Welcome to NAB’s newsletter on the Sustainable Finance market from an Australasian perspective.

Insight

Welcome to NAB’s newsletter on the Sustainable Finance market from an Australasian perspective.

Insight

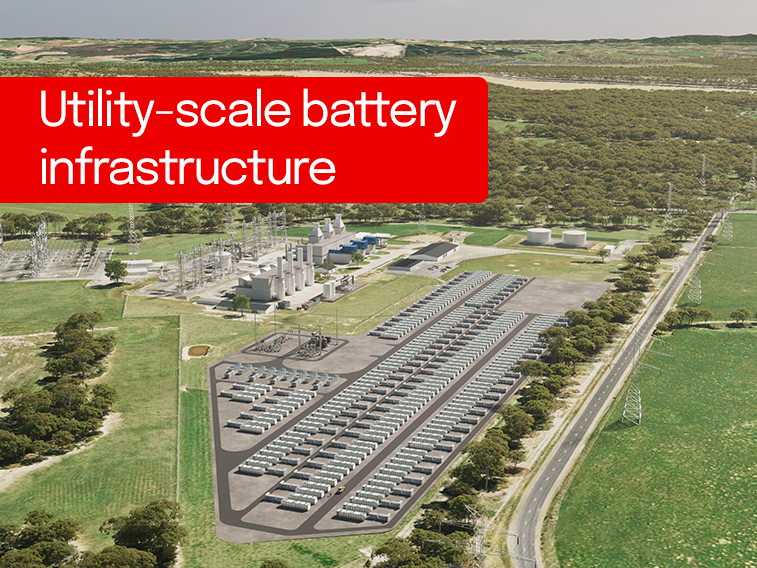

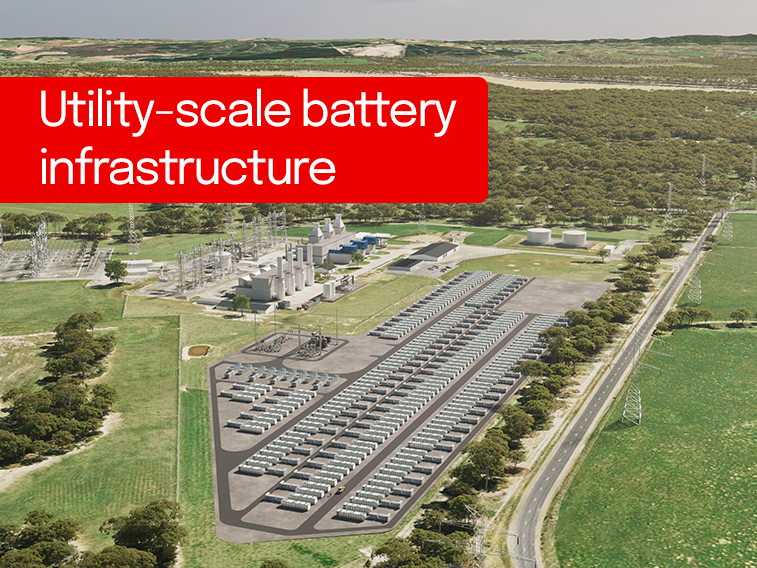

Providing a secure, renewable energy supply is critical for the energy transition, with utility-scale battery infrastructure supported by NAB playing an important role.

Australian carbon project developers see a maturing of institutional financing as key to scaling the market and taking it on a similar trajectory as renewable energy.

NAB has marked a major climate milestone with the bank’s 200th renewable energy transaction as Australia looks to step up investment in the sector ahead of 2030 targets.

Article

Australia needs a vast amount of capital to build out the utility-scale wind and solar projects to power a net-zero future by 2050. NAB’s Executive, Specialised Finance, Andrew Smith and Executive, Capital Markets, Sarah Samson explore potential debt funding options in market.

Article

Rural businesses are looking for equipment funding solutions that meet their needs in an evolving environment. Article originally published in The Advisor on 20/09/23

Article

The new report asks 800-900 Australian corporates across the non-farm business sector (who may or may not be NAB customers) on their progress, plans and strategies to achieve net zero greenhouse gas emissions.

ACCU discount to global prices is out-of-step with looming step-change in demand. View the full report.

A look at what's been happening in the sustainable finance market in Australia and abroad.

RBA surprises (most) for second month running with 50bps Cash Rate rise to 0.85%

NAB’s first sustainability-linked foreign exchange (FX) derivative aligns environmental, social and governance (ESG) targets with financial risk management for a major London-listed infrastructure investment company.

Australia’s first female Deputy Chief of Army has a personal stake in building workplace diversity as she outlines her strategic insights – from geopolitics to sustainability - as special guest at the NAB Capital Markets 2022 conference.

After the fanfare of the opening statements and commitments, the second week at Glasgow meant bridging divides to reach a consensus deal in extra time as the Paris 2015 ambitions start to take flight.

An insight into what the road to carbon neutrality really looks like

While the world’s press and pundits assess the ongoing talks in Glasgow, we look at what’s happened so far and what to expect during this crucial time for climate action.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.