How WA businesses can position for more growth and opportunity

WA’s economy has emerged from the pandemic stronger than ever. Our experts outline the challenges and opportunities ahead.

WA has long been acknowledged as an economic powerhouse and in 2020-21 it cemented that reputation, growing by a healthy 4.3 per cent – lockdowns, supply chain disruptions and widespread uncertainty notwithstanding. By contrast, national GDP grew by just 1.5 per cent over the same period.

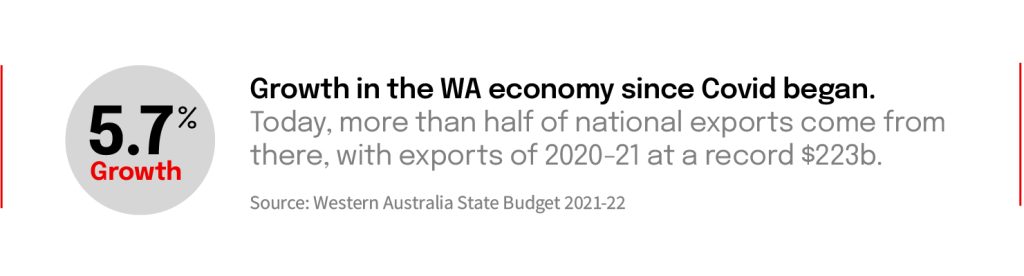

The state’s domestic economy has expanded by 5.7 per cent since the pandemic commenced, according to the WA government. That makes it the strongest performer of all the states, as well as the only one to have recorded domestic growth in 2019–20 and 2020–21. Meanwhile, its exports grew to a record $223 billion in 2020–21, accounting for more than half the national total.

Since the state’s borders reopened earlier this year, things have continued on the up and up, with NAB’s April 2022 Monthly Business Survey noting business conditions and confidence remained strong.

But while conditions are favourable, doing business in the post-Covid economic landscape is not without challenges. NAB Executive for Perth Regina Sun and WA Commercial Real Estate Executive Gary Louis share their insights on what lies ahead for WA businesses – and how they can drive productivity, profitability and growth.

Investing in automation

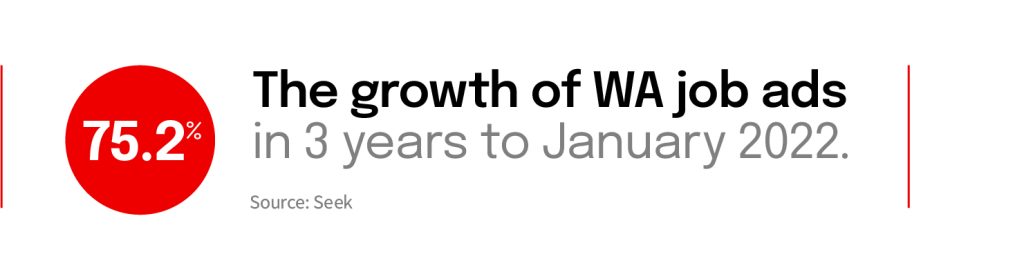

Staff shortages continue to act as a handbrake for businesses across Australia, and they’re particularly acute in the West. January 2022 saw Seek list a whopping 75.2 per cent more job ads in WA than in January 2019, with the greatest demand coming from the trades and services, manufacturing, transport and logistics and resources and energy sectors.

The supply and demand imbalance is likely to result in wage wars in some sectors. It may also be the catalyst for increased investment in automation, as businesses turn to technology to combat the shortage of people power and propel their operations forward.

“Customers are reaching out to request we connect them with automation experts in their fields, and we’re seeing high growth in equipment financing – it’s up 27 per cent, year on year – as people bring forward their investment decisions,” Sun says. Meanwhile, she notes, global supply chain issues mean it’s taking a long time to source and commission plant and equipment.

Combatting supply chain disruption

The new NAB Supply Chain Insights Special Report indicates 35 per cent of WA small and medium businesses said supply chains were currently a “significant” issue for their business, the highest of any state nationally.

By industry, it was a “significant” issue for almost one in two (47%) Wholesale SMEs, and was also particularly problematic in Manufacturing (44%), Retail (37%) and Construction (30%). Around one in five (or 21% of) WA SMEs expect supply chain will still be a significant issue in 12 months which is lower than the national average of 23% per cent.

Businesses were asked what strategies they believed should be implemented to deal with current and future issues. Overwhelmingly, almost seven in ten (68%), said investment in local manufacturing facilities was key. Around one in two pointed to improved road, rail, sea & air infrastructure (52%) or investing in technologies that reduce time, materials energy & labour (48%). More than four in 10 highlighted investment in education & training (44%) and a relaxation of immigration policies, while just over one in three (35%) cited fostering greater international cooperation and new trade agreements.

Those supply chain issues are also prompting businesses to rethink their approach to inventory management, according to Sun. Many are making the switch from a ‘just in time’ to a ‘just in case’ model, stockpiling components and products to ensure they can maintain business continuity and fulfil contracts.

It’s a prudent approach, given the well documented shortages of everything from building materials to foodstuffs that have plagued businesses since the pandemic began. But it comes at a cost.

“Holding more stock sounds easy but it chews through your cash flow,” Sun says. “In recent months, we’ve worked with numerous businesses to ensure they have the working capital they need to support their revised inventory requirements and sales cycles and lending for working capital is up 36 per cent year on year.”

Hot property

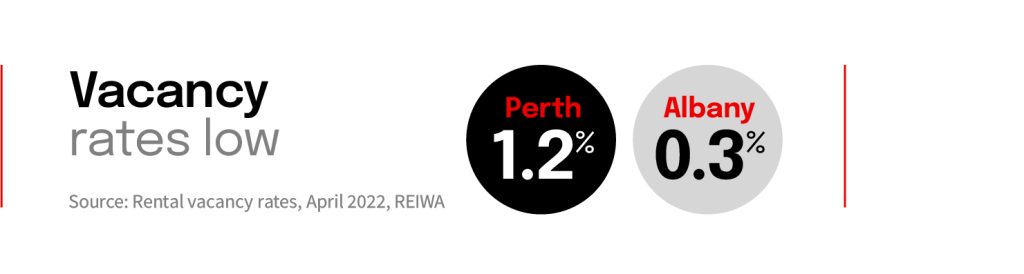

Meanwhile, WA’s property market is buoyant. Residential rental vacancy rates remain low – REIWA’s quarterly survey for April 2022 showed rates of 1.2 per cent and 0.3 per cent in Perth and Albany, respectively – and builders’ books are full until late 2023, according to Louis.

The NAB Commercial Property Survey Q1-2022 revealed both short- and long-term confidence in the outlook for WA’s commercial and industrial sectors.

Although interest rates are on the rise, they remain low by long-term standards, making property an attractive investment for local businesses and high-net-worth individuals, Louis notes.

“Current conditions are prompting business owners to buy their own premises and pay them off, rather than renting,” he says.

“WA is still seen as one of the most affordable states in the country. It provides some of the best yields, and we’ll continue to see a lot of enquiry from east coast investors, as well as locals.”

Partnering with a bank that’s truly local

In changing times, having the support of a bank that understands business and the local economy is critical.

NAB has had a presence in WA for more than 150 years, and is deeply committed to supporting the state that continues to make an oversized contribution to Australia’s ongoing economic prosperity.

Many of the bank’s relationships with WA businesses span three generations.

“We’ve supported our customers as they’ve navigated fluctuating geopolitical and market conditions,” Louis says. “And, because we regard ourselves as business experts, we’ve brought them together, to share information and insights to help them optimise their operations.”

“We believe in the West, and we’ll continue to back WA, with over 300 local business banking experts on the ground,” adds Sun. “As local businesses address the challenges and opportunities of the post-Covid economic landscape, we look forward to making the journey with them, providing the funding and support they need to innovate and grow.”

Regina Sun

Regional Business Bank Executive, WA

regina.j.sun@nab.com.au

+61 467 816 176

Gary Louis

Commercial Real Estate Banking Executive, WA

gary.louis@nab.com.au

+61 452 672 003