Price growth edges lower despite reasonable economy

Insight

OPEC+ has struck a deal to slowly increase oil production from next month, rather than letting the production cuts fall off a cliff.

https://soundcloud.com/user-291029717/one-deal-down-two-to-go?in=user-291029717/sets/the-morning-call

“Ooh, tell me how will I know (don’t trust your feelings); How will I know; How will I know (love can be deceiving); How will I know”, Whitney Houston 1985

Not yet, though UK media report a deal could still be concluded on Friday and GBP continues to trade like there has been a deal with GBP up 0.8% overnight to 1.3450 (high 1.3500).

Negotiations also continue on a US fiscal stimulus package with Pelosi and McConnell meeting overnight, but with no breakthrough despite positive soundbites.

Democratic House Leader Pelosi has lined up behind the bi-partisan $908bn proposal, while Republican Senate Majority Leader McConnell continues to advocate for a smaller $500bn package.

An added complication remains the Georgia Senate run-offs with Democratic odds of securing an effective senate majority marginally lifting to 31% according to PredictIT. One deal that was agreed to overnight was OPEC with Brent oil up 1.0% to $48.75 (more on that below).

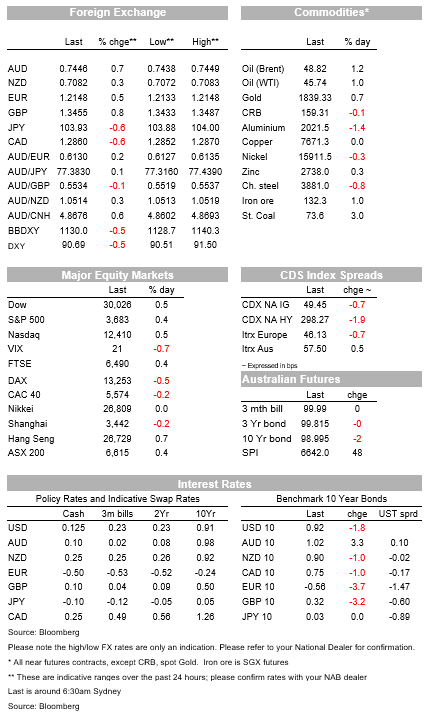

Though the S&P500 did eek out another record high. The S&P500 rose 0.4%, with industrials +0.8% outperforming on the back of airline stocks (airlines sub-index +4.8%).

Vaccine hopes remain high and it is widely expected emergency use authorisation will be granted in the US by mid-December after the UK’s approval earlier in the week (note the UK’s assessment used a rolling review to review data in real-time, while the US FDA is going through the submitted application).

In Australia, it is expected an assessment on approval will occur in January, with a vaccine rollout from March.

In contrast yields fell, with US 10yr yields -1.8bps to 0.92%. There was little news to drive the moves, while it is worth noting the ECB is set to unleash more QE next week and the US FOMC is also expected to announce some sort of twist operation with their purchases at the upcoming December FOMC meeting, which may slow the potential rise in yields.

The implied inflation breakeven on the 10yr was unchanged at 1.87% with still some notion investors are wary over the potential for inflation.

The US ISM Services Index played into that view overnight with the prices paid index lifting to 66.1 and the highest since 2012. The overall ISM Services Index though was broadly as expected at 55.9 (consensus 55.8).

The USD continued its march lower with the DXY -0.4% with the boarder BBDXY also down -0.4%. The fall was broad-based with EUR +0.4% to 1.2141, GBP +0.8% to 1.3451, and USD/Yen -0.5% to 103.97.

GBP continues to lift in anticipation of a UK-EU trade deal. Progress on a deal could occur as early as Friday, though one UK Government source told the PA news agency that “At the 11th hour, the EU is bringing new elements into the negotiation. A breakthrough is still possible in the next few days but that prospect is receding.”.

While there was little in the way of Australian data, the iron ore price has lifted further with futures up 1%.

Australia-China trade tensions also appear to be not getting worse and over recent days it was reported that China has allowed some Australian coal cargoes to be unloaded at ports despite a ban on such imports being in place.

The positive news for Australia continues in today’s press with the AFR reporting the government is likely to upgrade key economic projections in the upcoming MYEFO (“senior sources said the government was still preparing upgrades to key economic measures but employment, final economic growth for 2020 and the budget position would all be revised” – see link for details).

US initial jobless claims beat expectations (Initial Claims 712k v 775k expected), but the exact signal is unclear given concerned over the quality of the data the possible impact from the Thanksgiving holiday which can affect the ability of states to process claims.

Still, the decline in unemployment benefits does fit with the data seen over recent weeks given retail sales rose in October and adds a little more uncertainty to Payrolls tonight.

OPEC+ managed to agree to a deal that gradually eases the oil output curbs next year.

It is expected 500,000 barrels a day will be added to supply in January, while OPEC Ministers will hold monthly consultations to decide whether to approve similar-sized hikes in subsequent months.

The agreement saw Brent oil lift 1% overnight to $48.75.

Domestically we have a final-read on retail sales for October which is unlikely to be market moving. Elsewhere it is also mostly quiet ahead of US Payrolls later tonight. For details, please see below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.