Markets Today – Singing from the same hymn sheet

US equities began the new week cautiously with hawkish Fed talk and concerns over upcoming earing season playing to the wariness in the air. A decline in UST yields weighed on the USD, but the AUD was unable to perform amid concerns over China and softer bulk commodity prices.

Today’s podcast

- US equities struggle for direction ahead of CPI and earnings season

- UST yields fall led by the belly of the curve

- US Consumer inflation expectations fall for a third month in a row

- Most overnight Fed speaker (ex Bostic) support further rate hikes

- USD on the back foot as UST yields decline

- Softer China inflation print symptomatic of a slowing economy

- AUD unable to perform. China and softer commodities weigh

- Coming Up: NAB Business Survey, AU Consumer Confidence, UK jobs, US NFIB

Events Round-Up

CH: CPI (y/y%), Jun: 0.0 vs. 0.2 exp.

CH: PPI (y/y%), Jun -5.4 vs. -5.0 exp.

US equities began the new week with a cautious tone, trading in and out of positive territory. Hawkish Fed talk and concerns over upcoming earing season playing to the cautiousness in the air. After the move up in yields last week, UST yields traded lower overnight with the move supported by another mover lower in US consumer inflation expectations. The decline in UST yields weighed on the USD, but the AUD was unable to perform amid concerns over China and softer bulk commodity prices

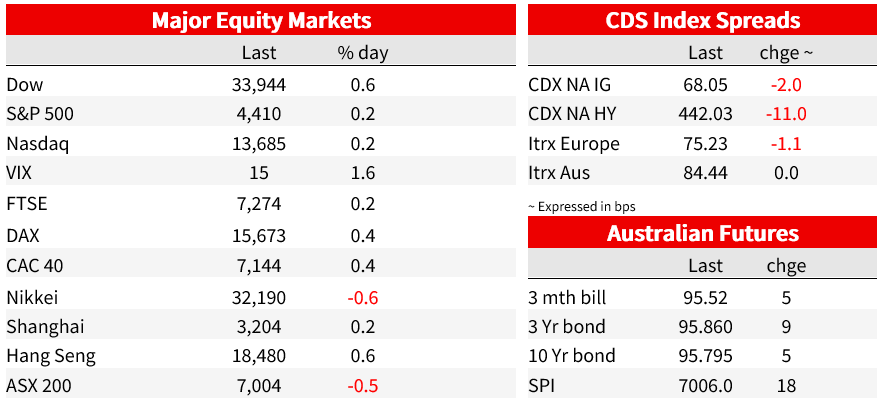

US equities have struggled for direction at the start of the new week, the S&P 500 traded in and out of positive territory with a small uptick into the close helping the benchmark close the day with a modest gain of 0.24% (the NASDAQ was 0.18%). This small gain ended a three day losing streak, but of note some of the mega stocks struggled with Amazon and Tesla down close to 2%. Ahead of the US CPI, Fed speakers were out in force overnight with most singing from the same hawkish hymn sheet.

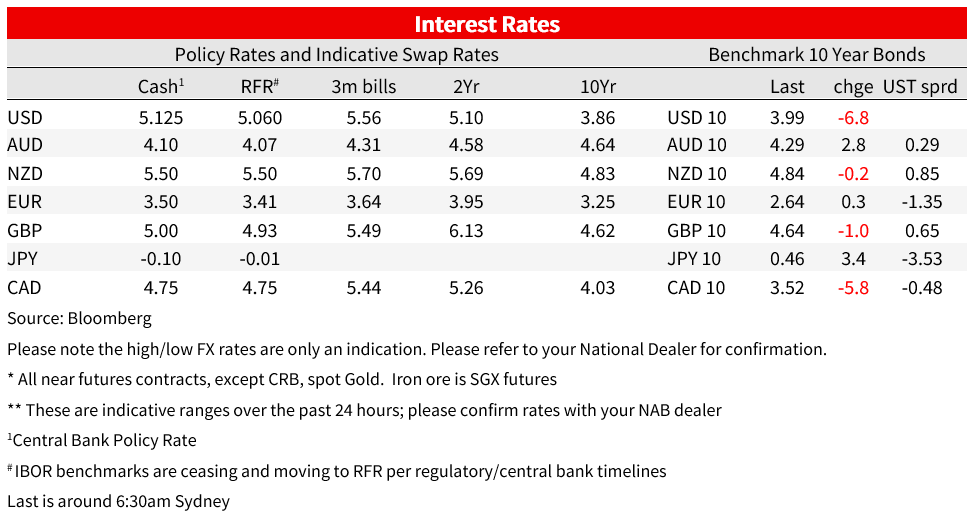

Fed Barr, Mester and Daly supporter the idea of further rate hikes over coming months in order to bring inflation back down to 2%. Fed Mester said “In order to ensure that inflation is on a sustainable and timely path back to 2%, my view is that the funds rate will need to move up somewhat further from its current level and then hold there for a while “. In a similar vein, Fed Daly said “We’re likely to need a couple more rate hikes over the course of this year to really bring inflation back into a path that’s along a sustainable 2% path,”. In contrast, Atlanta Fed Bostic, sounded a bit less hawkish, noting that while the rate of inflation is too high, policymakers can be patient for now amid evidence of an economic slowdown.

In addition to the mostly hawkish Fed talk and US CPI release on Wednesday, equity investors are also seemingly wary of the new earning season that kicks off in earnest later in the week when some of the big US banks report their Q2 figures . A Bloomberg survey noted investors are on the lookout for profit warnings as the move up in yields begins to bite with optimism of a soft landing for the economy fading with stubbornly high inflation keeping central banks hawkish.

Moving on to the rates markets, after the big rise in yields recorded last week, UST yields traded lower overnight with the belly of the curve leading the charge. The 5y tenor fell 12bps to 4.238% while the 2y Note declined by 8bps to 4.863%. As I type the 10y Note has edged just below 4% (3.99%), down 7bps over the past 24 hours.

A combination of factors has seemingly played into the move lower in yields outweighing the hawkish message from most Fed speakers. Overnight the NY Fed released its latest US Consumer inflation expectation survey which revealed a third monthly consecutive decline in the one year median inflation expectations, down to 3.8% from 4.1% in May. The inflation outlook at the three-year horizon was unchanged in June at 3%, while the five-year measure rose by 0.3 percentage point to 3%. The move lower in the 5y part of the curve was also supported by a Morgan Stanley recommendation to buy 5y Treasuries on the view that inflation is “likely to fall precipitously into year-end.”

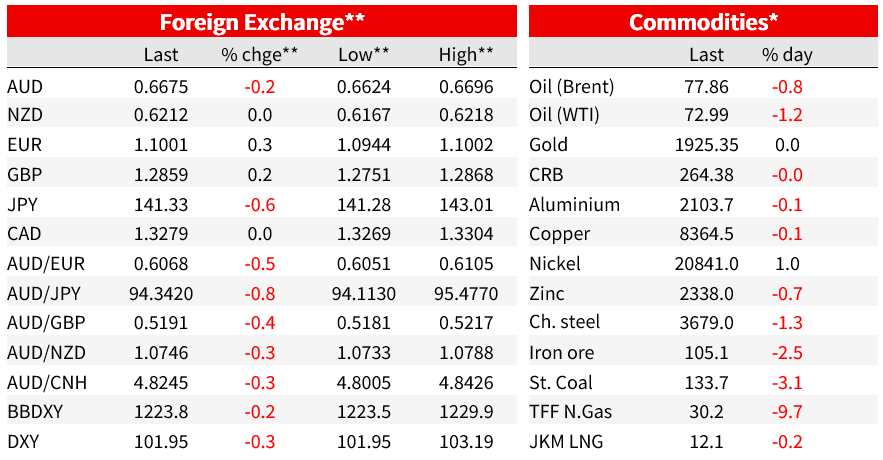

The USD edged a little bit higher during our trading session yesterday, but then overnight it succumbed to the move lower in UST yields. The USD is down around 0.25% to 0.3% when looking at the DXY and BBDXY indices and vs G10 the greenback is down mostly against JPY and European FX. The AUD is the notable underperformer, down 0.22% over the past 24 hours and starts the new day at 0.6675.

The NOK is at the top leader board up 1.3% an impressive move when considering oil prices are down ~0.9% overnight. Instead, gains in the NOK were driven by a bigger than expected rise in Norway’s core inflation (7.0%yoy in June vs the 6.6% forecast by analysts) fuelling the notion of further rate hikes by the Norges Bank. JPY is up by 0.63% with USD/JPY trading at ¥141.34 supported by the move lower in UST yields and cautiousness in equity markets. Meanwhile the euro also managed a modest gains, up 0.3% to 1.1002.

Yesterday China inflation data for June printed below expectations. CPI inflation declined from 0.2% y/y in May to 0.0% last month, that was a 28th month low, raising concerns of deflation. Meanwhile PPI deflation deepened further last month ( -4.6% y/y in May to -5.4% last month) to its lowest in more than seven years. The lack of price pressures in China is symptomatic of a slowing economy with anaemic demand reflecting the need for a robust fiscal stimulus.

The data release weighed on bulk commodities which partly explained the AUD underperformance against a softer USD backdrop. Iron ore closed the day 3.78% lower while Thermal coal was -3.1%.

Coming Up:

- This morning New Zealand publishes credit card spending figures for June and Australia gets its monthly Consumer survey followed by the June NAB Business survey. Last month business conditions continued to ease with notable declines across the trading, profitability, and employment sub-components, so we will be paying close attention to see if these trends remain evident in June. Also in May, Confidence fell to -4 index points in the month and has tracked at or below 0 since February – with most industries now in negative territory.

- Later today the UK releases Labour market figures for May. The unemployment rate is seen unchanged at 3.8% and employment change at +80k vs 250k prev. That being said, the highlight is likely to be May Average Weekly Earnings where the prior April data revealed a sharp rise in wages to 7.2% 3M y/y and to 7.9% for the private sector.

- Germany releases is final CPI reading for June (unchanged at 6.4%yoy) along with the ZEW Survey where Expectations are seen down to -10.5 from -8.5 while current Situation is also expected to deteriorate to -61.5 from -56.5.

- The US gets the June NFIB small business optimism, 89.9 expected from 89.4 previously.

- ECB Villeroy speaks.

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.