Price growth edges lower despite reasonable economy

Insight

It’s Thanksgiving today in the US and markets have been cautious ahead of the holidays.

White meat, dark meat, You just can’t lose, I fell off my moped and I got bruise, Turkey in the oven and the bunds in the toaster, I’ll never take down my Cheryl Teags poster – Adam Sandler

United States citizens may not feel they have much to the be Thankful for this year (other than those of a certain political persuasion, perhaps) but the lyrics to Sandler’s 1992 ode to Thanksgiving, that he first sang on Saturday Night Live in 1992 are hilarious. But some aren’t fit to print in this publication.

Vale Diego Maradona, one of the greatest footballers who ever lived, who tragically died overnight at the age of 60

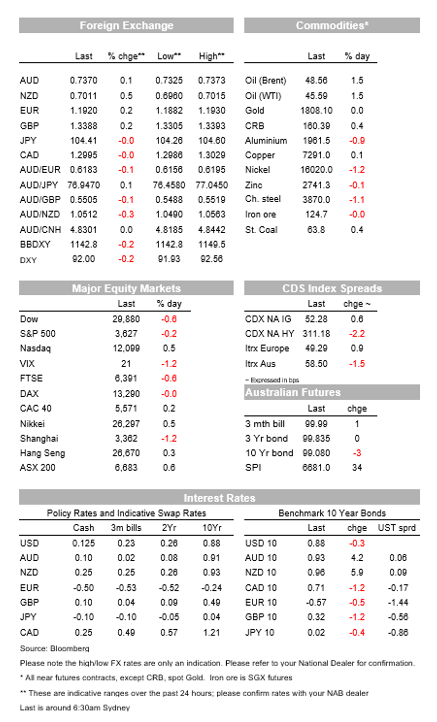

With US markets heading into Thanksgiving, markets have been more subdued with equities taking back a little of Tuesday’s strong gains, though the USD is softer (gains for currencies again led by the NZD) while US bond yields initially fell out of the FOMC minutes released at 06:00 AEDT but have since retraced.

The FOMC minutes show ‘many’ participants considering how they might adjust their current QE bond buying programme (currently totalling $120bn per month) and this has put the market on the scent of an adjustment – most likely involving skewing Treasury purchases at least to the longer end of the US yield curve, if not an outright increase in the volume of monthly purchases.

US 10 year Treasury yield were trading at 0.8730 in front of the minutes and were down on the day, then fell another basis point to 0.8630 straight after, but are currently back to 0.88% (‘buy the rumour, sell the fact?’). certainly there was no great surprise here, but the language of the Minutes does suggest that such an adjustment will now come out of the December meeting not later – especially given the lack of progress to date on agreeing any form of additional fiscal support for the economy this side of the new President and Congress being sworn in in January.

The crying need for additional fiscal support and sooner rather than later has been laid bare by some of the US statistics released overnight, chief among them the second consecutive rise in weekly jobless claims (to 778k, well above the 730k expected) and drop in Personal Income in October, by 0.7% (worse than the -0.1% expected). So while consumer spending is currently holding up – exemplified by the better than expected 0.5% rise in real Personal Consumption Expenditure – this can be confidently put own to a drawdown of savings emanating from past pandemic-related additional unemployment benefits, plus the big jump in job creation in October, neither of which will survive the end of the year.

Durable Goods Orders came in better than expected at 1.3% both in headline and ex-transport terms and +0.7% in the less volatile orders ex-defence, ex-aircraft, while the October trade deficit at $80.3bn, in line with expectations, showed both imports and exports up on the month, by 2.2% and 2.8% respectively.

The rise in exports, as we are seeing in other countries – Germany especially – owes much to the veracity of China’s economic recovery, which typically leads manufacturing activity in other parts of the word by several months.

The ‘problem’ here, for the US especially but also elsewhere, is that manufacturing represents little more than 10% of the overall US economy an so can’t on its own be relied on to sustain US economic expansion.

Construction activity can help as well though, in which respect the latest New Home Sales numbers, running at 999k last month and just over a million in September, confirm ongoing strength in the housing market which in turn feeds housing construction activity. US Q3 GDP was unrevised at 33.1% (saar).

US equities are currently showing the S&P -0.7% (having been about -0.1% in front of the Minutes) with the Dow -0.3% and NASDAQ +0.4%. So a bit more of the ‘rotation of the rotation’ back into the ‘stay at home’ sector, in which respect the incoming US COVID news remans grim.

California is predicting that daily deaths will exceed their previous highs by Christmas, Texas reported record daily case numbers for yesterday and Alberta has declared a state of emergency,

The narrow DXY dollar index is -0.27% and the broader BBDXY -0.16% – the latter to its lowest in more than two and a half years.

EUR/USD and GBP/USD are both up 0.2%, driving the USD weakness, Sterling still rising high despite EU Commissioner von der Leyen warnings that there still remain big differences to bridge in key area regarding a UK-EU trade deal.

NZD (+0.44% to 0.7010) continues to benefit from the earlier-in-the-week re-pricing of RBNZ easing prospects even though Governor Orr yesterday suggested that the reserve Bank already takes in to account house prices in its deliberations and that the message from the latest MPS – that the RBNZ retains an easing bias – still stands. AUD/USD is currently little changed on 24 hours ago at 0.7365.

The next cab off the rank by way of Q3 GDP partials is Capex, where Victoria’s second lockdown is likely to have weighed. NAB has a below-consensus -5% forecast (market -1.5% but within a wide -6.0% to +1.7% range).

The offshore calendar is very light tonight, with nothing of particular note (NZ trade, German consumer confidence). Of some interest, the ECB publishes its account of its October policy meeting, where the need for additional policy measures before year-end is likely to have been discussed. Overnight, the ECB has warned that banks in the region may be under-provisioning for loan losses due to the pandemic.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.