Price growth edges lower despite reasonable economy

Insight

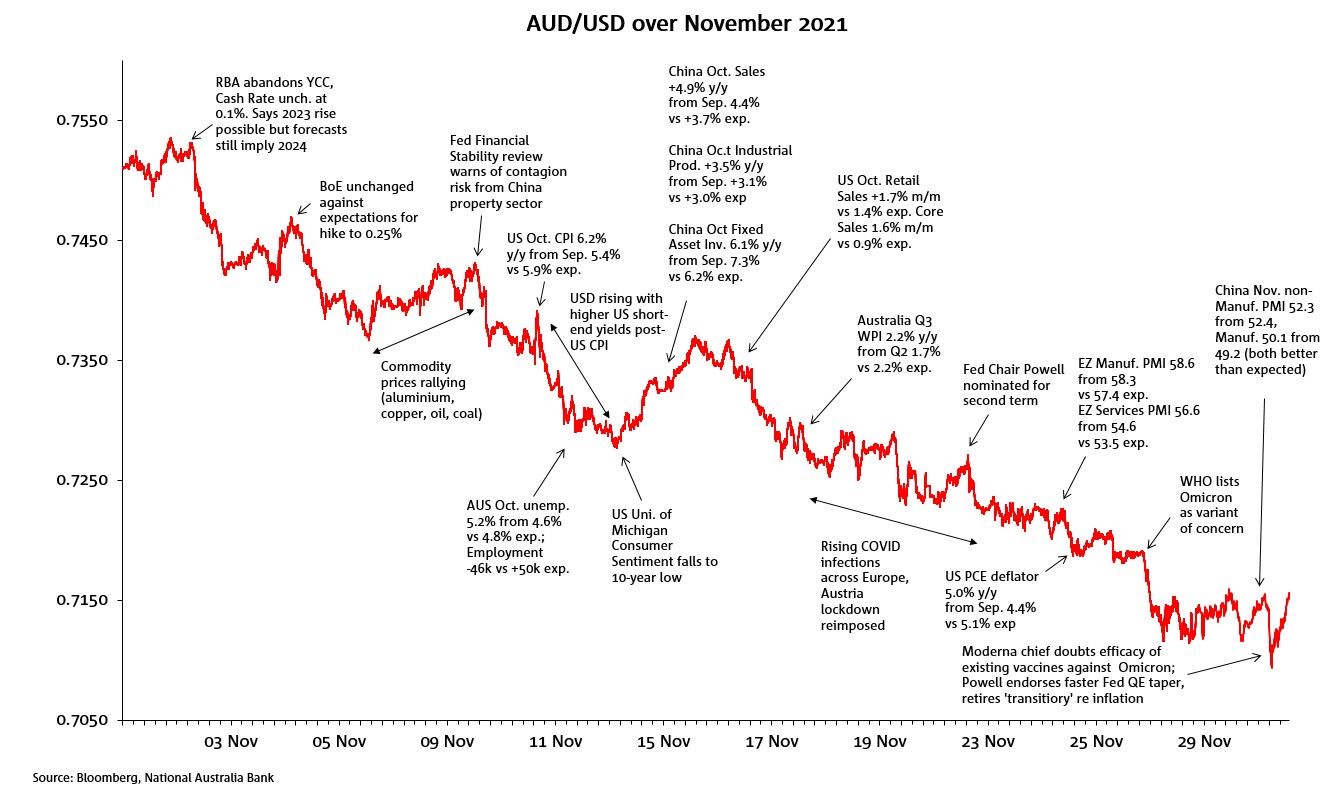

The overwhelming negative influence late in the month was the emergence of the Omicron covid-19 variant and doubts over the efficacy of existing vaccines against this strain and all that might imply for the global economic re-opening process.

November was characterised by almost uninterrupted traffic south for AUD/USD, the pair falling from a high of 0.7550 on November 1 to a new year to date low of 0.7063 on the last day of the month (its lowest since November 4, 2020 in fact). On a monthly close-to-close basis, the 5.2% fall (0.7518 to 0.7127) was comparable to the 5.9% pandemic-induced fall in March 2020.

AUD weakness last month was not just the all too familiar story of USD strength, albeit that was part of it. USD appreciation was driven in large part by the big upside US CPI surprise on November 10 and subsequent commentary from various Fed officials suggesting a speeding up of the QE tapering may be appropriate, in turn creating optionality for the Fed to start raising rates as early as Q2 2022. This view received endorsement from (newly re-nominated) Fed chair Powell on November 30, who also said it was time to retire the ‘transitory’ inflation narrative.

AUD-specific downward pressure on the currency began early in the month, after the RBA formally abandoned its YCC policy focussed on the November 2024 bond. There was no surprise here after the prior week’s failure to buy the bond in the face of a sharp rise in its yield, but the RBA line that while a rise in rates was possible in 2023, its forecast still implied not before 2024, was a catalyst for the AUD to start selling off. Adding to the pressure later in the month was the Q3 Wage Price Index, which though ‘as expected’ at 2.2% yr/yr., was evidently softer than some in the market were positioned for, given evidence of significant wage pressures elsewhere in the world.

Bouts of AUD strength came alongside some (temporary) uplift in various commodity prices during the month (aided by reports China official may ease some restrictions on property developers). Better China data (mid-month activity indicators, then the end-of-month PMIs) also helped. But the overwhelming negative influence late in the month was the emergence of the Omicron covid-19 variant and doubts – articulated by many including the Head of Moderna – over the efficacy of existing vaccines against this strain and all that might imply for the global economic re-opening process.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.