Having passionate young professionals on the team is proving a powerful differentiator for Ecovis director Elissa Lippiatt.

Video

NAB specialists help brokers support business customers to mitigate market risk and grow. Originally published on Australian Broker on 05 Feb 2024.

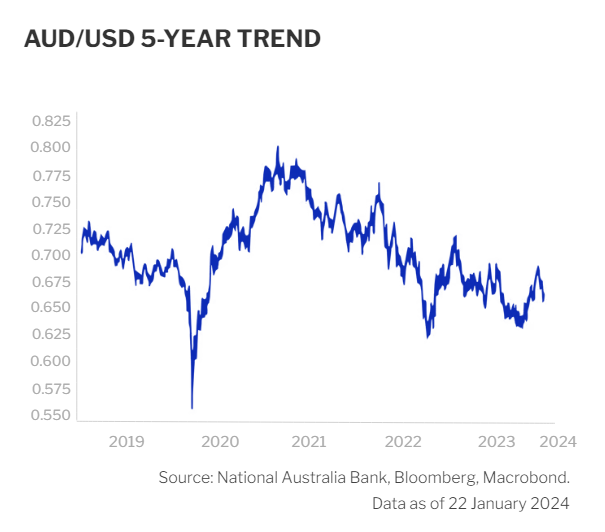

Market Risks can affect the profitability of Australian businesses, but many overlook factors such as foreign exchange volatility. Fluctuations in foreign exchange and commodity prices can have a significant impact on businesses that buy or sell in offshore markets.

NAB executive, markets business and private bank sales Lucia La Bella says this creates opportunities for commercial brokers who can identify those businesses’ needs. Commercial brokers can work with NAB specialists to help their customers navigate through dynamic markets and grow their businesses.

“A lot of customers don’t utilise the various products, tools or advice available when managing foreign exchange risk in their business. They should be looking to a broker or a specialist partner like NAB who can say, ‘Hey, have you thought about this?’,” La Bella says. “It makes the broker more valuable to the customer if they’re identifying a potential risk in the business and then partnering with someone that can provide solutions.”

Commercial brokers can identify when a customer would benefit from specialist advice simply by understanding whether the business may be exposed to market risks.

“For instance, if they’re an importer. They might be buying products from, say, America, and given the volatility in the US dollar, they’d want to make sure they’re still making a good profit when the exchange rate changes,” La Bella says.

Businesses importing goods from offshore may need to pay demurrage, insurance or other costs as part of their shipping fees. These charges may have to be paid in foreign currency at international ports.

Trading businesses with international supply chains, consulting or professional services firms with offshore branches, and customers buying equipment for agricultural, manufacturing or mining enterprises from offshore suppliers may also need to transact in foreign currency.

La Bella says businesses with turnover in the $5 million to $40 million range typically benefit most from specialist advice tailored to their financial needs. Smaller businesses with turnover of $5 million or less generally have simpler payments requirements and transact at the foreign exchange rate on the day when buying and selling in overseas markets.

“We find in medium enterprises where customers have better forward views of larger payments that they require, that’s really where a hedging strategy comes into play. As the payment sizes get bigger, that’s when they want to really manage that risk and their cash flow,” she says.

“Many businesses in this size range “don’t know what they don’t know”, La Bella adds. “They’re really looking for a specialist to help them assess the risk in their business and put a strategy in place.”

When a broker identifies that a customer may need specialist support, their NAB banker is a good first point of contact. Together, the broker and banker can then decide which specialist to engage and when to bring them in. This might include NAB trade and working capital specialists as well as the NAB markets specialists in La Bella’s team.

Some brokers choose to be heavily involved in the process, keeping across all solutions provided to the customer. Other brokers prefer the specialist to work with the customer and the banker directly.

“We really work with the broker around what their particular relationship is with the customer and how they’d like to handle it, but we always keep the broker up to date with what’s going on,” says La Bella.

“That’s the value of NAB being a business-focused bank: we have everything in-house, and we work collectively around offering the best outcome for the customer depending on their individual business need.”

The NAB markets team runs a personal advice model that supports business customers with financial products for managing foreign exchange, interest rate and commodity price risk. The team is comprised of degree-qualified financial advisers who are licensed to provide advice and tailor strategies to the customer’s needs.

“We’re the only major bank that does that. It really is a point of difference comparative to our peers,” La Bella says.

“What that means is we can go into a customer’s business, work with them and understand their business, its drivers and financials, and put in place an appropriate protection strategy, such as a hedging solution for managing interest rate risk or foreign exchange risk.”

One broker La Bella’s team recently supported had a customer that was buying equipment from overseas. The payment was to be made in US dollars. The broker immediately contacted their NAB banker to arrange equipment finance, and the NAB team worked together to also provide hedging strategies to minimise risk on exchange rate movements.

“Within a week we got credit limits and hedge limits in place because the broker did such a good job in terms of identifying that need early. That’s a good example of three different parts of the bank working together to get an outcome, and it makes the broker look good because the customer could have potentially paid more for that equipment if they had not put that solution in place,” La Bella says.

“The timing of this particular transaction was just before the US dollar rallied and the Aussie dollar dropped. So, the hedging strategy meant the customer saved about 10% on the purchase price of the equipment.”

Market risk may not be top of mind for business customers, but tailored solutions such as hedging strategies to protect against currency risk can make a big difference to their bottom line. Brokers can build strong relationships with business customers by working with NAB specialists to help them navigate dynamic markets to grow their businesses.

Having passionate young professionals on the team is proving a powerful differentiator for Ecovis director Elissa Lippiatt.

Video

Sally Auld, NAB Group Chief Economist, shares her insights on the economy

Webinar

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.