Hear NAB’s senior expert panellists discuss a range of topics to provide key insights to help you and your business prepare for the current property market climate.

Market updates, insights and education empowering you to make informed investment decisions.

Hear NAB’s senior expert panellists discuss a range of topics to provide key insights to help you and your business prepare for the current property market climate.

Commercial property sentiment improved in Q4 but remained weak and below average

Insight

No matter what kind of investor you are there are equity strategies that may enhance your investment portfolio

Article

Tailored FX solutions can provide stand-alone enhanced income streams or form part of a wider investment strategy. Let's explore the choices

Article

Capital raisings can be a great entry point into real estate investment trusts, but there are a few things to consider to get your strategy right

Article

Capital raisings can be for listed or unlisted businesses. Both pathways may suit you, but first lets understand how they work

Article

Exchange Traded Funds provide easy access to investment themes across the world without the need to pick individual stocks

Article

Interest rate differentials between the US and Australia are set to narrow further, creating Foreign Exchange opportunities for investors

Article

Challenging conditions (particularly in Office and Retail markets) weighed further on commercial property market sentiment in Q3…

Insight

Seeking income and have conviction on a stock or market direction? NERTIs may fit the bill to meet your investment goal

Article

When bond yields move quickly the market is signalling a pending adjustment, and it may mean investors need to react

Article

Bonds are an essential part of a diversified investment portfolio, we examine the options and how best to allocate funds to fixed income

Article

Doing the research and understanding what you are investing in is a key part of being successful when building a share portfolio

Article

Rural businesses are looking for equipment funding solutions that meet their needs in an evolving environment. Article originally published in The Advisor on 20/09/23

Article

One of Australia’s most successful executives gives some inside tips at NAB’s Women in Property Finance industry networking event and reveals the biggest intellectual challenge of her post-Mirvac life.

Commercial property market sentiment and confidence moderates in Q2 amid growing economic uncertainty…

Insight

The required slowdown in consumption and its impact on the economy is becoming more worrisome as central bank's take a hard stance on inflation vs growth.

Article

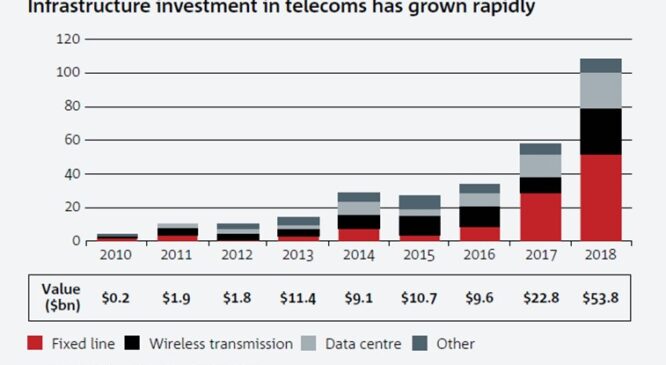

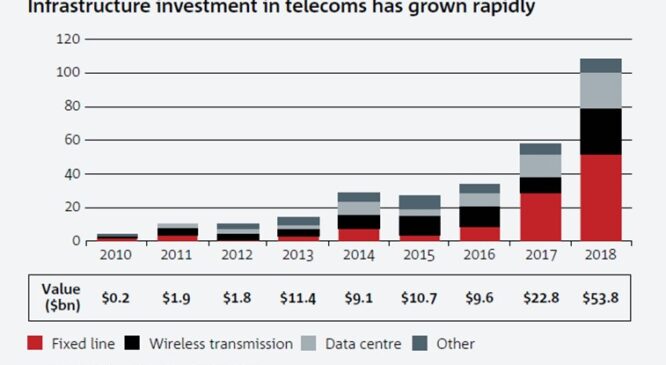

A series of NAB-led deals involving major telcos and private capital from infrastructure investors points the way to effectively monetising undervalued assets for growth.

Article

Using debt to build wealth is a well established path. Taking that strategy into an equities portfolio is not so well understood, but it can transform long-term outcomes

Article

The NAB Commercial Property Index improved a little further in Q1 but economic uncertainty seems to be weighing on confidence.

Insight

The NAB Commercial Property Index improved in Q4, but is still negative overall and trending well below the survey average.

Insight

Global growth is expected to slow this year, but there are paths opening as we enter the new Lunar Year that could lead to a brighter picture, with a bit of luck in the Year of the Rabbit.

Article

NAB and ASFA examine superannuation portfolio holdings disclosure data released this year as part of regulatory changes aimed at enhancing industry transparency.

Article

NAB’s Commercial Property Index shifted back into negative territory in Q3.

Insight

What megatrends are here to stay...and what defines them?

Podcast

Thank you for a successful Flood Relief Trading Day.

Article

BlackRock’s Head of Wealth Australia explains why ETFs are the ideal tool to diversify your portfolio and ride out the current market uncertainty.

Article

NAB's Commercial Property Index eased to +1 pt in Q2 (+11 in Q1) amid reports market is starting to respond to higher inflation and interest rates.

Insight

NAB’s Commercial Property Index rose to +11 pts in Q1, building on the gains seen in the last quarter when the index moved back into positive territory for the first time in 2 years.

Insight

Our Q4 survey saw commercial property market sentiment move into positive territory for the first time in 2 years, with the NAB Commercial Property Index at +3 pts.

Insight

NAB's 2021 biennial Super Fund FX Survey highlighted that on average, close to 47% of funds’ assets are allocated offshore.

NAB Private Direct webinar focuses on current trends around Markets and Investments.

Webinar

New NAB research shows how asset managers are working towards a more sustainable future through their investing activities and how companies can best embrace the change.

As part of NAB’s Bank for Transition interview series we speak to Associate Professor Rae Dufty-Jones and Dr Neil Perry from Western Sydney University on the future of building sustainable communities and how government is listening.

Our 10th biennial survey – the only survey of its kind to examine hedging techniques of Australian Super Funds – captures their shifting priorities in this rapidly changing landscape.

A new NAB report offers insights into how asset managers are incorporating sustainability metrics into their investing activities and what companies can do to develop best-in-class strategies.

The Q3 NAB Commercial Property Survey shows sentiment has declined, reflecting a fall in business confidence and conditions following the extended lockdowns in VIC and NSW.

Insight

Join us for this insightful webinar where our expert panellists discuss a range of topics around global and local investment themes, alternative investments and responsible investing.

Webinar

Companies with strong ESG characteristics are experiencing increased availability of equity and a reduced cost of equity.

Responding to changing asset manager behaviours and expectations.

Tapering is not tightening; the RBA is still adding to the stock of bonds on its balance sheet, just at a reduced rate.

Article

Q2 NAB Commercial Property Survey shows confidence edged higher, but recovery will remain slow.

After a wobble early last week, equity markets have resumed their upwards trajectory.

Article

A look at how industry leaders are changing their behaviours across the infrastructure cycle from investment to planning to delivery.

Investors have well and truly embraced sustainable bonds. But do they have what it takes to help better the world?

Article

It’s hard to invest for income right now. Maybe it’s time to try something different.

Article

The NAB Commercial Property Index lifted for the third straight quarter, but remained negative and well below average.

Insight

Australia’s high net worth investors face continued uncertainty – locally and globally. So what’s the smart next step? NAB Private and JBWere CEO Justin Greiner reveals his thoughts on how best to navigate 2021.

Article

NAB recently hosted the inaugural Capital Markets 2021 Virtual Conference for issuers and investors.

While NAB’s Commercial Property Index lifted for the second straight quarter, it was still weak and well below average.

Insight

According to BNEF, 2020 was a record year for sustainable debt issuance with annual issuance reaching US$732.1 billion across both bond and loan formats, representing a 29% uplift on 2019 levels.

With yields rising there’s been a question mark over whether the appetite for treasury bonds is falling.

Record levels of spending will call for record levels of funding this decade. That’s a golden opportunity for the private markets – and high net worth investors.

Article

The post-Brexit trade deal and the US fiscal stimulus deal have been pushed back time and time again, but we really are at the point of no return.

Q3 2020 saw increased issuance momentum with a record US$155bn of sustainable finance debt raised fuelled by the COVID-19 pandemic and global sustainability concerns.

The COVID-led economic downturn continued to weigh heavily on commercial property market sentiment in Q3.

Insight

We’ve partnered with The Australia—United Kingdom Chamber of Commerce and the New South Wales Government to launch the second business insight report in this three part series: Impact 2020: Seven Lessons in Social Value.

Green, social, sustainability and sustainability-linked bond market nearly doubles in Q3 2020.

Responsible investing among Australia’s wealthiest individuals is rising exponentially. The question is: why?

Article

There have been massive falls in US equities, particularly tech stocks.

Facilitating the flow of capital towards sustainable initiatives and investing in our economy to drive recovery, create jobs and supercharge innovation has never been more important.

US equities continue to race upwards, at or near record highs.

An Australasian perspective on sustainable finance markets.

Australian investors have had largely overlooked alternatives. COVID-19 may well change that.

Article

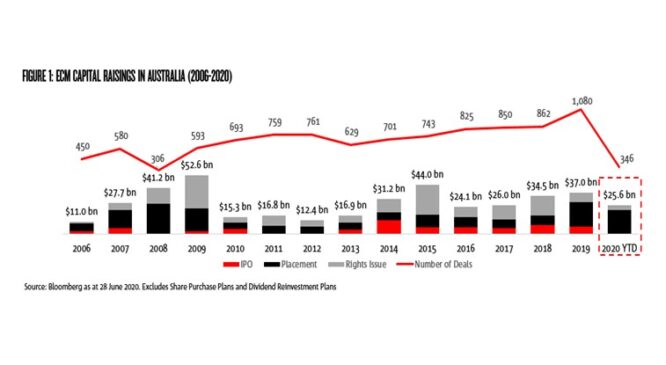

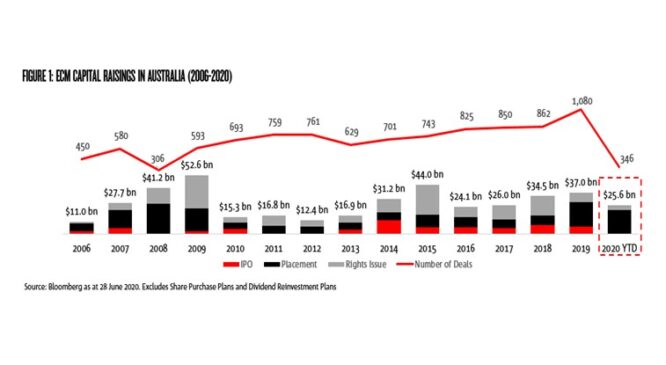

A temporary easing in rules around equity capital raisings has helped a surge in activity and this is expected to continue as companies shore up their balance sheets.

The COVID-19 led economic slowdown had a major impact on commercial market sentiment in Q2.

Insight

The COVID-19 pandemic is set to accelerate the shift to the digital economy, expanding the relatively new asset class of digital infrastructure.

Equities in the US spent most of the session rising, driven by the news that Pfizer and BioNTech’s experimental vaccine has being fast tracked in the US.

Dr Fauci has declared the virus as ‘out of control’ in the US and more measures need to be brought in to contain it.

There’s a little positive sentiment pushing shares higher again today and helping the US dollar gain on the Yen and Swiss Franc.

A monthly look at the ESG debt markets from an Australasian perspective.

Rising infection rates in US southern states hit equities hard on Friday.

The easing of banks’ investment rules contained in the so-called ‘Volcker Rule’ has helped to boost stocks.

In a day that’s been light on news, markets have had a chance to take a more positive outlook, pushing equities higher and the US dollar lower.

New COVID-19 social bonds have been met with overwhelming support from investors, leading to rapid growth in the sustainable debt market and a welcome outperformance, experts told a NAB Roundtable.

Globally equities had been dampened on Monday morning but equities are back on the rise in the US.

There’s been a swift move to bonds and safe haven currencies since the Fed’s message yesterday that it would take a couple of years at least for life to return to normal.

The rally in equities has stalled for now – except for the NASDAQ.

This week, we thought it might be interesting to discuss the most common questions we are getting asked by businesses and investors on the outlook for the Australian economy.

A look at the Australasian ESG debt markets during the last month.

US equities continued to rally as investors looked for signs the economy would be getting back on track. But then …

Equities have staged a broad-based rebound and are expected to continue as markets reopen in the US and UK.

Podcast

Market sentiment was tempered somewhat by rising rhetoric between the US and China.

It’s been another positive session, driving equities higher and giving another boost to the Australian dollar.

The longest period of bond market disruption since the GFC appears to be ending.

There’s been big increases in equity markets and bond yields on news of a successful stage one vaccine trial in the US.

The US President has said the US needs to get back to work, vaccine or not.

The US and Australia have both reported dour job numbers, although markets were braced to expect it.

When we’ve had positive risk sentiment in the past we’ve tended to see a stronger Aussie dollar but that’s not the case today.

The NAB Commercial Property Index fell 8 points to a below average 0 in the March quarter.

The Euro and Italian bonds took a hit with German judges challenging the ECB on its QE activity.

Airline stocks have taken a heavy hit after Warren Buffet’s decision to bail out at the weekend.

A monthly look at the Australasian ESG debt markets.

Listen to new podcast: COVID-19 investment trends.

Podcast

There’s still talk of a v-shaped recovery in the US.

Industrial production numbers from China on Friday gave investors hope.

March data out of the US is bad and the share market has taken it badly.

Australia joined the bull run in the share market yesterday, clocking up 20.7 percent growth since March 23.

The US Fed has extended its QE shopping list, agreeing to buy junk bonds from corporations suffering the impacts of the coronavirus.

With public debt markets in flux due to the spread of COVID-19, patience is the watchword for Australian borrowers in private capital markets.

The NAB Commercial Property Index increased 5 points to an above average +8 in Q4.

NAB’s Fixed Income Beyond the Institutional Sector Summit looked at the trends that are likely to shape the way we live, work and interact for years to come.

A financial system that has taken centuries to evolve will change dramatically in the next few years.

Investors are directing capital towards the projects and companies that will remain viable in the transition to a low-carbon economy, a major international conference was told.

Venture capital is too important for investors to ignore as it occupies an increasingly large part of the global economy and provides opportunities not available elsewhere, experts told the 2019 Association of Superannuation Funds of Australia.

Customers and investors alike want companies to create a positive contribution to society, alongside profit.

Climate change is a long-term problem, but when it starts to affect asset prices it will happen very quickly, experts told the recent 2019 Association of Superannuation Funds of Australia.

Listed companies and superannuation funds can lift returns and boost Australia’s economic growth if they work together, the recent 2019 Association of Superannuation Funds of Australia heard.

The offshore wind industry is booming, with 22GW of installed capacity worldwide and the first project planned for Australia.

Growth is key in a low-yield environment. But it’s also vital to protect the wealth you’ve spent years building.

Janari Tonoike, head of NAB Japan Securities Limited, National Australia Bank’s (NAB) new Tokyo-based, wholly-owned subsidiary, showcases the long-standing relationship between Japan and Australia, and explains how the new entity can help investors and borrowers in both markets and beyond connect better in a challenging global business environment.

As the end of year approaches, we’d like to recognise how our corporate and institutional clients are making a difference, in Australia and around the world.

Financial institutions including NAB are working on a range of ways to support customers as the global economy faces challenges from climate change, a recent conference was told.

Investors are keen to understand how their portfolios are exposed to global risks from climate change and want more green and sustainable products to invest in, a recent conference heard.

The NAB Commercial Property Index fell 4 points to +3 in Q3 2019, in line with its long-term average (+3).

Why it might be time for you to put your portfolio under the ESG microscope.

We helped Neuberger Berman set up Australia’s first listed investment trust focused on global fixed income, to turn global bonds into income for Aussie investors.

More Australians will be able to access affordable housing following a $2 billion commitment from NAB which will see more homes being built across the nation.

Global renewable energy owner, operator and developer, Pacific Hydro partnered with NAB to realise its renewable energy vision.

Companies sometimes seek changes to covenants during the life of a 10 to 15-year note. In this article, we examine the issues that can prompt such a request.

The recent NAB Super Evolution conference considered the implications of low interest rates on investments and asset allocations, and how that could affect superannuation returns.

Amid an expensive market and an uncertain global economy, fund managers are cautioning discipline, though there are opportunities for investors to look outside traditional markets and work on assets.

A landmark PPP refinance meets the needs of investors for a low-risk investment as well as the needs of borrowers for longer-dated debt.

Our 9th biennial survey – the only survey of its kind to examine hedging techniques of Australian super funds – captures their shifting priorities in this rapidly changing landscape.

The bond market has long been opaque, with bonds traded in parcels far too large for the average investors, but what might a more accessible bond market look like?

Overall market sentiment lifted 9 points to +7 in Q2. It rose in all states (bar SA/NT), and was highest in VIC & NSW.

It’s taken a while to gain momentum, but fixed income is starting to feature in high net worth portfolios in Australia, catching up with offshore peers.

Panelists at NAB's annual DCM conference discussed the ideal confluence of demand and supply in the Asia Pacific (APAC) region, which is home to some of the worlds fastest growing economies.

NAB recently brought together a group of insurance professionals with ESG market experts and practitioners to explore risk, operations, reputational and investment issues.

June was another month of two halves for the AUD/USD.

What are Australia’s wealthiest doing to prepare for tax-time?

Australia offers Asian investors portfolio diversification in a stable economic and political environment.

Overall market sentiment (measured by NAB’s Commercial Property Index) fell 11 points to -2 in Q1 2019 - its first negative read in over 4 years.

Sustainable bonds are appealing to a wider set of investors as the market develops, a recent conference was told.

High net worth and sophisticated investors are increasingly looking to corporate bonds as a way to preserve capital while delivering higher yields than cash or government bonds.

Growth capital is more important than ever. But while we’re seeing new and innovative forms of funding stepping up to meet this need, it’s clear small and medium-sized businesses must step up too.

A vintage sports car, a pink diamond necklace, a precious work of art – they may be more fun than a share portfolio but do they make sense as investments? We examine the world of high-value collectibles – the good news and the cautionary tales.

Global investors are increasingly allocating funds to infrastructure and many investors are implementing new methods and measures to both adapt to and lead a stewardship mandate into infrastructure investment.

Overall sentiment among property professionals increased marginally in the final quarter of 2018.

Australia’s energy landscape is undergoing a significant transformation which includes the increased penetration of renewable energy technologies.

Tapping into a giant retirement savings pool.

Macquarie saw demand for long tenors and appetite for socially responsible investments.

The Chinese economy is liberalising and opening up to the rest of the world, paving the way for foreign investors to tap into opportunities in the increasingly wealthy nation, the 2018 ASFA Conference heard.

After a year of credit spread tightening, investors are becoming more cautious and selective.

As 2018 draws to a close, we’d like to share some of the achievements of our Corporate and Institutional clients over the past year.

Australia’s superannuation funds should seriously consider infrastructure investment opportunities that help build the nation, NAB Chief Customer Officer of Consumer Banking, and former Premier of New South Wales, Mike Baird, says.

Build-to-rent could provide new avenues for investors as well as improve housing affordability, a NAB conference has been told.

Wherever you look, the future is about technology – the way we invest, care for our health and even how we grow our food. We take a look at where technology might take us in 2019.

It’s beginning to dawn on investors – and the people for whom they invest – that they’re in a unique position to change the world, without sacrificing financial gains.

Overall sentiment in commercial property markets (measured by the NAB Commercial Property Index) fell 9 points to a 2-year low +8 in Q3, but is still well above long-term average levels (+3).

Using blockchain to boost green investment: How to create trust, transparency and liquidity for green infrastructure opportunities.

This week, we're reproducing a thematic piece on US stock market valuations.

Growing interest from investors has underpinned the rapid development of the renewables sector, a key industry conference has been told.

A strong first half and continuing near term momentum but slowing into the medium term.

The NAB Residential Property Index fell sharply for the second straight quarter in Q3 2018, down 15 to a 7-year low -9 points, and its first negative read since mid-2012.

September was a challenging month for the AUD/USD.

Australian investors, generally speaking, display a noticeable bias towards domestic equities, property and cash. It’s just one reason why it might be time for some to review their investment options.

International and domestic events have added to the AUD/USD volatility.

Property issuance in the US Private Placement market is back in favour with investors across North America.

Australian markets started this week with a new Prime Minister. The Weekly looks at eight key issues for business and investors to consider.

If you think it’s hard to spot the next big digital start-up, imagine picking the next big thing in the art world.

Active asset management still offers value despite the rise of low-fee passive strategies in the fixed-income sector.

Caution but not panic is the mantra among top Australian property investors as they adjust to a new phase of the market cycle.

The financial crisis and its aftermath fundamentally reshaped bank business models, allowing investors to focus mainly on macroeconomic factors when they analyse the sector. Speakers at the KangaNews-NAB Fixed Income Beyond the Institutional Sector Summit shared insights into the present and future of bank investment.

A major conference of the UN Environment Finance Initiative in Australia has been told that the weight of money is driving the shift towards a more sustainable economy.

The digital economy has given rise to its own infrastructure needs, and investors are paying attention.

As the current phase of privatisations approaches its conclusion in Australia, local infrastructure investors are looking to international markets for investment opportunities. At the same time, global capital that was drawn to the Australian market by the deep pipeline continues to actively pursue Australian deals. This has created significant competition in Australia and seen infrastructure investors increasingly focus on a broader class of assets.

Overall sentiment in commercial property markets (measured by the NAB Commercial Property Index) moderated in Q2. The Index fell 4 points to +17 but remains well above its long-term average (+3).

Globally, the finance sector is directing ever-greater amounts of capital to address social and environmental challenges. Australia has more work to do on this front.

For corporates with a growth agenda but no formal credit rating, the bond market is providing a new avenue for capital.

Political risks and uncertainty may be on the rise. But a recent tour of Asia for the NAB Asian Debt Capital Markets Conference reminded NAB Global Head of Research Peter Jolly of the many causes for optimism about Australia’s economy.

At NAB’s 2018 Asian Debt Capital Markets Conference, experts, issuers and investors zeroed in on the forces that will build connections and foster future opportunities.

Major Australian organisations are now directly investing in large-scale renewable energy projects through the new NAB Low Carbon Shared Portfolio, the first of its kind in Australia.

The Low-Carbon Shared Portfolio is the first of its kind in Australia.

Socially responsible investing has skyrocketed in Australia over the past few years. What does it mean to invest responsibly and what is its impact?

The world’s first sustainability bond from a university is funding a better future for students and for vulnerable communities.

A new debt market is evolving that could help give mid-sized Australian companies that don’t have a credit rating more options to secure debt funding from investors.

NAB and Asiamoney's latest poll on Asian and European investors’ appetite for Australian debt tells a story of consistency and stability as the region presents a safe option amid turbulence - while also offering sustainable opportunities.

From a lick of paint to renting out rooms – 10 ideas on boosting the value of your own building.

Overall sentiment (measured by NAB’s Commercial Property Index) rose 4 points to +21 in Q1.

NAB’s review of first quarter corporate debt issuance.

March was a month of two halves for the AUD/USD.

Ports and airports, toll roads and tunnels. These are just some examples of infrastructure sold into the US Private Placement (USPP) market over the last several years.

Think charitable giving is the only way to make a valuable difference? Think again. You can now use your investments to help effect social and environmental change, with increasing opportunities to back projects that promise to address our world’s most pressing issues.

NAB’s general manager, capital markets and advisory, Jacqui Fox, and head of debt syndicate, Mark Abrahams, highlight the key themes for Australian credit in 2018 and why they point to a positive fundamental story despite the resurgence in equity market volatility early this year.

Buying into start-ups has long been the holy grail of forward-thinking investors. Equity crowdfunding opportunities are finally opening the doors.

AUD/EUR continues to approach its two-year lows.

NAB’s positive view of GBP and forecast decline in AUD/GBP is in the immediate term.

In February the AUD/USD gave back all of its January gains and some more. February was a month characterised by an increase in market volatility, particularly in equities amid US inflationary concerns alongside a rise in US bond yields and their implicit valuation concerns for physical and risk assets.

Clare Lewis, NAB Director Corporate Debt Markets Origination talks about the outlook for the corporate bond market in 2018.

NAB has debuted several innovative green and social bonds in recent years. In this article we go behind the scenes to find out how a new, green investment product reaches the market.

Fresh from the annual Private Placement Industry Forum in Miami, we consider the options for investors looking to add a rock-solid asset to their portfolio.

Listed Investment Companies evolve and thrive in 2017.

Observations from the OurCrowd Summit – how crowdfunding is creating opportunities for high-tech entrepreneurs and investors.

Global air traffic and demand for aircraft stays strong in 2017.

2017 saw all 45 OECD countries and the major emerging economies in synchronised growth for the first time in 10 years. JBWere examines the impact ‘synchronised growth’ has on markets and what’s in store for investors in 2018.

NAB’s Securitisation team goes from strength to strength, being the clear house of choice for customers and thought leader in the market.

2017 has been the best year for both issuers and investors since 2006.

Steve Killelea, the man behind the Global Peace Index, explains its potential value in helping make investment decisions.

2017 was marked by a return to stability following the volatility of recent times and the rise of innovative new products, especially in the green and social sectors.

We’re living longer and our kids are experiencing the challenges of establishing themselves in a world of higher house-to-wage ratios. Our over-leveraged governments have responded by cutting back on spending in health, education and social services as well as super tax breaks that encourage us to save. The upshot is, we have to rely on ourselves for a comfortable long-term future.

What will the new year bring in the world of business trends? Whether it’s health or agriculture, hyper local advertising or self-trained artificial intelligence, NAB has one eye on the (crystal) ball.

In a wide-ranging state-of-the-market perspective, Steve Lambert, Executive General Manager, Corporate Finance at NAB, attributes Australian transaction breakthroughs in 2017 to long-term positive trends on the demand side.

While there was plenty of concern about potential geopolitical and economic crises at the recent ASFA conference, at least one senior industry figure was upbeat.

*Launch of world-first low carbon shared portfolio backing renewable energy*.

Reduced government funding and a growing population are forcing local councils to find alternative funding for public assets and community projects. NAB has already started filling the gap, with new mechanisms opening up funding sources usually closed to small lenders.

This independent report for National Australia Bank (NAB) by the Crawford School of Public Policy at The Australian National University, examines the outlook for the South Korean economy and its growing importance in the Asia Pacific region.

Mike Baird, NAB’s Chief Customer Officer-Corporate and Institutional Banking talks to the opportunities the infrastructure market offers and how our clients can benefit from Australia’s infrastructure investment.

Chris Black, a portfolio manager from Alexander Funds Management shares his insights on portfolio construction and what tips non institutional investors should and should not mimic from institutional investor portfolios.

Tom Wirth, NAB’s GM of Balance Sheet Strategy shares his insights for Ethical investing and what role it can play in a portfolio.

Securitisation has been one of the compelling stories in the Australian market in 2017. Issuers are keen, investors are willing and there’s abundant appetite for new and exciting assets and structures.

Increased global liquidity, Asia’s growing wealth and the rise of the regional investor base have made the US$ Reg S market an increasingly important source of funding for Asia Pacific issuers. NAB sees US$ Reg S issuance from Australian corporates tripled from 2016 to 2017, with ample room to grow.

Australia’s high-yield fixed-income market has evolved from being virtually non-existent just a few years ago to now offering a reasonably consistent funding option for Australian companies.

Margin lending can offer you considerable flexibility to build your investment portfolio, just the way you want it.

It’s among the top three challenges facing us all according to the World Economic Forum – climate change adaptation. But there are challenges to financing such investments in Australia. How can we ensure critical infrastructure is resilient for a changing climate, integrating physical risk into investment practices?

Overall sentiment in commercial property markets moderated for the second straight quarter, with NAB’s Commercial Property Index down 5 points to +18 in Q3, but still well above long-term average levels (+2).

Beyond reaching institutional investors, socially responsible investment (SRI) assets need to develop sufficient scale and momentum to attract interest from the wholesale markets.

Aussie superfunds face a world where investment themes are changing and there’s a continued search for yield. NAB’s latest Superannuation FX Hedging survey indicates they’re up to the challenge.

NAB’s most recent FX Hedging survey shows that superfunds are adapting their hedging strategies, thanks in large part to an increase in size.

The Queensland Government’s first social bond that seeks to reduce reoffending by young people has been launched by Life Without Barriers and NAB.

Ethical investment was a hot issue at the KangaNews-NAB Fixed Income Beyond the Institutional Sector Summit in July. NAB’s Mark Todd and a panel of ethical investment industry leaders discussed how this market is developing in Australia.

Our 8th biennial survey captures the shifting priorities of Australian super funds in a rapidly changing landscape.

A panel of fund managers and NAB’s Connie Sokaris discussed the vexing issue of how to create income in a low interest environment at the KangaNews-NAB Fixed Income Beyond the Institutional Sector Summit.

NAB’s Mark Todd and a panel considered the future of fintech and the implications for investment at the KangaNews-NAB Fixed Income Beyond the Institutional Sector Summit.

At a basic level, SRI asset managers often adopt one of two approaches whilst for an individual investor, there are three main approaches.

SRI aims to incorporate environmental, social and governance (ESG) factors into investment decisions and the industry is growing rapidly.

After the recent investor jitters triggered by the failure of some Public Private Partnership (PPP) toll roads, it looks like a new wave of infrastructure PPPs, kick-started by Federal and State Government investment, are making a strong comeback.

The AUD bond market is not just one market. It's, at last count - at least six markets with their own features, documentation and target investors.

The nation’s first Sustainability Bond demonstrates how the corporate and education sectors can partner to address pressing issues facing our society and environment.

Australian housing market sentiment (measured by NAB’s Residential Property Index) fell noticeably in the June quarter after climbing to a 3-year high in March.

Any examination of the Asia-Pacific region’s capital requirements, whether by a government, issuer or investor, must begin with the acknowledgement that demographic and financial pressures mean countries can no longer ‘go it alone.’

Not yet a wholesale investor? It’s time you found out what you’re missing out on.

Socially responsible investing (SRI) means integrating non-financial factors – such as ethical, social or environmental concerns – into the investment process with the aim of earning both a financial return and a moral ‘return’.

The NAB Monthly Business Survey posted another strong result in April, with both business conditions and confidence improving – pointing to ongoing strength in business activity in the near-term.

On 1 July 2017, some of the biggest changes to superannuation in a decade come into effect. Some of the rules and tax concessions available are changing; discover what this means for you and what opportunities you could make the most of before the end of the financial year.

Impact investing (sometimes also referred to as mission-related investing) is an investment strategy where an investor proactively makes investments that can generate both financial returns, as well as intentional social or environmental returns for the community.

Results from the March NAB Monthly Business Survey point to an overall healthy economy that is gaining momentum, at least in the near-term.

Australian businesses in the healthcare sector are well positioned to capitalise on significant changes in the Chinese healthcare system as major demographic shifts unfold in the world’s second largest economy.

Did you know that not all investors are eligible to claim the franking credits? There are a number of strategies investors may look to utilise to limit their exposure to a fall in the share price of their chosen stock, while remaining eligible to receive the franking credits.

Research continues to show that companies with gender diversity in their leadership teams deliver better financial results. A new product from NAB – and Australia’s very first ‘social bond’ – allows investors to put their money where their mouth is and finally invest in gender-inclusive organisations.

Private equity has made headlines in Australia over the past year or two, but for many of the wrong reasons. The demise of Dick Smith Holdings was a high profile collapse that impacted many shareholders and retail customers, and a lot of blame has been pointed at the private equity fund manager who floated the business.

Business survey suggests solid near-term activity, despite easing from multi-year high.

Low-tier SMEs’ business conditions now comparable to that of their mid-tier and high-tier counterparts

Get the latest monthly update on housing market conditions around Australia.

The strength witnessed in last month’s NAB Monthly Business Survey continued into January, with both business conditions and confidence jumping to much higher levels.

Mornington Peninsula Shire is investing an estimated $9.5 million in emissions reduction projects over the next five years as part of a far-reaching plan to generate a cleaner and greener environment as well as operational savings.

From a political perspective, President Trump’s decision to withdraw from the TPP reflected US sentiment against globalisation, particularly in the mid-west rust belt.

Business confidence has held up quite well and is remarkably steady given the context of major uncertainties both at home and abroad. That said, the level of confidence has not picked up to reflect the overall strength in business conditions seen over the past year or more.

By state, confidence has improved in VIC and QLD relative to the last survey, but this was offset by much weaker confidence in SA/NT and a small fall in NSW

Apartment construction which has risen strongly over the past few years was reported by the Statistician to have declined in the September quarter.

The key views of NAB and BNZ's economists and strategists

Steve Lambert, EGM Capital Financing, explains, innovation and volatility again dominated 2016. Markets were challenged by social, political and economic events which brought about new opportunities for our customers. We delivered insights and solutions to help them face into the increasing environment of disruption and regulation.

Get the latest monthly update on housing market conditions around Australia.

Since the middle of 2015, the seven-day Shanghai Interbank Offered Rate (Shibor) has been unusually stable – when compared with the extreme volatility in this market over the preceding five years.

The market has been largely focussed on the US Election over the past month – and is now dealing with a fundamental change with the election of Donald Trump as President.

Read more to learn how you could use annuities in your portfolio.

Australian housing market sentiment improved in the third quarter of 2016, supported by more positive expectations for house price growth.

In early September equity markets sold off after a US Federal Reserve official suggested interest rates could be increased at the September Fed meeting. Markets recovered later in the month when interest rates went unchanged.

While GDP growth has been modest, jobs growth remains solid and inflation is edging up.

As Australia’s population ages and ‘baby boomer’ retirements head toward their zenith in 2025, a discussion on the Retirement Risk Zone, that is the 10 years leading to retirement, is timely.

This insights paper has been prepared by NAB Corporate Health and JBWere to address the current challenges facing providers and to examine some of the successful strategies being adopted.

The bigger picture – A Global and Australian economic perspective

The rust belt region has continued to underperform in recent times – as service focussed provinces have driven a greater share of China’s growth. In 2015, the three rust belt provinces were among the four weakest growing regions.

No surprises in the latest data, weaker real estate sector leads to a softening in the growth profile

The “X factors” that had been dominating negative market views – bad debts in the Italian and Chinese banking system, terrorism, political issues and the rise of anti-globalisation – have given way to a “fear of missing out” rally.

We review July conditions and recommend overweight exposure in cash and alternative assets, with underweight positions in fixed interest, property and Australian equities, while keeping neutral exposure to international equities.

We review July conditions and recommend overweight exposure in cash and alternative assets, with underweight positions in fixed interest, property and Australian equities, while keeping neutral exposure to international equities.

It was a difficult month for equities with an initial sell off in early June, following the release of weak jobs growth figures in the United States and another decline later in the month following the UK’s decision to leave the European Union.

This is the sixth in a series of reports prepared by the Australian Centre for Financial Studies for National Australia Bank aimed at explaining the potential role of corporate bonds in retail investor portfolios and promoting growth of the corporate bond market.

Brexit is a significant shift in the geopolitical landscape, with associated uncertainty. Investors will need compensation for this with lower share prices. We believe a 15% global equity sell-off over the next 6-8 weeks is a reasonable base case.

The concept of assessing a company’s quality gained popularity after the collapse of the tech bubble of 2001. Here we explore the quantitative and qualitative measures implemented to determine quality investments.

We’re pleased to announce the launch of our new brand and exciting new partnership that combines the strengths of both NAB Private and JBWere.

Read more to learn how you could use asset-backed securities in your portfolio

In most of the major economies the outlook remains fragile, as a result of political uncertainty and disappointing earnings results. However recovery in equity prices has continued into April, primarily to the bounce in commodity prices and supportive central banks.

Investors commonly take the view that bonds are not a good investment in an environment where the central bank is expected to increase interest rates, but the decision may not always be that simple.

In our April update, Nick Ryder, JBWere Investment Strategist, highlights that the local equity market faces a number of headwinds from the rise in the AUD, lower commodity prices, higher potential bank capital requirements and profit margin pressures.

In our March update, Nick Ryder, NAB Private Wealth Investment Strategist, talks mixed messages with slumps in developed markets, India and China while the US posted slight improvements and Australia performed reasonably well. Meanwhile, Europe’s inflation entered negative territory.

With the mining boom at an end, the dining boom has certainly fuelled the Australian agricultural sector. This sector is 5 percent of the Small Ordinaries and has been a source of great returns over the past few years.

Sally Campbell from JBWere looks at the carbon footprint considerations within fund managers’ assets, highlighting that some are more progressive than others.

The property market is clearly cooling as a result of deterioration in affordability due to higher prices and marginally higher mortgage rates.

In this discussion of alternative investments, Nick Ryder explains that the increased weighting in this asset class is the result of less attractive prices in traditional asset classes.

Nick Ryder, highlights that January was a difficult month for financial market with renewed investor jitters over slow growth in China and falling commodity prices.

Setting long-term asset allocation targets in a portfolio and achieving them are two different things. Here we discuss portfolio drift and how to manage it.

In November we’ve seen small declines in dwelling prices in Sydney and Melbourne with auction clearance rates falling to 60% along with average selling time. Reversing recent trends, prices in other metros rose in November.

In our December update, Nick Ryder, NAB Private Wealth Investment Strategist, highlights how equity markets rose again in November helped by expectations of further monetary stimulus from the European Central Bank.

Movements in the residential property market affect everyone - whether you’re an investor, an owner occupier, or a renter. After several years of incredibly strong house price growth, primarily in Sydney and Melbourne, there is now heated debate over where prices are likely to move.

The growth of the industrial internet phenomenon and its impact on our automated life. We look at how this trend is evolving the structure of companies that manufacture hardware and software technology.

Nick Ryder, NAB Private Wealth Investment Strategist, highlights how equity markets recorded their strongest rise in four years in October and continue to offer the best prospective returns of any asset class.

Food catering has evolved from being an add-on to mainstream shopping complex merchandising, to an attraction in its own right.

Sally Campbell from JBWere looks at timing the market given recent volatility and how viewing the data more closely can help you understand what’s really happening below the surface.

The Chinese Government’s surprise move to devalue the Yuan and make daily prices subject to market forces has prompted debate.

Nick Ryder, NAB Private Wealth Investment Strategist, provides insights into the emerging self-driving car industry.

Global financial markets recovered in July following the debt deal in Greece and stabilisation of the Chinese stock market. Locally, the news is also good – the unemployment rate appears to have peaked while business conditions and confidence have also picked up.

The United Nations-supported Principles for Responsible Investment Initiative is an international network of investors that support responsible investing.

Nick Ryder, NAB Private Wealth Investment Strategist, explains takeover and defence tactics used by listed companies.

An investment portfolio can be designed based on risk tolerance, age or lifestyle objectives but using historic average returns (of different asset classes) to build that portfolio can be dangerous.

Nick Ryder, NAB Private Wealth Investment Strategist, explains the different ways analysts and fund managers value listed company shares.

Ructions in Greece and China are worrisome for investors but are unlikely to have a material impact on markets or on asset allocation recommendations.

Financial markets remain focussed on a Greek exit from the Eurozone, wild gyrations on the Chinese equity market and further hints about a rise in US interest rates. Locally, markets are concerned about falling commodity prices and strong property prices.

NAB joins with the Australian Centre for Financial Studies to launch their report ‘Improving access to the Corporate Bond market for retail investors’ which assesses where the market currently is, the factors affecting its growth, and the impediments to connecting investors and issuers.

The US Federal Reserve expects the US unemployment rate will fall to 5% by year end. Locally, the Reserve Bank of Australia is hoping lower interest rates will translate to a lower Australian dollar which would help the non-mining sectors.

Sally Campbell, Executive Director, JBWere, explains why investors should stick with their active fund managers, despite a period of underperformance by some.

Australia’s Real Estate Investment Trusts (REITs) have regained popularity as investors seek high yielding investments in a low interest rate environment.

The link between bond yields and share prices over the past few weeks has spooked many investors but may be good news.

The US economy recorded slower jobs growth in April while GDP growth slowed to a crawl. This means the US Federal Reserve may delay raising interest rates until September. In Australia, jobs growth was higher than expected while core inflation sits comfortably in the middle of the Reserve Bank’s target range.

Developed market equities appear expensive compared to average long-term price-to-earnings ratios. However, given relatively subdued earnings growth, many investors argue that they aren’t expensive when compared to current bond yields.

The End of Financial Year (EOFY) provides a good opportunity to consider strategies that can save you tax and maximise your investment returns.

The US Federal Reserve has given itself the flexibility to raise interest rates from June, responding to record jobs growth. Meanwhile in Australia, consumer and business confidence has eased back in the most recent surveys, despite the recent interest rate cut.

In Australia, interest in ethical investing (an investment method which looks to maximise financial and social returns) has continued to rise, but there are several ways to action your wishes.

Knowing when to reduce the proportion of equities in a portfolio and when to increase exposure to other asset classes like property, cash and bonds, can be part science and part art. Valuations, fundamentals and sentiment all play a role.

NAB’s Director of Fixed Income, Mark Todd, is joined by John Pearce from UniSuper and Nick Bishop from Aberdeen to discuss where rates are headed, equities with sustainable dividends, and whether we're in a bond yield bubble.

NAB’s Director of Fixed Income, Mark Todd, speaks with Tano Pelosi from Antares and Matthew Johnson from UBS about inflation and interest rates in Europe, along with the actions of European Central Bank President Mario Draghi.

A February interest rate cut and a strong company reporting season buoyed the Australian share market while overseas, resolution of Greek debt negotiations and continuing monetary stimulus, benefited developed global markets.

Over recent years, the impressive growth of ETFs has seen somewhat of a reversal back to direct investing with more than 100 ETFs now listed on the ASX, offering investors the opportunity to quickly and easily access global equity, bond, currency and commodity markets.

With bond yields at or near record lows in many parts of the world, particularly Europe, but with share markets in the United States and Germany hitting fresh record highs, signals are mixed, so it may be time to consider alternative investment opportunities.

NAB’s Director of Fixed Income, Mark Todd, is joined by Steve Goldman from Kapstream and Adam Goldstein from Skeggs Goldstein to chat about the global economy and key US economic indicators, and how they could affect US Federal Reserve decisions.

NAB’s Director of Fixed Income, Mark Todd, is joined by Steve Goldman from Kapstream and Adam Goldstien from Skeggs Goldstein to discuss how diversifying across asset classes during this time of low yield can still generate decent returns.

The US Private Placement market offers a rich source of long-term funds for a wide range of Australian corporates. Our latest survey reveals the key factors that influence US investor buying decisions and their expectations for 2015.

Government funding for new infrastructure in the higher education sector has recently dried up. As a result, a number of universities are accessing capital markets and bank loans for their infrastructure financing needs – in turn offering significant opportunities for debt providers.

Long-term US research shows investors are frequently driven by fear and greed in their decisions - for example, selling out in weak markets. However, more recent findings show the average investor has learned from some past mistakes.

2014 was another strong year for international shares, with only part of the gains for Australian investors attributed to a weaker AUD. However, with the prospect of Australian interest rates falling further, investors’ future income from currency hedging is unlikely to be as high.

Global equity prices in developed markets lost 0.5% in January, with strong gains in Europe offset by weakness in the United States. Australian shares rose 3.3% while the Australian dollar fell four cents to US$0.78, against a strengthening US Dollar.

Overall, global equity markets are in a sweet spot. China, Japan and Eurozone Central Banks are looking at ways to maintain economic growth, while the United States has completed its quantitative easing and is looking at the appropriate time to raise official interest rates.

Global equity markets extended the October sharp rally through November, while gains were broadly based in Europe, Japan and the United States. Locally, fourth quarter data continues to show improvement in business credit and capital investment from non-mining sectors.

NAB’s Director of Fixed Income, Mark Todd, is joined by Ken Hyman (Antares) and Francesco De Stradis (Ord Minnett) to discuss the Federal Open Market Committee's decision to lift interest rates and drop GDP forecasts.

NAB’s Director of Fixed Income, Mark Todd, asks John Moore from Northward Capital to explain what to look out for when searching for a fund manager.

NAB’s Director of Fixed Income, Mark Todd, is joined by Ken Hyman (Antares) and Francesco De Stradis (Ord Minnett), to consider whether the market will see 'herd instincts' kick in when investors exit the carry trade.

While one economic indicator is a statistic about economic activity, a range of economic indicators paint a picture of how the Australian economy is performing. They can also influence interest rates, exchange rates, commodity and stock market prices. Nick Ryder explains them in detail.

While equity valuation measures imply US shares are about 60% overvalued versus long-term averages, returns could be as low at 0.2% per annum if valuations return to long-term averages. Therefore, as Nick Ryder explains, there’s a need to find additional sources of portfolio returns.

Global equity markets staged a sharp turnaround in October. It was led by the US where their Federal Reserve reassured markets that interest rate rises remain data dependent. Meanwhile, there was additional modest improvement seen in Australian business and consumer confidence.

While the US economy remains robust, Australian shares fell 5.4% as markets digested falling commodity prices, a weaker Aussie dollar and the possible introduction of policy brakes on housing credit, as James Wright, JBWere Chief Investment Officer reports.

Managed funds offer an attractive way for investors to obtain exposure to an asset class that would be very difficult to access directly or in a diversified form. But how do you select one from the thousands on offer? Nick Ryder, NAB Private Wealth Investment Strategist, investigates.

With the large fall in the Australian Dollar over the past month, we’re reminded that currencies are good “shock absorbers” in financial markets and the economy. We share some suggestions for how best to manage your portfolio in this changing environment.

Following a recent NAB-hosted roundtable event on Social Impact Investing, The Australian Financial Review today released editorial covering the topic from two journalists who were in attendance, James Dunn and Jonathan Shapiro.

NAB’s Director of Fixed Income, Mark Todd, asks Mercer's Russell Clarke and Chris Joye from the AFR to explain what a Carry Trade is.

NAB’s Director of Fixed Income, Mark Todd, chats with Mercer's Russell Clarke and Chris Joye from the AFR about longevity, and how it’s a game changer for asset allocation.

Since 2000, changes have been made to how philanthropic efforts are treated by the Australian tax system – offering smarter ways for donors to arrange their giving to benefit them and future generations. JBWere Consultant, John McLeod discusses how to structure your philanthropic giving.

NAB’s Director of Fixed Income, Mark Todd, discusses the economic outlook for Europe with Grant Eshuys (Citibank) and Mark Bayley (Aquasia), and together they explore the challenges the European nations are facing.

With better US economic data, global markets were stronger in August. Locally, as James Wright, JBWere Chief Investment Officer explains, company reporting season was positive and stocks rewarded for delivering solid earnings, yields or capital management.

People invest so they can have more money in the future than they have today. However, they have different objectives which generally fall into three categories: preserve capital; generate income and grow capital, as Nick Ryder, NAB Private Wealth Investment Strategist reports.

There are options to consider when allocating property to your portfolio. NAB Private Wealth aligns its views with those of institutional investors and favours core unlisted commercial property, with low to moderate gearing, rather than listed property securities or residential property.

NAB’s Director of Fixed Income, Mark Todd, chats with Mercer's Sue Wang and the National Party's Kevin Hogan about disengaged investors - people who are uninterested in closely monitoring their superannuation - and the importance of more simple and transparent products for these people.

NAB’s Director of Fixed Income, Mark Todd, discusses how changes in Australia's demographics threaten to have major impacts upon the Australian economy with Mercer's Sue Wang and the National Party's Kevin Hogan.

Despite US equity markets posting fresh records in July, a late, large fall saw equity markets finish lower. While valuations are stretched, JBWere Chief Investment Officer, James Wright, reports that the US economic recovery should support current earnings forecasts.

After deciding that US equity market valuations are over-stretched, we’ve changed our asset allocation recommendations. In particular, we’ve decreased our exposure to international shares from over-weight to neutral and increased our cash weighting from neutral to overweight.

Equity income funds are those which aim to generate income from investing in shares. But as NAB Private Wealth Investment Strategist, Nick Ryder reports, the issue is whether investors should care whether they get profits through dividends or capital gains.

NAB’s Director of Fixed Income, Mark Todd, chats with Adam Goldstien from Skeggs Goldstien and Simon Ibbetson from Millinium about the property markets and how a change in these markets could affect inflation and therefore the banks.

Even though equity prices are high compared to historical levels, we believe equity valuations are not excessive, so equities are still attractive compared to other asset classes. We provide insights on our favoured asset classes and how best to position your portfolio.

The US equity market posted fresh highs in June, but price support remains good globally and locally, says James Wright, Chief Investment Officer, JBWere. Read more for currency and property news from the NAB FX Strategy team and Nick Ryder, NAB Private Wealth Investment Strategist.

It’s time to revisit your global equity exposure. Following a period of strong performance in international shares, it may be a good time to consider taking some profits and rebalancing your portfolio back to long term target weightings, says Duncan Niven, Analyst JBWere.

NAB’s Director of Fixed Income, Mark Todd, chats with Adam Goldstien from Skeggs Goldstien and Simon Ibbetson from Millinium about which asset classes are facing bubbles, along with discussing some markets where good value lies.

NAB’s Director of Fixed Income, Mark Todd, is joined by NAB Head of Research Peter Jolly and Laminar economist Stephen Roberts to discuss the Federal Reserve's Balance Sheet.

NAB’s Director of Fixed Income, Mark Todd, is joined by NAB Head of Research Peter Jolly and Laminar economist Stephen Roberts to discuss the Australian and US economies, along with the Australian Federal Budget and issues posed by our ageing population.

NAB’s Director of Fixed Income, Mark Todd, chats about where interest rates are headed and their subsequent impact on term deposits with AFR columnist, Chris Joye and Montgomery Investment Management strategist, Andrew Macken.

NAB’s Director of Fixed Income, Mark Todd, discusses the 2014-15 outlook for the US Federal reserve and interest rates with AFR columnist, Chris Joye and Montgomery Investment Management stategist, Andrew Macken.

NAB’s Director of Fixed Income, Mark Todd, is joined by FIIG Analyst Gavan Madson and FNArena Analyst Rudi Filapek-Vandyck to discuss the proposed legislation to be introduced known as 'simple bond legislation', which has the intention of opening the bond market up to retail investors.

Over the past couple of years, Australian investors have increased investment in overseas assets, particularly equities. Global equities exposure isn't always what it seems as classifications and labels may not reflect the full picture.

The synchronised movement in bond and equity prices has many strategists wondering what is going on - both the bond market and equity market cannot be right about future growth. We provide insights on our favoured asset classes and how best to position your portfolio.

Last month, investors ignored mixed economic data and geopolitical risks to push the US share market to a record high, reports James Wright, Chief Investment Officer, JBWere. Read more to also find out what happened in currency markets and the residential property market from Nick Ryder

NAB’s Director of Fixed Income, Mark Todd, introduces the concept of aged-based investing in corporate bonds and how institutional players are becoming active in this space.

NAB’s Director of Fixed Income, Mark Todd, answers a viewer question on inflation and its impact upon cash investments with FIIG Analyst Gavan Madson and FNArena Analyst Rudi Filapek-Vandyck.

NAB’s Director of Fixed Income, Mark Todd, introduces the 'Bond Access Service', a way in which to easily access the bond market.

NAB’s Director of Fixed Income, Mark Todd, outlines the concept of market volatility, absorbing volatility and what it means for self-managed super funds.

NAB’s Director of Fixed Income, Mark Todd, discusses what is happening in the Equity Market with FNArena analyst Rudi Fliepek-Vandyck, and how 2014 is looking like the year that the investors from the sidelines will come back to the share market in light of volumes coming back.

NAB’s Director of Fixed Income, Mark Todd, discusses growth of BHP and the impact of capital expenditure on inflation with Gavan Madson, Analyst at FIIG and FNArena Analyst Rudi Filapek-Vandyck.

In this episode of Your Money, Your Call, NAB’s Director of Fixed Income, Mark Todd, looks at the developments in the corporate bond market, including Simple Bond Legislation, with AFR columnist, Chris Joye and Montgomery Investment Management strategist, Andrew Macken.

NAB’s Director of Fixed Income, Mark Todd, is joined by FIIG Analyst Gavan Madson and FNArena Analyst Rudi Filapek-Vandyck to discuss Qantas credit default swaps, and cyclical yield outperforming in rising markets and underperforming in falling markets.

NAB’s Director of Fixed Income, Mark Todd is joined by Sue Wang from Mercer to explain the 'My Super' reforms and how changing your superannuation investment strategy as you age can make a big difference on your retirement.

NAB’s Director of Fixed Income, Mark Todd, talks with two analysts about what they look for apart from growth when analysing a company - including finance risk, business risk, management history, assets, gearing, mix of debt and equity.

NAB’s Director of Fixed Income, Mark Todd, discusses the issues and strategies around setting up a self-managed super fund (SMSF) with Sue Wang from Mercer and Chris Black from the Laminar Group.

NAB’s Director of Fixed Income, Mark Todd, is joined by FNArena analyst Rudi Filapek-Vandyck. They begin by discussing investing in BHP stock, before assessing inflation - including current forecasts and how velocity, innovation and the labour market can impact upon it.

NAB’s Director of Fixed Income, Mark Todd, discusses the current trends in mining stocks and why they've become attractive to dividend hunters with FNArena analyst Rudi Filapek-Vandyck.

NAB’s Director of Fixed Income, Mark Todd discusses setting-up a self-managed superannuation fund with Sue Wang from Mercer.

In a break with tradition, young people are taking a more active interest in their superannuation with the 30-49 year old group being the most concerned about planning for retirement, according to the latest quarterly MLC Wealth Sentiment Survey.

NAB’s Director of Fixed Income, Mark Todd, chats with Steve Lambert, Executive General Manager of Capital Markets at NAB about the evolution of the Corporate Bond Market, why it's important and how it relates to the individual investor.

NAB’s Director of Fixed Income, Mark Todd, is joined by Sue Wang from Mercer and Zach Zacharia from Centra Wealth to discuss ideas behind researching stocks before looking at developments in Managed Discretionary Accounts.

How to add Australian Debt Securities & Corporate Bonds to a portfolio. We bring you the third of five research reports examining the Australian corporate bond market. In this report we cover the important topic of accessing the fixed income market and the various methods investors can use to access debt securities and corporate bonds.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.