We've captured the standout insights from the event series in an investor-ready eBook.

Report

Options, also know as derivatives, can be used to protect value within your share portfolio. Learn how to use them

When markets are driven by fear or euphoria the result can be dramatic swings in share prices. In turn, this can lead investors to make decisions based on emotions, rather than reasoned appraisal.

During a downward swing, one way to reduce its impact is to use options as a hedge to protect existing positions.

Options are a form of financial security that can be used for multiple purposes including:

The two types of options commonly used are:

The owner of an option decides if they wish to exercise the option by comparing the share price with the strike price. An investor pays a premium to purchase an option.

More complex combinations of put and call options (different strike prices and expiry dates) can be used to deliver different financial outcomes.

The key risk faced by an equity investor is that the share price goes down. One way to protect against a falling price is by purchasing a put option. As mentioned, a put option gives the owner the ability to sell an asset at a fixed price at the expiry date. If share prices go down, the value of the option goes up because it provides the holder to sell the share at a price which is higher than the market value of the share. The put option allows the owner to hedge their losses on the underlying asset.

Example: Using a put option to protect against losses in Wesfarmers (WES.ASX)

The following example uses a put option to demonstrate how gains in Wesfarmers (WES) can be protected against losses.

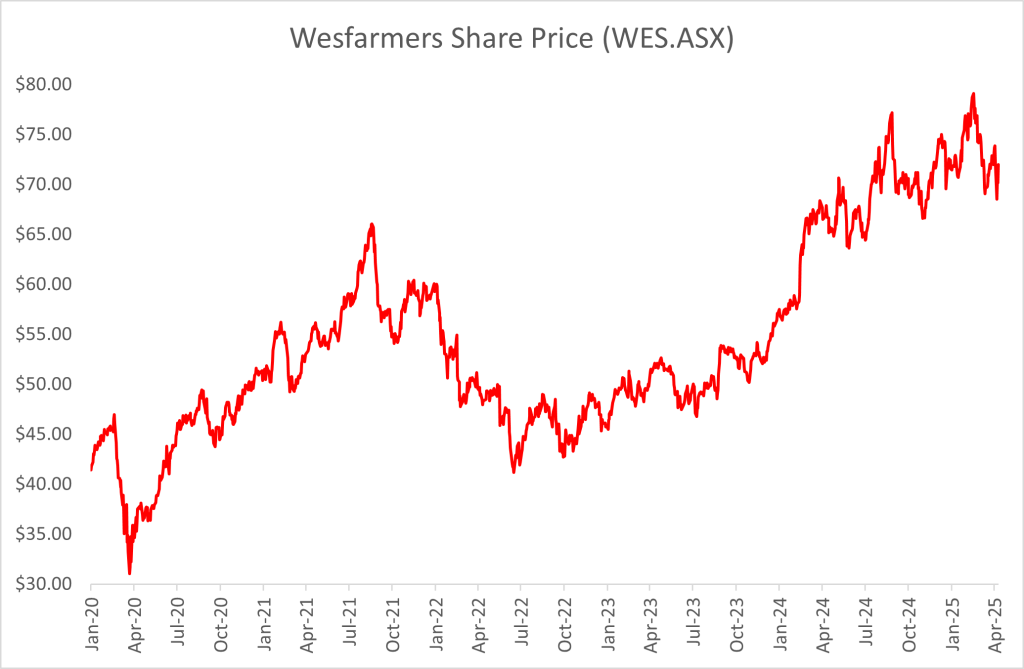

Source: Bloomberg

Wesfarmers has been a strong performer over the past five years, up 73% (excluding dividends) compared to its price in January 2020. However, in recent weeks its share price has been volatile, reflecting broader market concerns on the impact of tariffs on global growth.

In response, a shareholder could take various actions depending on their preferences, risk tolerance, tax position and timeframe. For example, a shareholder could:

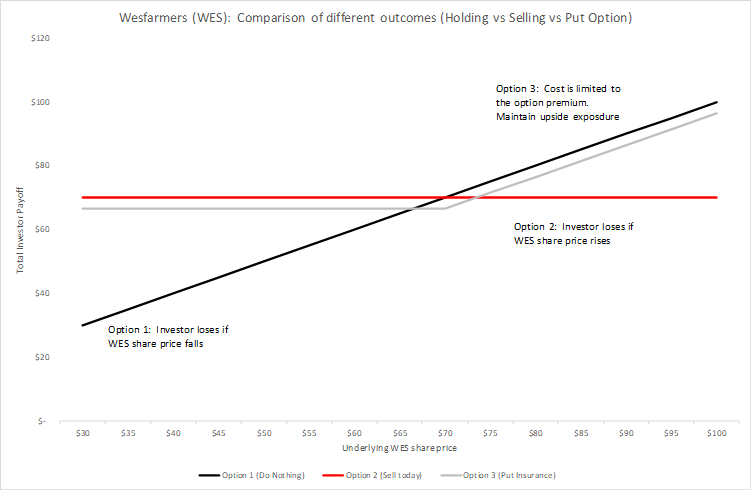

An illustrative range of outcomes for Option 3 are shown in the chart below. This assumes a share price of $70 at the time the 3-month put option is purchased with a strike price of $70. The option premium is calculated to be approximately 5% of the initial share price or $3.50.

Note: option prices will vary depending on the parameters including strike price, stock volatility, interest rates, time to expiry and dividends and are calculated via a derivative pricing model.

As the chart shows, the downside is limited to the option premium: in this example $3.50. If the underlying share price falls to $40 at the time of option expiry, the value of the put option increases to $30, leaving a total value of $66.50 ($40 + $30 – $3.50). On the other hand, if the share price rises to $100 at expiry, the overall value to the shareholder is $96.50 ($100 – $3.50). In this case, the put option is not used and expires worthless.

With Option 2, the investor will receive the proceeds of the sale but may miss any subsequent gains on a rebound.

With Option 1, the value of the holding will simply follow the Wesfarmers share price.

The following chart summarises the outcomes of the three strategies.

In this chart, Option 2 is only marginally better than Option 3 if the share price falls (but this excludes any re-investment risk). Option 1 is slightly better than Option 3 if share prices increase, but significantly worse if share prices decline. Option 3 protects against a downside and provides the best risk-adjusted outcome.

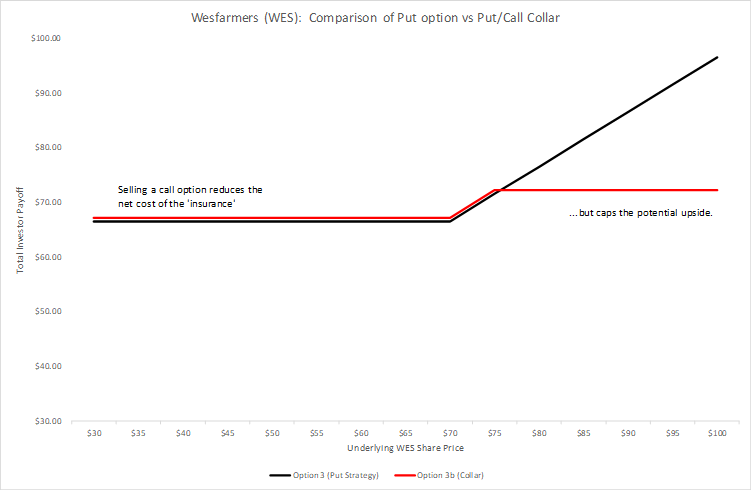

Put and call options can be combined to deliver different financial outcomes. Depending on the underlying volatility of a stock and the time to expiry, put options can be expensive. One way to reduce the cost is by buying a put option and selling a call option. This is called a collar option strategy.

Depending on the strike prices selected, the premium received for selling the call option may assist in offsetting the cost of buying the premium option. A potential issue with this strategy is that the upside is capped. This means that if the underlying price exceeds the strike price of the call option, then further upside will be capped. However, if the investor holds higher risk names with heightened downside risk (i.e., due to potential ongoing volatility) then this strategy may be appealing to some investors.

The following chart shows the payoff diagram for this strategy, using a strike price of $75 for the call option (and assuming a premium income of 1% for selling the call option).

This chart illustrates that using a collar strategy can reduce the net cost of managing downside events but limits the upside when the underlying price exceeds the exercise price. However, for this happen, the owner of a call option would need to exercise their option at a higher underlying share price, capping the upside. This strategy may be appropriate for a bearish investor.

Even more sophisticated combinations of options can be constructed to deliver different investor outcomes.

Put options can be used to protect equity portfolios against financial loss during periods of heightened market volatility, whilst capturing exposure to positive share price gains. Whereas more sophisticated approaches can reduce the cost of the protection but limit upside gains. Options can be implemented at the individual stock level, or across major equity benchmarks.

To discover more call 1300 683 106 or email us on investordesk@nab.com.au

Charts are for illustration only and do not represent actual outcomes. The information contained in this article is believed to be reliable as at April 2025 and is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article.

©2025 NAB Private Wealth is a division of National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. NAB does not guarantee the accuracy or reliability of any information in this article which is stated or provided by a third party. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article. You may be exposed to investment risk, including loss of income and principal invested.

You should consider the relevant Product Disclosure Statement (PDS), Information Memorandum (IM) or other disclosure document and Financial Services Guide (available on request) before deciding whether to acquire, or to continue to hold, any of our products.

All information in this article is intended to be accessed by the following persons ‘Wholesale Clients’ as defined by the Corporations Act. This article should not be construed as a recommendation to acquire or dispose of any investments.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.