Hear NAB’s senior expert panellists discuss a range of topics to provide key insights to help you and your business prepare for the current property market climate.

The post-Brexit trade deal and the US fiscal stimulus deal have been pushed back time and time again, but we really are at the point of no return.

https://soundcloud.com/user-291029717/one-minute-to-midnight-on-us-and-uk-eu-deals?in=user-291029717/sets/the-morning-call

Take a good look around, you’d see

That it’s closer than you might believe – Alanis Morissette

Risk assets are having a good overnight session with US equities set to record another day of positive returns.

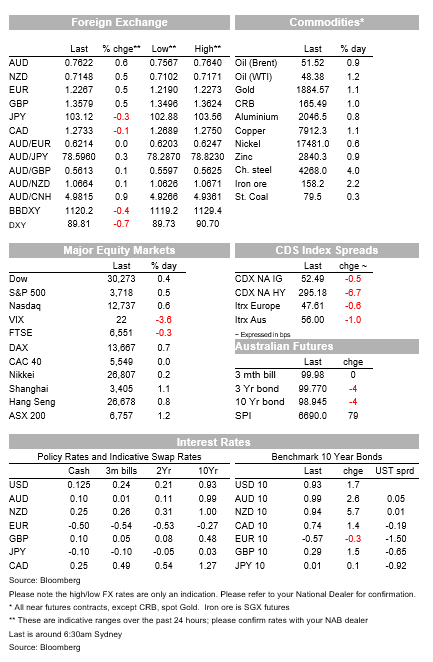

Although we have not had any concrete news, the buzz evident in recent days continues to point to an imminent EU-UK trade deal and US Fiscal stimulus. Core yields have edged a little higher with longer dated maturities leading the move up. Meanwhile the broad USD decline remains unabated, NOK is the outperformer aided by gains in oil prices, GBP now traded above 1.36 and AUD is comfortably above 76c.

All major US equity indices are travelling with gains between 0.40% and 0.70% and look set to end another day in the green.

The wrangling over the details of a circa $900bn US fiscal stimulus continues, still the smoke signals suggests the political will to get a deal done remains very strong . Comments like the one from Republican Senate leader McConnell said that a fiscal stimulus package is “close at hand” support this view. That said, many medial outlets including the WSJ note that that there is a risk the relief bill made not be ready before the current government funding expires one minute after Friday’s midnight.

This means we may see yet another a short-term spending patch bill to allow for more time to get the relief package finalised. So, a deal is imminent, but we might have to wait until next week for the stimulus package to be confirmed.

The prospect of an imminent US fiscal stimulus has trumped the underwhelming US economic news overnight and still very alarming COVID-19 infection and death statistics.

Investors continue to focus on the positive medium-term news from vaccine roll out and fiscal stimulus, overlooking the signs of a slowing economy and overwhelmed healthcare service.

Printing at 885k for the week and some analysts suggest it could breach the 1 million mark over coming weeks, as economic activity falls while COVID19 spreads. Bloomberg reports the US passed 17m total infections after hitting a record 3,835 deaths on Wednesday.

The Philly Fed index fell to its lowest since May, with big falls in new orders and employment. Housing starts and permits data confirmed that the housing market remains one of a few key bright spots of the economy.

.

The positive US fiscal stimulus vibes also helped European equities extend their recent positive run, the Stoxx Europe 600 Index advanced 0.3% and all major EU equity indices ended the day in positive territory.

The UK FTSE 100 fell 0.3% with the strength in GBP probably a big factor for its underperformance.

EU-UK trade deal negotiations have not yielded any concrete news overnight, but the vibes continue to suggest a deal looks more likely than not, but not necessarily over the next couple of days. Like a good drama the last Brexit chapter still may have a couple of twist and turns before the end.

Brexit discussions continue with the media in the UK and EU all reporting this week steady progress through the remaining thorny issue of the level playing field, dispute resolution mechanism and fishing.

EU chief Brexit negotiator, Michel Barnier, said it will be “difficult but possible” to reach an agreement on Friday. But just to keep things interesting, UK Cabinet Office Minister Michael Gove told a House of Lords Committee that the deadline for getting a deal will be in the days immediately after Christmas .

The rationale here being that the EU could apply a provisional application of the treaty allowing the EU to implement a deal before it’s formally ratified by the EU Parliament. Gove also noted that the UK Parliament could be recalled from its vacation to approve any Brexit deal rapidly.

UK PM Johnsons and EU Commission President Von der Leyen held a call and in recent minutes Von der Leyen has been reported as saying that substantial progress has been achieved in many issues, but that big differences remain on Brexit.

So, a deal looks more likely than not with GBP already pricing a high probability an agreement is a done deal, but the formality could take a bit longer than the next couple of days.

Cable has traded to an overnight high of 1.3624, but it has now dip below the figure following President Von der Leyen’s comments.

The Bank of England’s latest policy announcement was a non-event as expected, as it kept policy settings unchanged. Like us, the Bank assumes an EU-UK trade deal will come into effect 1 January.

The positive US fiscal and Brexit vibes have continued to weigh on the USD with the green back down between ~0.5% and 0.70% in index terms.

The DXyY index now trades below 90 (89.75) and BBDX is flirting with a break below 1120.

NOK is at the top of the leader board, up 1.4% and again showing a big degree of sensitivity the move in oil prices.

Brent (086%) and WTI (1.20%) are having a good night as the market prices a solid global economic recovery in 2021.

Also helping NOK, the Norges Bank left its policy setting unchanged overnight, as expected, but the Bank also noted that it now sees a gradual rate increase from 1h of 2022 (which is sooner than previously expected, foreseeing an average policy rate of 0.9% at the end of 2023 vs pev 0.6%).

Both the AUD and NZD enjoyed some support after stronger than expected economic data releases, with the Australian unemployment rate falling to 6.8% and a strong NZ GDP report (14% q/q in Q3).

The positive Brexit and US fiscal stimulus vibes along a broadly weaker USD have lifted both antipodean currencies further overnight. The AUD now trades at 0.7622, after trading to an overnight high of 0.7639. NZD now trades at 0.7148, after recording an overnight high of 0.7171.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.