SME business conditions fell in Q2

Insight

A new year looks set to bring improvements that should help Australia’s SMEs leave current challenges in the rear-view mirror.

My message for business owners reading this latest NAB Business Pulse is hold tight, there’s good news around the corner.

And that good news is a sooner-than-predicted first cash rate cut, with NAB Group Economics now expecting the Reserve Bank to start lowering rates in February 2025 – a full quarter earlier than expected.

Another positive sign is a forecast uptick in GDP growth. While it’s been fairly flat this year, at 1.0%, we can expect the pace to pick up imminently, with projected growth of 2.2% in 2025 and 2.3% in 2026.

Together, it bodes well for SMEs that, according to NAB’s latest quarterly survey of Australian SMEs, have been bunkering down while waiting for better business conditions to arrive.

Amid these inclement conditions, cash flow, at 38%, is the top concern. Consumers are still active, and there are opportunities out there, but businesses across the country are telling us about the challenges that inflation, input costs and profitability are presenting. Profitability has become more problematic (36%), with the number of SMEs citing this as a key risk climbing for the second straight quarter.

Thankfully, concerns over the labour market are easing, down to 28% from 35% in Q1. This will be a relief to those businesses – and that would be almost all of them – that have struggled with staffing over the past few years.

While Australian SMEs wait for these more positive times to arrive, now is the ideal moment to take control of what you can, focus on managing costs where possible and prepare for what the figures below tell us will be a stronger pace of growth in the year ahead.

|

NAB Group Economics has moved its projection for the first rate cut up a full quarter, from May to February 2025. From there, we continue to see a steady profile of one cut per quarter back to 3.10% in early 2026. |

| Cash flow has overtaken labour shortages to become the No.1 concern of Australian businesses, edging upwards to 38% in Q3 from 34% in Q1. While demand for some goods and services is running hot, businesses need to be proactive in balancing input costs and pricing strategies. |  |

|

Concerns over finding, attracting and retaining staff are easing, dropping from 35% in Q1 to 28% in Q3. NAB Group Economics is projecting the unemployment rate to reach 4.5% by end-2024, and remain there through 2025, although, importantly, employment growth is expected to remain positive. However, some industries and regions are still feeling acute pressures with TAS (44%), SA (43%) and QLD (39%) above the national average. |

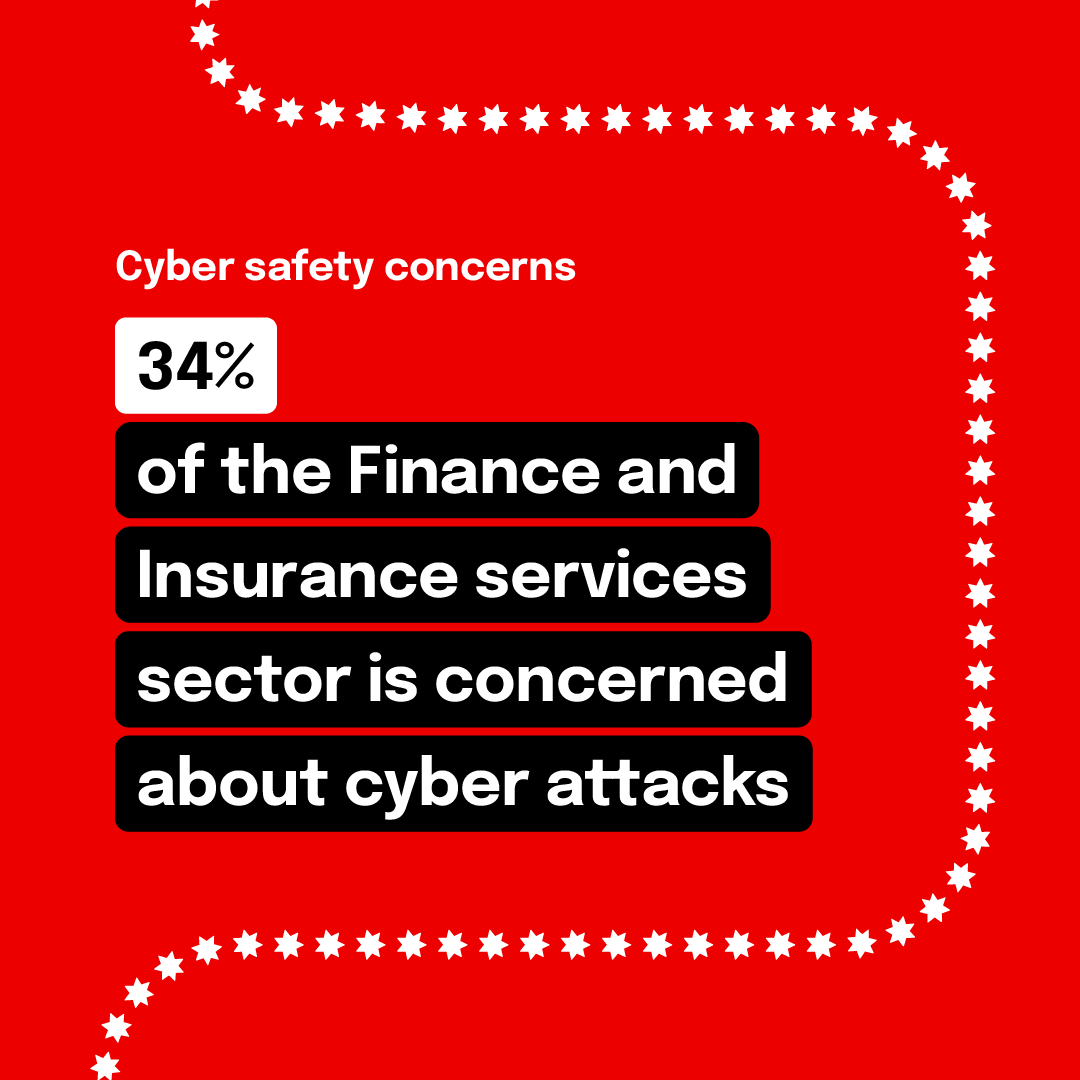

| Cyber attacks continue to be a concern for 34% of those in the Finance and Insurance services sector. While the threat of scams and attacks is ever-present, efforts by businesses, banks and other stakeholders can help reduce their impact. A recent ACCC report showed scam losses reported to Scamwatch between January and March this year were down by 11% compared to the previous quarter. Visit nab.com.au/security for the latest tips. |

|

|

Inflation and the cost of doing business is a top priority at the moment for Accommodation & Hospitality businesses (60%), as well as those in Health Services (45%). The cost of doing business is always a challenge, but the divergence reported by SMEs active in different regions and industries demonstrates the complexity in Australia’s economy and current business conditions. |

Whenever I’m asked about how Australian businesses can make profitability part of their core business strategy, I point to V Resource, led by Vincent Huang.

Based in Meadowbrook, just south of Brisbane, V Resource recycles used industrial and consumer lead-acid batteries to produce lead and plastic for the domestic and export markets. It’s the only company of its kind in Queensland, and one of just a handful across the country.

The company maintains high environmental and safety standards with an almost-entirely automated process and plant. Controlling costs is also built into its everyday way of doing business. Efficiency is the watchword, with a focus minimising wastage of every input and maximising productivity of human talent and operational assets. Employee turnover is low, with the tenure of core office staff averaging over a decade.

Both operational and business strategy were designed with efficiency and profitability in mind from day one, and are coupled with a focus on responding quickly and effectively to changing business conditions and customer requirements; for example, through upgrades to invoicing and payment processing systems and improved visibility of product inventory.

V Resource is a great example of how setting up for success while looking to the future can leave you well placed to profit in even the most challenging business conditions.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.