Robust growth for online retail sales observed in June

Insight

A strong start to the new year after a volatile 2022 is offering attractive conditions for capital markets participants ready to act while stability holds.

With the triple shocks of COVID fallout, a war in Europe and the subsequent rise of global inflation, 2022 was a pivotal test for the resilience of capital markets.

While such economic and geopolitical realities are yet to recede, 2023 so far signals a return to more stable conditions, offering value for investors and better funding certainty for issuers, NAB market specialists say.

Sarah Samson is NAB’s Global Head of Securitisation Origination and says she is cautiously optimistic looking ahead as the market continues to adjust over a challenging period.

“We’ve already had a great start to the year,” Samson says. “Markets have been calmer and open. That doesn’t mean all-time record low pricing, but there’s a healthy pipeline, and if things continue the way they are it will be a solid year for funding capital markets.”

Samson says the perfect storm of challenges which hit the market hard after February 2022 has resulted in asset repricing globally to offer greater value and certainty for 2023.

“I think this will be more a ‘normal year’ where there are a few challenging periods for whatever reason but on the whole it should be more stable,” she says.

“So far there are a lot of green shoots and positive sentiment coming from investors, which was really absent for most of last year. We’ve seen some very good senior unsecured issuance which is usually a good sign for securitisation.”

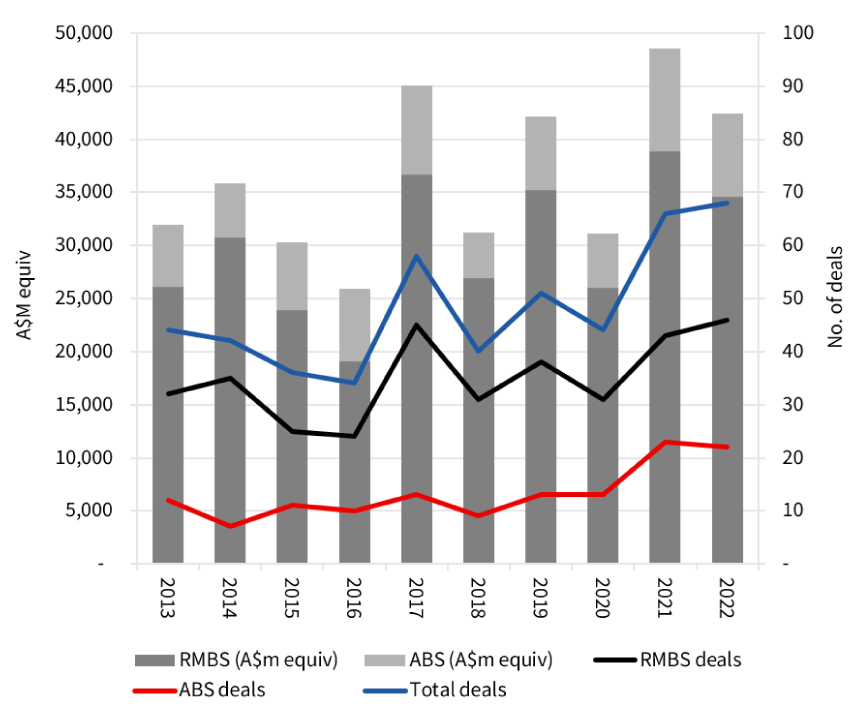

NAB data shows total public RMBS and ABS issuance was A$42.1 billion in 2022, down 13% from 2021’s record A$48.6 billion. However, there were 68 deals issued into the market, two more than the previous year and a new post-GFC high1.

Australian collateral-backed RMBS issuance

Samson says renewed investor interest, after a year of concerns over managing redemptions and liquidity, means issuers should have confidence to come to market, while still being prepared for those periods of disruption.

“Try to be nimble and take advantage of stable markets while they’re here. Go early, because like last year showed us, you just never know what’s going to happen.”

Samson says the repayment of the RBA’s term funding facility (TFF) COVID-era stimulus this year would be a driving factor for markets, with bank issuers returning after a lengthy absence and more being open to RMBS than historically.

She says while the non-banks will be competing for the same investment pool, the extra ADI issuance can actually help by setting very good pricing to piggy-back off.

The impact of rising rates on the economy and higher wholesale funding costs in a post-stimulus era, however, will put greater focus on the performance of underlying assets and credit quality going forward, Samson adds.

“Australian securitisation product will continue to offer good value relative to global product. Even though we expect some credit stress, I think it will hold up far better than potentially credit in the US and the UK, for example, which is often what we’re competing with for investors.”

Samson says while global risks remain somewhat heightened – reflecting the US economy and ongoing geopolitical tensions – a positive takeout from the run of shocks in 2022 came with the orderly sell-off in securitisation after the reaction to the UK Government’s mini-Budget in September. This included large volumes of Australian RMBS and Samson says investors can be confident of the liquidity this event showed.

For NAB Syndicate Executive Director Richard Coyne, engaging across the range of capital markets transactions locally gives insight into the macro themes in play this year for Australian issuers and investors.

Coyne says while some of the risks and volatility remain to impact issuance windows, the market has started very strong for the year on investor appetite and credit spread performance.

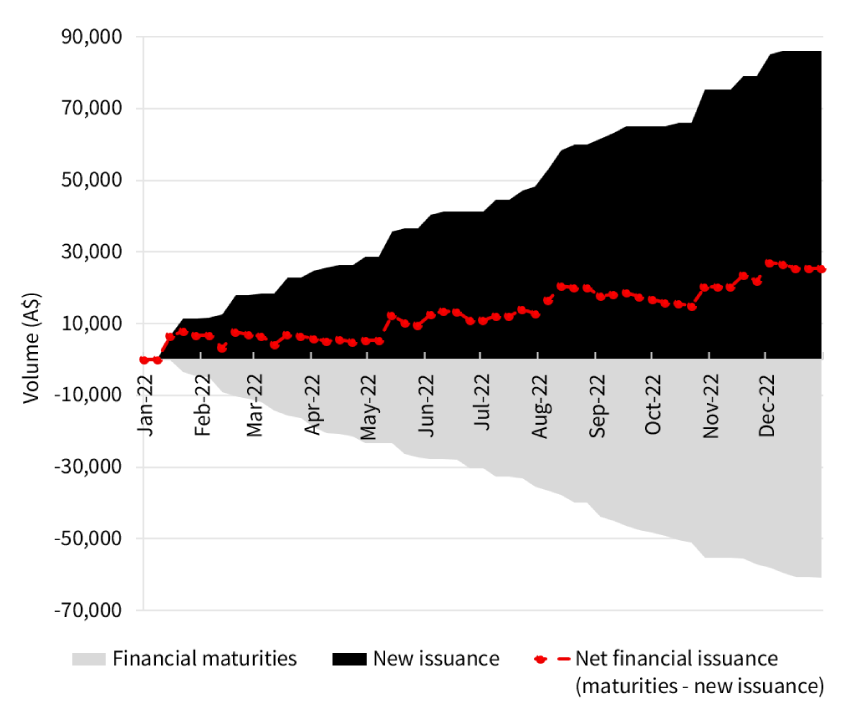

He says the unwinding of COVID-era stimulus and the roll-off of the TFF remains a big factor, with similar drivers globally in Europe with the Term Long Term Repo (TLTRO) and quantitative tightening in the US.

A$ financial redemptions vs new issuance FY22

On the broader economic front, the outlook for inflation is another key talking point, with the market suggesting a return to pre-COVID levels over time but with uncertainty still in the air on factors like the effects of China’s economy re-opening and geopolitical jitters.

Locally, the impact of the “fixed rate cliff” where low fixed rate mortgages begin to reprice over coming months is yet to be seen, he says.

Despite the challenges, Coyne says there has been a strong capital market response so far this year, with issuers and investors having a more complete risk picture now, which has been factored into pricing for some instruments over 2022.

“The evidence that we’re seeing in primary market transactions right now is that investors certainly have cash to put to work and are willing to put it to work,” he says. “They see the relative value that is on offer in fixed income at the moment and they’re keen to invest in offerings that they see value in.

“We’ve got interest rates and credit spreads at attractive levels relative to what they’ve been in the past. What happened last year – the sell-off in bond yields and credit spreads – has created a lot of value in fixed income.”

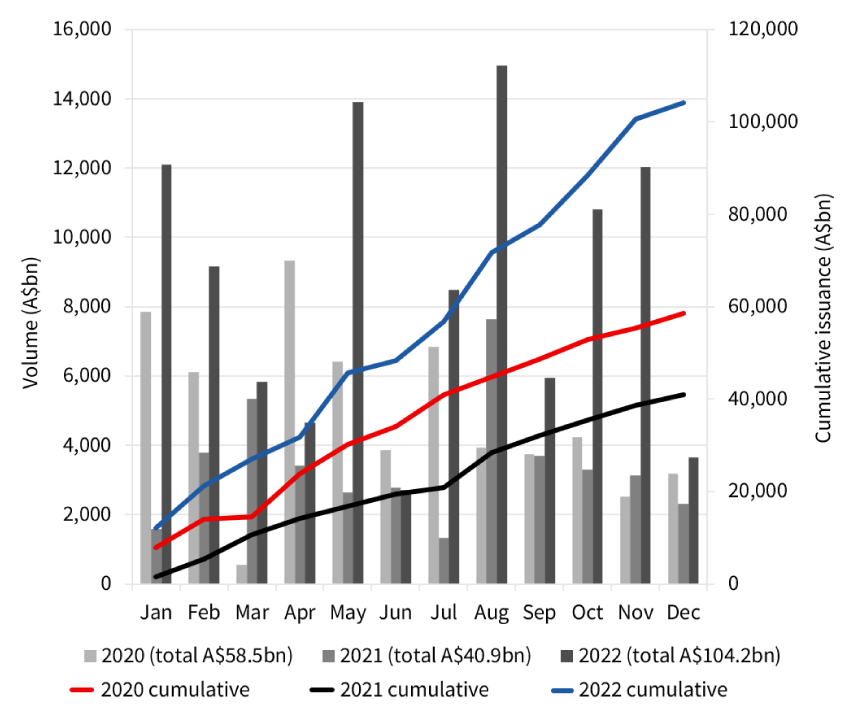

A$ financial issuance – month by month analysis

Coyne says with these “normalising” of conditions it makes sense for issuers to fund promptly ahead of any left-field risks that may emerge.

“There will be periods where the markets will be challenged again,” he says. “So think about getting your funding plan and executing the majority of it early, if you can, or getting ahead of your run rate. Don’t sit on your hands, because things can change very quickly.”

Coyne also notes a number of successful transactions from major and regional banks as indicative of a more “steady state” refinancing perspective for the financial sector as more ADIs enter the market.

“I would put heavy weight on the fact that there have been some phenomenal transactions done at the back end of 2022 and in January,” he says. “The evidence is the primary market is extremely robust at the moment.”

Coyne says this holds true for government as well, and while corporates have been away from the market, there is strong demand for diversity there too.

Anecdotally, investors are making inquiries asking after corporate issuance, which remains scarce, while at the same time the senior bank paper is being well-absorbed. After taking a more conservative approach over the past year to help manage liquidity, it seems asset managers with surplus capital are looking for opportunities in 2023.

After a slowdown globally over the disruption of the past year, ESG investing is again an overarching theme in 2023, as societal and generational shifts create greater appetite for sustainable product.

NAB securitisation market analysis shows in 2022 there were A$1.6 billion of green and social notes priced from seven different issuers, up from A$985 million from three issuers in 20212. Further growth in sustainable finance securitisation is anticipated in 2023, the analysis shows3.

Bloomberg New Energy Finance reports global ESG bond sales rebounded in January to record the highest month in a year at US$111.4 billion. This is the busiest since the January 2022 figure of US$111.8 billion, the Bloomberg compiled data says4.

The local market has seen a number of green loans and sustainably-linked loans closing in December 2022 and January 2023 as well as green and sustainable bond issuance, NAB data shows5.

NAB Sustainable Finance Director Sharyn Jaques says the increasing ambition around decarbonisation and evolving demands for data and disclosure are providing exciting opportunities to support customers in the move to a low carbon economy.

“We’re here to support our customers on their journeys to embed ESG into their businesses and specifically in aligning financing to ESG strategy,” Jaques says. “It’s great to see momentum in the market, with a pull from investors as well as ongoing work on industry certification and transparency. It’s an ever-evolving space which we can help navigate.”

She says as the 2030 interim goals get closer, it makes good business sense for customers to be addressing these material risks and aligning finance appropriately.

“If businesses are addressing their material ESG risks then they’re demonstrating commitment and ambition to the market and the business is thinking long term,” Jaques says.

“There’s a lot of work to be done and I’m optimistic and excited about what 2023 will bring.”

1 NAB internal data

2 Ibid

3 Ibid

4 ESG Bond Sales Hit 12-Month High; Debut Deals Pile Up – Bloomberg

5 NAB internal data

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.