21 August 2025

December 18, 2024

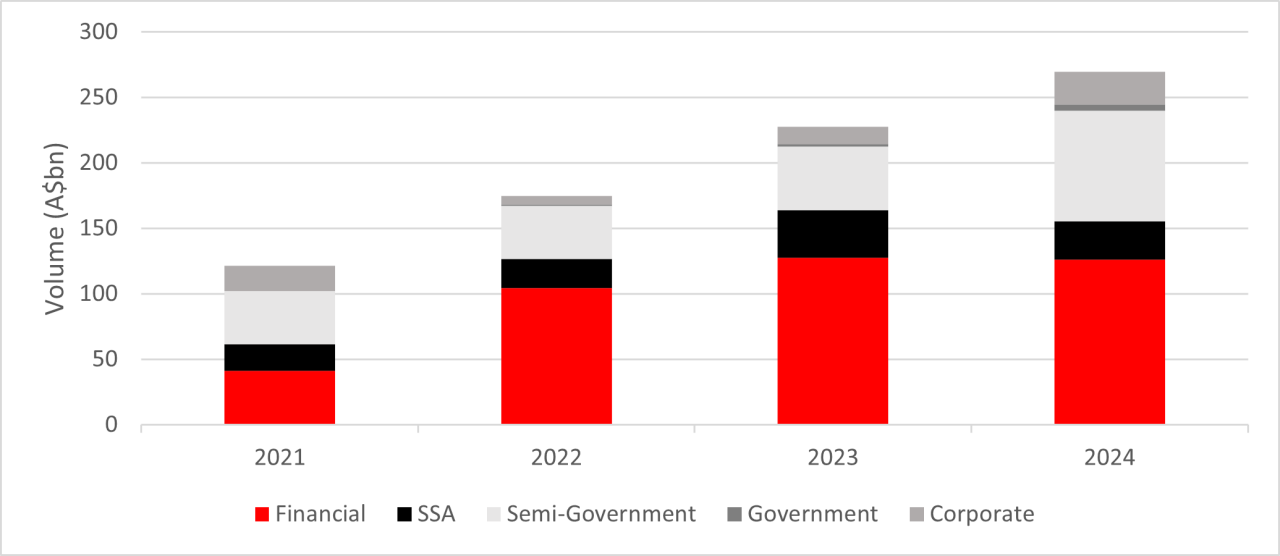

Strong funding year points to step change in supply

Financial institution issuance has recorded another high-volume year in the Australian dollar bond market, with some key questions still to explore ahead of a fast start in 2025.

By James Arnold

The A$ financial institution (FI) funding market has recorded another strong year, despite some persistent challenges on the regulatory, geopolitical and economic fronts.

Amid a record year for the market overall, the FI sector closed with a total volume of A$125.8 billion, down just slightly (1.15%) from the bumper issuance of 2023 following on from a similar surge in 2022[i].

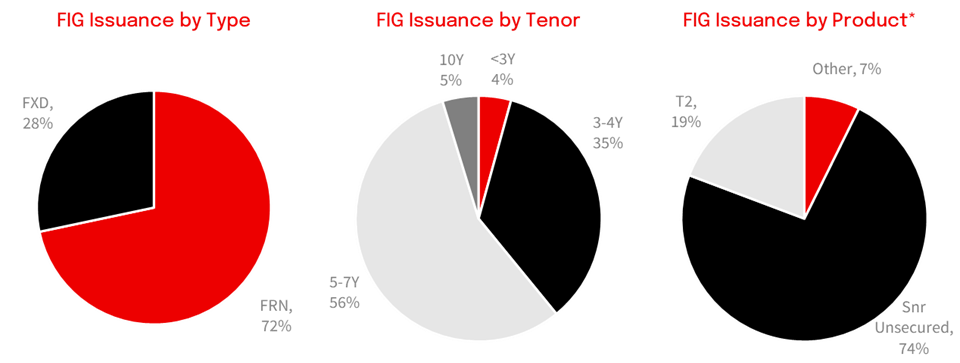

Issuance patterns have remained broadly in line with the past two years, with format skewed to floating rate product, tempered only in the third quarter with the re-emergence of the bid for fixed rate tranches of both senior and Tier 2 (T2) transactions after the rates sell-off.

Interestingly, the demand for 5-year paper dominated, with spreads contracting and investors moving out the curve for incremental spread pick-up. The 10-year part of the curve also proved to be well-supplied by normal standards, with 15NC10 T2 product continuing to be incredibly popular as a yield play for local and offshore accounts.

A$ yearly issuance overview

Source: NAB internal data, Bloomberg

Source: NAB internal data, Bloomberg

Financial institution issuance breakdown

Source: NAB internal data, Bloomberg

Source: NAB internal data, Bloomberg

While the major Australian banks were less prolific in their T2 issuance in 2024, having largely already met their loss absorbing capacity (LAC) build-up requirements, offshore issuers were still keen to access the A$ market as a source of funding diversity and, in some cases, modest arbitrage pricing.

However, as we look to 2025, some key questions remain on how long the A$ market can continue to deliver these high volumes of liquidity; the regulatory outlook and impact on issuance; and prediction for spread products into the new year.

1. Step change in supply

NAB’s sense is that the surge in supply over the past two years is likely to remain for the foreseeable future. We see this being driven largely by demand-side factors, some of which we believe are now structural as opposed to cyclical.

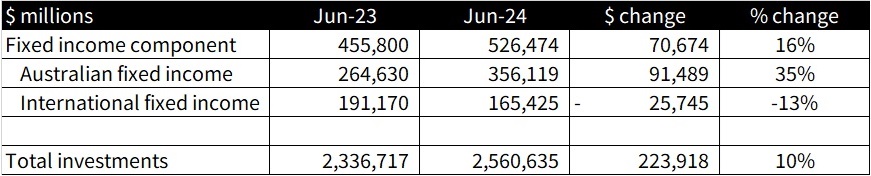

Looking at the Australian superannuation system, figures from regulator APRA show total investments grew 10% across the 12 months from June 2023 to June 2024, adding an additional A$223.9 billion to the pool of assets. Within this, fixed income assets grew by 16% and, importantly, there was a rotation from international fixed income into Australian fixed income, resulting in an increase of A$91 billion of assets into the local fixed income market.

APRA-regulated superannuation balances

Source: APRA

Source: APRA

Prolonged re-allocation of offshore portfolios into A$

While the A$ bond market has seen continuous growth since 2020, the same cannot be said for the most adjacent markets, which have generally seen a steep decline in issuance volumes. Specifically, the Asia G3 (ex-Japan) US$ market has seen its volume fall from a peak of US$43 billion in 2021 to US$170 billion in 2024, a drop of 50%[ii].

Importantly, we continue to see the investors who were key supporters of this market now active participants in the A$ bond market. With these investors having stayed active in A$ for up to three years now, our view is this money is increasingly a core structural component in the A$ market.

There is a similar pattern if you look at the decline in loan values in Asia and Australia. These declines are most pronounced in the Asia market which is down approximately 30% from its peak in 2021[iii]. While the Australian market is not directly comparable with the Asia bond market, it is likely there has been a transfer of liquidity to the A$ market.

Currency and rates

As regional investors rotate out of US$ and into A$, they have been able to do so with the benefit of the A$ being at consistently low levels versus the greenback. Significantly this relationship has been relatively stable over the past two-and-a-half years, while showing a general trend of a weakening A$, driven by the divergence of the Australian and US rates environments as well as the general weakness from our largest trading partner, China.

While it seems we are at an inflection point on interest rates, with the US firmly in a cutting cycle and the Reserve Bank of Australia more likely to be in an extended pause, there is a risk that we see the A$ appreciate versus the US$, however there are other factors at play, namely trade and the impact of US tariffs under the new government that will likely see the A$ trade in a narrow range.

2. Regulatory impact

While the year was relatively stable from a regulatory perspective, particularly coming after the 2023 note from APRA flagging the likelihood of allowing all T2 instruments to be called, the recent news around Additional Tier 1 (AT1) funding has caused some sharp intakes of breath.

While originally flagged in 2023 as some form of restriction on sales to retail investors, APRA this month announced that AT1 as a product will be phased out by 2032 with no new AT1 issued from 2027, and T2 taking its place in the capital stack[iv].

Surprisingly, the T2 market has taken all this in its stride, with spreads closing the year tighter than at the start. The build out of T2 is likely to start gradually and to be incremental for the banks, particularly given the progress on their LAC build-out requirements.

Other notable APRA regulatory changes have come in the liquidity space and have been more impactful on those ADIs under the Minimum Liquidity Holdings (MLH) classification, such as the mutuals, which will in general need to move to a liquidity regime closer to that of the larger banks. This means they will need to hold a greater portion of liquid assets in Australian Commonwealth Government Bonds (ACGB) and Semi-Government bonds as opposed to bank paper. This is likely to have an impact on the profitability of these banks, as the return on ACGB and semi bonds is materially lower. It’s not unreasonable to think that continued pressure on the small mutual banks from actions like this will accelerate consolidation within the sector.

3. Issuance outlook

We remain bullish on the issuance outlook for 2025, with an expectation of volumes staying steady. That said, there some obvious areas that may provide some headwinds as we move through the year.

- Limited FI maturities: The first quarter of 2025 has only A$17 billion of maturities, which is relatively light when compared with Q1 2024[v]. We feel this is surmountable, given the lack of issuance in December of this year and the continued inflows discussed above.

- Geopolitics: We keep flagging this as a potential issue, and despite the ongoing Russia and Ukraine conflict and conflicts in the Middle East, markets continue to function well. That said, there has been some recent dislocation in France (and the euro covered bond market) because of internal troubles. Expect to see small-scale evidence of this throughout 2025, which will make tactical decisions about which market for global issuers to access more challenging.

- Elections: While the US election itself has passed, we will be cautious around inauguration day on January 20. Although the President-elect may flag numerous policies ahead of this date, the event is likely to remain a focal point that could be volatile. Away from this, 2025 also sees general elections held in Australia, Canada, Germany, Ireland, Japan and Singapore.

Fast start to 2025

Bearing all this in mind, we say the A$ market is poised for an overall constructive 2025. While the past two weeks have been subdued following a short period of market indigestion arising from over-issuance in the T2 sector, we are certainly expecting a busy start to the new year.

Heading into the holiday season, the first issuers are expected to be out of the gate as early as the week of January 6 – so much for the market shutting down from Melbourne Cup to Australia Day!

Watching all this momentum, here’s to a promising 2025.

James Arnold is NAB Executive Director FI Origination, Capital Markets Origination

Endnotes

[i] Bloomberg, NAB internal data December 16, 2024

[iI] Ibid

[iiI] Ibid

[iv] APRA to phase out AT1 as eligible bank capital | APRA, opens in new window

[v] Bloomberg, NAB internal data December 16, 2024

Corporate and Institutional Investors

The Forward View – Australia: August 2025

INSIGHT