Competition heats up for premium properties

Article

We helped Neuberger Berman set up Australia’s first listed investment trust focused on global fixed income, to turn global bonds into income for Aussie investors.

Australian investors are keen to diversify their holdings – and in need of income-producing investments. Yet many lack exposure to international companies. That may be about to change, thanks in part to the success of global asset manager Neuberger Berman’s big idea and its collaboration with NAB.

When the team at global asset manager Neuberger Berman successfully launched their retail listed investment trust in Australia last year, to the tune of $400 million, they realised their grand ambition of breaking into what was essentially a new market for them.

Their big idea, however, went much further than this. Neuberger Berman recognised the very real need for investment income among Australians – particularly retirees and those approaching retirement.

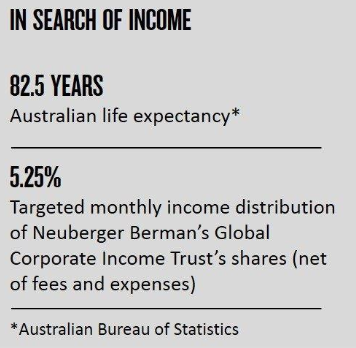

With life expectancy at an all-time high of 82.5 years, Australians are beginning to understand that they need to guard against longevity risk. That requires taking on an appropriate level of increased financial risk so they can get the necessary returns to make their retirement funds last the distance.

Jason Henchman, a Managing Director for Neuberger Berman Australia, says: “Through the last few years there’s been a real demand for income and what we were aiming to provide was access to a globally diversified source of income, particularly for retirees.”

The trust targets an annual income distribution of 5.25 per cent1 – net of fees and expenses, paid monthly – a strong income return in a low interest rate environment.

Neuberger Berman also recognised the need for asset-class diversification among Australian investors. The trust provides an unprecedented opportunity for investors to gain easy access to the bonds of large global companies not previously available in listed form on the ASX to Australian investors.

Despite this, the initial public offering (IPO) was always going to have to overcome some challenges to achieve its desired outcome.

While Neuberger Berman wasn’t new to the Australian market, it was almost unknown to self-managed super funds (SMSFs) and high net worth investors prior to launching the trust. “Neuberger Berman sounds like a German law firm; it gets pronounced in all sorts of different ways. Brand awareness was clearly a big challenge,” Henchman explains.

There was also the fact that the NB Global Corporate Income Trust2 represented the first listed investment trust with an offshore manager delivering income by investing in a global underlying asset class. While Australian investors understand the need for diversification in their portfolios, they still tend to favour home-grown companies that they’re highly familiar with. “Like many developed markets around the world, Australian retail investors tend to be domestically biased,” Henchman says.

Even more challenging, however, was the credit rating of the underlying assets, which were sub-investment grade bonds. As joint arranger and lead manager, NAB was keenly aware of the education required here.

“We needed to ensure investors clearly understood the risk/return attributes of US-dollar sub-investment grade bonds,” NAB General Manager Investor Sales, John Bennett says. “But it was exciting to take clients on a new journey.”

Realising a big vision

Realising a big visionCertainly, none of the issues proved insurmountable. And given Neuberger Berman was determined to establish a retail presence in Australia, they were challenges the firm was up for.

“In the UK we were able to build a managed fund business off the back of doing a couple of listed funds, so we were very much looking to do the same in Australia,” Henchman says.

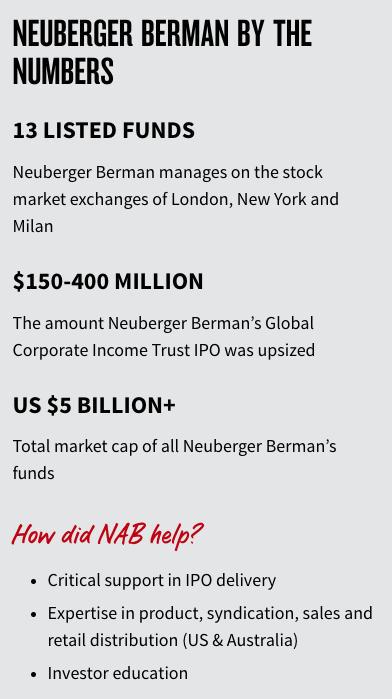

The structuring of the IPO was critical, as was its delivery. That’s where NAB’s various teams of experts – both in the US and Australia – came in, collaborating with each other on the product, syndicate, FIG and sales side to help bring the deal successfully to market.

NAB’s Hybrid & Structured Capital Origination team advised Neuberger Berman on the deal’s structure, timing and the best parties to be involved. They spent countless hours discussing which was the most appropriate strategy for coming to market. Stefan Visser, a Director in NAB’s team, notes that “it was not about ‘what’s the highest yielding opportunity to invest in?’ but more importantly ‘what’s actually most suited to the Australian market when considering current alternatives?’.”

It was then a matter of helping Neuberger Berman with the messaging of that, Visser says, and getting the educational collateral in a format that most Australian investors could relate to.

Educating retail investors about the finer details of the deal was a must. “It wasn’t simply about raising the capital,” Bennett says, “it was about educating investors, giving them context about the market generally and how this investment forms part of a well-constructed investment portfolio.”

First and foremost, investors had to get comfortable with Neuberger Berman – its long history in asset management (it’s been around for 80 years) and its extensive experience in listed trusts (the firm manages 13 listed funds on the stock exchanges of London, New York and Milan with a total market cap across all funds of more than US$5 billion).

But it was also important for people to understand how large and liquid the high-yield market truly is and the inherent quality of many of the companies issuing bonds in that market. The trust was to invest in 250-350 companies across numerous countries and industries – a big plus for a set of investors who tend to be overweight in property and the top ASX 200 shares. And while they were high yield, all were of a certain size and all were denominated by US dollars, euros or sterling.

NAB Director, Financial Institutions Group (FIG) Matthew Johnson explains: “The deep part of the educational piece was having the investors understand and connect emotionally with the companies issuing debt. The US dollar high-yield bonds that form the portfolio are actually household names that produce products investors can actually understand.”

One deal, thousands of investors

One deal, thousands of investorsOf course, in order to convince investors, Neuberger Berman had to approach as many of them as possible – a challenge, given the granularity of the retail market. NAB’s distribution capabilities, however, meant that a huge swathe of Australia’s SMSFs and high net worth individuals came into contact with the deal, either directly or through available channels, including online and intermediaries.

At the end of the day, they were evidently convinced. The IP0 began at $150 million but was upsized to $400 million by the end. As Henchman notes: “What we raised is testament to the fact that we did a good job of identifying and overcoming the challenges.”

Neuberger Berman is now well placed to bring more retail-based investment strategies to the market, offering further diversity for Australian investors.

“One thing to note about the trust is that it’s done what we said it would do,” Henchman says. “It’s consistently traded at a premium since we listed, which would suggest that there is ongoing demand, and paid a consistent and stable income stream.

“We’ve validated that demand by continually engaging with both existing investors and those who may not have participated in the IPO and subsequently launching an Entitlement and Shortfall Offer for NBI in May 2019. We believe the Entitlement Offer also allows NBI an opportunity to further increase its market liquidity by way of an expanded investor base.”

NAB General Manager and Global Head of FIG Patrick Ryan, who’s based in New York, is confident there’ll be future activity from other global fund managers given the success of this deal. Indeed, it’s one of the reasons why NAB has been growing its footprint offshore – to support the continued and increasing interest of global fund managers in the Australian market, both in terms of investment and sourcing capital.

He cautions, however: “As much as we’re incredibly proud to have been involved in this transaction with longstanding client Neuberger Berman, and want to continue to diversify investors’ income streams and portfolios generally, typically we’ll be partnering up with large issuer clients where we feel the asset class is appropriate for the market.”

Nevertheless, he says there will be more to come. “It’ll be beneficial to both the investors and issuers. We look forward to working with more of the world’s best fund managers to bring access to new and interesting asset classes, including US credit.”

Speak with a specialist

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.