May 6, 2025

Stagflation: Why is it so bad?

Stagflation is a term that has been increasingly discussed in the business media as a risk for the US economy and the global economy more broadly. So - what is stagflation, and why is it so bad?

By Derek Bilney - Investment Insight

Stagflation, a blend of “stagnation” and “inflation,” describes an economy with low or negative growth, rising prices, and, in many cases, high unemployment. Stagflation contradicts the typical expectation that strong growth fuels inflation or that weak growth curbs it, making it a perplexing challenge for policymakers.

Stagflation is rare but impactful. The most notable instance occurred in the 1970s, triggered by the 1973 oil crisis, which disrupted global supply chains, spiked prices, and slowed growth. Some economists have identified potential stagflation-like conditions present in Australia in recent years. For example, inflation exceeding the Reserve Bank of Australia’s 2–3% target (peaking at 7.8% in 2022) and negative per-capita GDP growth for seven consecutive quarters, (from March 2023 to September 2024) marking the longest period of consecutive declines in per-capita GDP since records began.

However, low unemployment (currently around 3.5–4%) is missing in the stagflation equation, just as high interest rates were the missing element in the 1990-91 recession. Post-COVID-19, stagflation concerns resurfaced as supply chain bottlenecks and labour shortages drove inflation, while growth lagged in some sectors. Though less severe than the 1970s, these conditions echoed earlier supply-driven pressures, underscoring stagflation’s relevance today.

The Policy Dilemma

In a typical economic cycle, strong growth spurs demand, pushing prices higher. Central banks respond by raising interest rates to cool demand, slowing growth and inflation. Once inflation stabilises, rate cuts encourage growth and employment, restarting the cycle.

Stagflation disrupts this pattern. With weak growth and high inflation coexisting, central banks face a dilemma: raising rates to tame inflation risks further stunting growth, while cutting rates could worsen price pressures. Fiscal stimulus, intended to boost growth, may also fuel inflation. The Phillips Curve, which expects an inverse relationship between inflation and unemployment, fails to explain stagflation, as both inflation and unemployment can rise simultaneously due to supply shocks. In the 1970s, the U.S. Federal Reserve prioritised inflation control, but balancing growth and price stability required nuanced strategies, a challenge echoed in recent debates.

Causes of Stagflation

Supply shocks are the primary drivers of stagflation. Sharp increases in oil prices, as seen in 1973, or resource shortages raise production costs, reduce output, and dampen demand. Tariffs act as supply shocks by increasing costs for consumers and disrupting trade, with reciprocal tariffs further harming exports and growth. The 1973 oil embargo, for instance, quadrupled oil prices, which contributed to the destabilisation of global economies.

Demand-side factors may also amplify stagflation. Wage-price spirals, where workers demand higher wages to offset rising costs, and excessive monetary stimulus can sustain inflationary pressures. Post-COVID-19, loose monetary policies in 2020–21, combined with supply chain disruptions contributed to inflation spikes, illustrating the interplay between wage-price spirals and excessive monetary stimulus.

.Stagflation’s persistence stems from the lack of straightforward solutions, making it typically harder to resolve than typical recessions.

Potential Strategies to Address Stagflation

Combating stagflation demands a multi-faceted approach. For example, in the 1980s, US Federal Reserve Chairman Paul Volcker raised interest rates to 20% in 1980–81, paired with supply-side reforms like deregulation and tax cuts under President Reagan. These measures curbed inflation but caused a deep recession. High debt levels today—global debt-to-GDP at 256% in 2024—make such aggressive rate hikes difficult, though not impossible.

More feasible strategies to address stagflation include:

- Supply-side reforms, such as deregulation to boost productivity, tax incentives for innovation, or targeted immigration to address skill shortages.

- Operational efficiencies, like process automation or adopting cost-effective energy sources.

- Dynamic pricing and cost optimisation to align with market demand and protect margins.

- Easing supply chain pressures through open global trade, such as reducing tariffs.

- Global coordination, like G7 efforts in the 1980s to stabilise trade and currencies, can also mitigate supply shocks.

Equity Performance During Stagflation

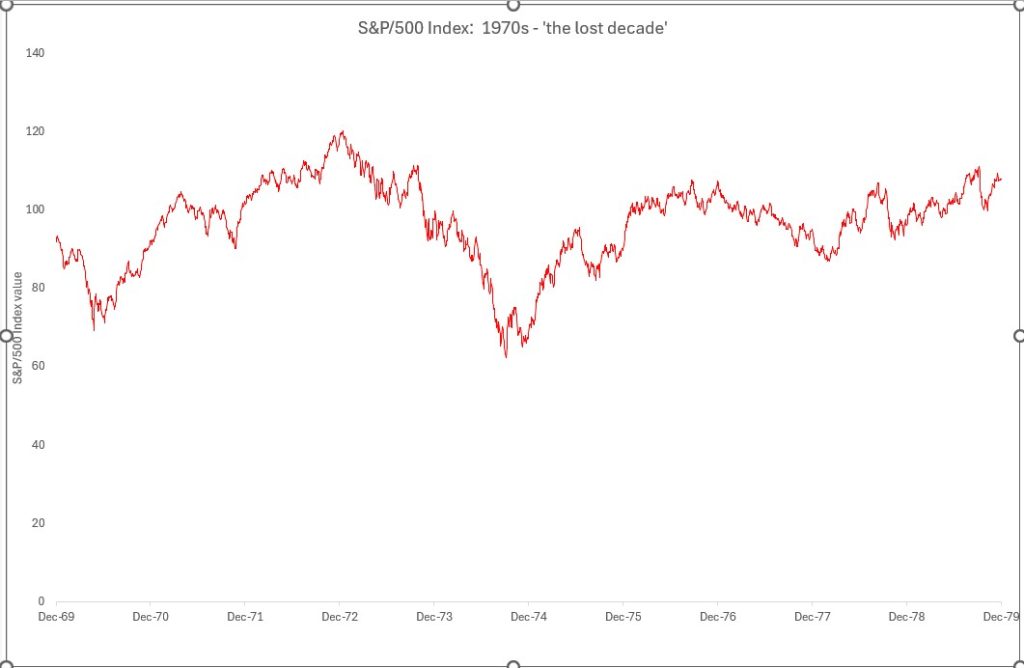

The 1970s was a “lost decade” for equities. The US S&P 500 traded between 90 and 110 points for much of the period, delivering a nominal return of 17% over 10 years (1.6% annualised, pre-dividends). Inflation, peaking at 13.5% in 1980, eroded real returns, with the S&P 500 losing nearly 50% of its inflation-adjusted value. As of April 2025, the S&P 500 stands at approximately 5,800, highlighting the era’s stark contrast.

Gold and oil outperformed, with gold soaring from $35 per ounce in 1970 to $850 by 1980, a 2,400% nominal gain, due to its role as an inflation hedge. Commodities and inflation-linked bonds also held value. Stagflation hurt equities through higher input costs (materials, labour, debt servicing) and reduced demand from unemployment. High interest rates lowered the value of future cash flows, compressing valuations. Typically, defensive, high-quality companies in essential sectors like utilities or healthcare fare better in such conditions, while growth-oriented or highly leveraged firms may struggle.

Conclusion

Stagflation’s impact on markets and societies underscores why central banks, governments, and investors remain vigilant. The 1970s showed its devastating effects, and recent episodes of stagflation, though milder, highlight ongoing risks. Central banks’ focus on inflation control, as seen in the RBA’s 2022–23 rate hikes or the US Federal Reserve’s actions, remains a key defence. Open global trade, supported by institutions like the WTO, also helps mitigate supply shocks. While stagflation is not an immediate threat in 2025—with global inflation cooling to 3–4% by IMF estimates—geopolitical tensions and energy risks warrant caution.

To discover more call 1300 683 106 or email us on investordesk@nab.com.au

View all Investment Insights and Articles

The information contained in this article is believed to be reliable as at May 2025 and is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article.

©2025 NAB Private Wealth is a division of National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. NAB does not guarantee the accuracy or reliability of any information in this article which is stated or provided by a third party. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article. You may be exposed to investment risk, including loss of income and principal invested.

You should consider the relevant Product Disclosure Statement (PDS), Information Memorandum (IM) or other disclosure document and Financial Services Guide (available on request) before deciding whether to acquire, or to continue to hold, any of our products.

All information in this article is intended to be accessed by the following persons ‘Wholesale Clients’ as defined by the Corporations Act. This article should not be construed as a recommendation to acquire or dispose of any investments.