Price growth edges lower despite reasonable economy

Insight

The markets have so far been unmoved by the FOMC announcement, perhaps because it said so little.

https://soundcloud.com/user-291029717/big-falls-in-shares-ahead-of-a-dovish-fed?in=user-291029717/sets/the-morning-call

And now times are changing, It’s not that hard to see – Ocean Valley “Way Down”

There has been a distinct shift in market sentiment with vaccine roll out concerns, dovish ECB comments and soft data not helping the cause.

German shares have led the decline in Europe while US equities look to be heading for their biggest decline since October with FOMC/Powell commentary accelerating the decline. The USD is broadly stronger with commodity linked currencies leading the decline.

The FOMC kept its policy setting unchanged, as expected. In the Statement, the FOMC acknowledged the moderation in the pace of recovery, something that has been evident in recent soft labour market data releases and retail sales figures. The Statement also acknowledged the recovery’s dependency on virus/vaccine rollout.

Fed Chair Powell stressed the point that the US economy is a long way from a full recovery. The Fed Chair also emphasised the point that it is likely to take `some time’ before we see substantial progress, adding that the real unemployment rate is closer to 10%.

Meanwhile inflation is not a concern, noting the Fed ‘will be patient and not react if we see small, transient inflation increases’.

Finally, and consistent with what he said a few weeks ago, Powell said that “It’s just too early to be talking dates. When we see ourselves getting to that point, we’ll communicate well in advance”.

US equity market were already in struggle street with main equity indices down more than 1%, but the dovish remarks from Powell have seemingly provided further ammunition to equity investors looking for the exit door. The S&P 500 now trades at -.2.44% and the NASDAQ is down 2.33%.

Powell’s acknowledgment of a slowdown in the pace of the recovery and dependency on vaccine roll out are not new news, but it does provide equity investors a bit of a reality check, pushing out the timing for the recovery and uncertainty around vaccination roll out programmes.

The Stoxx Europe 600 Index fell 1.2% on the day with all major regional indices in the red, notably Germany’s DAX index was the big underperformer down 1.81% with its health care sector leading the decline, down 2.56%.

EU officials are becoming increasingly enraged by vaccine delays with the spat between the EU and AstraZeneca turning farcical with both sides disagreeing over whether a planned call to resolve the issue would take place. The EU’s vaccination pace is lagging the US and UK.

German consumer confidence fell to -15.6 from -7.5, a much bigger fall than expected with confidence at its lowest level since last June.

French consumer confidence also fell. Meanwhile in the US, total durable goods orders rose 0.2%, below the consensus, +1.0%.

The risk off environment has benefited the USD, amid a safe-haven bid.

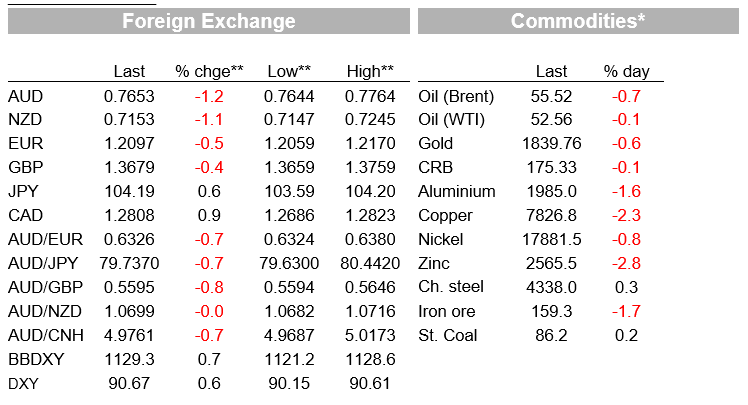

BBDXY is up 0.62% while the euro heavy DXY index is up 0.52%.

The Euro is down 0.50% and currently trades at 1.2101, but dovish ECB commentary early in the session saw the pair briefly trade down to a low of 1.2067.

The ECB is worried the market is not taking or pricing the possibility of more interest-rate cuts seriously enough.

Bloomberg reported the Governing Council last week discussed how market pricing foresees little chance of a reduction further below zero, and concurred on the need to highlight that possibility, the officials said, asking not to be identified because the deliberations were private.

The news follows commentary early in the session from Governing Council member Klaas Knot, the Dutch central bank president, noting the central bank has tools to counter EUR appreciation if needed, adding “I always quip that we’ve explored the effective lower bound, but we haven’t found it yet,” he said. “There is still room to cut rates.”

Commodity linked currencies have been the big G10 underperformers with NOK down 1.17%.

Oil prices traded higher on reports US crude stockpiles shrunk by nearly 10m barrels last week, the biggest decline since July, and exports rose in the wake of global supply cuts. But the move proved short lived with declines in equities eventually dragging oil prices lower (Brent/WTI are now down 0.6% and 0.1% respectively).

So far this year the pair has been roughly contained in a 0.7650 to 0.7820 range. The pair is now testing the lower end of the band and a break of this support technically opens the door to test 75c. T

he AUD is a risk sensitive currency so an extension of the current equity decline is an imminent risk for the pair.

NZD has also underperformed overnight, down 1% and now trading at 0.7154, very close to its low for the week of 0.7150.

The risk off mood sees US 10-year Treasury yields down about 1bps on the day to around 1.02%, notably the 10y Note is 1bps higher since the FOMC. The yield did briefly dip just below 1.0%, a level last seen on January 6 when the outcome of the Senate runoff elections in Georgia put the Democratic party on track to control both chambers of Congress.

That spurred a bond sell-off that would take the 10-year yield to its recent high of just over 1.18% on January 12, before falling on concern over new virus variants and stimulus delays

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.