Price growth edges lower despite reasonable economy

Insight

A round of softer than expected PMIs on Friday added further fuel to ongoing concerns over a global economic slowdown with the move into contractionary mode for both the EuroZone composite and US Services PMIs the main culprits.

https://soundcloud.com/user-291029717/softer-data-harder-rba?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

Events Round-Up

JN: CPI (y/y%), Jun: 2.4 vs. 2.4 exp.

JN: CPI ex fresh food, energy (y/y%), Jun: 1 vs. 0.9 exp.

GE: Manufacturing PMI, Jul: 49.2 vs. 50.7 exp.

GE: Services PMI, Jul: 49.2 vs. 51.4 exp.

EC: Manufacturing PMI, Jul: 49.6 vs. 51 exp.

EC: Services PMI, Jul: 50.6 vs. 52 exp.

UK: Manufacturing PMI, Jul: 52.2 vs. 52 exp.

UK: Services PMI, Jul: 53.3 vs. 53 exp.

US: Manufacturing PMI, Jul: 52.3 vs. 52 exp.

US: Services PMI, Jul: 47 vs. 52.7 exp.

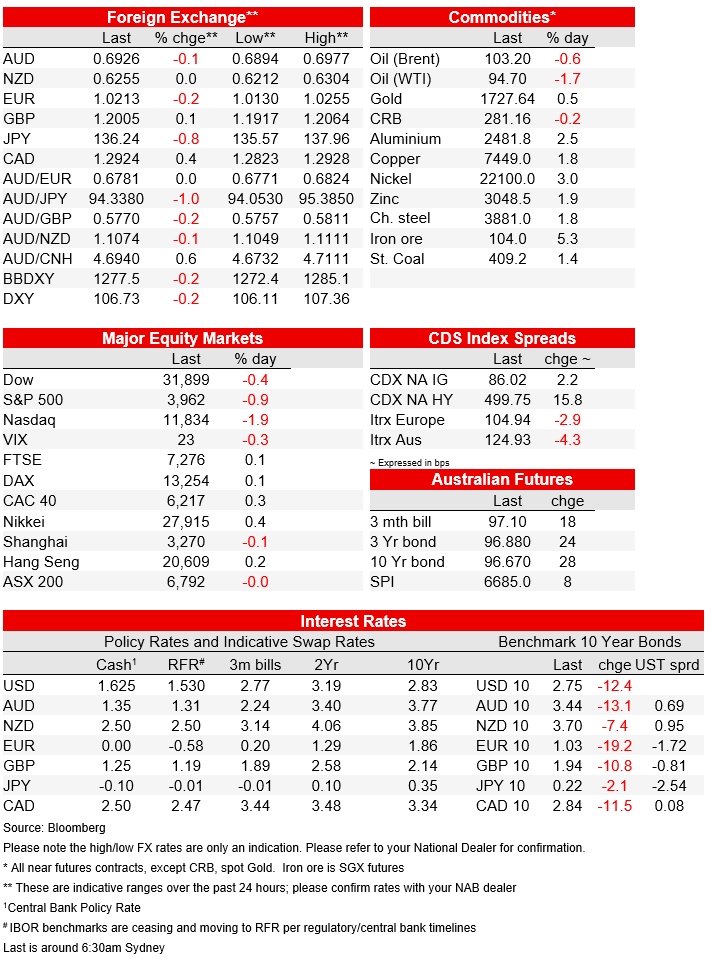

A round of softer than expected PMIs on Friday added further fuel to ongoing concerns over a global economic slowdown with the move into contractionary mode for both the EuroZone composite and US Services PMIs the main culprits. Core global yields rallied with the market also trimming rate hike expectations for both the Fed and ECB. Equity markets in Europe managed to record small gains while tech shares drove a decline in the US. The big dollar was mixed on Friday with JPY gains the notable FX mover. The AUD ended the week little changed on the day, but up on a week where the USD was broadly weaker.

Friday’s price action was mostly about the reactions to softer than expected PMI releases. In Europe, both the Services and Manufacturing PMIs in Germany fell below the 50 mark while the European Composite PMI fell from 52 to 49.4. Readings below 50 indicate activity is contracting with the sub 50 move in Germany, not a great omen for its economy. Similarly, the EU composite reading was well below consensus that had predicted a more modest dip to 51.0. This was the first time the composite reading has fallen into contractionary territory (excluding Covid-related lockdowns) since 2013 with the reading consistent with the Eurozone economy contracting at a 0.1% q/q rate.

Prior to the PMI’s release, one could have argued that the Eurozone economy was showing remarkable resilience bearing in mind the energy crisis that has erupted since the Russia -Ukraine war with sentiment and activity remaining buoyant notwithstanding a neighbouring war. The July PMIs now suggest these factors are finally weighing on activity and is difficult to suggest we have seen the end of it, the war is still ragging on and the risk gas supply could be interrupted again is a real risk, playing to the view some precautionary energy rationing will be needed.

Rubbing salt into the (EU growth slowdown) wound, after the European close in ECB president Lagarde said in an op-ed for Germany’s Funke Mediengruppe, “ We will raise key interest rates for as long as it takes to bring inflation back to our target. Inflation is too high. This is hurting people and businesses across the euro area, especially low-income households.”. Like many other central banks, including the RBA, the ECB is talking tough on inflation and need to bring inflation to heel. This is a manageable approach as long as the economy is coping, but if the economy is contracting and inflation is not coming down fast enough, then Central Banks resolves will be tested, a story that now looks set to be the big topic for markets around the turn of the year, if not earlier.

Reaction to the European PMI’s triggered a rally in EU yields and a pull back in ECB rate hike expectations. 10y Italian BTPS rallied 22bps to 3.29% while the 2-year German rate fell an extraordinary 26bps on the day, to 0.36% and the 10-year rate, which peaked at 1.94% little over a month ago, plunged 19bps, ending the day 19bps lower at 1.02%. The market still sees a 50bps ECB hike in September, but it now only prices an additional ~75bps of hikes after that.

PMI downward surprises also extended to the other side of the Atlantic with the Services reading slumping from 52.3 to 47.5, well below expectations and now at its lowest level since 2009 (excluding the period in early 2020). S&P Global, which now administers the index, said more firms reported plans to cut costs and reduce employees, consistent with recent anecdotes from big tech firms such as Meta and Apple, even though the employment gauge remained firmly above 50. The US manufacturing PMI was steady at: 52.3 vs. 52 expected and 51.7 previously.

The US PMIs are not as widely followed as the ISM surveys, but the sharp decline in the Services PMI was too big to ignore. The US gets its advance Q2 GDP reading on Thursday, a day after the Fed is expected to hike by 75bps as it tries to arrest persistent inflation. The market is looking for a 0.5% outcome after the economy contracted in Q1, but if the Atlanta Fed GDP Now is any guide ( see more below), then there is real risk the Q2 reading will print below 0%, taking the US economy into a technical recession.

Reaction to the US PMIs resulted in an extension of the US Treasury rally that had begun during the European session. US 2-year and 10-year rates fell by 12bps on the session, the latter now near its lowest levels since April, sitting right at the bottom of the trading range, around 2.75%. The Fed is still expected to raise its cash rate by 75bps this week, but the market now sees a 50bps hike in September as the most likely outcome (previously 75bps) and a peak in the cash rate under 3.50%. Additionally, the market is pricing almost three rate cuts in 2023, consistent with a view that the economy is likely to head into recession and inflation likely to rapidly decelerate.

Looking at European equities, the sharp move lower in European rates seemingly overwhelmed any concern over a sharp economic slowdown. The Stoxx 600 Index closed 0.31% higher on Friday with regional indices also managing small gains on the day. EU equities recovered this week, (Stoxx 600 up 2.9%), notwithstanding the political crisis in Italy, concerns over Russia shutting off gas to the region and following the first-rate hike from the ECB in 11 years. That said, given ongoing uncertainties, it is hard to see EU equity gains can extend from here.

The softer US economic data didn’t help equity sentiment with the S&P 500 falling for the first time in four days (-0.93%), while the tech-heavy Nasdaq 100 underperformed major benchmarks, closing down 1.87%. Snap poor results and Twitter’s sales miss raised concern about online ad spending ahead of a new week where big US tech such as Meta and Alphabet are due to report their earnings. Still, looking at the week both the S&P 500 and NASDAQ closed higher with the move lower in UST yields seemingly helping, but of note too with just over 20% of SPX reporting to date, 75% of firms have beaten expectations, while 25% have fallen short (the earnings season so far has been relatively heavy financials, where earnings have been weak, in absolute terms).

Currencies had a volatile Friday with a mixed outcome for the USD on the day . JPY was the notable outperformer, helped in no small measure by the sharp declines in 10y UST yields, USD/JPY fell just over 1% to ¥136 while the euro ended 0.2% lower just above 1.02, after falling to 1.130 following the softer than expected local PMIs. After trading to an overnight high of 0.6977, the AUD was little changed on the day, closing the week at 0.6929 ( now 3 pips lower).

Looking at the week, the FX theme was a weaker US, weaker across the board with SEk and NOK the big outperformers up over 2% followed by JPY (2%) and the AUD (1.77%).

Looking at commodities, iron ore was the outperformer on Friday (+5%) and on the week (+7%) with copper also showing signs of life, after enduring sharp declines in previous weeks, the red metal was up 5% on the week. Oil prices were mixed with WTI down 1.7% in Friday and 2.96% on the week while Brent gained 2% over the past five days.

In other news, on Friday, Russia and Ukraine agreed a landmark deal to resume Ukraine’s grain exports from three Black Sea ports, including Odesa. The deal was hailed as a vital step toward alleviating a global food crisis. The feel-good vibes, however only lasted a couple of hours following reports Russia had carried out strikes in Odesa.

ere is where details matter, as the text of the arrangement notes both parties have agreed not to attack merchant and other civilian vessels and port facilities engaged in the transportation of grain. Russia said they were targeting a Ukrainian naval vessel and for now Ukrainian officials indicated they’re still moving ahead with the deal.

The World Health Organization (WHO) has declared monkeypox outbreak is a public health emergency of international concern , overruling a divided expert panel to issue the group’s highest alert. The declaration is call to action for a for stepped-up in global cooperation to stop the virus. Responding to the news, US president Biden said his administration has made vaccines, testing and treatments available and is “determined to accelerate our response in the days ahead”.

Read our NAB Markets Research disclaimer. For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.