AMW: Favourable developments for the RBA as we begin 2023

We compare the state of the economy to that assessed by the RBA at their December 2022 Board Meeting.

View the full report here

Favourable developments for the RBA as we begin 2023

- In this Weekly we compare the state of the economy as we begin 2023 to that assessed by the RBA at their December 2022 Board Meeting. Five key developments have occurred, which while still seeing the RBA hiking rates by 25bps in our view in February and March, firms our view of a pause thereafter. Given favourable developments, the RBA will debate moving by 0 or 25bps, rather than 0, 25 or 50bps

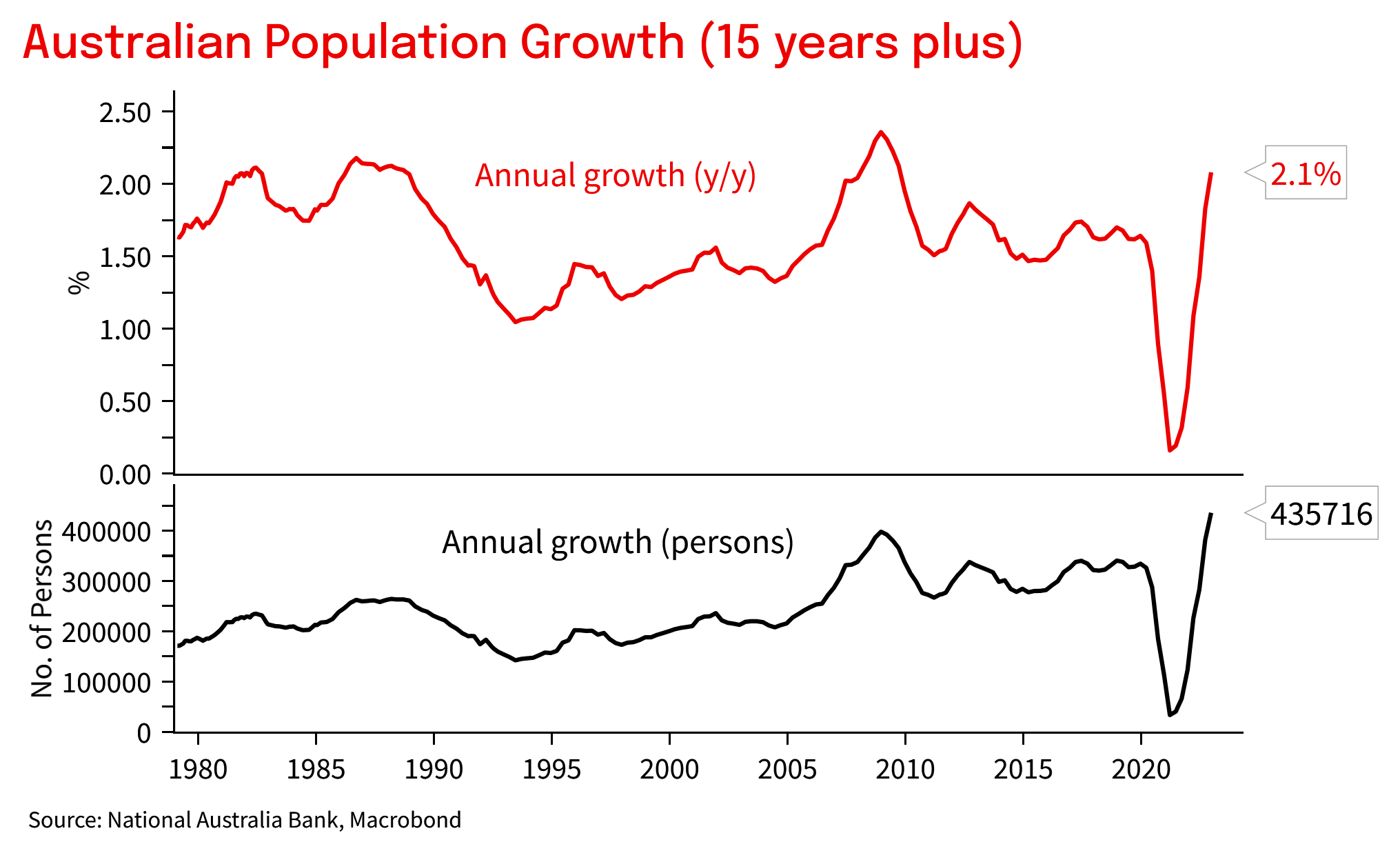

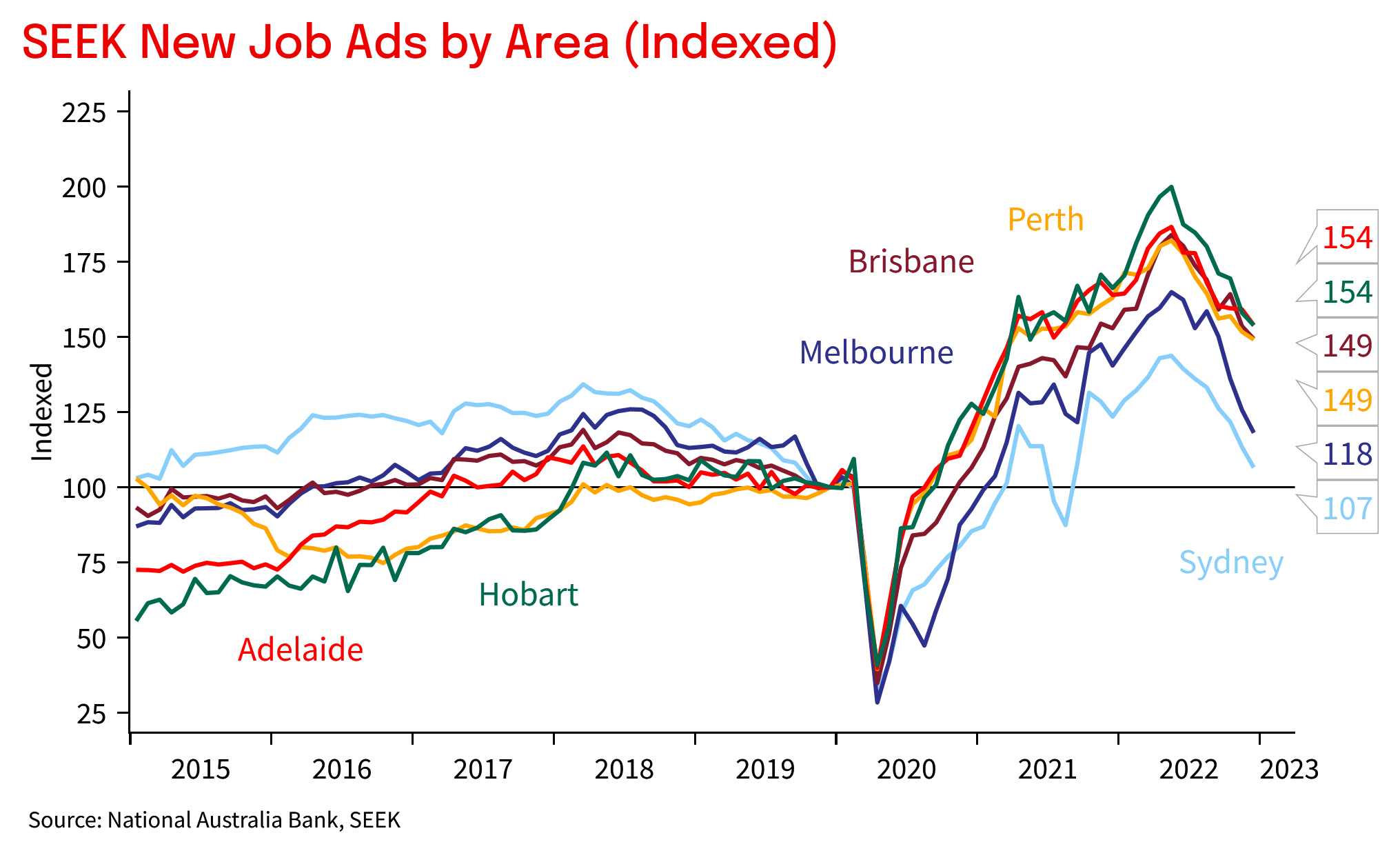

- (1) Australia’s labour supply is recovering sharply as migration rebounds. The RBA noted in December that “…labour availability remained a key challenge, although there were tentative signs this had started to ease a little.” Since then, updated data shows the 15 years plus population increased by 435.7k in 2022, up from +123.1k in 2021. SEEK Job Ads suggest labour market tightness has eased.

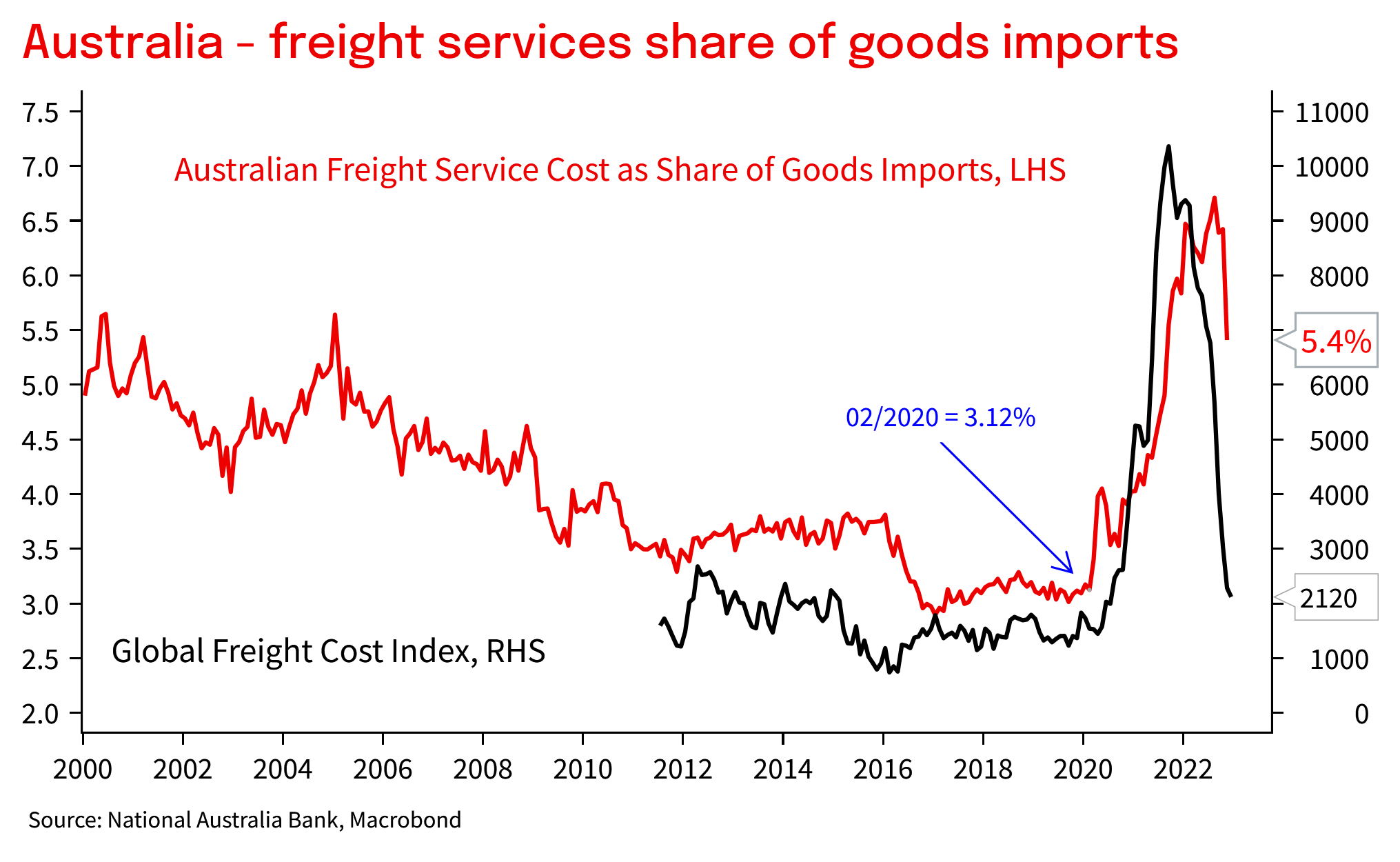

- (2) Global supply chains continue to heal, adding to the RBA’s cautious optimism that “a sustained decline in inflation was expected in 2023, as global supply-side issues continue to be resolved, the recent declines in commodity prices work their way through to consumer prices and growth in demand slows”. Trade data shows lower global freight costs are now being seen by Australian importers.

- (3) China has pivoted to living with Covid at least 3-4 months earlier than many had imagined. The RBA in December had noted China’s containment strategy “remained stringent by international standards”. The pivot should reduce risks to global growth, so too should Europe’s mild winter weather. Less clear though is whether China’s rebound will be inflationary or disinflationary.

- (4) The Australian consumer remains resilient with very strong retail sales data and still solid anecdotes from the Christmas trading period. In December the RBA reported “retailers had reported mixed results for ‘Black Friday’ sales”, and expected higher rates, falling real incomes, and falling house prices to weigh on consumption. So far this has not occurred. Interest rate impacts are expected to be impact from Q2.

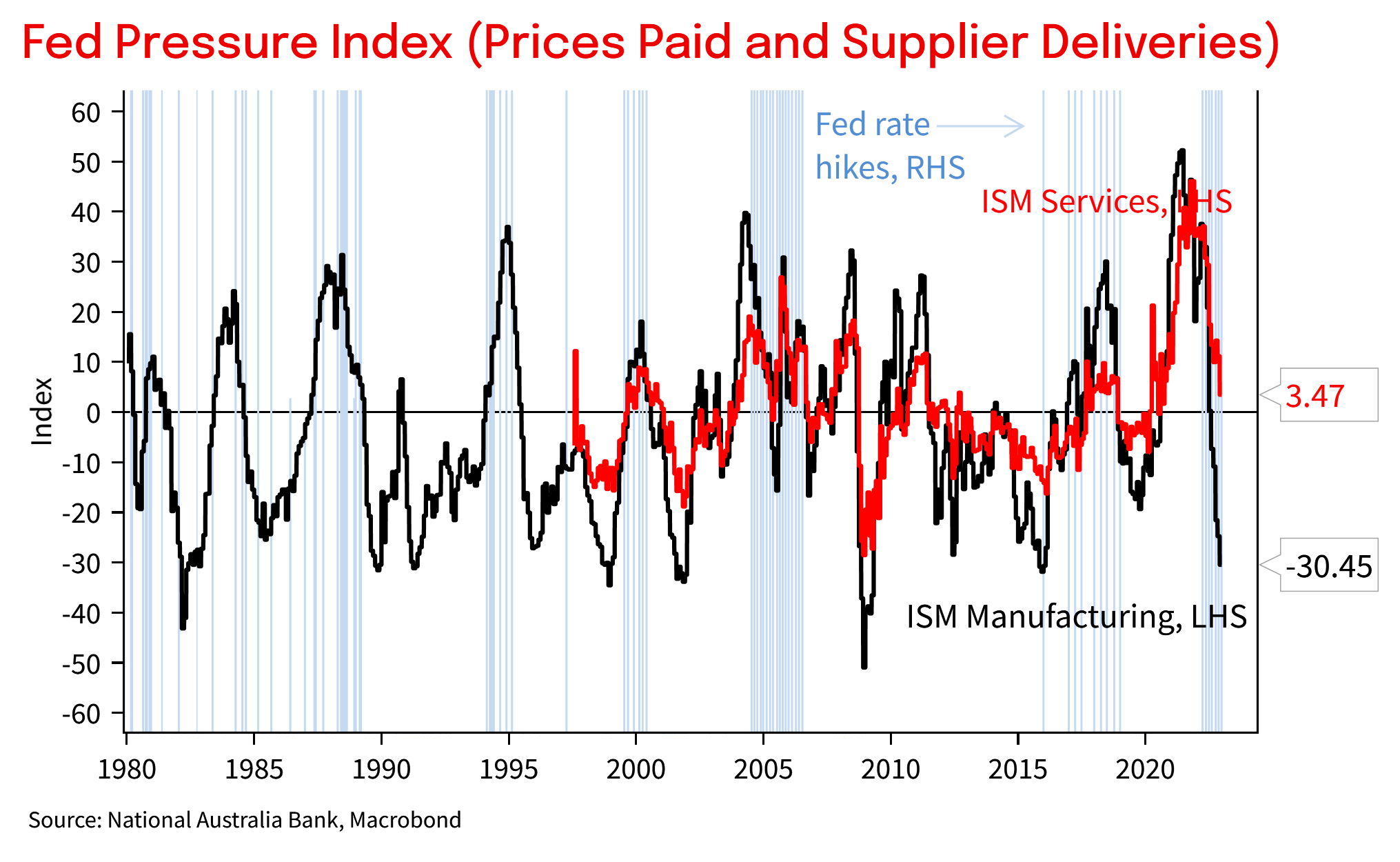

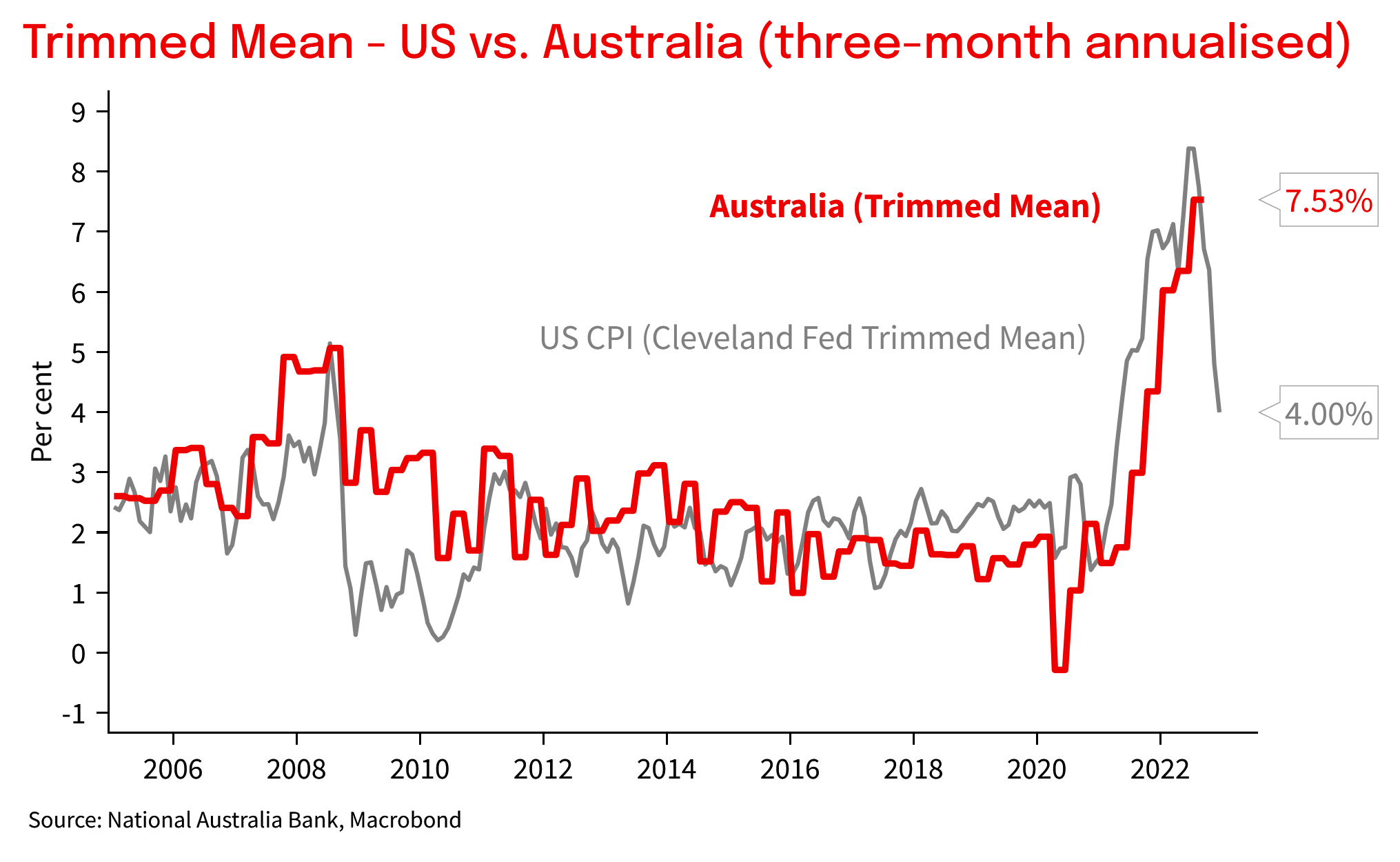

- (5) Peak US Fed hawkishness is starting to shift. A second consecutive downshift in the size of rate rises to 25bps in February is likely to occur, while the Fed is also likely to start to discuss what they need to see to pause the hiking cycle. NAB’s view is the Fed hikes in February and March, pauses thereafter and then starts cutting rates in H2 2023. The past three months of inflation data has been encouraging.

Chart 1: Migration has returned and population growth is lifting sharply. With labour supply recovering, the risks of a wages outbreak have reduced.

Chart 2: SEEK job ads have normalised rapidly in Sydney and Melbourne. Likely a combination of normalising labour supply, a slowing of hiring as the rapid reopening recovery fades, and in some industries an outlook for a slowing in activity as tighter financial conditions start to bite.

Chart 3: Lower global prices (in this case freight rates) are starting to be passed on to Australian importers, bolstering confidence that input cost inflation should continue to ease in the months ahead.

Chart 4: In the US, survey data is more consistent with the Fed pausing with our Fed Pressure Index strongly in easing territory for the manufacturing sector, and broadly neutral for the services side.

Chart 5: US inflation looks to be past its peak and if it continues to head lower, that should give us greater confidence that Australian inflation trends should too. Much of the inflation drivers this cycle have been driven by varied exposure to common shocks (i.e. the pandemic), and we note that core inflation pressures in Australia have generally lagged the US by six-nine months in this cycle – the Delta lockdowns back in 2021 one factor driving the lag.

Read our NAB Markets Research disclaimer.