23 April 2025

April 16, 2024

Supporting the transition in 200 deals

NAB has marked a major climate milestone with the bank’s 200th renewable energy transaction as Australia looks to step up investment in the sector ahead of 2030 targets.

By Andrew Smith

When NAB started financing utility-scale renewable energy projects in 2003, it heralded a tremendous opportunity to make an impact in helping to address climate change.

Back then, generation from renewables in Australia formed less than 10%1 of the total mix, with the bulk coming from hydro and significantly smaller amounts from wind and solar2.

Financing renewable energy through project finance was also in its infancy, with structures relatively conservative and the banks still getting to grips with resource and technology risks in the sector.

The first utility-scale project to reach financial close with NAB in Australia was the 66-megawatt (MW) wind farm at Cathedral Rocks, a stunning and remote coastal site near the southern tip of the Eyre Peninsula in South Australia.

The area’s rugged limestone sea cliffs look out towards Antarctica and are buffeted by strong winds, making it a prime location for the joint-venture between Acciona Energia and EnergyAustralia. Both companies hold 50% equity in the project which has powered the equivalent of 35,000 homes every year since becoming fully operational in May 20073.

Fast-forward to today, with NAB marking our 200th renewable energy deal globally, the market has matured significantly, with an established track record, a more diversified energy generation mix and an increase in investment, driven largely by energy transition momentum and legislated climate targets.

Image: Cathedral Rocks Wind Farm (Credit: Getty Images/John White Photos)

Expanding capacity

The milestone brings NAB’s committed renewable energy project funding to $16.8 billion since 20034. To help achieve a net zero future, however, Australia still needs a vast amount of capital as we crucially decarbonise the energy sector as a key part of achieving the nation’s transition goals.

Estimates from Bloomberg New Energy Finance say $300 billion5 is needed for utility-scale wind and solar photovoltaic projects to ensure we can expand to include enough renewables capacity to meet Australia’s 2050 net zero target.

Latest figures cited by the Australian Energy Market Operator (AEMO) for the first half of 2023 show renewable energy now accounts for almost 40%6 of the total capacity delivered through the National Electricity Market (NEM).

This makes for a significant investment opportunity today. To help reach the 2030 interim target of 82% renewables for the NEM, the Federal Government’s expanded Capacity Investment Scheme is set to provide opportunities totalling $67 billion7 alone. This is for a total of 32GW of new capacity nationally, to be made up of 23GW of renewables capacity and 9GW of clean dispatchable capacity.

NAB’s funding commitments are playing a role here, including the recent deal milestone set with Squadron Energy’s Uungala Wind Farm8 near Wellington in regional New South Wales.

Construction has officially started on Squadron’s 69-turbine, 414MW project which when complete is set to generate enough renewable electricity to power more than 220,000 homes and avoid more than 560,000 tonnes of carbon emissions that would otherwise go into the atmosphere each year9.

The road ahead

Ultimately, ageing coal-fired power plants are set to retire, and renewable energy firmed with storage and backed by gas is the lowest cost replacement pathway10. The capital investment opportunity here is both deploying into new projects and continued consolidation/M&A of operational assets.

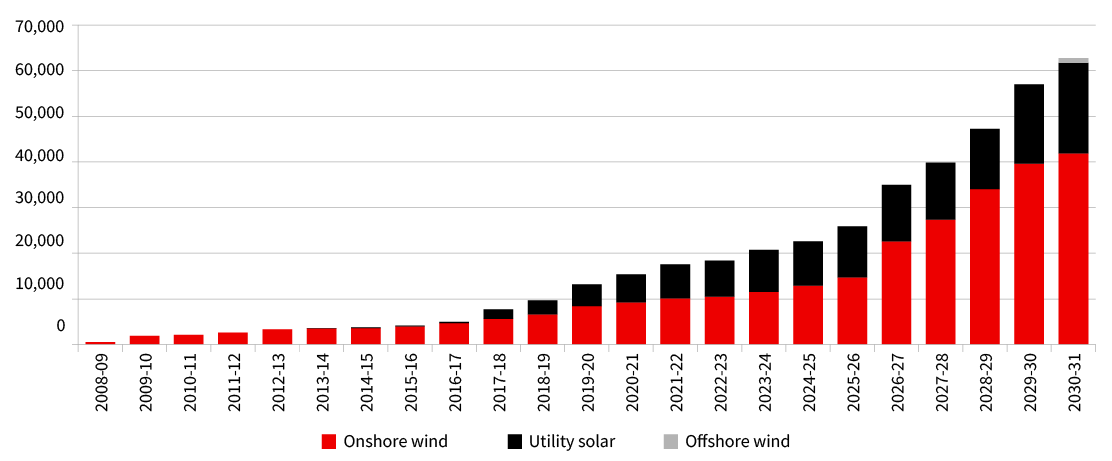

This is in line with the AEMO’s Draft Integrated System Plan 2024, which forecasts installed capacity of renewables will grow from around 18GW in 2022-23 to more than 60GW in 2030-31.

The chart below shows the projected growth in onshore wind, offshore wind and utility solar capacity in the NEM under the “Step Change” scenario contained in the plan to meet Australia’s emission reduction commitments in a growing economy11.

Under this scenario the installed capacity of these three technologies grows by 44.3GW from 18.4GW in 2022-23 to 62.7GW in 2030-31, highlighting this potential opportunity for capital investment.

NEM installed capacity (MW)

Chart: NAB, data AEMO

From a debt financing perspective, NAB continues to see the bank market as a reliable source of funding, with the renewables build-out an attractive opportunity for balance sheet support.

Carefully assessing reliability and price with the realities of the transition, however, is not easy. Supply chains, grids, planning, social licence issues, capital allocation/cost of capital, offtake arrangements and global competition remain key areas of focus.

Given the scale of the funding task we also see alternate debt markets as being important sources in the medium to long-term, so helping develop these markets to ensure they are ready is another priority.

As we mark NAB’s 200th deal, however, it’s worth noting how far the sector has come.

While resource and technology risks remain, banks today are more focused on the value of the output (price risk) and whether it can be exported (grid risk).

As technology has evolved, project size has increased needing greater funding, while in many markets, utility-scale renewables are now the lowest cost new entrant providers of bulk electricity. Where subsidies still exist, they are often price stabilisers rather than seeking to bridge material price gaps.

We’re also seeing a progressive change of the investor universe, broadening continually as investors respond to climate change in different ways. In the early years, interest was mainly driven by the utility companies. Today, while utilities remain a constant source of capital, it is private capital that is the driving force.

NAB acknowledges the move towards renewable energy sources is critical to the decarbonisation of the electricity grid and Australia meeting its emissions reduction goals12.

In the 2023 financial year, NAB lent more than $2 billion to renewable projects and has already committed over $2 billion in the first half of FY24.

Successfully closing our 200th renewable energy transaction globally is an important milestone for NAB and one we are very proud of as a tangible proof point of NAB’s support of customers in their transition towards a more sustainable future.

We thank all our customers and look forward to continuing the journey together as we embrace the opportunities of the transition.

1. Australian electricity generation | energy.gov.au, opens in new window

2. Australian electricity generation renewable sources | energy.gov.au, opens in new window

3. Cathedral Rocks wind farm | ACCIONA | Business as unusual, opens in new window

4. NAB milestone shows appetite remains strong for renewable energy projects – NAB News

5. BloombergNEF “Australia’s Net Zero Needs $413 Billion in Power Spending – May 29, 2023

6. Draft-2024-isp.pdf (aemo.com.au), opens in new window

7. Capacity Investment Scheme – DCCEEW, opens in new window

8. Squadron Energy starts work on largest NSW wind farm, opens in new window

9. Ibid

10. Draft-2024-isp.pdf (aemo.com.au), opens in new window

11. Ibid

Corporate and Institutional Renewable energy