December 8, 2025

Capital Markets

January 7, 2026

Quality year sets stage for robust 2026

By James Arnold

After a year of consolidation amid significant progress in areas of execution, regulatory development and global alignment, 2026 sees a solid AUD Financial Institution (FI) market primed for performance and issuance opportunity.

In a world where success is generally measured by an annual compounded rate of growth, a first glance at the AUD Financial Institution (FI) market numbers for 2025 could potentially disappoint.

But looking at volumes alone and focusing on quantity over quality simply doesn’t tell the full story of this strong market and the further issuance opportunities ahead.

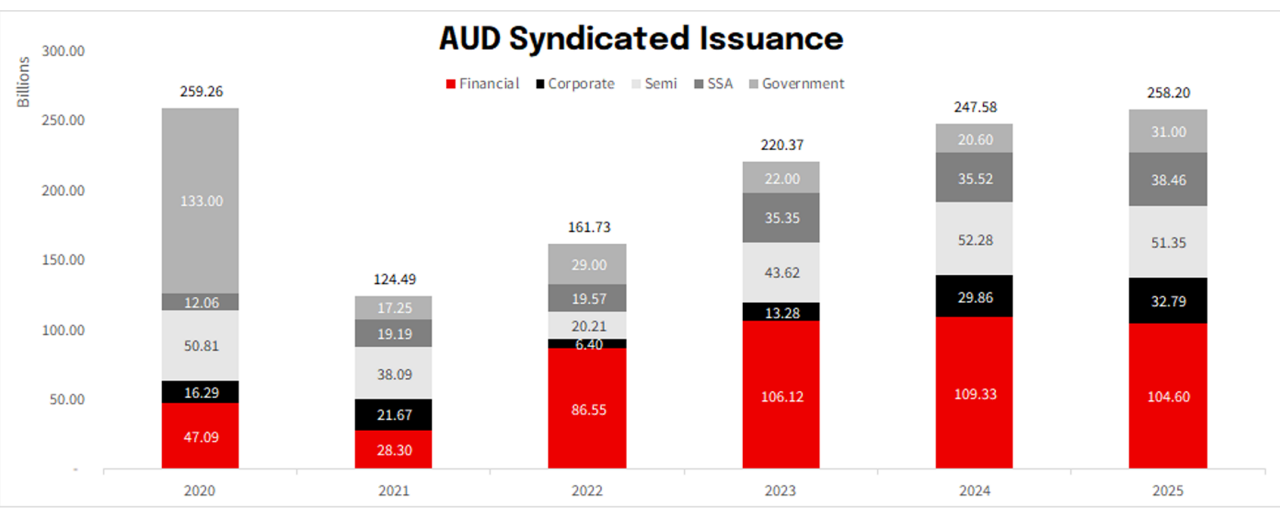

Source: IGM, December 2025

The past year has been one of consolidation, with total issuance contracting some 4.3% to A$105 billion (IGM data, see graph above). Reduced refinancing needs, when compared with the previous two calendar years, certainly impacted volumes, along with the imposed pause in April associated with “liberation day” in the US and related global volatility.

Moving into 2026, however, we expect to see the pace of the refinance across the market increase and provide the base for what should be another benchmark year in the AMTN (Australian Medium-Term Note) FI market.

Source: IGM, Bloomberg, December 2025

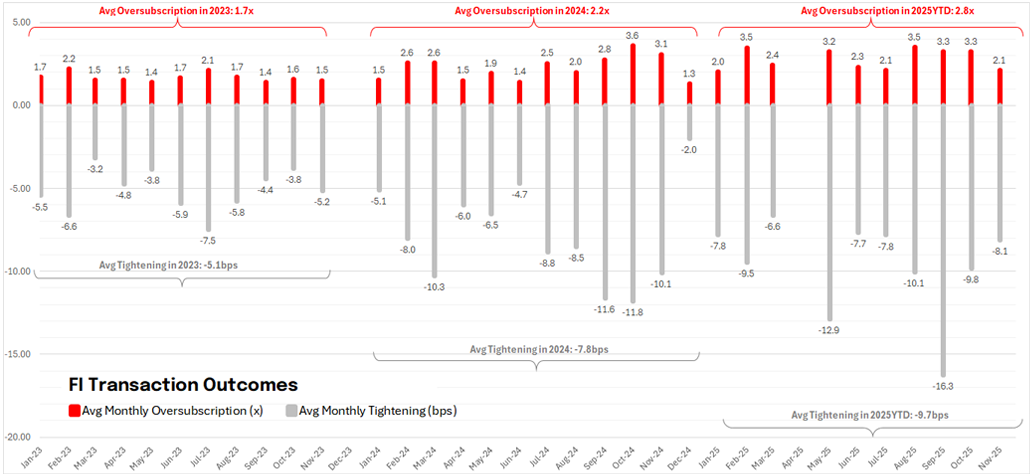

Notable developments and progress seen over the year include: (i) pricing at, or approaching, historical tights; (ii) the development and consolidation of the long end of the credit curve and; (iii) a continued buildout of the global investor base for AUD (seen in the geographic distribution across the majority of transactions).

As such, 2025 should, in fact, be remembered as a highly productive and successful year in FI capital markets.

Source: IGM, December 2025

Competitive pricing dynamics to continue

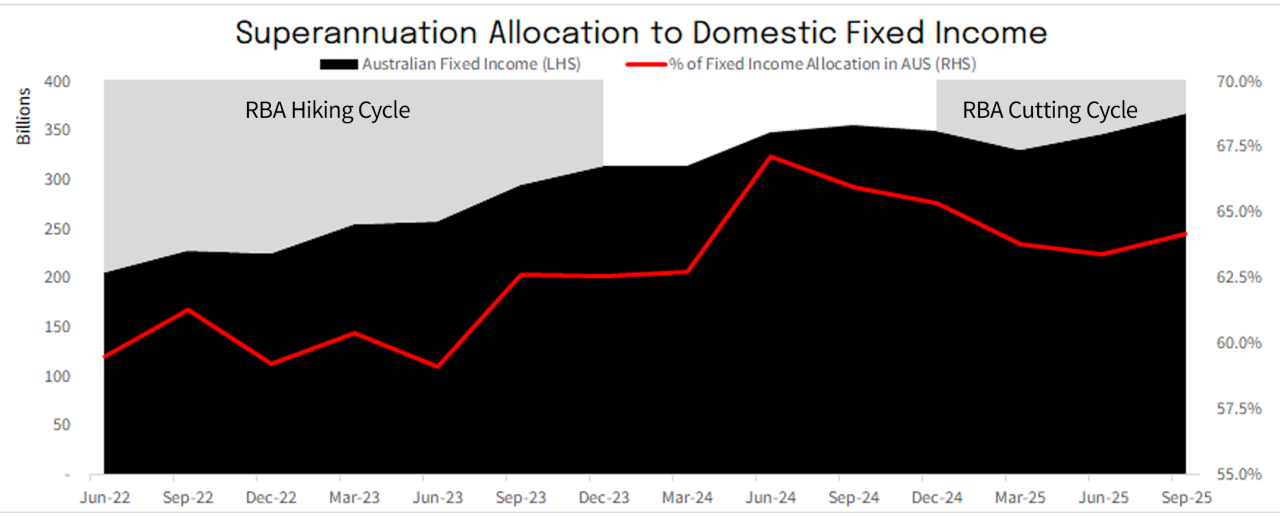

Closing off the year, credit spreads across all asset classes were at multi-year tights. And given the earlier period of tariff-related volatility, this trend in spread performance remains very encouraging. We largely attribute the move in spreads to the continued inflows of liquidity in the Australian superannuation sector, the liquidity of AUD in Asia and, more recently, the outperformance of credit in substitute markets such as the US 144A market.

Source: APRA, December 9, 2025

Traditionally, when we see offshore markets providing major bank senior funding at levels that are effectively flat to the domestic curve, we see the issuers shift to issue in the alternate currency. This reduces the potential supply domestically and further skews the supply/demand imbalance pushing domestic spreads tighter in both secondary and primary markets.

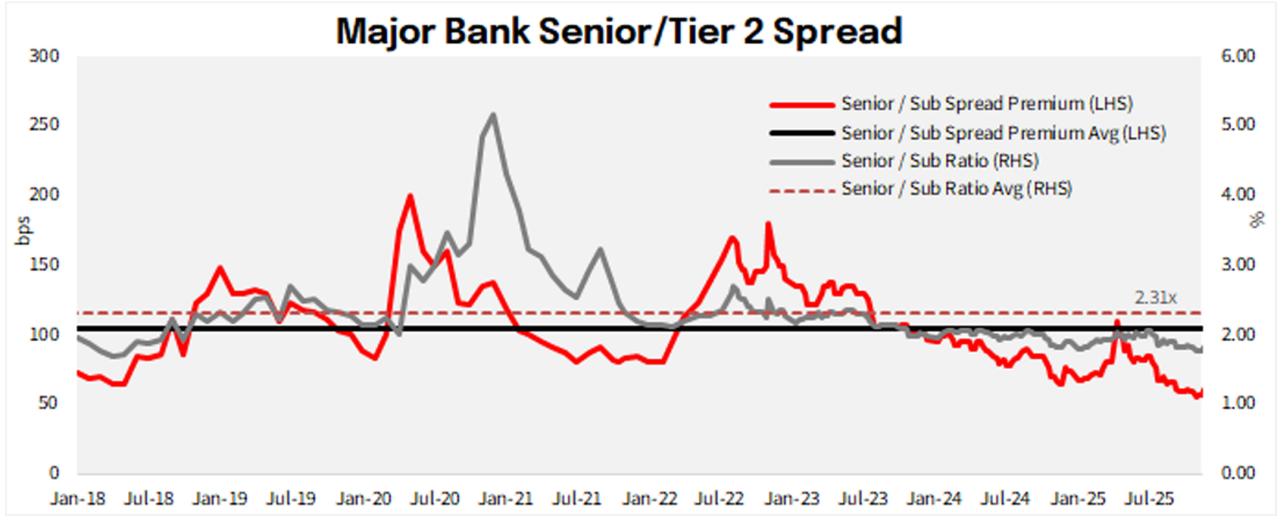

Potentially more significant, though, is the relative outperformance of T2 (Tier 2) compared to senior unsecured. In a market where the private bank and wealth aggregator investor base in Australia is actively seeking higher-yield product in the absence of AT1 (Additional Tier 1), the primary and secondary bid for this product feels insatiable. The timing of this is fortuitous, as it coincides with the buildout of the T2 stack in place of AT1 to meet the new APRA regulations.

Source: NAB Syndicate internal data, December 2025

If we overlay the spread outperformance of T2 with the competitiveness of the USD and EUR markets for shorter dated senior product, there is a scenario where we see a bifurcation of issuance, with AUD becoming a natural market for issuers to source T2 or longer-dated senior, and the offshore markets being relied on more heavily for shorter-dated senior issuance.

Execution evolution adding to transparency

The past year has also seen a continuation and refinement of the execution process in the AMTN market. Increasingly, this points to a further maturity within the market and an alignment to the more traditional USD and EUR markets.

Execution has evolved from its conservative roots, anchored by tight initial price talk (IPT) and anchor orders, to more dynamic strategies that prioritise price transparency and volume flexibility.

With deeper liquidity pools, issuers are open to initiating IPTs 10 to 15 basis points (bps) behind fair value, allowing for real-time adjustments over the course of execution. This is trending towards practices in USD and EUR markets and fosters true market-clearing outcomes.

Source: IGM, December 2025

While this approach notionally places more execution risk on issuers, it offers greater flexibility in final pricing, allocation and volume. Issuers and investors generally accept a 10 to 15 bps progression but remain cautious about adopting the more aggressive 20 to 25 bps seen in USD markets.

Regulatory development

APRA is rapidly reshaping the regulatory framework, with the phase-out of AT1 progressing quickly as liquidity shifts towards other high-yield products. The Council of Financial Regulators paper, which introduced a series of possible changes, remains dynamic, and updates to covered bond legislation are expected through 2026.

There is a strong possibility that revisions to HQLA (High-Quality Liquid Assets) requirements will be incorporated into the APS 210 standard review, scheduled for the first half of 2026.

Meanwhile, fast-moving changes in the Reserve Bank of New Zealand policies regarding bank capital are expected to have a moderate effect on major bank T2 issuance and may be even more significant for the development and status of New Zealand's capital markets in the future.

New year outlook

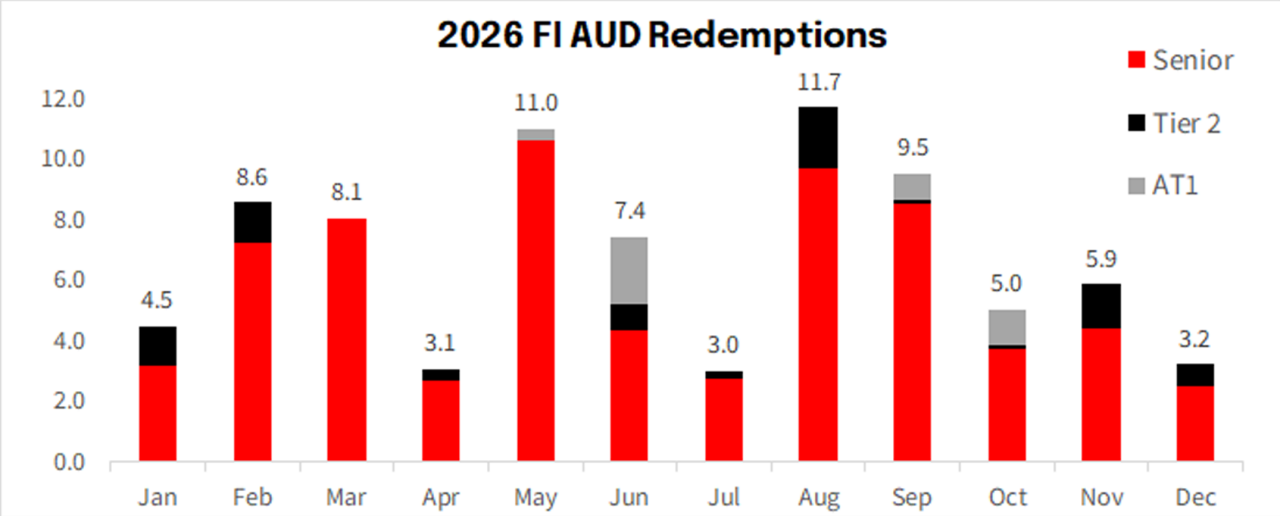

With higher rates and a holiday pause in issuance, early Q1 should see favourable market conditions as issuers turn their attention to accessing capital markets. The late Lunar New Year allows issuers more time to access the market before the all-important Asia bid takes a pause for the second last week in February.

As usual we expect SSA (Sovereign, Supranational and Agency) issuers to lead the reopening in January. Supply from the Australian major banks is likely to be contingent on the persistence of the onshore-offshore spread differential discussed above.

In summary, when we look beyond the volumes for 2025, the AMTN market did in fact make notable progress, both in execution and regulatory adaptation. Shifts towards greater price transparency, flexibility, and improved issuer-investor alignment are bringing the market closer to the global standards seen in USD and EUR markets.

Overall, higher rates, a strategic issuance break, and a well-timed start to Q1 are setting the stage for robust issuance opportunities in 2026.

James Arnold is NAB Executive Director FI Origination, Capital Markets Origination

Corporate and Institutional