Price growth edges lower despite reasonable economy

Insight

The US dollar continued to rise at the end of last week hitting a two-month high after the surprisingly bullish outlook from the Fed, but is the Aussie dollar paying too high a price?

https://soundcloud.com/user-291029717/aussie-dollar-caught-in-the-storm?in=user-291029717/sets/the-morning-call

The repricing of risk assets after last week’s hawkish FOMC meeting continued Friday with equities adding to their weekly loses while the flattening of the UST curve also extended as the market brought forward Fed rate hike expectations in the front end and trimmed growth and inflation expectations in the long end. The USD was broadly stronger with commodity linked currencies the big underperformers weighed down by a combo of broad risk aversion and ongoing unwinding of the reflation trade, the latter evident by the decline in metal prices. AUD and NZD traded below support levels with the AUD opening the new week at 0.7486 while NZD is at 0.6937.

Reaction to last week’s hawkish FOMC meeting continued Friday with the market pushing front end UST yields higher reflecting an increase in fed funds rate hike expectations. For instance, the June 2023 Fed fund futures climbed another 5bps to 0.50% while the December 2022 future climbed 2bps to 0.32%. Playing to this narrative, speaking to CNBC St Louis Fed President Bullard revealed himself as one of the 7 FOMC members pencilling a rate hike by the end of 2022. Bullard is not a voting member this year and has a history of being very dovish and very hawkish, still given market sensitivity Bullard’s interview contributed to the flattening move in the UST curve and broad USD gains recorded on Friday.

Notwithstanding his hawkish stance, Fed Bullard also noted that although the taper discussion is now open, “it’s going to take several meetings to get organized”, suggesting a pullback in the buying isn’t imminent. Also speaking close to the end of Friday’s trading day, Fed Kashkari said he still had no hikes in the forecast horizon arguing that is going to take time “to really achieve maximum employment”. Similar to Fed Bullard, Kashkari noted that “it will probably take beyond September to have enough data to make a judgment on (tapering)”.

In addition to the move up in front end yields, the flattening of the UST curve was accentuated by the move lower in longer dated yields . The 2-year US rate increased 5bps, to 0.25% while the 10y year and 30 tenors fell by 7 and 8 bps, to 1.44% and 2% respectively. The aggressive move in the back end of the curve reflected further declines in inflation expectations (US 10-year ‘breakeven’ inflation -4bps to 2.24%) while arguably the market is also wondering about the long term growth expectation for the US economy with the real yields also moving lower, the 10y real rate closed down 3bps to -0.81%.

Moving onto equities, the S&P 500 fell 1.3% on Friday closing 1.9% lower on the week with the unwinding of the reflation trade evident by the decline in financial (-2.45%) and energy ( -2.92%) . The small-cap Russell 2000 index recorded its heaviest weekly loss since late January, falling more than 4% while the NASDAQ fair better, falling 0.9% on Friday, ending the week just 0.3% lower. True to form the tech heavy index yet again showing a higher degree of sensitivity to longer dated rates ( lower rates being a positive force for growth sensitive stocks).

European shares were also a sea of red on Friday with the Eurostoxx index down 1.80% while the industrial heavy Dow was the big underperformer on the week, down 3.45%

The USD was broadly stronger on Friday benefiting from the combo of broad risk aversion and higher shorter dated UST yields . BBDXY and DXY gained 0.37% on the last day of the week and climbed 2% and 1.8% over the past five days, both indices are now approaching their late March year to date highs. The unwinding of the reflation trade has certainly been a theme across markets and the dollar is clearly benefiting from the unwinding of short positioning after the hawkish FOMC meeting last week.

Playing with this narrative against a backdrop of a decline in commodity prices, particular within metals, commodity linked currencies were the underperformers on Friday with both the NZD and AUD printing fresh year-to-date lows . Both antipodean currencies fell close to 1% on Friday with CAD -0.90% and NOK -1.4%. The decline commodity linked currencies has been exacerbated by the break below key support levels, the AUD accelerated its decline once it traded through its previous YTD low of 0.7532 while NZD also accelerated its decline once it traded below its previous low of 0.7116. The AUD now opens the week at 0.7486 while NZD is at 0.7937.

Interestingly and reflecting the force of the unwinding of position alongside break of key support levels, the move up in front end yields has not just been a US story . AU and NZ rates have also moved up post the FOMC meeting and on Friday in Australia the move gathered momentum after Westpac economist Bill Evans brought forward his call for the timing of the RBA’s first hike to early 2023. The market has moved to price the first hike for the RBA by late 2022, with a further two 25bp hikes priced in by the end of 2023. Australia’s 3-year swap rate increased 7bps on Friday, to a more-than-12 month high of 0.51%, following on from the previous day’s 7bp increase.

For now, risk aversion and Fed repricing is the dominant force in FX markets. That said, when we look at fundamentals, the decline in both the AUD and NZD are not fully justified by the still elevated commodity prices and small moves in relative rate differentials. Unwinds of positions are almost certainly exacerbating the market moves though and it remains to be seen how long this might take to play out.

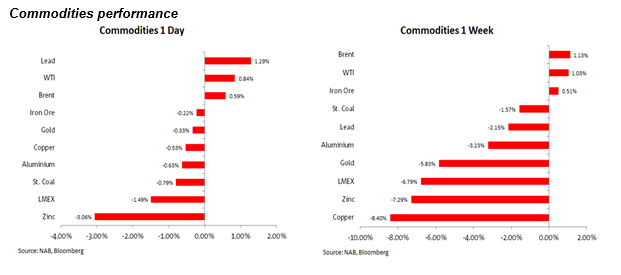

Commodities remained under pressure on Friday with metal prices the big underperformers on the day and copper was the notable underperformer on the week, down over 8%. Meanwhile oil prices remain the exception climbing over 1% in the past five days.

Lastly a word on COVID, Bloomberg noted that cases of the highly transmissible delta Covid-19 variant almost doubled in a week across the UK with more people admitted to hospital while the FT reports the Delta variant has become dominant in Portugal and appeared in clusters across Germany, France and Spain, prompting European health officials to warn further action is needed to slow its spread.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.