Family succession on the back-burner? Delay can create unforeseen complications down the track

Article

Private equity has made headlines in Australia over the past year or two, but for many of the wrong reasons. The demise of Dick Smith Holdings was a high profile collapse that impacted many shareholders and retail customers, and a lot of blame has been pointed at the private equity fund manager who floated the business.

While there’s no denying private equity is a risky asset class, its benefits are well known and widely proven. When managed well, it can provide excellent diversification and return potential. This is especially relevant right now, with high volatility and low returns coming from listed shares and fixed income.

MLC’s Alicia Gregory sheds some light on the diversity of the asset class.

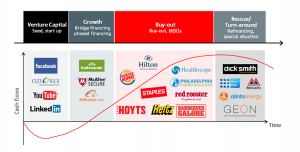

A good way of looking at the private equity investment universe is by breaking it into four categories: venture capital, growth, buy-outs and rescue/turn-arounds. This is illustrated in chart 1.

Chart 1: The private equity investment spectrum

Source: MLC Private Equity.These companies have been chosen for illustrative purposes only. MLC Private Equity may not invest in all or any of these companies.

These are companies in their early stages – they’re looking for seed capital and they’re in the start-up phase. You’re investing in an idea or a business plan, for example, the early days of Mark Zuckerberg demonstrating his first prototype of Facebook, with a few parties willing to invest and provide advice to help them expand and grow.

It’s an exciting investment category with lots of buzz, especially in places like Silicon Valley. But while the potential rewards can be huge, it’s important to remember it’s very easy to lose out. Harvard Business School lecturer Shikhar Ghosh’s research indicates that as many as 75% of venture-backed companies fail1.

Growth investing is similar to venture capital, but it’s investing at a later stage. The company will tend to have revenue streams and profits, but needs finance to help grow further.

With both venture capital and growth investments, you tend to take a minority stake in the business. An important role of the investor is to provide advice and guidance to help the company grow, navigate new markets or create new product lines. The best investors here tend to be entrepreneurs themselves; they’re people who accept failure, understand risk, want to be alongside the company for the ride and help them make good decisions. For example, private equity investors, including Silver Lake Partners and General Atlantic, helped founder Jack Ma grow Alibaba into one of the largest e-commerce companies globally and guided the company to a successful US initial public offering (IPO).

Unlike venture capital and growth, with buy-outs you take a controlling stake of the company. The investor will run the business plan. They’ll usually have an idea about how they can optimise the business and make back a significant return on their investment in a short period of time (three to five years). These investors will tend to use debt and leverage to optimise the business and capital structure. For example, Australian buy-out manager Pacific Equity Partners acquired cinema group Hoyts and transformed the business through fully digitising the cinema network, entering out‐of‐home advertising and expanding into adjacent verticals, such as Hoyts DVD kiosks and streaming, before successfully exiting the company to a trade buyer.

Here, you’re investing in a failing company or a complex transaction that a regular investor would run a mile from. You often need to take control, roll-up your sleeves and really help the company transform. Like venture capital, the potential loss rates here are high. There are only a handful of investors who have proven they can invest successfully in this field and these are the types of transactions which tend to hit the headlines when things go badly. For example, TPG acquired power generation company Alinta in 2010 in the largest debt-for-control restructuring in the Australian market at the time. They recruited a new CEO from AGL Energy and successfully completed the operational turnaround of the company in conjunction with their in-house operations team.

With low returns and high volatility coming from listed shares and fixed income at the moment, investors are looking for alternative sources of returns. Private equity is a risky asset class, but with risk comes higher return potential. Chart 2 shows the massive dispersion of returns that have come from investing in private equity historically.

What’s more, private equity returns don’t tend to be influenced in the same way by factors that impact broader share and fixed income market returns. This means, when it’s part of a broader portfolio, private equity can provide excellent diversification and potential for returns.

Chart 2: Private equity has historically provided a wide dispersion of returns

* Returns are based on the internal rate of return (IRR). IRR is a standard calculation used to measure the performance of private equity.

Source: Preqin Performance Analyst. Past performance is not a reliable indicator of future performance.

So there are many different types of investment opportunities within the private equity universe, but it’s clear that the average investor wouldn’t have the amount of money or expertise needed to invest directly in these types of opportunities.

Specialist private equity fund managers exist to find the best investments across the spectrum. They are experts in their field and tend to get access to the best deals first. Accel Partners, Sequoia and Benchmark are just a few global specialists.

MLC takes a combined multi-manager and co-investing approach to investing in private equity. This means we invest into a range of private equity fund managers, as well as alongside these managers directly into some of their most attractive portfolio companies. This helps diversify the risk of investing, and expands the investment set. MLC then gives Australian investors access to the world of private equity, via a regular diversified multi-asset portfolio.

To request further information about the MLC PE program please contact your Private Client Manager.

1Why Companies Fail – and How Their Founders Can Bounce Back: http://hbswk.hbs.edu/item/why-companies-failand-how-their-founders-can-bounce-back, as at 16 May 2016.

Important information

This information is provided by nabInvest Capital Partners Pty Limited (ABN 44 106 427 472, AFSL 308953) trading as MLC Private Equity (“MLC Private Equity” or “We”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060.

The information in this communication may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

You should obtain a Product Disclosure Statement (PDS) relating to any financial products mentioned in this communication and consider it before making any decision about whether to acquire or continue to hold these products. A copy of the PDS is available upon request by phoning the MLC call centre on 132 652 or on our website at mlc.com.au.

NAB does not guarantee or otherwise accept any liability in respect of any financial product referred to in this communication.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.

This information is directed to and prepared for Australian residents only.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.