NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

Author

The Corporate and Institutional Banking team is wholly focused on delivering the best client relationships: understanding and supporting clients over the long term, providing consistent execution and proactive relevant advice.

NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

Join us as we discuss interest rates, general economic conditions, and the NAB AUD/USD forecast

Webinar

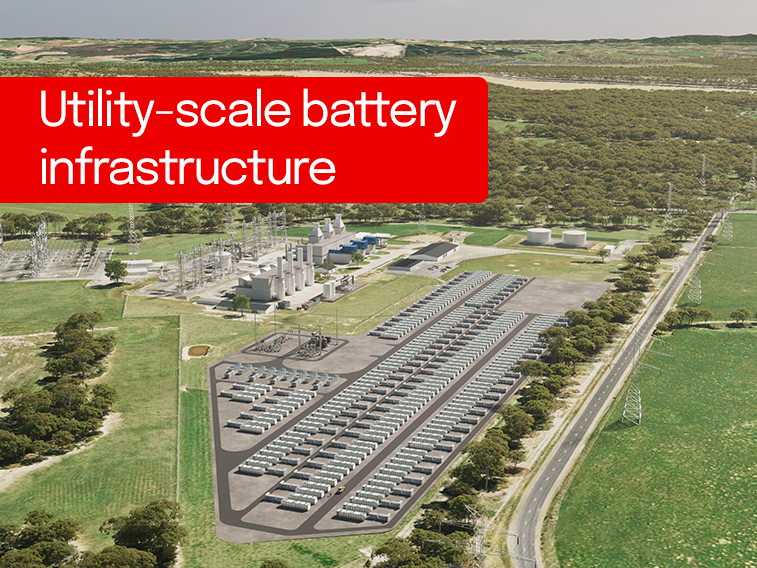

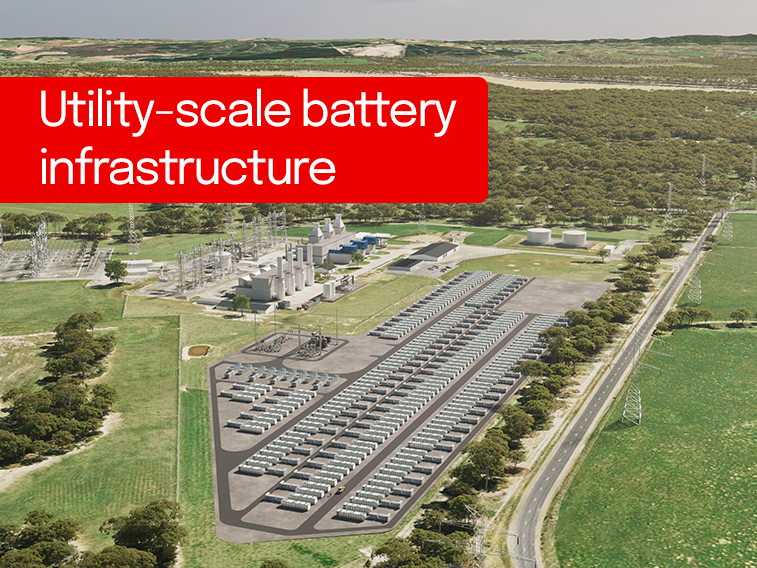

Providing a secure, renewable energy supply is critical for the energy transition, with utility-scale battery infrastructure supported by NAB playing an important role.

Australian carbon project developers see a maturing of institutional financing as key to scaling the market and taking it on a similar trajectory as renewable energy.

Rising artificial intelligence could see as much as half the work being done today automated within 20 years and organisations need to know how to get ready, an AI expert tells NAB’s Transaction Banking customer event series.

Article

Creating cost-effective choices for consumers while forging business success is nothing new for Chemist Warehouse co-founder Jack Gance. As special guest at a recent NAB Transaction Banking event series, he looks at a new way to pay for businesses and customers.

Article

Join us as NAB Markets break down the week of Trump tariff market volatility.

Webinar

Join us as we discuss the impact of Trump's tariff policy on the Australian Dollar.

Webinar

NAB specialists and clients from across the bank’s Fund Sponsors, Strategic Investors and Alternative Assets (FSA) business gathered over lunch recently to share career stories and advice on promoting greater diversity and inclusion.

Hybrid issuance is becoming an ever more relevant funding instrument and capital management tool for corporate issuers today, attracting strong investor demand, write Tabitha Chang and Stefan Visser from the NAB Capital Markets Origination team.

NAB Markets discuss the outlook for the Aussie Dollar in a Trump 2.0 World

Webinar

The NAB FX Small Business team discuss how Trump's second term as U.S. President could influence the AUD.

Webinar

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.