6 August 2025

There are signs of improvement in the Australian economy. It’s all the more reason to think big – and long-term.

Business insights

November 20, 2024

Overcoming the current challenges and unlocking new growth for small and medium businesses requires a collective effort – from banks, industry bodies and government.

By NAB Sector Insights

Small and medium enterprises (SMEs) are the backbone of our economy, making up 99 per cent of Australian businesses and employing two-thirds of our workforce.

But persistent and emerging barriers to growth are impeding their potential – taking precious time away from already stretched owners who are struggling to stay one step ahead in the current environment.

In our new NAB report, Backing our businesses: Unlocking growth for small and medium enterprises, opens in new window, we take a closer look at the challenges these businesses face and suggest a series of practical solutions to help address them based on extensive discussions with multiple customers.

Ultimately, if Australia’s smallest businesses are to succeed, they require banks, governments and industry groups to come together – not just for our customers, but for all businesses and the broader economy.

This includes NAB. As Australia’s largest business bank, we believe we have a key role to play in helping remove these barriers so our customers can go on to thrive and unlock new growth.

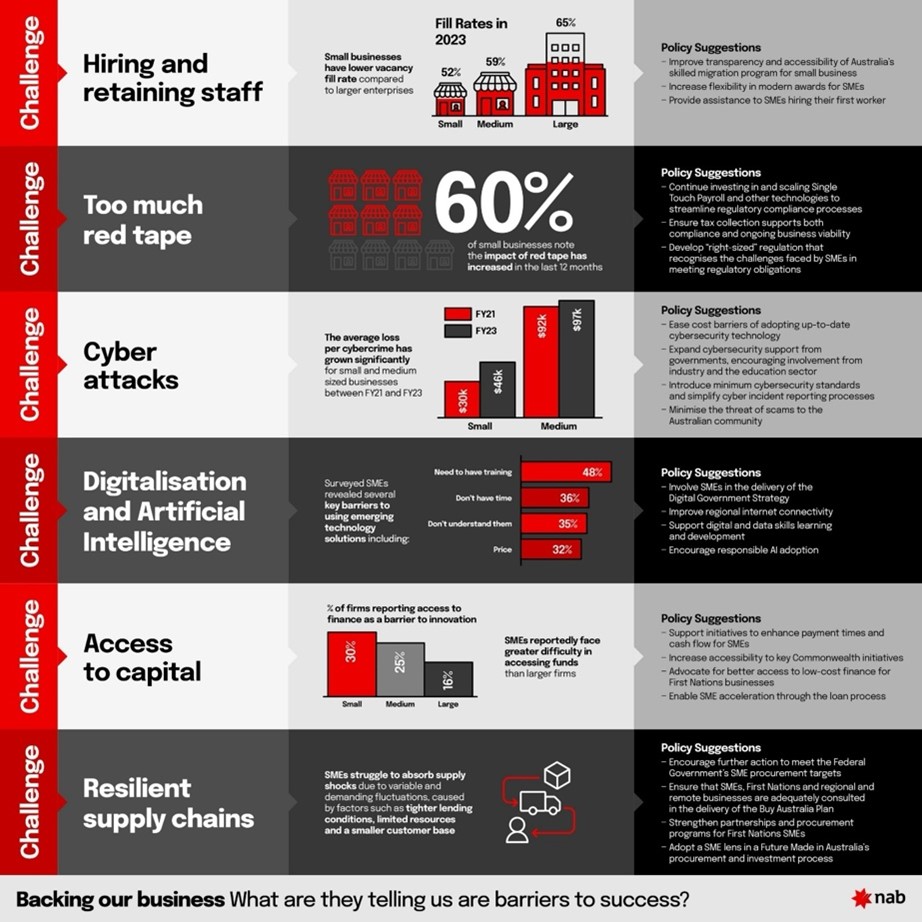

Red tape, hiring and retaining staff and cyber security threats topped the list of things NAB’s small business customers said were keeping them up at night. Accessing capital, supply chains and digitisation and AI rounded out the roadblocks.

“These are not new challenges to Australian businesses, but they need new thinking to address them,” NAB Group CEO Andrew Irvine said.

“Businesses, banks, governments and industry groups all need to come together to find solutions and unlock more productivity, jobs and economic growth.”

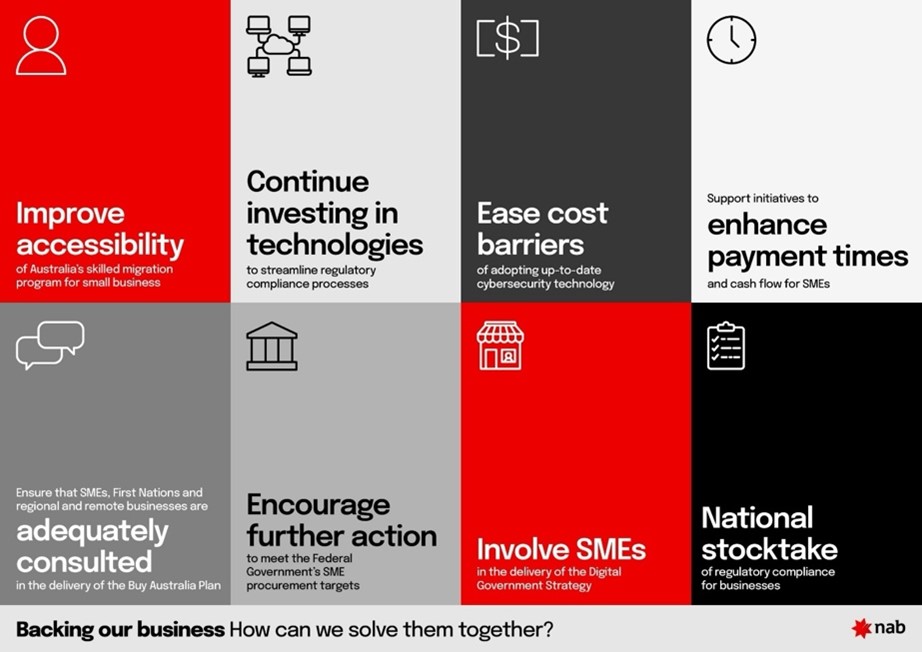

NAB’s report highlights several policy recommendations to ease the burden on businesses, including:

“Small businesses are the heartbeat of our economy, but complexity has added up over time and they’re finding it harder to drive growth,” says NAB Group Executive Business and Private Banking Rachel Slade. “As Australia’s leading business bank, we need to use our voice to back business and help find a way through.”

Adds Slade: “Small businesses can’t do this on their own – and they shouldn’t be expected to.”

Deniz Karaca, owner of Cuveé Chocolate, says his business has been battling supply chain challenges for some time and it’s only been getting worse with the global shortage of cocoa beans.

Deniz and Kylie, owners of Cuveé Chocolate

“We rely on third party suppliers for cocoa butter, and with the global shortage of cocoa it’s near impossible to buy cocoa butter and when you do, prices soar,” he says.

“It’s not a reliable way to run a business when chocolate is your main ingredient and running out of cocoa would be catastrophic.”

To overcome this, Deniz had to invest in a cocoa butter presser, costing just over $100,000. “We had no choice but to come up with the money upfront and it wasn’t easy. I know not every business has the means do this,” he says.

“The last few years has only seen things get harder for small businesses – we’re facing increased difficulties in running a business, more red tape and higher costs than ever before.”

Business Business insights Insights Small business

ARTICLE

6 August 2025

There are signs of improvement in the Australian economy. It’s all the more reason to think big – and long-term.