Price growth edges lower despite reasonable economy

Insight

AUD/USD closed above 0.74 for the first time this year, cementing its position as the world’s strongest G10 currency year to date.

https://soundcloud.com/user-291029717/peace-hopes-and-understanding?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

Friday proved to be a day where risk sentiment and with it equity market performance continued to draw some support from ongoing optimism toward an early Russia-Ukraine peace agreement, which might be expected to continue into the new week despite the absence of any positive omens out of Friday’s Xi-Biden talks. The US yield curve flattened again Friday, aided by a string of hawkish Fed commentaries that can only feed expectations the Fed will deliver a 50-point rate rise at one (or both) of the next two meetings. In currencies, AUD/USD closed above 0.74 for the first time this year, cementing its position as the world’s strongest G10 currency year to date.

With the exception of HK, seem talking breather after a 9% rally on Thursday following the memo from China’s State Council signifying official support for both China and Hong Kong equity markets, including the ADRs of US-listed Chinese entities, all major equity indices ended Friday in the green. NASDAQ outperformed all others, +2.05%, notwithstanding the fact that it is higher US risk-free rates that have been a key driver of their underperformance earlier in the year and where no relief on this front is in sight.

Hopes for peace, or at least a cessation of Russian bombardment of Ukrainian cities – but for which there was, tragically, zero evidence over the weekend – was evidently supportive of risk sentiment on Friday. Overnight, Turkish media report that Russia and Ukraine “have almost reached agreement” on four critical points of a potential peace agreement , Turkey’s foreign minister telling Turkey’s pro-government Hurriyet newspaper that there was a growing “convergence” between Moscow and Kyiv after intense diplomacy over the past week. “On important subjects, critical subjects, there is a convergence between the two sides,” Cavusoglu said. “Especially on the first four points we see that they have almost reached agreement.” Turkey, which is mediating in the talks alongside Israel, said Ukraine and Russia had made significant progress on Kyiv declaring neutrality and abandoning its drive for NATO membership, “demilitarising” Ukraine in exchange for collective security guarantees, what Russia calls “denazification”, and lifting restrictions on the use of Russian in Ukraine.

While this news might maintain the positive risk sentiment which drove up equities at the end of last week (alongside China’s state Council missives which prompted the sharp turnaround in China/HK stocks), Joe Biden and Xi Jinping on Friday reportedly failed to bridge their differences over the Ukraine war, with the US president warning of “consequences” if Beijing provided military aid to the Kremlin and China’s leader lashing out at “sweeping and indiscriminate sanctions” imposed on Russia by the west. The two leaders held a two-hour call on Friday, at the end of a week in which Washington raised fears that China would aid the struggling Russian military, which has seen its advance in Ukraine largely come to a halt in the face of fierce resistance.

The FT reported Saturday that the White House said Biden raised those concerns during the conversation, saying he “described the implications and consequences if China provides material support to Russia”. In Beijing’s account of the call, it said Xi criticised the economic punishment the US and its allies have imposed on Russia in response to the invasion which, it notes, could be extended to other countries, including China, if they side with Moscow.

Also on China, its national health authorities reported two Coronavirus deaths on Saturday, both in Jolin, the first recorded rise in the death toll since January last year , as the country battles an omicron-driven surge. China reported 2,157 new community transmissions on Saturday, with the majority in Jilin. The Guardian reports that with China now facing its worst outbreak since late 2019, officials have vowed to double down on the zero-tolerance strategy to contain the current surge. However, China’s leader, Xi Jinping, acknowledged for the first time the burden of the measures on Thursday, saying that China should seek “maximum effect” with “minimum cost” in controlling the virus.

For the time being though, there seems little prospect of any step-change in China’s approach to handling covid, so preserving the headwinds to a material pick up in the pace of overall economic activity despite the various monetary and fiscal easing measures in train (in which respect China’s Loan Prime Rate announcement is today, but after the 1-year MLF rate was held steady at 2.85% last week, a reduction today is not expected).

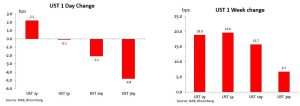

In bond markets , the 2s-10s Treasury curve flattened by just over 4bps on Friday, the curve twisting around the 5-year point (2s -2.2bps, 10s and 30s -2.1 and 4.8bps respectively); on the week the curve is just over 3bps flatter, so overall not a lot of change from pre-FOMC readings. There was plenty of Fed speak on Friday, all of it reflective of the more hawkish tone evident out of last week’s meeting. The upshot is that the US money market ended the week ascribing 50-50 odds to a 50-point Funds Rate rise at the next (May) meeting but 72.5bps out of the next two, so an almost certain prediction that one of the next two meetings will deliver a 50-pointer.

Fed Governor Waller said. “The data is basically screaming at us to go 50 but the geopolitical events were telling you to go forward with caution. So those two factors combined pushed me” to support the 25 basis points increase, he said. “Going forward that will be an issue whether to think about going 50 in the next couple of meetings or not. But the data certainly seem to suggest that we move in that direction.”

Waller’s former boss at the St. Louis Fed, James Bullard , who was the (hawkish) dissenter last week, said, “I recommended that the committee try to achieve a level of the policy rate above 3% this year. This would quickly adjust the policy rate to a more appropriate level for the current circumstances,” Bullard said in a statement. “In my view, raising the target range to 0.50% to 0.75% and implementing a plan for reducing the size of the Fed’s balance sheet would have been more appropriate actions,” for this week’s meeting.

Richmond Fed President Thomas Barkin said, “I am very open to half-point moves, which we have done before….it is time to normalize rates. The path to restrictive goes through normal. You don’t have to solve restrictive quite yet. You just have to solve normal”

And the traditional uber-dovish Minneapolis Fed President Neal Kashkari says he projected raising the target range of the Fed’s main interest rate to 1.75%-2% by the end of 2022, in forecasts submitted for this week’s policy meeting of the U.S. central bank (making him one of the five median dots). Kashkari also favours starting to shrink the Fed’s balance sheet from as early as the next (May) meeting.

Economic news after we went home was limited to US February Existing Home sales which fell by a bigger than expected 7.2% (-6.%E) more than countering the 6.6% January jump. And Canada retail sales continued a recent string of upside economic surprises, +3.2% m/m (2.4%E) and +2.5% ex-autos against 2.2% expected.

In FX , the AUD/USD close above 0.74 for the first time this year, albeit not yet exceeding its 0.7441 March 7 high. This does though cement its position as the strongest G10 currency year to date (+2%) and AUD/JPY one of the best performing cross rates (+5.5%). Friday’s gains came despite a mixed performance from commodities and a mostly ‘down week’, risk sentiment seemingly taking up the mantle as a positive driver. Also well worth noting is positioning, with Friday’s IMM data covering the week through last Tuesday showing a significant reduction in net short speculative positions, particular amongst the leveraged community (synonymous with hedge funds and CTA-type investment managers). Evidently, some of those betting on AUD inevitably being one of the main currency market casualties of Russia’s invasion of Ukraine, have been forced to run for cover.

The USD had a small up day on Friday, making the AUD’s gain all the more impressive, but on the week the DXY index was 0.9% lower, a move consistent with it being a positive one for risk sentiment, but also with the (post-10090) historical experience of the USD rising into but weakening out of, the first Fed rate rise of a tightening cycle.

In FX, the AUD/USD close above 0.74 for the first time this year , albeit not yet exceeding its 0.7441 March 7 high. This does though cement its position as the strongest G10 currency year to date (+2%) and AUD/JPY one of the best performing cross rates (+5.5%). Friday’s gains came despite a mixed performance from commodities and a mostly ‘down week’, risk sentiment seemingly taking up the mantle as a positive driver. Also well worth noting is positioning, with Friday’s IMM data covering the week through last Tuesday showing a significant reduction in net short speculative positions, particular amongst the leveraged community (synonymous with hedge funds and CTA-type investment managers). Evidently, some of those betting on AUD inevitably being one of the main currency market casualties of Russia’s invasion of Ukraine, have been forced to run for cover.

The USD had a small up day on Friday, making the AUD’s gain all the more impressive, but on the week the DXY index was 0.9% lower, a move consistent with it being a positive one for risk sentiment, but also with the (post-10090) historical experience of the USD rising into but weakening out of, the first Fed rate rise of a tightening cycle.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.