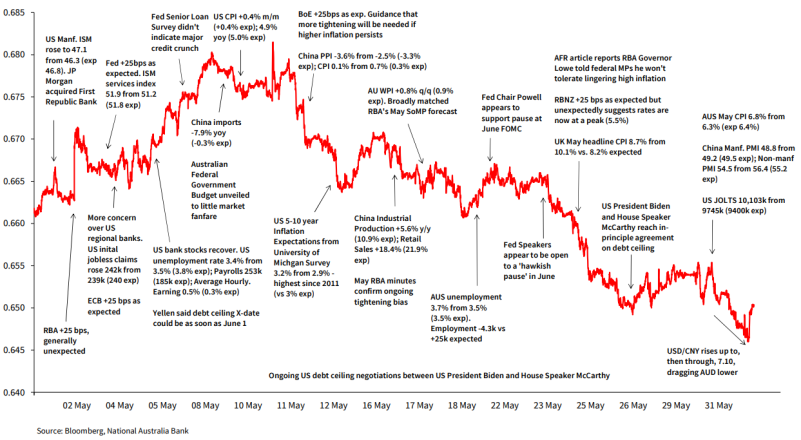

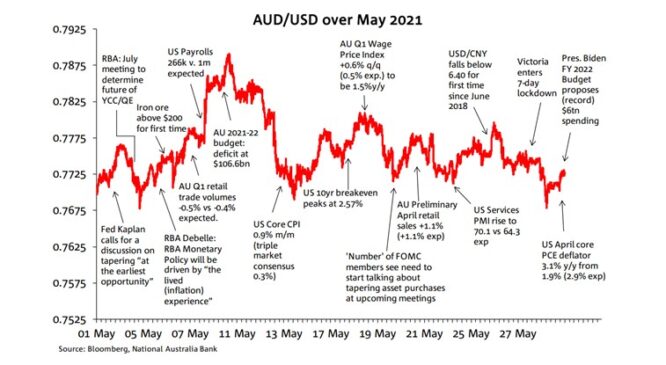

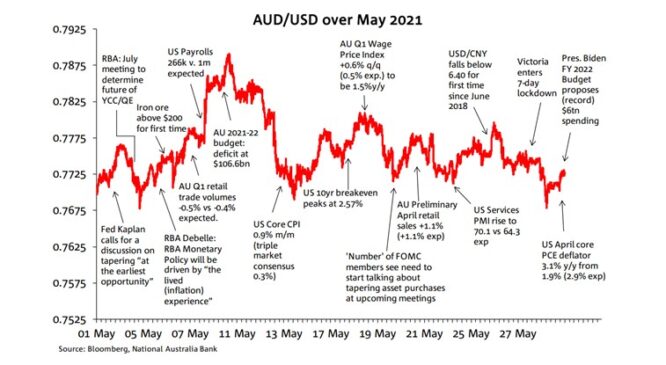

The AUD fell below 65 cents in May, in doing so re-establishing a more ‘normal’ monthly trading range after two months of highly compressed volatility.

The AUD had fallen to a new post November 2022 following more disappointing China data

NAB presents detailed insights into superannuation investment behaviours and trends in our comprehensive survey of Australian Superannuation Funds undertaken every two years and opening again for 2023.

The Markets Economics team looks at the progress rebalancing supply and demand in Australia and find that Australia is likely to lag the progress being made in the US on rents, energy and wages/services.

After enjoying a long weekend, the US is back with mixed signals coming from equities and bond markets. US Treasuries have led a move lower in core global bond yields while the S&P 500 is unchanged. Oil prices fall over 4% with OPEC + meeting looming large, the USD is little changed, but AUD and NZD struggle, not helped by Yuan weakness.

Public Holidays in the US, UK and Germany made for a very quiet night as far as market moves are concerned.

US equities were higher on Friday as hopes grew of a debt ceiling deal, ahead of news on the weekend that an agreement in principle had indeed been found. US data was strong and Fed tightening expectations firmed.

The US dollar extended its positive streak and yields globally were higher despite mixed economic data as AI-related tech saw US equites higher

Still no sign of breakthrough on US debt ceiling talks, souring risk sentiment.

The absence of a debt ceiling deal weighs on risk sentiment even as Biden calls talks ‘productive,’ while global PMIs reaffirm the stark divergence between services and goods.

In this Weekly, we delve into last week’s WPI data in more detail and discuss the risks to wages projections and the RBA's outlook

A quiet start to the week with little in the way of significant market moves.

In this Weekly we explore two key US themes we are tracking closely for the trajectory of rates and inflation, in both Australia and the US

US equities struggled for direction on Friday, ending the day marginally lower. After a choppy session, UST yields closed higher across the curve with the USD broadly weaker, ending a three-day winning streak. Debt impasse did not helping sentiment while Fed Chair Powell expressed a bias for pausing rate hikes in June.

Hopes for a deal on the debt ceiling improved.

Positive soundbites from Biden and McCarthy give hope a debt deal can be reached.

A flurry of global economic data but relatively modest market movements.

A quiet start to the week with little in the way of new news or top-tier data.

Markets were spoked on Friday by an unexpected rise in US consumer inafltion expectations

The Bank of England raised rates by 25bp as expected, while softer data out of China and the US weighed on risk sentiment

Markets are showing relief that the key US CPI release overnight was not higher than expected

Markets are treading water as we await the outcome from the Biden-McCarthy debt ceiling meeting and the US CPI data release tonight. US and EU equities have ended the day lower while core yields have edged a little bit higher. Fiscal updates revealed contrasting AU and NZ fortunes while cautiousness in the air has favoured the USD.

The Australian budget Tuesday night is likely to feature a small surplus for the current financial year...

US and EU equities have closed with modest gains while core yields extended Friday’s rise. The Fed Senior Loan Officer revealed a modest deterioration in lending standards alongside a drop in demand for loans, so no evidence of an imminent credit crunch. The USD is little changed with NZD leading a modest outperformance by pro-growth currencies.

Payrolls more than solid enough, challenging views of imminent rate cuts

The federal budget has substantially improved over the past year to the extent that the 2022-23 Final Budget Outcome could be in surplus.

Latest US yield curve movements are giving an even stronger signal of imminent US recession

US yields were lower and the dollar stronger with the FOMC increasing rates by 25bp as expected and dropping the expectation for further hikes.

Kapitol Group shows how a culture of innovation and the right banking partnership has helped build a small construction start-up into a significant industry corporate in just five years.

Big moves in markets overnight as US regional bank worries reignited, signs of catering in European loan demand, and a sharp fall in US job openings.

US yields are higher and the dollar stronger with little fallout from the failure of First Republic, being acquired by JP Morgan in an FDIC-supported deal.

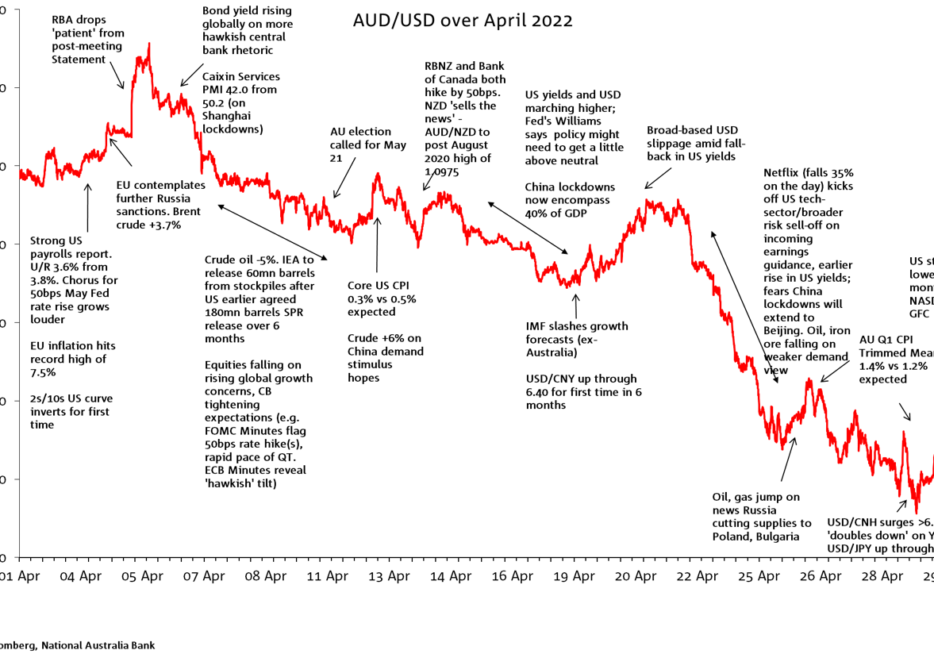

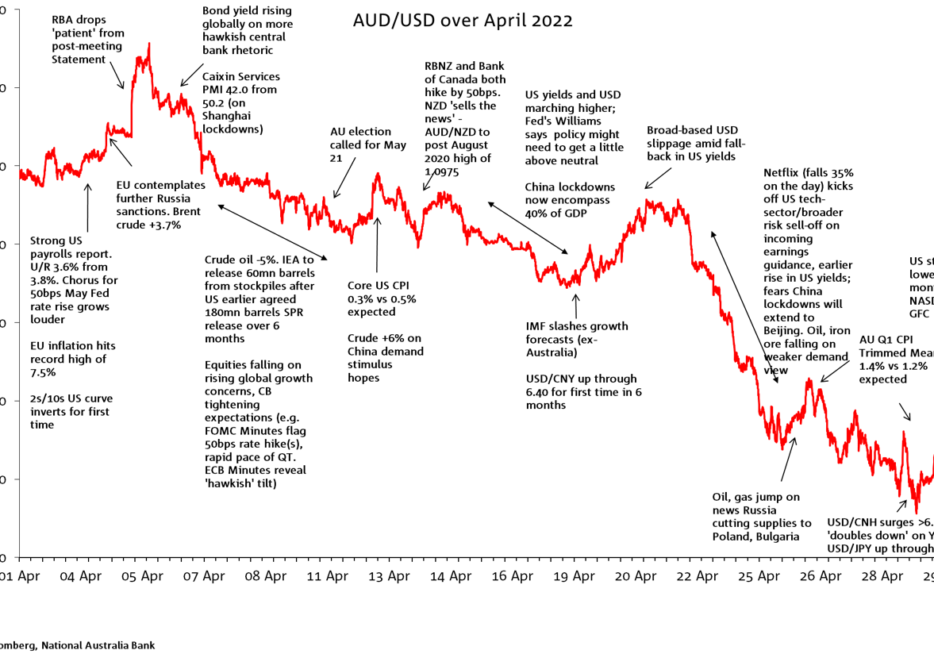

After reducing to just a 2.2 cents range in March, April’s AUD/USD range was little different – 2.3 cents

The last trading day of April had a lot to digest with BoJ policy decision alongside market moving data both in Europe and the US. Equities ended the month on a positive move, core yields drifted lower amid growth concerns while the USD was little changed. JPY was the big underperformer and AUD starts the new week at 0.6601.

A look at what’s been happening in the sustainable finance market in Australia and abroad.

Softer US growth but stubbornly sticky prices has seen US yields higher, while US equities recorded their biggest gain since January.

The US share market is split between tech majors, doing well on the back of strong earnings versus Financials (and the rest) which are buffeted by banking uncertainty and recession fears. Core global yields are higher and the USD is weaker largely reflecting EU FX outperformance while the AUD has led a commodity linked FX decline.

Us equities haven fallen sharply, bond yields are lower and AUD/USD is back near 0.66, ahead of CPI this morning.

A quiet end to a choppy week, with some intra-day volatility following stronger than expected PMIs.

Weaker second-tier US data has helped push global yields lower, while disappointing earnings by Tesla (-9.7%) and talk of margin compression dragged down equities.

We expect CPI on Wednesday to confirm that inflation is past its peak in Q1 but remains well above the RBA’s target. In this Weekly, we outline our detailed forecasts.

The RBA ‘Fit for the future’ review out this morning, with media saying Treasurer Chalmers accepts all 51 recommendations

Payments are at the heart of every business and with today’s rapid technological changes there are even more exciting opportunities to leverage in the space.

Article

A quiet overnight session despite the plethora of earnings reports.

The uplift in US bond yields continued overnight, supporting the US dollar but not hurting equities

Stronger than expected US data pushed US yields higher and supported a broadly stronger US dollar on Friday.

Todays podcast Soft US PPI helps drive a risk-on rally Adds to views the US Fed is almost done USD falls, and AUD and NZD outperform Yields mixed, equities up ahead of earnings Coming up: US Retail Sales, US Bank Earnings “Love is in the air, everywhere I look around; Love is in the air, […]

US treasuries retraced most of their post-CPI rally overnight with core CPI coming in as expected.

It was a quiet session overnight ahead of key risk events later in the week (US CPI is on Wednesday and bank earnings are on Friday, including Wells Fargo, Citigroup and JP Morgan).

The RBA opted to pause rate increases last week, sooner and at a lower level than many of their central banking peers. In this Weekly, we look at the risks in their approach.

There were no major surprises in Friday’s US NFP report, unlike the prior days weekly jobless claims data.

Softer US data saw recession concerns to the fore, with yields lower over the day but some safe-haven dynamics supporting the USD.

Late on Friday, the Treasurer formally received the independent review into the RBA, which has 51 recommendations.

A softer than expected JOLT report shook the market overnight, triggering a bull steeping in the UST. The USD fell with JPY along with European currencies outperforming. Commodity linked currencies lagged the move with AUD the notable underperformer, following yesterday’s RBA decision to pause it tightening cycle. US equities ended a four day rally with pro-cyclical sectors underperforming.

Weak US Manufacturing survey data overnight reversed the impact of higher oil prices, leaving bond yields lower and the AUD higher. It’s all about the RBA today

The strong return of international students is helping to bolster a sector undergoing post-pandemic changes amid challenging economic conditions.

A NAB panel explores the practical implications involved for superannuation funds in their net zero investment ambitions.

Report

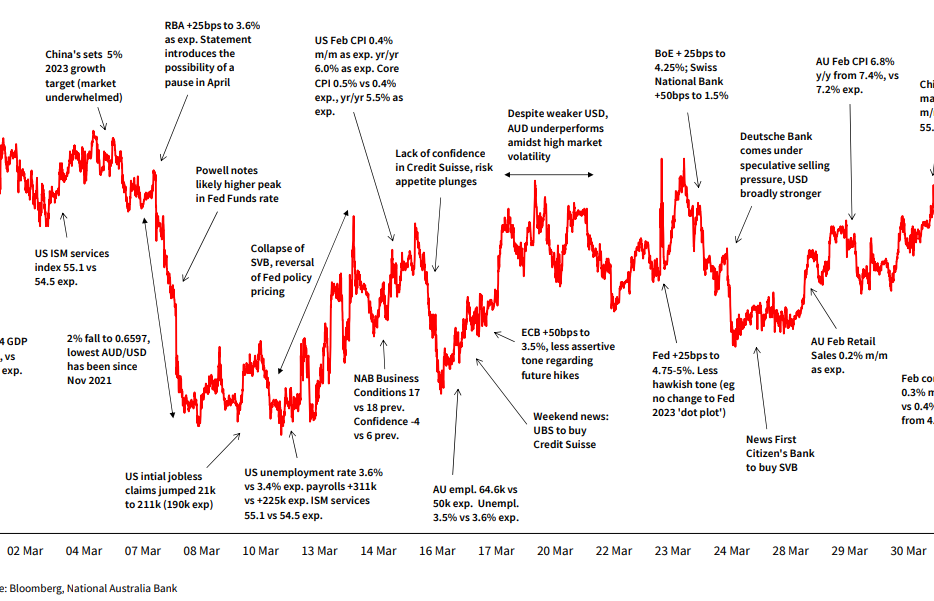

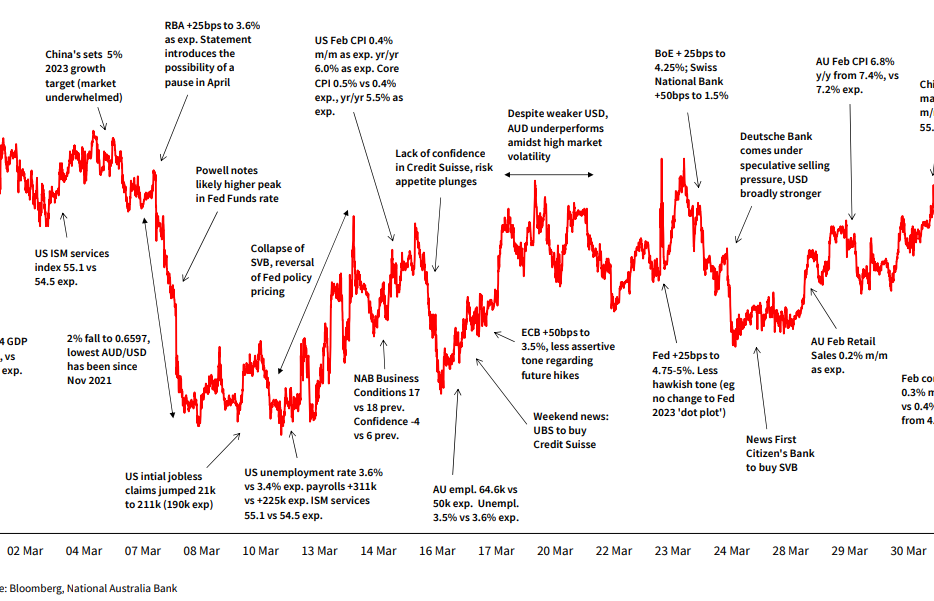

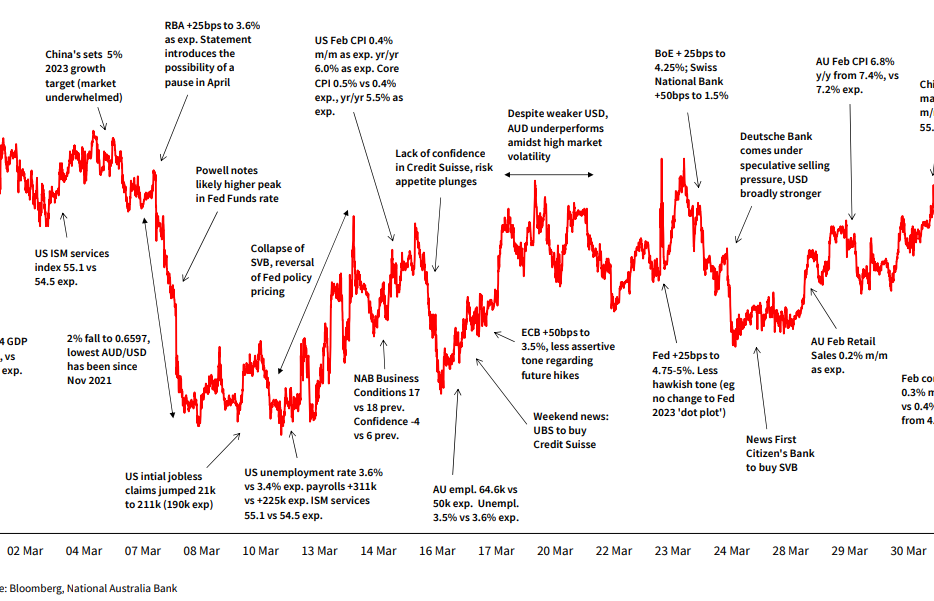

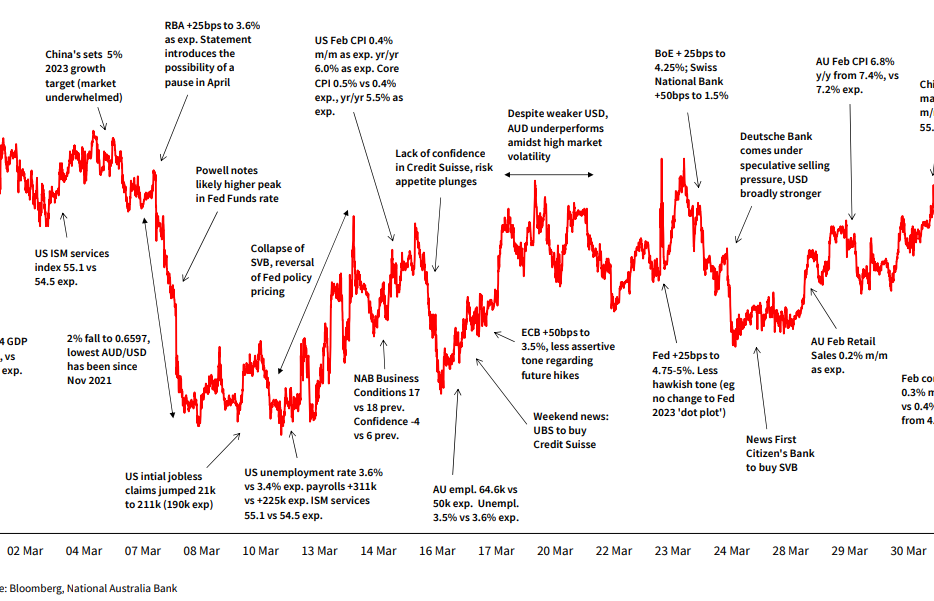

Following two months of well above-average ranges, the AUD/USD range reduced to just 2.2 cents in March, though the currency did hit a 4-month low of 0.6565.

A softer than expected US Core PCE Deflator (0.3% m/m vs. 0.4% expected) helped push yields lower on Friday (US 10yr -8.1bps to 3.47%).

It’s a third successive day of relative calm across markets, though an upside surprise to German CPI has seen European yields push higher.

The positive vibes evident during our trading session yesterday have extended overnight with European and US equity indices higher on the day. Movements in rates and FX markets have been more subdued. The USD is a tad stronger in index terms with JPY the notable underperformer. AUD and NZD are also lower with the former not helped by a yesterday’s softer than expected monthly CPI print.

There has been little top-level news flow over the past 24 hours, which has seen markets relatively calm by the standards of recent weeks.

Bond yields are sharply higher overnight, improved sentiment towards the banking sector one key driver

Deutsche Bank woes weighted on European equities and on US equities at the open, but the latter enjoyed a decent rebound before the close. Core global yields ended Friday lower across the board , the USD was broadly stronger , but still fell for a third consecutive week, AUD and NZD were the week’s underperformers.

After a positive start, US equities struggled for direction amid lingering banking stability concerns. Front end tenors have led a decline in UST yields with similar price action seen in European curves. BoE, SNB and Norges Bank deliver on expected rate hikes. AUD gives back earlier gains as equities struggle.

The FOMC hiked rates by 25bps to 4.75-5.00%, continued QT, and kept the existing dot plot which pencils in one further hike to 5.00-5.25%. Market reaction was dovish, but was not risk on.

Todays podcast VIX tumbles as investors see the glass half full ahead of FOMC early tomorrow morning Banks lead gains in Equities with HG bond issuance also signalling improvement in risk appetite UST and Bund curves bear flatten as market increases Fed and ECB rate hikes expectations 2y UST jump 20bps, 10y UST gain […]

This week, we update financial condition indices for Australia and the US and outline how central banks are likely to navigate financial stability and price stability priorities.

It was another fairly volatile day following the weekend deal for UBS to buy Credit Suisse, though overall the deal seems to have found some cautious acceptance.

A deal was struck over the weekend that sees UBS buying Credit Suisse for CHF3.0bn, a fraction of its value at Friday’s close. Iitial market response, in FX at least, has been (cautiously) favourable.

The ECB delivered on its 50bps rate promise but scraps forward guidance. Meanwhile the US’ First Republic Bank gets a $30bn deposit injection from other banks

Banking sector turmoil is back to the fore driving all markets, today centred on Credit Suisse.

This week, we consider the likelihood of further tightening by the RBA and what impact - if any - the recent failure of Silicon Valley Bank might have.

Bond yields rose sharply on the developing assessment of turmoil in US banking, helped by but largely overshadowing a stubbornly strong US CPI.

Reassurances from US authorities not enough yet to appease markets. Bank stocks remain under pressure with bond yields diving as the path of future Fed hikes comes into question. The USD is also weaker across the board.

The collapse of SVB, the 16th largest bank in the US with $209bn in assets (as at 31 Dec 2022), shook markets on Thursday and Friday. That

Jump in US jobless claims provides hope US labour market may be cooling while Challenger layoff data suggests there is more weakness ahead Softer US data triggers rally in UST and weakens the USD. AUD struggles to perform as US equities tumble with bank stocks leading the decline.

Markets broadly held onto Tuesday’s wild moves, which were driven by US Fed Chair Powell’s Senate Testimony. Overnight Powell spoke again to the House.

Is Australia different? We put the inflation and activity data in context and discuss why Australian rates might not need to go as high as elsewhere.

The market was not prepared for Powell’s hawkish remarks, sending short rates and the USD higher and equities lower.

Hawkish comments from ECB’s Holzmann send European yields higher in an otherwise quiet night for news flow

The US dollar and Treasury yields both fell back on Friday in what was a good day for equities everywhere – except Australia.

The run of worse than expected (global) inflation-related news continues to ripple through markets, the latest culprits being core Eurozone CPI and revised US Q4 unit labour costs.

An exclusive CRE webinar discussing the economic and interest rate environment.

Insight

The US 10yr finally breached 4.00% for the first time since November, following five days of resistance. A hot German CPI and renewed price pressure in the Manufacturing ISM drove, while risk assets were mixed given the strong China PMIs yesterday

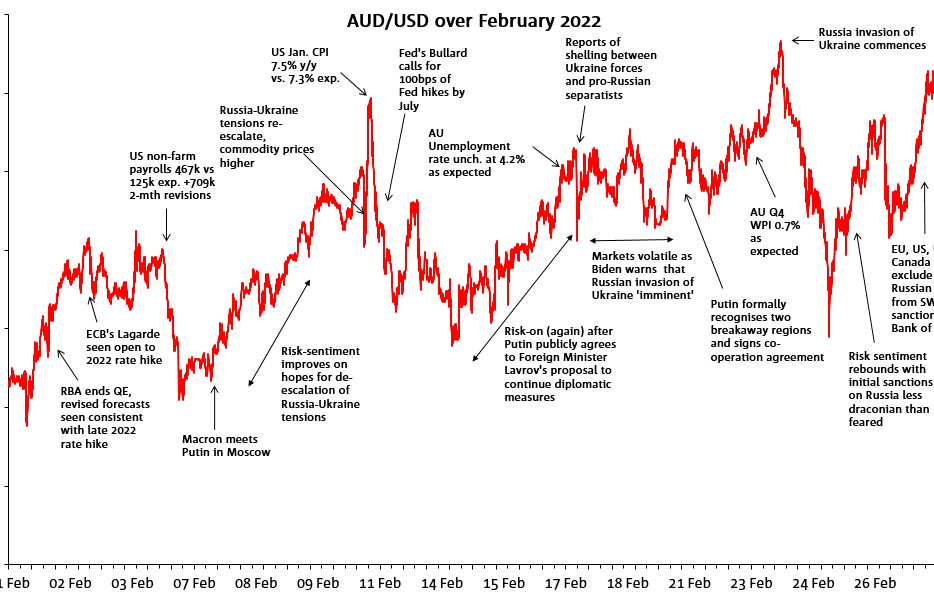

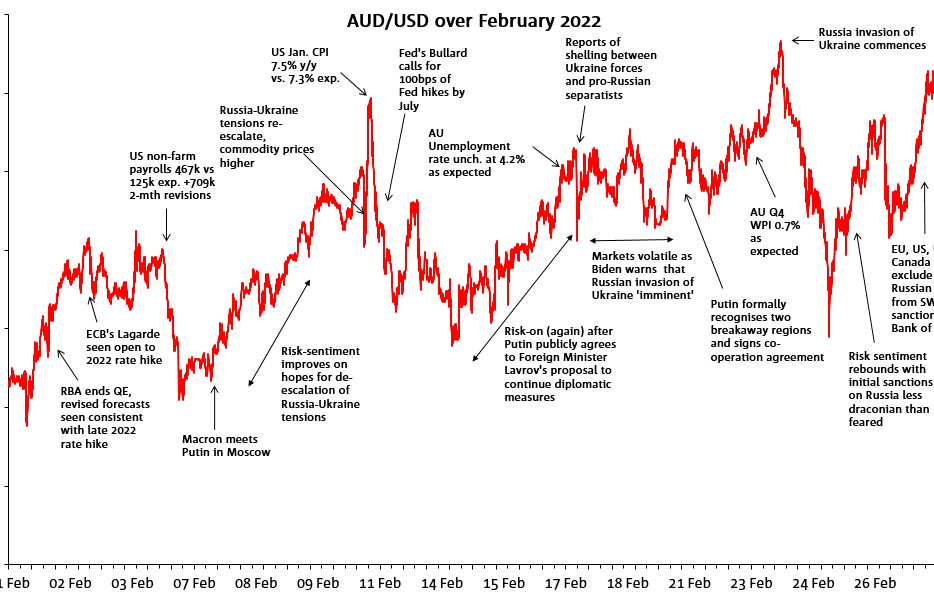

AUD performance in February was an almost exact mirror image of January, AUD/USD trading back down to near 67 cents from above 0.71 cents, having risen from sub-0.67 to above 0.71 in January.

Upside surprises to European inflation out of Spain and France have seen ECB pricing and European yields push higher, with some bleed through into the US. Elsewhere, US equities are little changed, shrugging off soft consumer confidence data, but are and on track for a monthly decline of more than 2%.

Overall clients on the Sunshine Coast and Noosa continue to report strong conditions and very tight labour markets. While only a microcosm, the themes from these clients are broadly reflective of what we are picking up in the NAB Business Survey, and it is clear the RBA is not yet in sufficiently restrictive territory to slow demand enough to be confident that inflation will return to the 2-3% target

A quiet start to the week with no top-tier data. The biggest piece of news was the EU and UK agreeing to a new Northern Ireland trade agreement, now termed the Windsor Agreement.

The US economy has started 2023 from a stronger position that many of us had expected and when looking at the Fed’s new preferred inflation reading that tries to exclude much of the noise in the data, the story doesn’t change.

US equities stage a late recovery, but remain edgy

In Australia yesterday, WPI wages data showed less wages pressure than feared. WPI grew 0.8% q/q and 3.3% y/y, 0.2ppts below the market consensus and RBA expectations.

On-demand video from our 2023 virtual Capital Markets Conference – Transition and Challenge.

Yesterday's Minutes make clear the RBA’s priority is inflation. While the Board is seeking to return inflation to target while keeping the economy on an ‘even keel’ it will do what is necessary to return inflation to target. The wages backdrop is a key risk.

The flow of economic data surprises has continued overnight and this time it was a uniformly stronger than expected performance of the services sector across major Developed Market economies.

President Biden visited Ukraine, where he pledged ‘unwavering support’ for the country as the Russia’s invasion nears the one-year mark.

It was mostly quiet on Friday and on the weekend, with an initial push higher in yields and sell-off in equities largely reversing later in the session.

A hot US PPI and hawkish comments by the Fed’s Mester and Bullard saw yields push higher and equities fall, though initial moves were pared somewhat.

US retail sales soared in January jumping 3% well above the consensus, 2.0% and Sales ex-autos jumped by 2.3%, more than double the consensus, 0.9%.

As for the data itself, US CPI was ever so slightly above consensus.

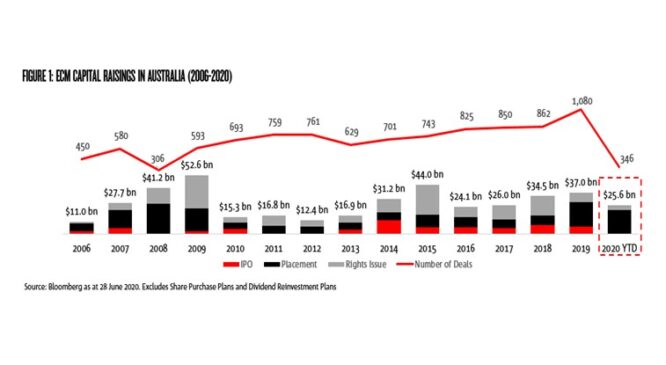

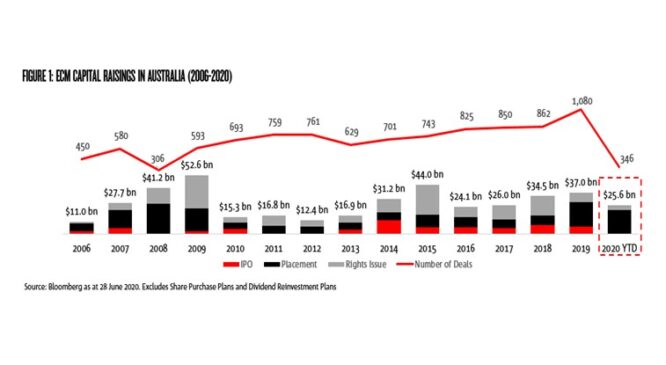

A strong start to the new year after a volatile 2022 is offering attractive conditions for capital markets participants ready to act while stability holds.

Article

NAB researchers have undertaken a detailed review of a large sample of the portfolio holdings disclosure (PHD) data made available in 2022 under regulatory changes for the industry.

Report

With many competing influences in the global macro backdrop, in this Weekly we take a step back and outline a framework for how we are making sense of the world.

The main takeaway being that Americans anticipate income growth to slow and inflation to stay elevated.

Headlines of impending Ueda nomination for BoJ Governor see volatile yen..

NY Fed’s Williams stressing importance of financial conditions in policy reaction function..

NY Fed’s Williams stressing importance of financial conditions in policy reaction function..

Powell then also noted how the strength in the labour market underscores why the Fed thinks it could take time to bring inflation down.

The RBA this afternoon and Powell interview in Washington tonight are today’s main draw cards.

Fed pricing has shot back up following Payrolls and the ISM to almost fully pricing a 25bps March hike and then a follow up May hike (there is now 40bps priced across the two meetings, up from 30bps the day prior).

Big moves overnight with the BoE and ECB feeding the market narrative that the end of the tightening phase may be nearing.

Fed hikes by 25bps, signals ‘ongoing rate increases’ will be appropriate..

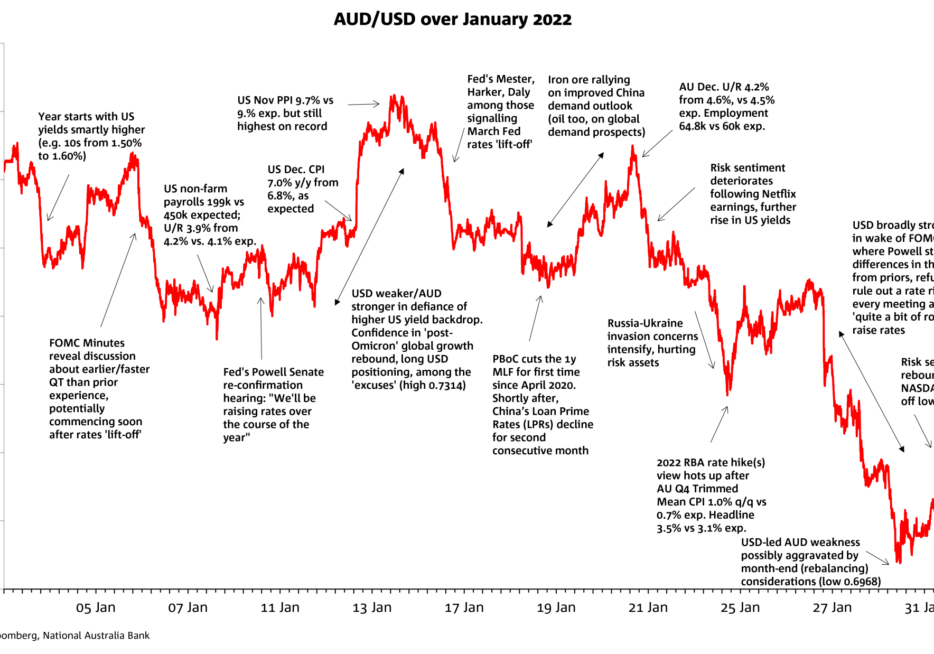

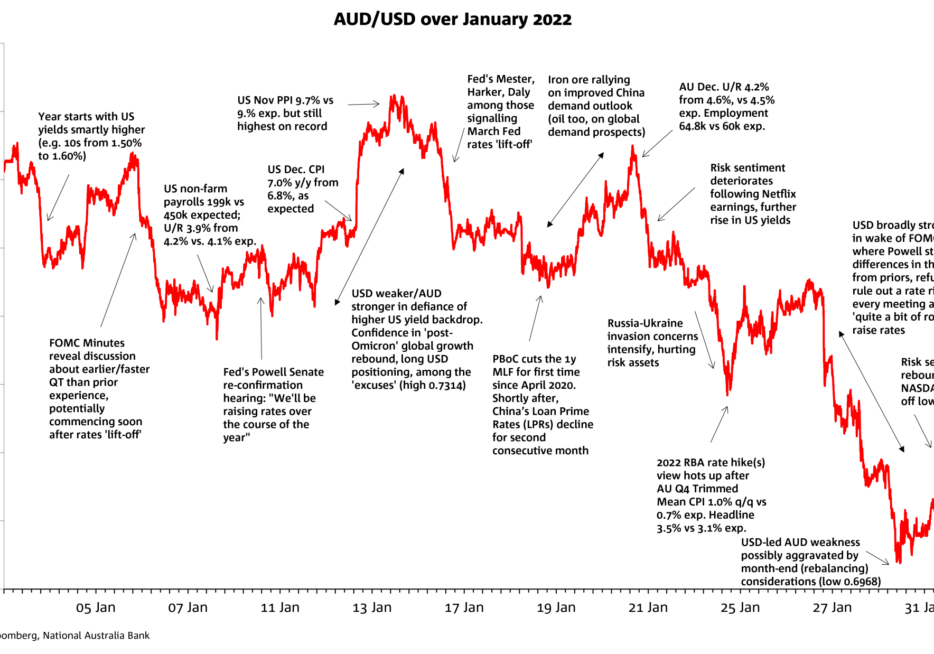

AUD/USD began the year at 0.6802 and ended January at 0.7056, a 2.5 cents or 3.7% gain.

We expect the forecasts to continue to draw a path to a soft landing, but the characterisation of the risks will be key to determine whether the RBA continues to be confident that it can return inflation to target without pushing rates deep into restrictive territory.

First to US wage data overnight. The Employment Cost Index (ECI) is closely watched by the Fed as it compositionally adjusts wages growth..

Market pricing for ECB meetings increased, helping European yields higher across the curve.

The S&P 500 Index closed 0.25% higher on Friday, finishing the week 2.5% higher.

Since Australia Day the two biggest pieces of news were the BoC explicitly signalling a pause to the hiking cycle on Wednesday after hiking by 25bps, and US Q4 GDP which although beating expectations had a soft underbelly (2.9% annualised vs. 2.6% expected; but private domestic just 0.2%).

European and US PMIs were the main data flow overnight.

We compare the state of the economy to that assessed by the RBA at their December 2022 Board Meeting.

Tech stocks lead gains in US equities. NASDAQ up just under 2%.

5% Netflix post-earnings pop helps drive best day for S&P500 in two weeks

USD softer despite ‘risk-off’ market tone.

Very weak US retail and industrial production adds to the tumble in yields

As the market waits for the BoJ policy decision today, the ECB has been the market mover overnight following a Bloomberg source story suggesting the Bank may be turning less hawkish.

CPI inflation is expected to have peaked in Q4 2022. Looking forward, we expected inflation to slow through 2023.

US out for MLK day holiday. S&P futures little changed

US equities managed to claw back into the green on Friday to extend the strong start to the year.

US CPI cools as expected, but with even more encouraging details.

Ahead of CPI tonight US Treasuries (and bonds globally) have rallied, 10-year US notes off 5bps (3bps of that seen in the Tokyo session) and 2s down just under 2bps.

ACCU discount to global prices is out-of-step with looming step-change in demand. View the full report.

Economic news flow overnight has been relatively light, though playing with the grain of the suggestion from last week’s US data (ISM Services) that the US is in process of losing its global growth leadership position.

Workplace experts, including Susan Ferrier, NAB Group Executive of People and Culture, predict what our post-pandemic model of working means for employers and employees, how to build the best model for your business and where the pitfalls lie.

Article

BoJ stuns markets with a 0% YCC tolerance band widening…

AUD/USD ended Dec 2022 much as it started. For 2022 overall, AUD/USD lost 6.2% which was the the second biggest annual range of the past decade, exceeded only in the 2020 first year of the Covid-19 pandemic.

The BoJ thus takes out our award for the most unpredictable central bank of 2022.

Equity sentiment has not been helped by a decent sell-off in core global bonds.

Recession risks were highlighted on Friday with the US S&P Global Services PMI again in contractionary territory.

Hawkish ECB rhetoric post 50bps rate rise spooks risk markets

Early this morning and in line with market expectations the Fed lifted the funds rate by 0.5% to a range between 4.25% and 4.5%, a rates level not seen since 2007. The 50bps increase was a downshift following four consecutive hikes of 75bps.

In today’s weekly, we suggest a framework for sifting through the various forces buffeting the 2023 outlook and pose five big questions that we think need to be answered to judge how the economy and central bank policy will evolve in 2023.

CPI comes in cool at 0.1% m/m and 7.1% y/y, two tenths below consensus

A distinctly cautious air prevails in front of tonight’s all-important US CPI release and tomorrow’s FOMC.

Solid US PPI cements apprehension ahead of the US CPI & FOMC

It was a quiet night for markets devoid of any top-tier data or news flow ahead of key risk events next week (of US CPI, FOMC, ECB).

The Bank of Canada rose 50bps, the sixth consecutive increase, and took the target rate to 4.25%.

A key issue for markets is whether the US economy is headed for a recession in 2023, and when can we expect a meaningful moderation in inflation that would then enable the Fed to start to pivot

The RBA increased interest rates by 25bp to 3.1% and continues to guide that “the Board expects to increase interest rates further over the period ahead".

WSJ’s Fed Whisperer Nick Timiraos wrote overnight if CPI on Tuesday comes in hot then the Fed could consider another 50bp increase in February.

The dollar was softer and US yields lower over the past week as markets both pared terminal rate pricing and priced in more cuts from mid 2023.

NAB and ASFA examine superannuation portfolio holdings disclosure data released this year as part of regulatory changes aimed at enhancing industry transparency.

Article

Markets hold, and more importantly extend yesterday’s post-Powell moves.

Investors head Down Under with NAB to meet local issuers keen to engage with a uniquely stable, long-term funding source amid volatile times.

The AUD ended the month in the ascendency, boosted by a less hawkish than feared Fed Chair Powell speech, forcing a broad USD retreat.

Markets were relatively muted ahead of Powell’s remarks with US yields and the Dollar were tracking a little higher and equities a little weaker.

The RBA Review is underway and the three panel members recently publicly discussed their approach. In this Weekly we summarise these discussions and what changes the RBA panel is likely to recommend.

China vaccination push sees Hang Seng gains extended to 5%+ by the close

China protests and COVID have seen a tone of caution to start the new week.

US equities close the week flat to lower, but with solid gains on the week

In a quitter session, relative to recent times, the risk positive vibes have extended into a third consecutive day with higher global equity markets, lower global rates and a weaker USD.

The single biggest piece of market-moving economic news overnight has come via the US S&P Global PMIs, which slumped to 47.6 from 50.4, well below the 50.0 consensus.

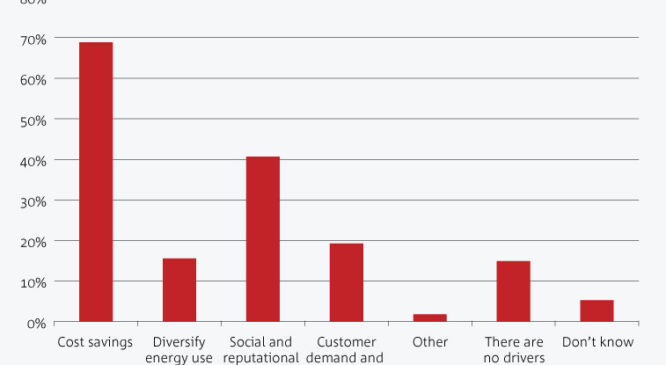

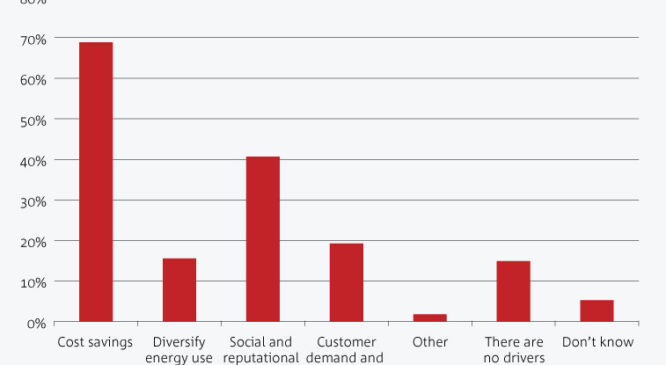

NAB’s 2022 Renewables Survey signals a further acceleration of Australia’s transition to renewable energy and net zero carbon emissions policies, a trend we expect to see globally into 2030.

In this Weekly, we dive into last week’s Q3 WPI to explain why the RBA should be more nervous about their strategy and why a near-term pause is unlikely.

US equity investors are certainly looking at the glass half full ahead of Thanksgiving tomorrow with all major equity indices showing decent gains on the day.

An exclusive webinar on commercial real estate, covering the retail market and a property update. Watch now.

Insight

Oil market volatility is showing no signs of let-up , Brent crude down to a low of $83 overnight on a Wall Street Journal report suggesting Saudi Arabia was contemplating a 500,000 barrels per day production increase from December.

Latest Fed speak from Boston Fed President Collins, suggests 75bps is still in play for December, noting markets price around 52bps for the December meeting.

US yields are higher and the dollar stronger in a modest and reversal of some of last week’s post CPI moves as Fed speakers remain stubborn that rates will continue to go higher to get to a level that is sufficiently restrictive.

Fed speakers were clear that a pause is not imminent and there is more to do, even as they may move at a slower pace, while stronger US retail sales numbers showed resilience in spending, providing some small counter to the burst of optimism after softer-than-expected US inflation data last week.

It has been a wild night in markets. After initially enjoying a broad and solid risk on move with equity markets rising and core global bond yields falling alongside a broadly weaker USD

In this Weekly, we explore recent RBA communications and forecasts and what it means for the path forward. It is clear there is a very high bar to step back up to 50bp hikes.

The new week has begun with a small reversal in the some of the risk positive moves recorded last week, particularly in FX markets and US Treasuries while equity market are showing resilience.

US CPI, US political gridlock (maybe) and China covid policy tweaks...

It has been a super risk positive night courtesy of a big downward surprise in the US CPI release.

Republican ‘red wave’ failed to materialise, but still expect slim House majority

By downshifting the pace of hikes, central banks are acknowledging that decisions are becoming more finely balanced as they tread a fine line of returning inflation to target, while avoiding significantly overtightening policy and slowing the economy more than needed.

The NAB Business Survey showed Conditions falling just one point to +22 to remain at very elevated levels, above the pre-pandemic highs for the series.

Speculation about China reopening continues to add some market volatility with WSJ reporting Chinese leaders were considering reopening steps getting some notice.

Risk appetite soared on Friday as Chinese whispers swept markets last week that China had put together a ‘conditional re-opening plan’, reportedly mapping out a material re-opening by March 2023.

Wednesday’s FOMC meeting continues to reverberate through markets.

FOMC Statement hints at reduced pace of tightening ahead…

It has been a volatile session in markets with risk assets initially lifted by rumours China was looking at phasing out its zero-covid policy, only for Beijing to later deny the speculation.

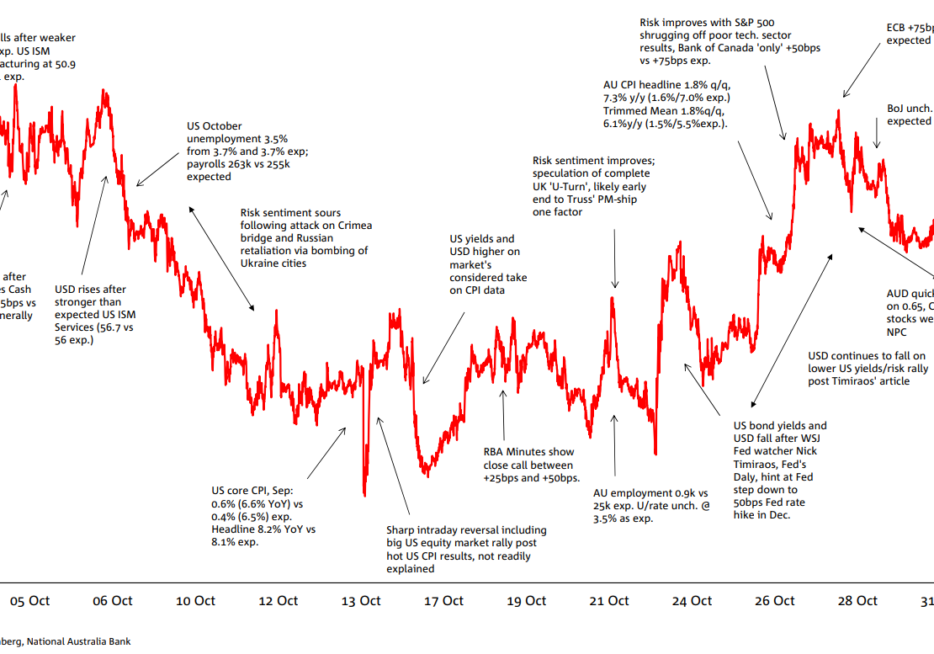

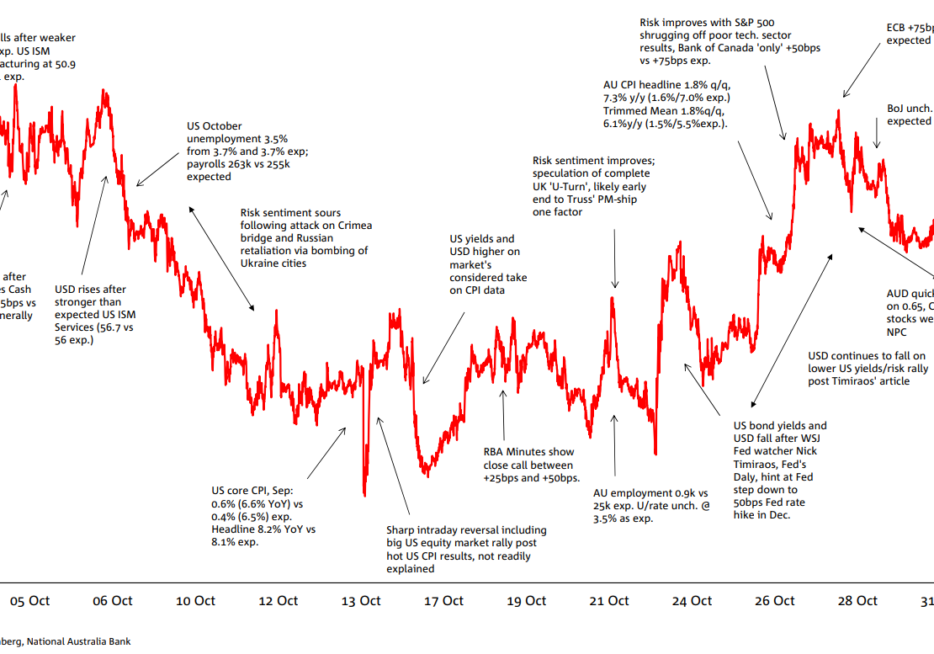

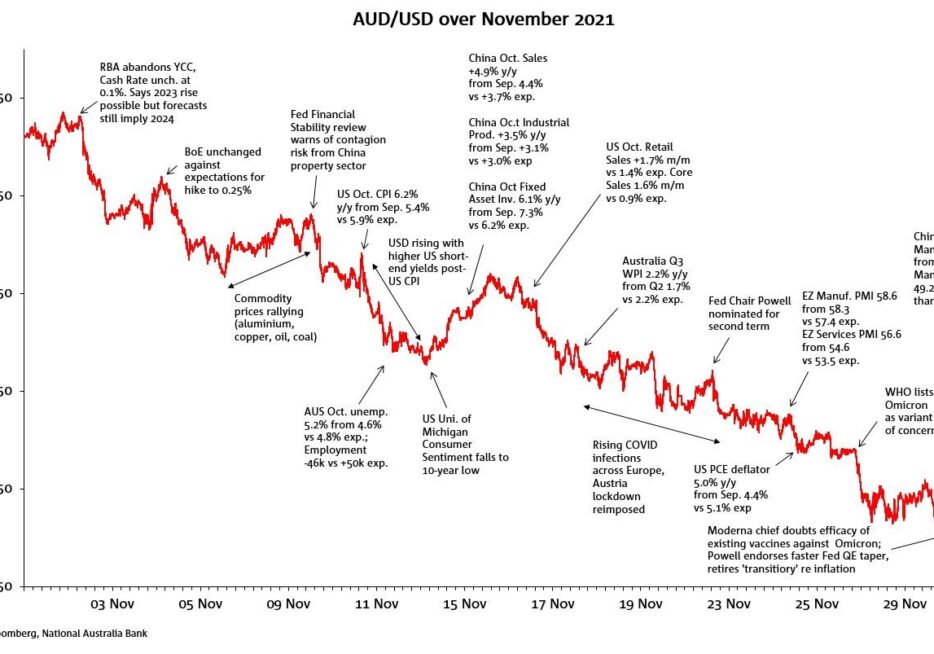

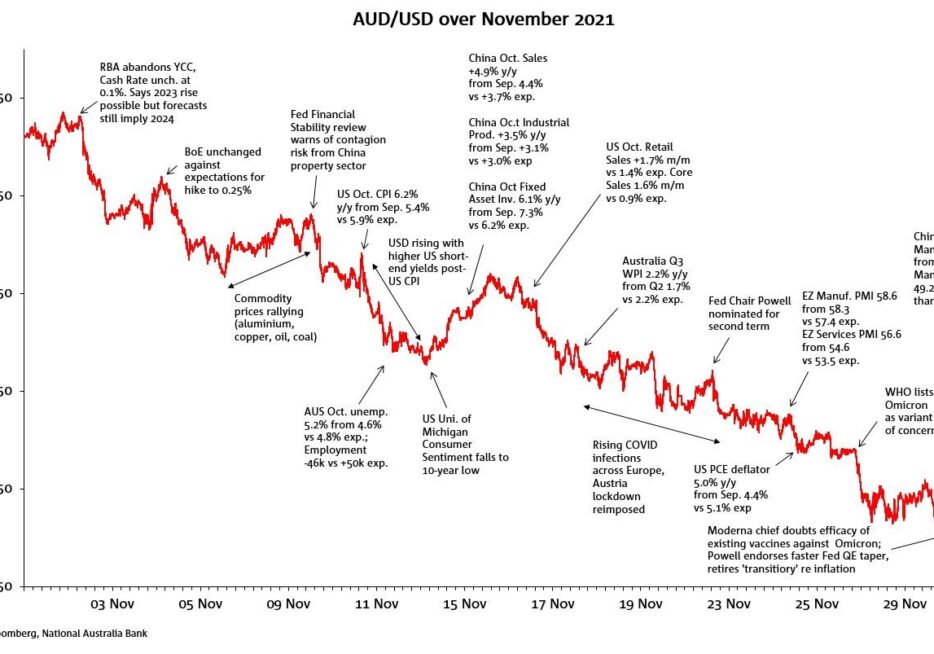

Australia specific influences on AUD once again played second fiddle to broader USD volatility and swings in risk sentiment.

NAB has pencilled in a 25bp hike, we also think there is a real risk that the RBA hikes by 50bps, and that this risk is higher than the 22% chance that markets are currently pricing.

Big gains in US equities on Friday help extend rally for a second week

The rise of e-commerce as an enduring consumer trend is driving a new kind of payments experience within the corporate and government space.

The ECB meeting was the big event for markets last night and as expected the Bank delivered a 75bps hike, but it sounded less committal on future rate hikes.

Yields are generally lower globally as the earlier run up in expectations for central bank tightening are pared a little further. A hike of ‘only’ 50bp from the BoC helping that sentiment.

Last night’s first Federal Budget under Labor Treasurer Jim Chalmers contained no fireworks, falling fully in line with pre-Budget media briefings.

The UK has a new PM in Rishi Sunak, and gilts have rallied in response. UK 10yr gilt yields were 31bp lower at 3.75%. That’s 90bp off their peak of 4.64%, but still about 60bp above their level before the Truss Premiership.

This week we provide a further update on supply chain disruptions and highlight a few areas where businesses might reasonably expect some lower prices from suppliers in coming months.

Growth rebounded in Q3, but base effects flattered the results

Insight

Friday’s offshore markets produced as many fireworks as we have seen on just about any day this year with the mere suggestion of the Fed stepping down from 75bps to a 50bps incremental rate hike in December producing a fierce rally in US equities.

Terminal Fed Funds pricing have lifted to 5.00% by March 2023 from 4.92% last week and continue to price a 75bp hike at the upcoming November FOMC meeting and a 75% chance of a follow up 75bp at the December meeting.

Yields rose to fresh cycle highs and risk appetite soured. US equities were lower, halting a 2-day rally despite relatively upbeat earnings from the likes of Netflix and United Airlines.

The selloff in bonds has seen a ‘reversal of the reversal’.

Australia’s second Budget for 2022-23 will be handed down next week (7.30pm on Tuesday 25th). Treasurer Chalmers has framed this Budget as one that will not add to inflation risks amid elevated cost-of living pressures and which occurs with a background of rising global recession risks.

Another big UK fiscal U-turn and positive earnings from BofA boosted global risk appetite last night.

Rise in 1y ahead US inflation expectations spooks markets

Volatile overnight session sees risk on, risk off then risk on again

UK markets remain at the epicentre of global market volatility

Q3 CPI is on Wednesday 26 October and we forecast Headline of 1.3% q/q and 6.7% y/y.

Bailey in Washington says bond purchases will end as scheduled on Friday

Risk aversion has dominated the start of the new week amid heighted geopolitical tensions and a market disillusioned by credible BoE support for the Gilts market.

It was ‘good news is bad news’ for US Payrolls which were a touch better than expected and seen as too solid to support a pivot narrative.

In Australia there are two macro developments worth watching, Seek new job ads and Consumption imports in the August trade balance.

Another volatile session in markets; US equities opened lower, not helped by anticipated news of a bigger oil cut supply agreement by OPEC +.

In this weekly we give our initial thoughts on Q3 CPI following last week’s August monthly CPI indicator. We will provide a full preview early next week ahead of Q3 CPI on 26 October.

Yesterday 25bps RBA cash rate rise, defied the broad consensus among economists and investors (~45bps was priced in for the meeting) but which was justified by the Board in part on the premise that “the cash rate has been increased substantially in a short period of time”.

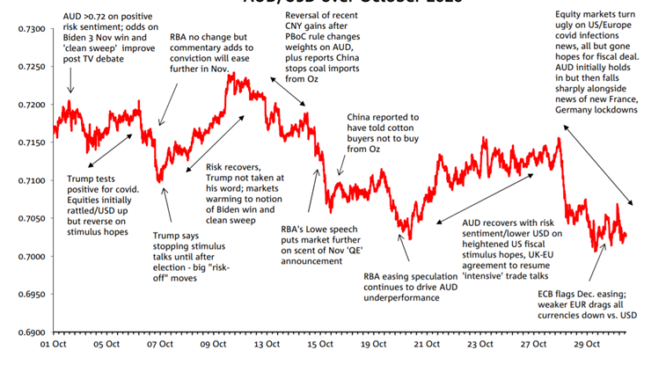

The AUD/USD high of 0.6916 came on the 13th and the low of 0.6363 on the 29th (last day of the month).

A surprise U-turn by the UK government on the fiscal package and a weaker than expected US ISM Manufacturing (50.9 vs. 52.0 expected) have driven a large fall in global yields.

US equites fall on Friday to close out a 3rd consecutive negative quarter

A look at what's been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what’s been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what's been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what's been happening in the sustainable finance market in Australia and abroad.

Newsletter

In a positive development the OBR will provide preliminary costings of the UK’s fiscal package on 7 October, instead of the previously signalled deadline of November 23 (the same day as the Budget).

Bank of England has pledged to buy up to £5bn of longer dated gilts each day for up to 13 days (£65bn total) with a motive of protecting the UK pension industry.

We explore in detail three features of the post-pandemic labour market that have added frictions and disrupted the supply of labour over and above the shifting macro environment.

UK rates continue to push higher

Fallout from UK mini-budget continues.

Epicentre of current market turmoil shifts across the Atlantic to UK on Friday

BoE, SNB and Norges Bank follow the Fed’s +75bps with 50bps, 75bps, 50bps respectively

Fed hikes 75bps as expected, looks for 125bps in ’22 then 25bps more in ‘23

Markets will be looking for any clues from the RBA Board Minutes as to whether the RBA might step down from its 50bps rises back to 25bps.

View the Full Report Reconciling a record divergence between business conditions and consumer sentiment This week It’s a relatively quiet week on the Australian data front this week, with really only the RBA Board Minutes tomorrow and a speech by Deputy Governor Bullock on Wednesday, which will review the RBA’s bond purchase program and presumably […]

A sourer tone took hold over the past 24 hours, with equities lower and haven currencies, including the dollar, stronger.

US yields continued to push higher ahead of the FOMC

Last week will be marked out as one of the more tumultuous for financial markets since the early days of the pandemic, says NAB's Ray Attrill.

Volatility has come roaring back in Thursday’s offshore session.

After recording hefty losses post the US CPI release on Tuesday, US equity markets closed with modest gains.

This week we update our analysis of the inflation reads in the NAB Business Survey and what this may mean for CPI pressures in Australia, particularly in Q3.

Today’s podcast Overview Rumours of inflation’s demise much exaggerated US CPI shocks to the upside: stocks, bonds take fright USD bounces back, AUD and NZD both down by more than 2% Next week’s Fed debate now seen to be between 75 and 100bps (83bps priced) German ZEW survey readings slumps while US NFIB Business Optimism […]

Positive risk sentiment ahead of US CPI tonight.

Risk appetite improves despite hawkish Fed talk

It has been all about the ECB and Fed overnight with the former delivering a jumbo hike and hinting at more to come while Fed Chair Powell reiterates commitment to act forcefully against inflation

A volatile night where earlier price action in Asia was largely reversed.

A broad rise in core global yields has been the big news overnight, fuelled by a better-than-expected US ISM report and news UK PM Truss is planning a huge debt-funded fiscal stimulus.

NAB expects the fourth successive 50bps interest rate increase to be announced on Tuesday as the RBA moves policy back to a more neutral level.

Eurozone bonds yields and stocks falling on the latest jump in energy prices – both oil and gas – following confirmation the NordSteeam1 gas pipeline will remain shut while Russian sanctions are in place.

A goldilocks payrolls report failed to support risk assets on Friday, with equities and the USD quickly reversing on news that Russia was not restarting gas flows through the Nord Stream pipeline

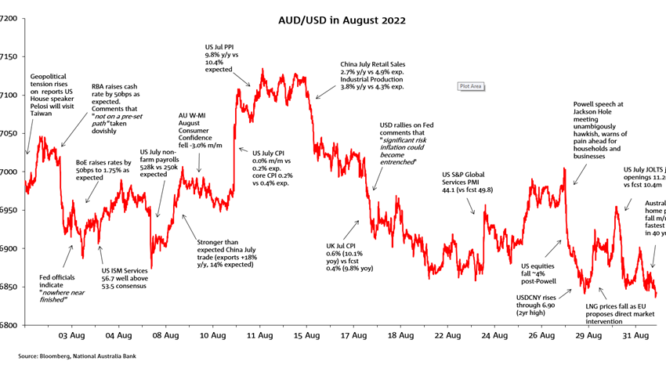

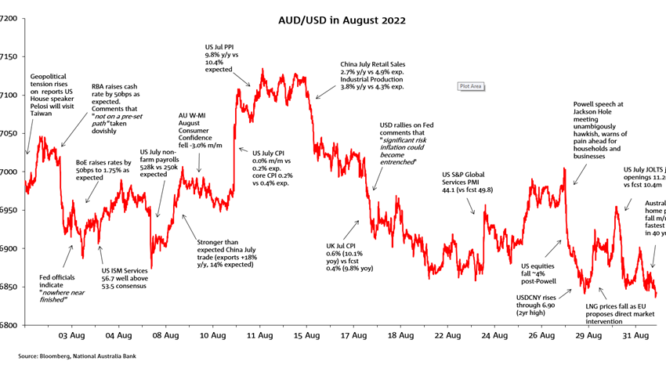

The AUD/USD spent August oscillating around the 70 US cents mark but spent much more time below than above.

The bond sell-off shows no signs of abating with a stronger than expected US ISM Manufacturing helping to drive the US 10yr yield up.

We'll help you find the right foreign exchange risk management strategy by understanding your core business and the challenges you face every day.

August has been a terrible month for balance fund investors with no diversification gains from holding a portfolio of equities and bonds.

Central bank officials from around the world met at Jackson Hole last week. In this Weekly we highlight the key discussion points and what implications this may have.

Goldman’s noted inflation could hit 22.4% y/y in the UK in early 2023 if gas prices don’t moderate and if there is little in the way of cost of living relief.

Following a negative lead from Asia, US and EU equities have begun the new week on the back foot.

After clocking 5.5 million podcast plays and 15,000 daily listeners, NAB’s Morning Call is celebrating six years of market highlights, with even more expert analysis to come.

Podcast

Fed chair Jay Powell’s address to the Kansas Fed’s Jackson Hole Symposium on Friday was short and as far as equity market investors were concerned, bitter not sweet.

Another day spent in anticipation of Powell’s speech tonight

Another night devoid of top-tier data or news flow. The past week has been a bit like Waiting for Godot with markets apprehensive ahead of US Fed Chair Powell’s Jackson Hole speech on Friday.

Composite PMI sub-50 everywhere in the world bar UK; US worst of all.

In this weekly, we explain why other wage indicators are lifting more strongly, including from NAB’s own business survey.

Markets are apprehensive ahead of US Fed Chair Powell’s Jackson Hole speech on Friday

NAB's Rodrigo Catril says the Canadians are out shopping; we also saw a big increase in purchase prices in Germany, in fact the largest monthly rise since 1949.

Following yesterday’s FOMC Minutes overnight we’ve heard from FOMC members wanting the Funds Rate up to 3.75-4.0% this year and questioning why you’d want to drag rate rises out into next year.

In Australia, wages data for the 3 months to May disappointed most forecasters, though the result was in line with the RBA August SoMP (and NAB) forecast.

This week we expand on the hot inflation reads seen in the NAB Business Survey and what this may mean for CPI pressures in Australia, particularly for Q3.

After a negative start, US equities managed to end the day in positive territory supported by better than expected earnings reports from retailers.

Oil prices have fallen to their lowest since early February 2022 with falls of around 4% in part due to weaker China demand.

Equities continued their relentless rise, brushing off the inflation expectations data and hawkish Fed rhetoric

The San Francisco Fed’s Mary Daly warned it is too early to ‘declare victory’ over inflation.

It was all about US CPI overnight with markets reacting sharply to a lower than expected print with Equity and FX markets taking the CPI miss as a positive signal, taking some pressure off the Fed and a sign that inflation has peaked.

Rebound set to fade as consumption slows in H2 2022

Insight

There was no let-up in elevated price pressures in the July NAB Business Survey published yesterday, with price indicators accelerating further from the already record highs of recent months.

In this Weekly we look at job ads in more detail to see what they may be portending for activity, and we also cross check the data with other information.

China is continuing its military drills around Taiwan, but that hasn’t impacted markets apart from gold (+0.7% to 1,787.61) retaining some slight geopolitical risk premium.

An all-round stronger than expected US employment report Friday dominated the end-of-week market price action; whether they extend or at least partially reverse this week hinges in large part on Wednesday’s US July CPI data.

As widely expected, the BoE lifted the cash rate by 50bps and retained the option to act forcefully in the future, the Bank now officially sees a recession in the horizon.

A few hours on from Nancy Pelosi leaving Taiwan and markets have almost forgotten she ever came. Equity market have recovered their poise, a tech sector rally seeing the NASDAQ close at its highest level since 4 May.

Our analysis in this weekly highlights that the RBA is indeed treading a fine line in trying to chart a credible path to at target inflation.

In Australia, the RBA met yesterday and raised the official cash rate by 50bps to 1.85% as expected, the third consecutive 50bps increase to be at its highest level since April 2016.

The AUD/USD opened the month at 0.6903, fell to its monthly low of 0.6682 on July 14 and made a high of 0.7032 on July 29 before closing the month at 0.6985.

Data releases over the past 24 hours have provided further evidence the global economy is slowing. China’s Caixin Manufacturing PMI confirmed that China’s reopening rebound is over.

US economic data on Friday underscored the inflation challenge facing the Fed

ECB’s Visco says “there is a risk of a recession” and that ECB policy can’t drive down gas prices.

The Fed delivered a unanimous 75bp hike as widely anticipated.

The Terms of Reference for the RBA Review have been finalised, the three-member review panel appointed, and March 2023 set as a deadline for a final report containing recommendations to the Government. In this Weekly, we look at what to expect.

More price increases are likely for food and grocery. If they continue to rise in Q3 and Q4, it is hard to see US core inflation numbers moderate sufficiently for the Fed to pivot.

Kremlin confirms 20% cut of gas to Europe from Wednesday. Gas up 9%

A round of softer than expected PMIs on Friday added further fuel to ongoing concerns over a global economic slowdown with the move into contractionary mode for both the EuroZone composite and US Services PMIs the main culprits.

The ECB hiked rates by a more-than-expected 50bps, taking the deposit rate back to 0% and ending its negative interest rate policy that has been in place since 2014

ECB now seen hiking by 50bps tomorrow and then again in September

In this Weekly we shine a spotlight on the household sector and what trends are starting to show as households react to higher interest rates and above-target inflation.

Oil is the standout mover, Brent +$4.50 and WTI crude +$4.60 on reports Saudi Arabia won’t be pumping any more oil

Risk sentiment rallied on Friday with a better than expected US retail sales print and positive earnings from Citigroup lifting equities

Australian employment data yesterday was showed a tighter labour market than the RBA had been expecting with the unemployment rate plummeting four tenths to 3.5% , a new 48-year low.

Bank of Canada surprises with ‘front-loaded’ 100bps rate rise

Risk off again overnight as recession fears intensify

In this Weekly we highlight some of the indicators that suggest a peak in global inflation is near

Risk off ahead of a big week for data, partly driven mainly by China virus news

US June non-farm payroll employment 372k vs. 265k expected.

Risk sentiment improved over the past 24 hours.

Global Central Banks have been lifting interest rates to combat 40-year high inflation numbers. What does this mean for commercial borrowers?

Webinar

Higher US yields together with a further drop in the EUR sees the USD in DXY terms now at its highest since September 2002.

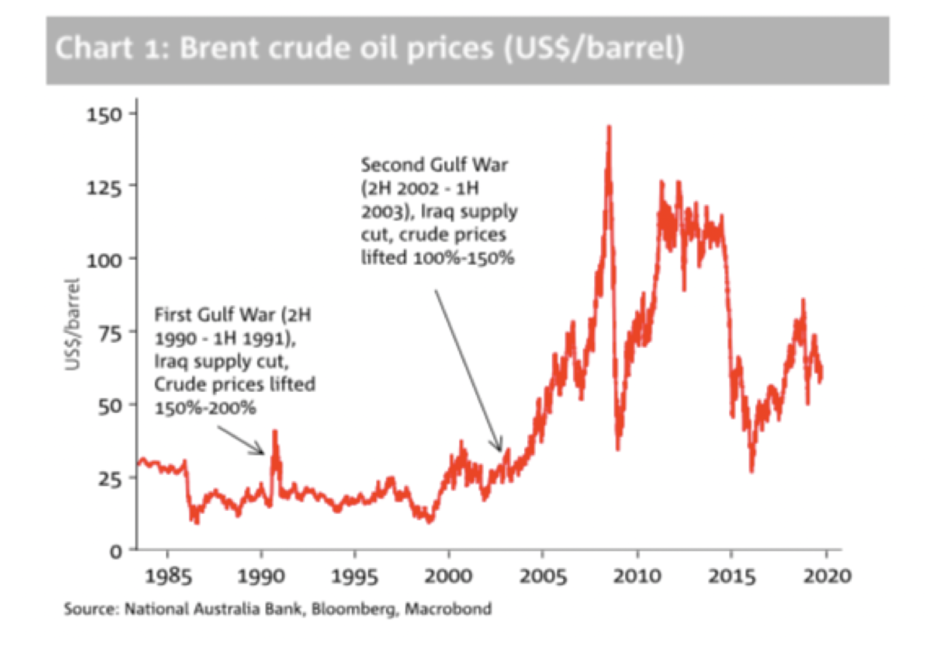

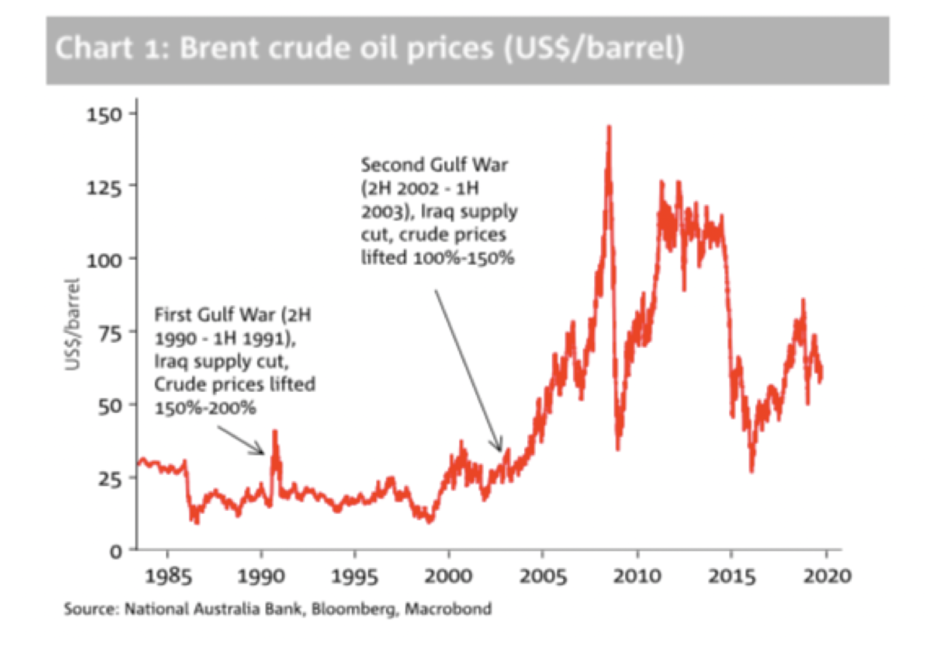

Brent oil prices are down 17% since 14 June and have the potential to drive some welcome relief on headline inflation prints.

In this Weekly we explore how central banks may respond to rising recession risk and expand upon some of the leading indicators of recession

Europe remains stuck in the middle between the Russia/Ukraine crisis and a weakening global economy

After a dismal first half, US equities start H2-22 with a positive tone

The AUD/USD opened the month at 0.7170, made a high of 0.7283 on June 3 and fell to its monthly low of 0.6851 on June 15.

A wild night for risk assets with recession risks rising.

Core global yields have been the big market movers overnight with European bonds leading the decline in yields.

In this weekly, we look at some indicators that might reliably provide warning of some unwind or easing of the supply chain disruptions.

Weaker US consumer confidence dents equities

A look at what’s been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

US equity markets have begun the new week on the back foot with a clear lack of conviction.

The ongoing disruption of the pandemic and Russia and Ukraine conflict have highlighted the need for a different approach to global logistics.

It was a great day for US stocks on Friday, with two-thirds of the mid-month sell-off now retraced.

An upended international trading environment brings both new pressures and fresh opportunities. In the second instalment of our Supply Chain Q&A series, our experts examine how Australian importers are moving forward and gearing up for further growth.

Article

Despite softer PMIs and still-hawkish messaging from the Fed, US equities managed to turn around intraday.

Recession or hard landing fears have taken a firmer hold on most markets in the past 24 hours.

On-demand video from our virtual Transitioning to Net Zero conference.

The RBA has upgraded its inflation forecasts, now seeing headline inflation at 7% by the end of 2022.

Some relief in equities with a strong bounce back from last week’s decline

The RBA is front and centre in local markets this morning.

US and European equities showed signs of stabilisation on Friday, but still ended with sharp declines on the week which was not helped by Fed Chair Powell's words that the Fed has unconditional commitment to restoring price stability.

The Bank of England rose rate by 25bps and left its options wide open on future moves

Fed delivers 75bps rate rise, sees 50 or 75 most likely at next meeting

A NAB networking event connects women across construction and property finance to help promote female participation in the sector.

The key policy challenge will be to gradually return inflation to the 2%/2-3% target ranges sought in the US and Australia respectively, while avoiding taking interest rates too high producing a recession and a sustained rise in unemployment

Ahead of tomorrow's FOMC meeting we have seen an increase in market volatility across Equity, Rates and FX.

A hot US CPI report and signs of inflation expectations de-anchoring on Friday has seen yields surge, risk assets sell off, and recession talk rise.

Announcing the end of the Asset Purchase Programme (APP) as of July 1, the ECB also pre-announced a 25bps rise in interest rates out of its July meeting with a further rise planned out of the Sept meeting.

Rise in oil prices fuels inflationary concerns and the need for central banks to increase their hawkishness.

RBA surprises (most) for second month running with 50bps Cash Rate rise to 0.85%

Putting Wealth To Work For Generations

Report

The RBA’s Board meets today and a further interest rate increase is unanimously expected by market economists with the size of the rate increase uncertain.

Yields rose notably in what was a quiet night for data and events.

Markets took the strong US payroll gains on Friday as affirming the near-term path for continued Fed tightening.

A positive day for risk sentiment ahead of US Payrolls tonight on no new news

Reaction to a strong set of US data releases has been the main story overnight

A review into the RBA is expected to occur “relatively soon” according to the newly elected Labor Government.

AUD/USD hit a near two-year low of 0.6829 on May 13 after hitting its highest May prints earlier in the month (0.7266, seen on both May 4 and 5).

Inflation is back in focus with European inflation at its highest ever level of 8.1% y/y helping rates extend yesterday’s selloff.

Brent oil recorded its 8-consecutive day of price increases, supported by expectations of a China reopening in addition to the expected EU Russian oil ban.

NAB’s first sustainability-linked foreign exchange (FX) derivative aligns environmental, social and governance (ESG) targets with financial risk management for a major London-listed infrastructure investment company.

After having moved briefly into bear market territory the previous Friday, last Friday saw the S&P500 up by its largest weekly gain so far this year.

US equities had a strong night with the S&P500 +2.0% and NASDAQ 2.7%.

The market found some relief on the notion that the FOMC Minutes revealed a broad consensus for 50bps hikes in June and July and the possibility for a pause later in the year.

In this Weekly. we discuss how broader financial conditions, and not just the cash rate, are influencing the economic outlook.

Monday’s upbeat sentiment was short-lived with falls in equities and yields overnight.

A more positive risk backdrop begins the new week. US equities are higher, the S&P500 up 1.9%, extending a turnaround after dipping into bear market territory intraday on Friday.

The S&P500 falls into bear market terrain Friday before late day pull-up

Although employment growth disappointed yesterday, and along with wages data from earlier in the week, remains consistent with a rate rise of 25bp by the RBA in June.

The S&P500 high to low fall since the early January high puts it down 19% year to date and although not officially in bear market territory yet, looks to be only a matter of time.

The UK's unemployment rate fell to it's lowest level since 1974 and along with a further pickup in average earnings growth, now see money markets pricing 125bps of BOE rate hikes by December.

It’s clear that with unemployment close to full employment levels and inflation way above target and forecast to rise higher, Australian interest rate settings should no longer be anywhere close to the emergency low settings implemented in the pandemic.

The biggest news overnight is commodities, oil prices are up, which threatens to prolong the inflation narrative.

US Consumer Sentiment fell further than expected to be at its lowest level since August 2011 and with consumer confidence so low, the risk of recession is rising.

Risk assets remained out of favour as concerns over inflation and recession risk continued to dominate.

Another volatile session in markets with an upward surprise in the April US inflation data release adding an extra layer of uncertainty

The RBA met last week and raised rates by 25bps, lifting the cash rate target to 0.35%, and signalled further hikes over coming months

Decline in inflation expectations drive core global bond yields lower with further fall in oil prices helping the move.

The ongoing theme of mounting growth concerns against a backdrop of central bank tightening is continuing to drive market movements.

The current debate in Markets is whether the Fed would be willing to let the economy slip into recession to tame inflation.

Inflation is now forecast to peak at over 10% this year in the UK

Research shows that the vast majority of family wealth is lost by the third generation.

Article

Powell comments that 75bps isn’t something the FOMC is actively considering and that 50bps is on the table for the next couple of meetings

The RBA yesterday increased the cash rate target by 25bp to 0.35% and said it will do what is necessary to return inflation to the band

US 10-year Treasuries have just breached the psychological 3% barrier for the first time since late November 2018 in what has been a further bear steepening of the US curve

The RBA Board meets tomorrow in a meeting now widely expected to see the first increase in interest rates since November 2010.

Sentiment toward the AUD went from hero to zero in April.

The NASDAQ recorded its worst monthly performance in more than a decade.

A wild ride in FX markets over the past 24 hours

News of Russia’s decision to cut gas supply to Poland and Bulgaria triggered a 30% jump in EU gas prices at the open before eventually settling 10% higher.

In this Weekly we look at the potential impacts on theoretical borrowing capacity at different interest rates.

The World Bank has warned the war in Ukraine is set to cause the "largest commodity shock" since the 1970s (referencing the 1973 oil embargo).

The rise in ESG investing can help address gaps in Australia’s affordable and specialist housing sector through innovative funding models, NAB’s experience in the UK shows.

There’s been a strong risk-off sentiment to the start of the week.

Markets are a little easier to understand today. Bond yields are back on the rise, given inflation expectations and more hawkish rhetoric from central banks.

A landmark $1.8 billion green sustainability-linked loan sets ambitious targets for reducing energy and water usage for a major fleet of city trains and maintenance centre.

Wages likely to pick up despite NAIRU uncertainty. The RBA’s latest ‘best guess’ of the NAIRU is 4%.

Bond yields have fallen sharply overnight, but that doesn’t mean inflation expectations are going away, or does it?

It’s not something that will continue for long, but US bond yields have risen sharply today, and so have equities. Which one will give in first?

Global yields continued their March higher over the Easter period with the US 10yr yield hitting a fresh cycle of 2.88%, its highest since 2018.

Despite 50 basis point hikes by the Bank of Canada and the RBNZ over the last 24 hours, bond yields haven’t moved a great deal.

US inflation rose as expected, but there’s still been a reaction in the bond markets.

Higher inflation is starting to impact buying conditions in the US. Will we see the same trend emerge in Australia?

Bond yields continue to climb with risk assets now coming under pressures.

No respite from rising Treasury yields – 10s up another 4bps to 2.70% +32bps on week further hurting tech. stocks/NASDAQ vs other indices and boosting USD DXY index to 100.

The reaction to the Fed minutes early yesterday morning continued to dominate markets overnight.

Australia’s first female Deputy Chief of Army has a personal stake in building workplace diversity as she outlines her strategic insights – from geopolitics to sustainability - as special guest at the NAB Capital Markets 2022 conference.

FOMC Minutes reveal plans for much faster and more aggressive balance sheet reduction than 2017-2019

The RBA clearly signalled it is contemplating lifting rates over coming months, removing language about being “patient” and pivoting the RBA to once again being forward looking.

RBA’s April meeting yesterday left policy on hold at 0.1% but underwent a substantial rewrite to the post meeting statement.

Talk of Europe restricting Russian oil and gas has re-surfaced, driving oil prices higher

Eurozone inflation printed a new record high with ECB hawks calling for policy action.

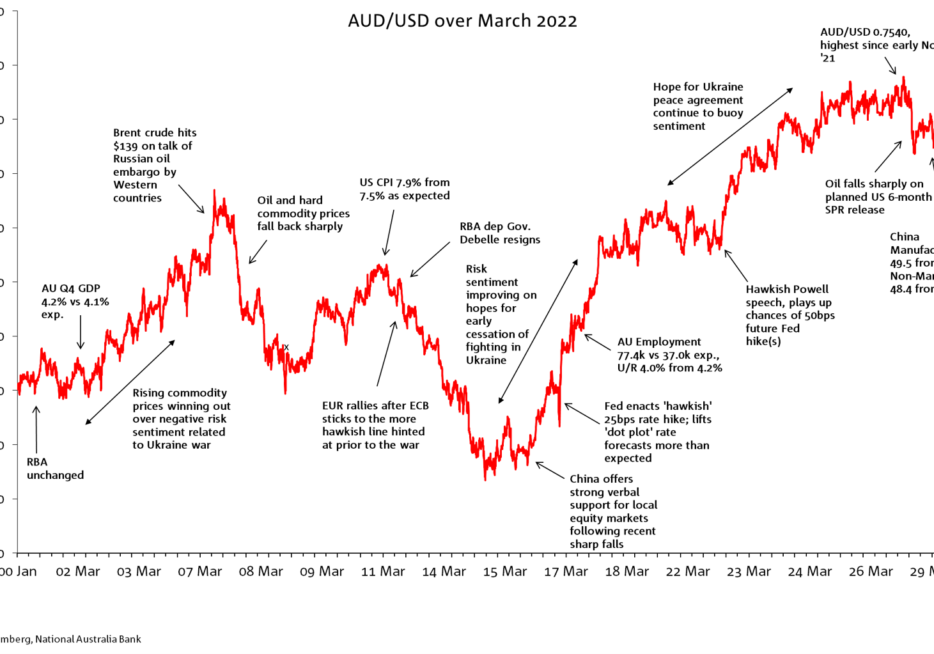

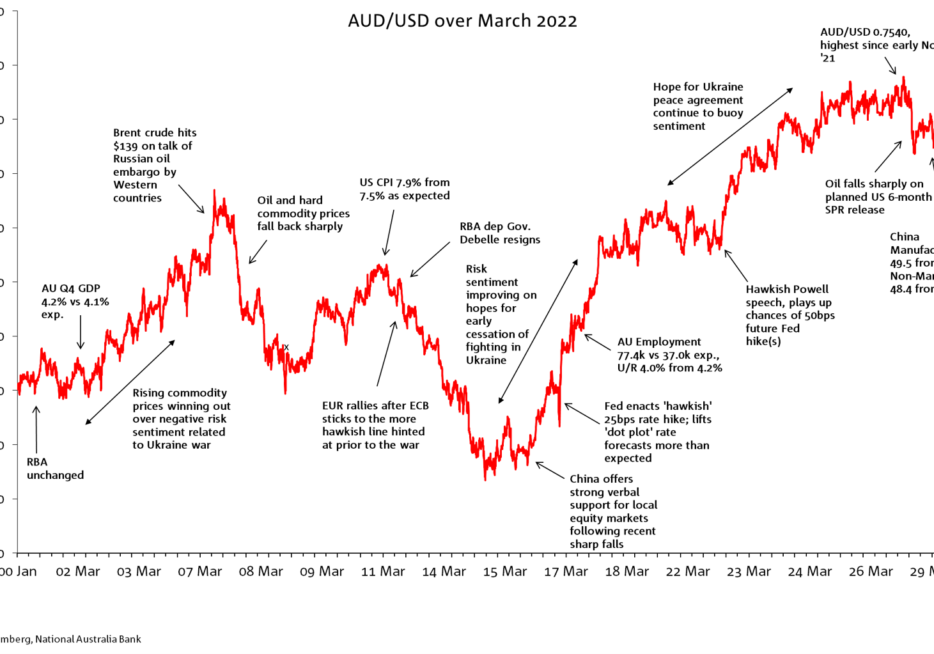

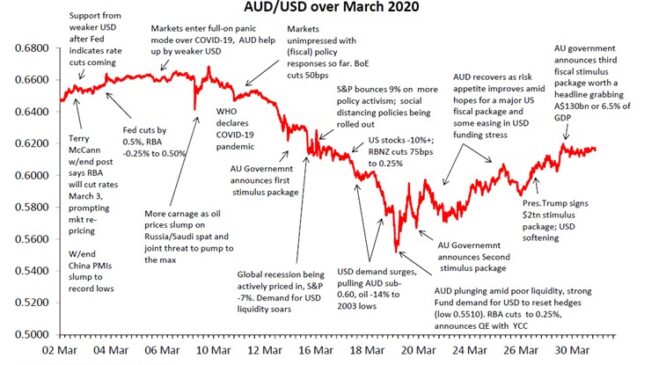

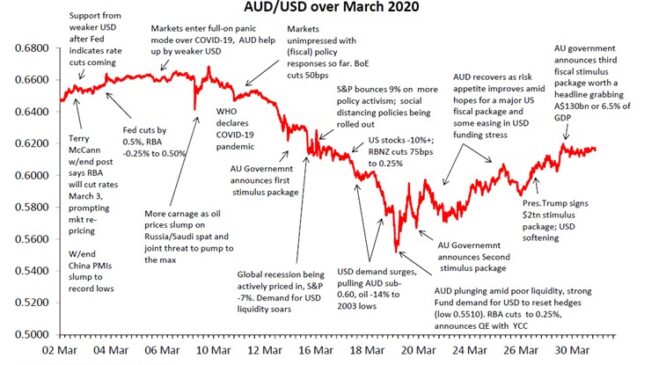

AUD volatility picked up in March, almost all accounted for by Global factors.

The main news overnight is the US decision to release 1m barrels a day for 6 months from their strategic petroleum reserve

ECB Lagarde warning of supply and uncertainty shocks from the Ukraine war.

NAB’s view is the RBA will start to hike by August 2022, depending on whether the RBA pivots to a forward-looking approach to policy.

Last night’s Federal Budget contained few surprises and won’t be a big influence on markets this morning.

It has been a nervous start to the new week with big moves seen in rates, oil and FX markets.

Economists outdo each other for Fed hikes with Citi calling four 50 basis point hikes back to back

Investors are showing a preference for US equities with all three major indices enjoying a decent rebound after yesterday’s decline.

Strong performance in the emerging technology sector shows how NAB is helping to create a robust industry ecosystem and deliver on what it takes to make it as a new digital business.

Russia intends to make ‘unfriendly’ countries pay for gas in rubles.

The Australian Budget is set to be unveiled next Tuesday night, ahead of the federal election that must be held on or before 21 May 2022.

Yields continue to rise with US 10yr now +9.6bps to 2.39%.

US bond yields march higher pre and post Powell speech

AUD/USD closed above 0.74 for the first time this year, cementing its position as the world’s strongest G10 currency year to date.

Russia makes USD bond payments, adding to a sense of hope on Russia/Ukraine

It was the theme which came through strongly at every session at NAB’s Capital Markets 2022 conference, with ongoing sustainability momentum proving a game changer for issuers and investors.

US Fed lifts cash rate 25bps, as expected

In this Weekly we explore how central banks might balance the two conflicting forces – inflation expectations key according to Fed speak.

A switch of market focus from Ukraine to China (and Hong Kong)

Growth in sustainable financing continues to exceed market expectation.

Webinar

Yields have soared even as commodity prices have fallen.

Friday was a day of contrasting fortunes for US and EU equity markets.

The ECB has surprised markets with an accelerated QE unwinding plan

War still rages, but Eurozone stocks and EUR roar back to life

Markets remain volatile unable to confidently price implications from the news flow given the complex state of the global economy

Brent oil is up 30% on the week to US$130 a barrel and wheat, thermal coal and gas prices have also surged.

Germany rejects proposed US, EU embargo on Russian oil imports

Risk sentiment was hammered on Friday with sharp falls in stocks and a large rally in bonds

EU considering further measures against Russia overnight which would allow them to impose tariffs and quotas to Russian exports, further disrupting global trade.

Russia’s Ukraine invasion and sanctions continue to roil commodity markets which were already tight given the increase in demand from a reopening global economy and low inventories

Head of FX Strategy, Ray Attrill and Director, Currency Overlay Solutions, Mike Symonds discuss the results of our 10th Biennial Superannuation FX Hedging survey with ASFA.

Despite being the month when Russia invaded Ukraine, the high-low range in AUD/USD was less than in January.

History suggests Russia’s actions in the Ukraine may result in only a short-lived episode of risk aversion with contemporary macro themes eventually reasserting themselves.

Risk sentiment craters (S&P500 -1.3%) as the Russia/Ukraine situation has no sign of ending

News from Ukraine remain bleak with Russia Ukraine talks yielding no resolution while fighting rages on.

Markets are opening up to headlines that ‘Putin puts Russian nuclear forces on ‘special alert’.

Biden announces range of sanctions on Russia, but not including SWIFT.

Ukraine/Russia tensions continue, no further military escalation apart from cyberattacks

Restrained market reactions so far (bar oil) to Russia-Ukraine developments…

How high rates will go in this cycle is a key question that is being asked by clients.

Geopolitical tension lifted overnight with President Putin formally recognising the two Ukrainian breakaway regions of Donetsk and Luhansk and signing aid and cooperation agreements.

US President Biden is convinced Russia has decided to attack Ukraine

Yesterday’s glimpses of risk off vibes have intensified over the past 24 hours with Russia Ukraine tensions the main culprit.

On-demand video from our virtual Capital Markets 2022 conference – driving growth and economic recovery.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

The standout data point overnight was US Retail Sales, which came in well above consensus expectations.

President Putin spoke to the media saying that "of course" Russia does not want war in Europe, but then added that his security concerns must be addressed and taken seriously .

The Q3 result showed WPI wage increases broadly back to pre-pandemic patterns, and our forecast for Q4 sees an acceleration in private sector wages growth to 2.5% y/y.