Markets Today: Misleading jobs numbers and more signs inflation is hard to beat

A hot US PPI and hawkish comments by the Fed’s Mester and Bullard saw yields push higher and equities fall, though initial moves were pared somewhat.

Today’s podcast

Overview: Take It Away

- Hot US PPI plays to higher for longer, keeping pressure on the Fed

- Fed’s Mester and Bullard give hawkish soundbites (note non-voters)

- US yields rise in what was a volatile session

- AU jobs yesterday was much stronger than the headline

- Coming up: RBA’s Lowe, UK Retail Sales, US Fed Speak

“Take it away, somewhere to go; Lead me astray where nobody knows”, L.A.B. 2022

A hot US PPI and hawkish comments by the Fed’s Mester and Bullard saw yields push higher and equities fall, though initial moves were pared somewhat. Core PPI ex food and energy came in at 0.5% m/m vs. 0.3% expected, while the prior month was also revised up by two tenths to 0.3% m/m. Meanwhile Mester noted that she “…saw a compelling economic case for a 50-basis-point increase” at the last meeting, and looking at future meetings noted “it’s not always going to be, you know, 25. ” Yields initially spiked with the 2yr at one stage up some 8bps, before paring to be only 2bps higher over the past 24 hours to 4.63%. Ditto the 10yr which also was up some 7bps at one point, and now over the past 24 hours is up 4.4bps to 3.85%. Pricing for the Fed was little changed with a peak terminal rate at 5.22% by July 2023 and there is now only around 21bps worth of cuts priced in H2 2023. The S&P500 is currently -0.4% as we head into the close, having pared a much larger -1.4% move at the open.

The USD was little changed with the DXY -0.1%, with the initial 0.5% spike higher on the PPI and Mester’s comments now reversed. Most pairs are not greatly moved on net: AUD +0.2%; NZD +0.1%; EUR +0.2%; GBP +0.1%; USD/JPY -0.4%. The AUD yesterday did initially fall on the employment headline to around 0.6868, before reversing and now currently trades at 0.6902. As we noted in our write-up details were much stronger with a larger number of people than usual ‘waiting to start work’ and so not yet counted as employed; if they had been counted employment would have been +61k instead of -11.5k (see below for details). Rates markets took more of a signal with around 10bps shaved off terminal RBA pricing with a peak terminal rate now 4.12% after having been above 4.20% prior to the data. AU 3 year bond futures also remain around 8bps away from their pre-jobs levels, and were little changed overnight. We get a chance to hear Governor Lowe’s interpretation in parliamentary testimony today at 9.30am.

As for data details, US PPI came in hot with the headline at 0.7% m/m vs. 0.4% expected. The prior month was also revised higher by three tenths to -0.2% from -0.5%. The core measures were also hot with the ex food and energy at 0.5% m/m vs. 0.3% expected, and ex food and energy and trade services was 0.6% m/m vs. 0.2% expected. With revisions, in annual terms ex food and energy is now running at 5.4% y/y vs. 4.9% expected. In other words, no matter how you cut it, inflation was hot. The latest data supports the Fed view of needing to continuing to raise rates and hold them there higher for longer. There was also a slew of other data other with Jobless Claims broadly in line at 194k (vs. 200k expected), while greater weakness was seen in the Philly Fed Manufacturing at -24.3 vs. -7.5 expected, and in housing starts at -4.5% m/m vs. -1.9% expected.

Fed speak was hawkish. Mester a non-voter and usually hawkish noted she saw at the last Fed meeting “a compelling economic case for a 50 basis-point increase”. Looking ahead to future meetings Mester also noted “it’s not always going to be, you know, 25”. While those comments were hawkish, the end point where Mester sees the Fed needing to get merely repeated the existing Fed messaging: “at this juncture, the incoming data have not changed my view that we will need to bring the fed funds rate above 5% and hold it there for some time ”. Finally it is worth noting the contrast to other central banks here in regards to the Fed, which sees greater risks on inflation then on overtightening. In Mester’s words, risks support the case for “overshooting” on policy and “over-tightening also has costs, but if inflation begins to move down faster than anticipated, we can react appropriately”.

The Fed’s Bullard also spoke latter in the session, and initially sounded less hawkish, noting “continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets, by keeping inflation expectations low”. However, Bullard then also said he had advocated for a 50bp hike at the last meeting (like Mester) and that he wouldn’t rule out supporting a 50bp hike. Note both Mester and Bullard are non-voters this year.

In Australia, yesterday’s employment data yesterday was much stronger than the headline suggested. As we noted in our write-up a larger number of people than usual were ‘waiting to start work’ and so not yet counted as employed (276.8k in Jan 2023 vs. 205.6k in Jan 2020). On our analysis, if that cohort was instead the same size as January 2020 and the rest were employed, employment would have been +61k, instead of the -11.5k published. The unemployment rate would have been 3.6% instead of the 3.7% published; 3.5% previously. As a result, we think February data should bounce strongly (see NAB note AUS: Employment stronger than it looks in January – don’t be head faked given more people were about to start work). The AFR’s RBA Whisperer Kehoe agreed, noting the “jobs numbers may not be as bad as they seem” and that the RBA would “need to see deeper evidence of a slowdown in the labour market before being convinced that higher interest rates are really biting. At least two more interest rate rises in coming months are on the cards…” (see AFR: Jobs numbers may not be as bad as they seem).

Finally, across the ditch my BNZ colleagues note that lower Australian rates spilled over into the Kiwi market. The 2-year swap rate closed the day down 5bps to 5.15%. Longer term rates fell from levels that had been earlier pushed higher from the force of higher US rates and 5-year swap closed the day flat and 10-year swap up 3bps, so some notable curve steepening there. The mulling over the impact of ex-tropical cyclone Gabrielle looked to be a factor in the steepening trade, with the market more convinced that a 50bps hike next week is more appropriate under the circumstances rather than a jumbo 75bps move, the OIS market for that meeting closing the day exactly at 4.75%. The higher fiscal costs for the rebuilding of infrastructure, likely to be in the billions, adds to the pressure on bond supply. While there was strong demand for NZGBs at the weekly tender, there was some modest underperformance of NZGBs versus swap. The 10-year NZGB closed the day up 5bps at 4.34%.

Coming up:

- AU: RBA’s Lowe: Governor Lowe gives Parliamentary Testimony to the House Economics Committee (9.30am), after having already given testimony to Senate Estimates on Wednesday. We do not expect anything additional to come from this testimony, apart from perhaps some pushback on the dovish interpretation that some gave to the labour market data yesterday. As noted above, January employment was much stronger than the headline suggested. In Senate Estimates Dr Lowe’s comments and tone suggested he is more worried about inflation risks than activity risks. Market pricing of three more hikes in a quick flurry looks justified on those remarks, as is NAB’s view of the RBA hiking rates to 4.1% by May 2023, seeing three consecutive 25bp increases in March, April and May (see NAB note: AUS: RBA Lowe reiterates the hawkish language from the SoMP, intends to serve out rest of his term which ends in September).

- EZ: ECB speak: ECB’s Villeroy. Also out is the German PPI

- UK: Retail Sales: Consensus sees core retail at -0.2% m/m, following last month’s -1.1%.

- US: Fed speak: Fed’s Barkin and Bowman speak. Unlikely to hear much new given the extensive amount of Fed speak recently.

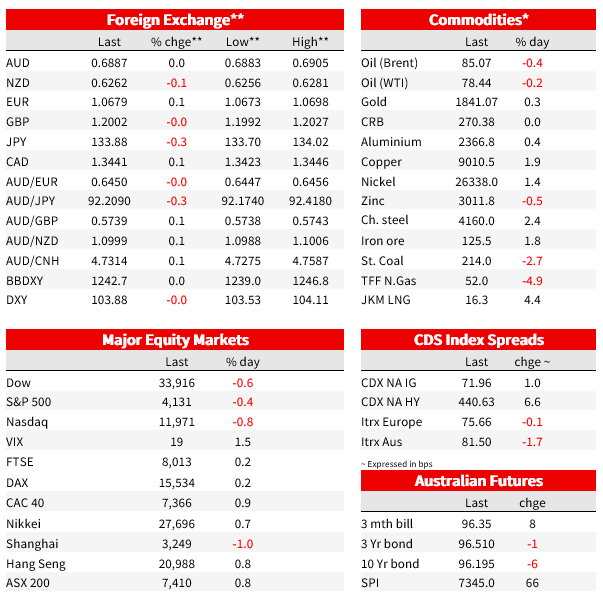

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.