28 August 2025

April 28, 2023

Can two new trends in offshoring help your business?

Two alternate supply chain options – near-shoring and friend-shoring – are attracting the attention of Australian trading businesses. Here’s what you need to know about both.

By Business View

Globalisation and the associated lower production costs of offshoring have, for years, been a boon for Australian trading businesses.

Then came the past two years of unprecedented supply chain disruption. At one point, 75 per cent, opens in new window of wholesale trading businesses reported experiencing supply chain disruptions. Today, while pressure is easing, supply chains are still a very significant issue for 31 per cent of SMEs in wholesale.

In this context, there is a definite move towards reducing supply chain risk, not just for the short term, but to increase resilience against future shocks, says Jackie Cooper, Executive of Trade & Working Capital, Business & Private Banking, at NAB.

“We are seeing some business customers bring manufacturing back onshore while others are trying to reduce their reliance on one or two key suppliers,” she says.

“This means spreading risk not only across multiple suppliers, but also different countries.”

Exploring new supplier avenues

As supply diversification has become crucial, two concepts are coming to the fore: near-shoring and friend-shoring.

Near-shoring sees businesses work with suppliers they are geographically close to, allowing them to still take advantage of lower labour costs while reducing the risk of lengthy shipping delays. Other benefits of near-shoring include lower shipping costs, time zone alignment and easier access to suppliers when making in-person visits. For Australian companies, good examples of near-shoring countries include Vietnam and Malaysia, Cooper says.

Friend-shoring moves offshore production and supply to countries that share values with the importing business. It is often used to reduce the risk of disruption due to geopolitical events; for example, the various sanctions imposed on Russia over the war in Ukraine or the import sanctions put in place by China on certain Australian products. With friend-shoring, a business has greater control over its supply chain in the face of world events while also enjoying the benefits of the added security and transparency that come from trading with a country with shared values.

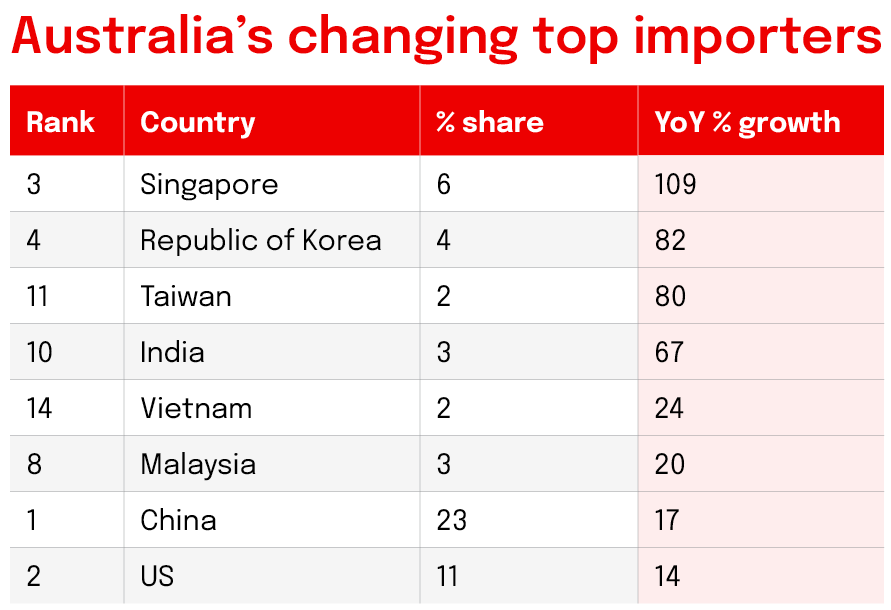

Numbers released by the Department of Foreign Affairs and Trade show that, while Australia’s top import sources remain China and the US, Singapore saw 109 per cent growth year-on-year, the Republic of Korea 82 per cent, Taiwan 80 per cent, India 67 per cent, Vietnam 24 per cent and Malaysia 20 per cent.

Source: Australia’s Trade in Goods and Services by Top 15 Partners, Department of Foreign Affairs and Trade

The risk of the new

For trading businesses, it’s critical to be aware of the financial and risk management implications of switching offshoring locations.

For example, while a business builds trust with a new supplier, the supplier might not be willing to provide payment terms, instead requiring a deposit or even cash up front. If a business is used to more generous terms, this change can have a big impact on cash flow.

“When importing a container of goods from a new supplier, understanding how you’re expected to pay and when is essential,” Cooper says. “Once you have a good handle on the terms, look at whether your current working capital can support them.”

Businesses should seek advice to understand these impacts, along with what help is available, Cooper adds. For example, NAB works with importers to provide instruments that reduce risk, including letters of credit – a contractual commitment by the buyer’s bank to pay once the terms of the letter of credit are met by the exporter.

Alternatively, a business’ bank or a specialist lender might be able to arrange a trade finance facility – a short-term loan that allows the business to manage its working capital and meet its commitments.

When changing supplier countries, it’s also advisable to get expert advice on managing foreign exchange risk, to protect against currency volatility. Equally important, Cooper explains, is understanding how interest rate fluctuations can impact a business and what tools are available to counter this risk.

Doing your due diligence

Beyond understanding the financial implications of diversifying offshore suppliers, businesses need to turn their attention to other practical elements.

“You want to make sure there’s no impact on the end consumer – which means the new products should be of similar price, functionality and quality,” Cooper says.

This means thoroughly vetting the supplier – whether that’s by visiting the country to meet them in person, or by appointing an agent to act on your behalf. It’s also imperative to research the supplier country’s laws and regulations, and whether Australia or the United States has any sanctions in place against it.

“Diversifying supply chains through near- and friend-shoring can be good options for companies looking to make their businesses more resilient against whatever the future might bring,” Cooper concludes. “They just need to make sure they get their due diligence, finance and risk management right up front.”