MT: China unrest hits Aussie dollar in early trade

US equities close the week flat to lower, but with solid gains on the week

Today’s podcast

Overview: Mixed Messages

- US equities close the week flat to lower, but with solid gains on the week

- Italian BTPS lead EU bond sell-off as ECB rate hike expectations ratchet up

- UST little changed on Friday, but down on the week. 10y UST down 14bps to 3.677%

- After three days of decline the USD enjoys a small rebound on Friday

- NOK leads USD gains on the week. AUD (+1.17%) and NZD (1.61%)

- PBoC cuts RRR for second time this year

- PBoC to offer cheap loans to buy beleaguered property bonds

- China Covid social unrest intensifies after Urumqi fire

- AUD gaps lower at the open, following China news (now at .6717)

- Cyber Monday stats the likely US focus early this week

- This week: AU Retail Sales & Monthly CPI, RBA’s Lowe, EZ Inflation, Fed’s Powell, US – ISM, PCE and Payrolls

Events Round-Up

NZ: ANZ consumer confidence, Nov: 80.7 vs. 85.4 prev.

NZ: Retail sales ex inflation (q/q%), Q3: 0.4 vs. 0.5 exp.

JN: Tokyo CPI (y/y%), Nov: 3.8 vs. 3.6 exp.

JN: Tokyo CPI ex food & energy (y/y%), Nov: 2.5 vs. 2.3 exp.

CN: Reserve requirement (%), Nov: 11 vs. 11.25 prev.

GE: GfK consumer confidence, Dec: -40.2 vs. -39.6 exp..

Unsurprisingly given Thanksgiving holiday on Thursday, US equities had a quiet end to the week, the S&P 500 was flat on the day while the Dow was a bit higher and the NASDAQ a tad lower. UST yields also ended little changed relative to Friday’s opening levels, but with decent intraday movements. Rates volatility came from Europe as the market reassessed the ECB outlook on the back of hawkish message from ECB speakers and upcoming EU inflation this week. Italian yields led the move with the 10y tenor up 18bps on Friday. After three days of decline, the USD enjoyed a small rebound on Friday, but on the week the greenback was weaker across the board. China Covid social unrest intensified after Urumqi fire, late Friday the PBoC announced its intention to cut the reserve requirement ratio for banks by 25 basis points (bps), effective from December 5.

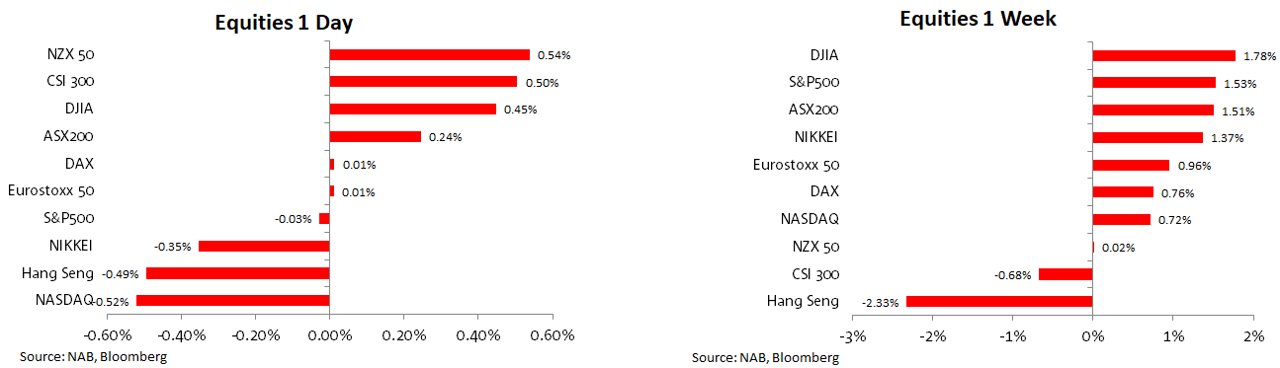

The S&P 500 was flat on Friday but up over 1.5% on the week, the NASDAQ fell by 0.52% on Friday but gained 0.72% on the week. Meanwhile the Dow gained 0.45% on Friday and was the outperformer on the week, up 1.78%. European equities also had a subdued end to the week with the Eurostoxx 50 index unchanged on the day, but up 0.96% on the week. Of note, the Eurostoxx 50 was up for an eight consecutive week, gaining 19.61% over this period. This is the longest winning streak since the week ending May 18, 2018 when the market rose for eight straight weeks.

In recent weeks equity investors have been buoyed by expectations central banks job to bring inflation down could be a facing a turning point following a lower-than-expected US CPI print . Playing to this narrative takeways from the Fed Minutes mostly favoured a step down in the pace of Fed hikes ahead with recent US data releases (PMIs and regional surveys) also pointing to a loss of economic momentum which could make the Fed’s job easier, if (and potentially a big if) the decline in activity comes alongside a meaningful decline in price pressures.

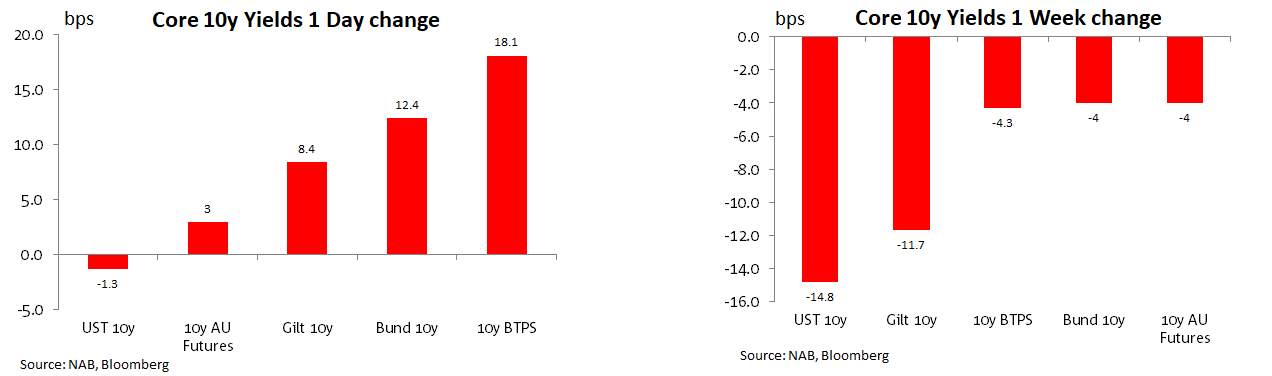

Equities Performance

While the Fed may be looking to step down the size of rate hikes in December, the outlook in Europe is now looking a little bit more uncertain. Friday saw a big move higher in European bond rates with 10y Italian BTPS leading the move up in yields, up 18bps to 3.83% while 10y German Bunds climbed 12 bps to just below 2%. 10UK Gilts also rose, up 9bps to 3.11%.

The message coming from ECB speakers turned more hawkish late on the week with the market digesting ECB Schnabel’s remarks who said on Thursday night there was “limited” scope to slow down the pace of rate hikes. ECB Muller echoed the sentiment on Friday , saying that the main risk in the battle to quench record inflation is halting the hiking process too soon. Fuelling this uncertainty, on Friday Bloomberg released its November Eurozone inflation forecast survey revealing a consensus view that the Euro zone CPI is likely to have slowed for the first time in 1 1/2 years, however almost all economists predicted the headline number will stay above 10%. The median of 32 estimates in a Bloomberg survey is for an outcome of 10.4% in the report due Wednesday with the core reading unchanged at 5%yoy. If right these numbers are right, then it is too soon for the ECB to be talking about slowing down the pace of hikes.

The ECB has raised rates by 75bps at each of the past two meetings and the market had speculated that it may step down to a 50bps hike in December. The market is now pricing around a 50% chance of third successive 75bps ECB rate hike.

After opening a few bps lower at the Tokyo open on Friday, US Treasuries ended the day little changed, although with decent intraday moves with the 2y Note trading in a 10bos range while the range in the 10y tenor was 9bps. In the end, US Treasury rates shrugged off the European bond sell-off, with the US 10-year rate closing the week at 3.68%. The US 10-year rate is now at its lowest level since the start of October, 65bps off its recent post-GFC high. The 2s10s UST curve extended its recent flattening closing the week at -77.4, down 6.8bps over the past five days.

US Treasuries over the past week

After the Nation Party Congress, another factor that has helped the risk positive vibes in recent weeks has been China signalling its intentions to ease up its zero covid approach. So far, the market has embraced this narrative and has been relatively calm by the rising Covid case numbers. That said, the increase in infection numbers has triggered a rise in “targeted” restrictions . Now, protests against Covid restrictions in China have seemingly intensified following a fire which killed 10 people in an apartment block in Urumqi. The BBC reported thousands of people took to the streets of Shanghai to remember the victims and demonstrate against restrictions. Many were heard calling for President Xi Jinping to resign.

Sticking with China and as preluded by media reports during the week, the PBoC said on Friday it would cut the amount of cash that banks must hold as reserves for the second time this year , releasing about 500 billion yuan ($69.8 billion) in long-term liquidity to prop up a faltering economy hit by record COVID-19 cases. The PBOC said it would cut the reserve requirement ratio for banks by 25 bps effective from December 5.

Adding to the dire economic picture, data released on Sunday revealed China’s Industrial profits in the January-to-October period fell 3.0% from a year earlier. That compared with a decline of 2.3% in the first nine months.

Whether an increase in liquidity has a material boosting impact on China’s economy, it remains to be seen. China’s problem is not the availability of credit, but rather appetite for it . Covid restrictions alongside a major property slump are hindering the animal spirit, denting confidence on individuals to get back into the housing market and on companies to invest or expand. This is classic case of a liquidity trap, suggesting here is a clear need for the government to do more in order lift confidence and activity.

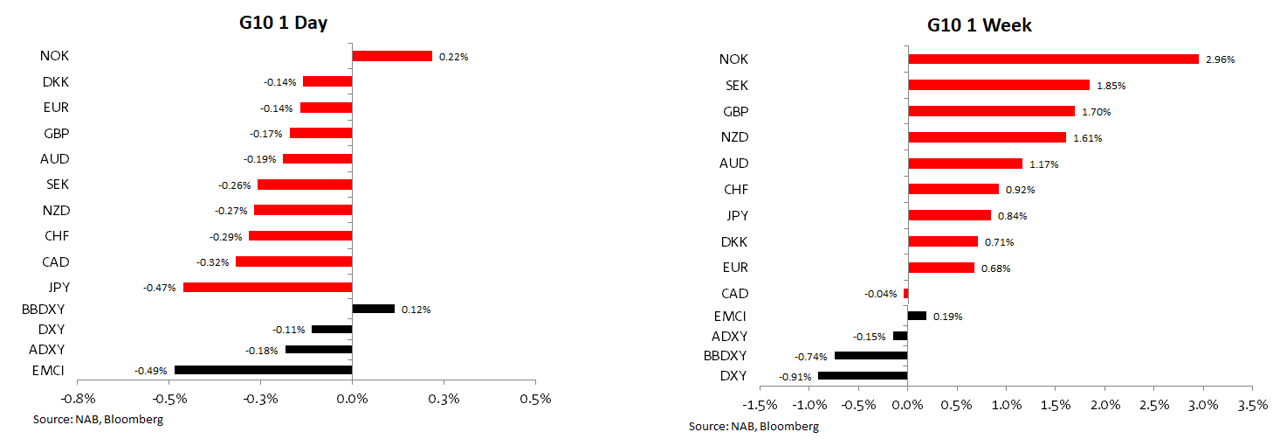

After falling for three consecutive days, the USD managed to record a modest rebound on Friday. The yen (-0.47%) led the declines against the USD on Friday with USD/JPY climbing back above ¥139, the AUD and NZD (both down between 0.20% and 27%) also lost a bit of ground on Friday, but with the exception of CAD which was unchanged on the week, all other G10 pairs recorded gains against the USD over the past five days.

Markets could open the new week with a cautious tone following the weekend China protests and softer data. Indeed, after closing the week around 0.6754, the AUD is down ~35 pips this morning as the investors wait for Asia to open. AUD now trades at 0.6718 and NZD is at 0.6223.

The USD DXY index closed the week at 106.05 and many technical analysts will be looking at the 200 DMA which is not too far away at 105.30. A break below this key support level, could incentivise Dollar bears to keep pushing the greenback lower.

FX Performance

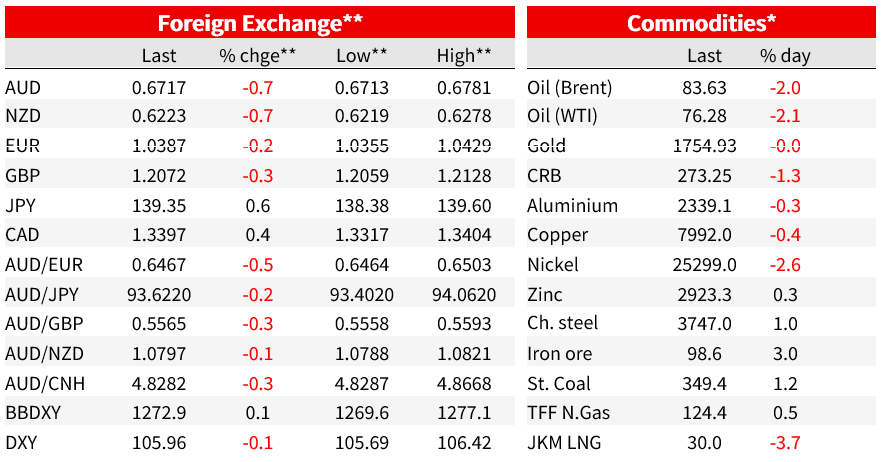

Looking at commodities, oil prices fell on Friday (~2%) amid concerns over China’s near term economic outlook. Supply factors may have been at play too with the Biden administration granting Chevron a license to resume oil production in Venezuela after US sanctions halted all drilling activities almost three years ago. The reprieve followed the resumption of talks by Venezuela’s political factions on Saturday with a deal to work together on a humanitarian spending plan.

In related news, negotiations between EU countries over a price cap for Russian oil broke down on Friday , Poland one of the countries to object to the price level being set above levels Russia currently sells at, meaning it would likely have little impact. The WSJ reported a deal is still expected to be agreed before the planned 5 December implementation date. Oil prices were lower again on Friday, by around 2% on Brent crude, taking Iron ore was the notable gainer on Friday, up 3.56% while copper edged 0.33% higher to 3.629 and for the week it was around flat. Gold closed unchanged at 1,756 and for the week it gained 0.40%.

Commodities Performance

Looking at commodities, oil prices fell on Friday (~2%) amid concerns over China’s near term economic outlook. Supply factors may have been at play too with the Biden administration granting Chevron a license to resume oil production in Venezuela after US sanctions halted all drilling activities almost three years ago. The reprieve followed the resumption of talks by Venezuela’s political factions on Saturday with a deal to work together on a humanitarian spending plan.

In related news, negotiations between EU countries over a price cap for Russian oil broke down on Friday , Poland one of the countries to object to the price level being set above levels Russia currently sells at, meaning it would likely have little impact. The WSJ reported a deal is still expected to be agreed before the planned 5 December implementation date. Oil prices were lower again on Friday, by around 2% on Brent crude, taking Iron ore was the notable gainer on Friday, up 3.56% while copper edged 0.33% higher to 3.629 and for the week it was around flat. Gold closed unchanged at 1,756 and for the week it gained 0.40%.

Coming Up

- Australia is the focus at the start of the new week with RBA Governor Lowe speaking before Parliament (10:00am Sydney time), followed by Retail Sales figures for October (11:30 am Sydney time). Dr Lowe also speaks again on a panel on Friday at the Bank of Thailand on “Central Banking amidst Shifting Ground ”. As for retail sales, our economists have pencilled in 0.3% m/m, a little below consensus for a 0.5% gain. The new Monthly Inflation Indicator is also out on Wednesday with headline likely to lift to 7.7% (for more see our Preview).

- For Europe and the US, today it is all about central bank speakers with ECB Knots and Lagarde on the roster followed by Fed Williams and Bullard early tomorrow morning. The US Dallas Fed Manf. Activity survey is the only notable data release ( -23 exp from -19 prev.)

- Looking at the rest of the week domestic data releases include Construction Work Done and Private Capex provide the first pre-GDP partials ahead of Q3 GDP next week on 7 December as well as Dwelling Prices, Building Approvals, New Home Loans and Private Sector Credit.

- In offshore markets, China Official PMIs are out Wednesday, and the Caixin Manufacturing is out Thursday. Consensus sees both again under 50 as the zero-COVID policy weighs on activity and impedes stimulus measures (manufacturing seen at 49.0 and non-manufacturing at 48.0).

- For the US there are two key events, Fed Chair Powell speaking on Wednesday and Payrolls on Friday. Powell is speaking on “the economy and labour market ” and will be watched closely for any pushback on recent market moves which have eased financial conditions. As for Payrolls focus will be both on the headline print with consensus at 200k and on average hourly earnings with consensus of 0.3% m/m. On Thursday the US also gets the ISM manufacturing reading with the market expecting a move into contractionary mode (49.8 exp. from 50.2 prev.) alongside the Fed’s preferred inflation gauge – the PCE deflator (Core 0.3%mom exp. vs 0.5% prev.).

- Inflation is also a major theme for Europe with the preliminary EZ November HICP inflation due Wednesday. In October EZ headline inflation printed at 10.7% y/y while the core reading was 5%. The market is looking for a small ease in price pressures with the headline reading expected at 10.4%yoy while core is seen unchanged at 5%. The eurozone economy is slowing, but with inflation still well above target the pressure is on the ECB to continue hiking.