We hear from NAB Group Chief Economist, as she shares her latest economic update. Watch now.

Consumers may be looking after the pennies but there’s still room for the good things in life, while business confidence enjoys a bump.

It’s a topic dominating backyard barbecues and front-page headlines alike: the cost of living.

So this month, to bring you five key insights on this hot topic, we’ve combined data and analysis from our economics team with our quarterly NAB Consumer Sentiment Survey, which draws on responses from 2,000 Australians.

What we found is that consumers are feeling the pinch of inflation, and of job security concerns – and they’re taking control of the way they spend and save. But while households are budgeting differently, it’s not all bad news: in fact, I’m pleased to report that business confidence is up.

Price-conscious consumers are making adjustments to their finances and their lifestyles. But, there’s still room in the budget to entertain, to care for yourself and your loved ones, and for the occasional treat. I’ve been hearing heartwarming and encouraging stories of business owners, just like households, who are assessing their situations and taking control. And while shoppers may substitute some expenditures for a more value-conscious option or plan indulgences more carefully, among this cautiousness Australian businesses are still finding opportunities to grow.

Consumers are adjusting their spending behaviour, with many saving an additional $320 a month by choosing cheaper options or cutting back on expenditures in just a few areas. Eight in 10 consumers identify price as the most important factor in purchases, while 4 in 10 are adding to their savings accounts, and 1 in 5 putting more towards debt or mortgages. Discounting businesses are viewed most favourably by shoppers.

While all consumers are conscious of price, there are some important differences in how different demographics are accessing information and determining value. Over-65s, who have made relatively few adjustments to spending, value service and reputation the most. Gen Zs, who have made the most changes to their spending, are relying more on influencers for product discovery.

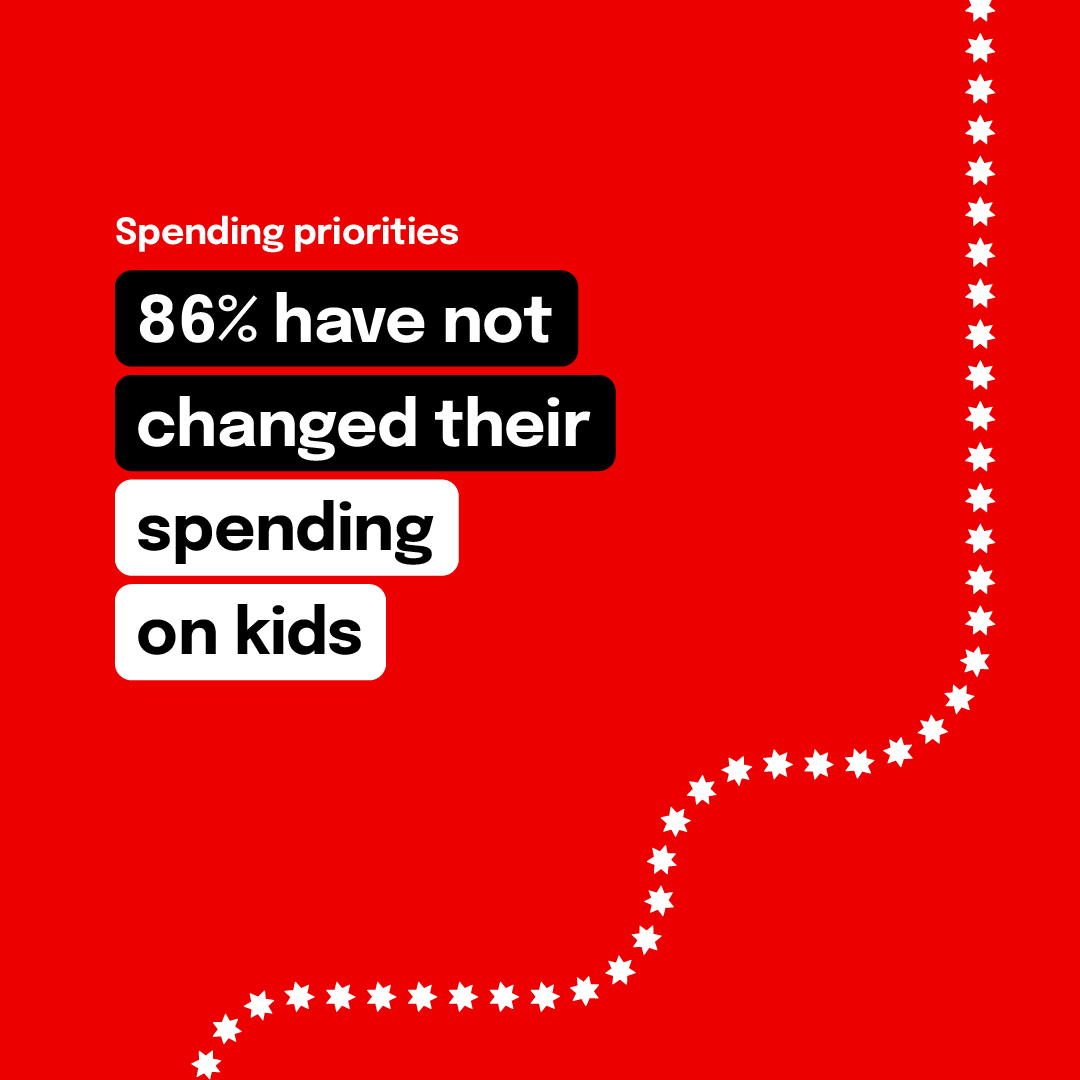

Almost 6 in 10 households (57%) have reduced their spending on restaurants, but taking care of loved ones is still a priority: just 23% have reduced spending on pets, and only 14% on children’s activities. Health and wellbeing expenditures are also sticky, with just 23% reducing spending on private insurance, and 23% on gyms and sport clubs.

The cash rate is likely to remain stable at 4.35% out to May 2025, according to a recent NAB Economics outlook. Looking ahead, the NAB Economics team forecasts a drop to 3.6% by December 2025, falling still further in 2026.

Business confidence has bumped up six points into positive territory, driven by a broad-base increase across industries. NAB’s monthly survey is now at +4, the highest since early 2023, despite a decline in business conditions. Capacity utilisation has also climbed to 83.5%, well above average.

Recently, the team behind family-owned menswear store Peter Jackson was gracious enough to show me behind the scenes of their operation. The company began its journey with a single store in 1948, opened by the two Jackson brothers. In the decades since, it’s grown to 77 locations across Australia, with further expansion via new stores planned in the near future.

Despite some challenging business conditions, the firm’s expansion plans demonstrate to me the resilience and strength of Peter Jackson, and of Australian business owners in general. Targeted investments are helping Peter Jackson push into new high-growth markets, while long-term stability is proving that existing outlets have the resilience to continue to trade well now and into the future.

In a period of significant global geopolitical uncertainty, I’ve been impressed and heartened by the resilience and the agility of the Australian character, demonstrated by consumers and by businesses. While we’re all having to be more conscious of how we manage our money, this data is showing that Australians are keeping their chins up, getting on with the job and looking out for opportunities to live well or to expand their businesses.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.