Markets Today: Big Trouble in Zero-COVID China

China protests and COVID have seen a tone of caution to start the new week.

Today’s podcast

Overview: Big Trouble in Zero-COVID China

- Risk off tone as China COVID further clouds outlook

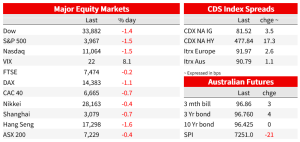

- Equities are lower; S&P500 currently -1.5%

- AUD weakest of G10, down 1.5% to 0.6652

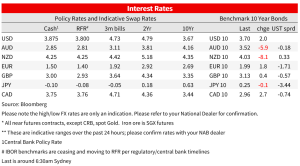

- US rates slightly higher as Fed speakers stick to hawkish script

- Coming up: JN unemployment, GE inflation, US consumer confidence

China COVID worries have weighed on sentiment, though the tension between near-term disruptions and the prospect of eventual reopening continues. The dollar is higher on the DXY, equities globally are lower, and the AUD is off 1.5% to 0.6652, the weakest of the G10 currencies. Fed officials insisted there was more work to be done to tame inflation, with Bullard saying markets may be underestimating the chances of higher terminal rates helping US equities extend further into the red in the US afternoon.

China protests and COVID have seen a tone of caution to start the new week. Chinese markets opened the new week in the red, the Hang Seng was down as much as 4.5% and the CNH off almost 1% intraday before paring losses, the Hang Seng ending down 1.6% but the CNH now back around 0.7% lower against the USD. Losses were pared as the prospect of greater near-term disruption to activity was weighed against eventual reopening and as Monday saw no repeat of weekend demonstrations amid a heavy police presence. With mounting evidence of public dissatisfaction with the current settings and another new daily record for COVID cases, a forward-looking focus remains on the prospect of movement away from COVID-zero. Reopening stocks including airlines and restaurants proved relatively resilient in Monday’s selloff and US-listed Chinese stocks rebounded.

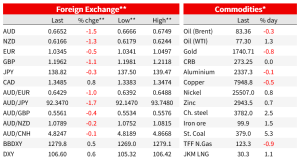

In currency markets, the further clouded near-term outlook for China and the weaker yuan saw the AUD down 1.5%. The AUD is currently around 0.6652 after ending last week around 0.6754. That puts the AUD back around levels before the move lower in the USD on Wednesday last week. The NZD also underperformed, 1.3% lower to 0.6166. The dollar is 0.6% stronger on the DXY. The euro lost 0.5% to 1.0345, although had spiked towards 1.05 overnight, its highest level in almost five months. The JPY gained 0.2% against the USD to its strongest level since August

Broader markets have also traded with a risk-off tone. The S&P500 is currently down 1.5% and the NASDAQ 1.6%, although these moves follow a strong run for US equities over the past six weeks. A 3% fall in Apple’s share price, after Bloomberg reported that the recent issues at its huge factory in Zhengzhou would likely see a 6 million shortfall of iPhone pro units this year, weighed on the broader indices. WTI oil fell to year-to-date lows yesterday afternoon, below $74, and Brent dipped and low as $80.61 on Chinese demand concerns, but it has reversed that move overnight on expectations OPEC and its allies expected to consider deeper production cuts when they meet this weekend. Copper futures have also recovered most of their losses from yesterday.

US 10yr yields fell to around 3.62% yesterday but have since recovered to be 2bp higher on the day at 3.70%. Fed speakers emphasised more hikes to come. St Louis President James Bullard said in a webcast interview that “Labor markets continue to be extremely strong,” and that markets are underpricing the risk FOMC may need to be more aggressive . Terminal pricing is currently around 5% early next year. Bullard reiterated he sees rates needing to get to the bottom of a 5-7% range, but sees a slowing in growth rather than a recession. New York President Williams, at about the same time, said rates had further to go, and that the Fed wouldn’t be rushing to cut rates. He said that policy is already cooling demand and reducing price pressures but that “I do think we’re going to need to keep restrictive policy in place for some time. I would expect that to continue through — at least through — next year.” Loretta Mester said the FOMC isn’t near a pause.

The message from ECB officials was also that there is more to do. President Lagarde emphasised that “how much further we need to go, and how fast we need to get there, will be based on our updated outlook, the persistence of the shocks, the reaction of wages and inflation expectations, and on our assessment of the transmission of our policy stance, ” leaving a lot of room for flexibility. Though she added that that may require rates to move into restrictive territory and that ECB economist say the risks are to the upside. Early in the day, comments from Dutch central bank chief Knot were less equivocal. He called the underlying inflation trends worrying, said that talk about over-tightening now was ‘a bit of a joke’ and that his main concern is declaring victory on inflation too early as it would take a protracted period to tame prices. Lagarde also said she’d be surprised if inflation had peaked. Ahead of Eurozone inflation numbers on Wednesday, German and Spanish reading are out overnight. Markets currently price around a 47% chance of 75bp from the ECB on 15 December.

While much of the focus was on the implications of developments in China, in Australia yesterday retail sales surprised lower at -0.2% m/m against 0.5% expected. The decline was broad based across the goods components excluding food, while cafes restaurant and takeaway spending, declined for the first time since January after a period of very rapid growth out of COVID impacts. The numbers confirm a slowing in goods spending, which had flatlined at very elevated levels over the past few months but is unlikely to be enough for the RBA to conclude the so far resilient consumer has turned a corner. RBA Governor Lowe in front of Senate Estimates yesterday said little of note for the near-term direction of policy, though did hold on to the RBA’s characterisation that growth in labour costs is consistent with inflation returning to target, which meant Australia had a better chance than others of achieving a soft landing.

Coming Up

- A rare quiet day in Australia in an otherwise busy week. Japan unemployment and retail sales data are out this morning.

- In Europe, ahead of preliminary Eurozone inflation on Wednesday, German and Spanish numbers released overnight will get some interest. Expectations for the German CPI are for a 0.2% fall m/m and the y/y rate unchanged at 10.4%. The ECB’s Guindos and de Cos speak and the final November EC Consumer Confidence number is released.

- On the US Calendar, the November US Conference Board measure of consumer confidence is seen falling to 99.9 from 102.5. Labour market indicators are worth a look for evidence of cooling. The number of respondents who saw jobs plentiful fell in October, while the number that saw them hard to get rose. S&P Corelogic September House Prices are seen down 1.2% m/m, while Canada Q3 GDP is expected to show 1.5% quarterly annualised growth

Market Prices

NAB Markets Research Disclaimer