A private sector improvement to support growth

Insight

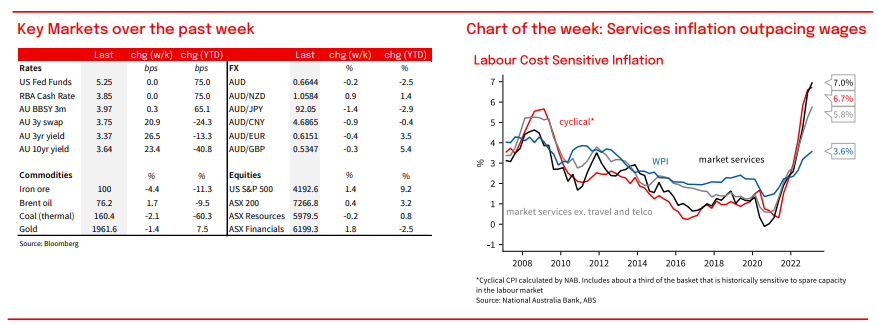

In this Weekly, we delve into last week’s WPI data in more detail and discuss the risks to wages projections and the RBA's outlook

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.