Sustainable finance update: August 2020

An Australasian perspective on sustainable finance markets.

Market overview

H1 sustainable finance market outlook

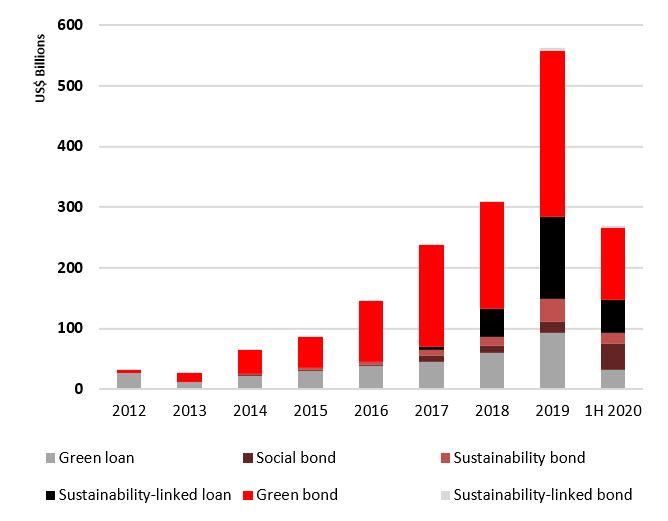

H120 Global Sustainable Finance issuance grew to US$267.3bn, up 13% on H119, according to Bloomberg NEF1

Green bond and sustainability bond issuance suffered through the Covid-19 pandemic, with green bond issuance falling 8% to US$119.6bn, sustainability bond issuance remaining flat at US$19.8bn while social bond issuance more than doubled, growing 376% to US$41.9bn.

Sustainability-linked loan volumes grew by 11% from a year earlier, while green loan issuance volumes dropped to US$32.8bn for the same period.

Sustainable debt annual issuance

Source: Bloomberg BNEF

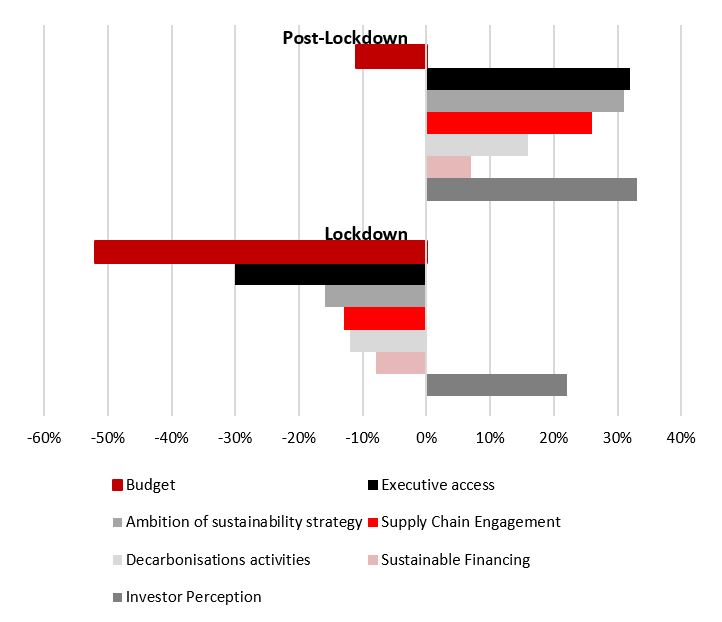

Sustainability Outlook: COVID-19 scenarios report

Sustainability looks to be one area benefitting long term from the COVID-19 pandemic, with decarbonisation activities, sustainable debt issuance and ESG fund performance all increasing according to a recent Bloomberg NEF report² .

COVID-19 impacts are driving companies to use sustainability as a proactive rather than reactive strategy with investor perception now seen as the most important driver of sustainability.

The pandemic is driving sustainability to become a requirement for investment.

Survey – How is sustainability practice in your business affected by the pandemic?

Source: Bloomberg NEF

Selected recent deals

Record issuance size and yields for corporate issuance

Alphabet, Google’s parent company, issued US$5.75bn in Sustainability Bonds on August 3rd as part of a US$10bn debt offering, the largest sustainability bond ever, while Visa issued their debut green bond, a 7-year US$500m green note. Both Alphabet and Visa’s issuances achieved record low yields with coupons of 0.8% and 0.75% respectively.

Australian and New Zealand issuance returns

- ANZ returned to the Australian market with their first A$ denominated SDG Bond, an A$1.25bn Tier 2 issuance.

- Mercury NZ Limited has announced their inaugural green bond offer (BNZ as JLM) expected to close on 4 September, with proceeds earmarked primarily for construction of the Turitea wind farm.

- Housing New Zealand, a subsidiary of Kainga Ora, announced a potential 15-year Wellbeing Bond (BNZ as JLM) expected to launch in the week of 31 August.

Australia’s first Climate Transition Index-linked bond

BNP Paribas issued an A$140m equity-linked green bond, linked to a new forward looking Australian Climate Transition Index.

Green loans in Western Australia and Victoria

Salt Lake Potash secured ‘green’ label certification for financing its Lake Way fertiliser production project. When completed it is expected to generate 60% less CO2 than comparable plants.

Victoria’s 209MW Murra Warra II wind farm secured green project finance loan to fund construction.

Investor and market news

NAB recognised for providing best ESG research

NAB was recognised for providing Best Research on Sustainability and ESG plus Best Overall Research in Australian Fixed Income in the KangaNews Fixed-Income Research Poll 2020.

Meanwhile, Bloomberg has launched in-house ESG scores following the lead of Refinitiv, MSCI, Sustainalytics, ISS and Moody’s.

NSW to fund big battery projects

The New South Wales government will support four new big battery projects totalling 170 MW.

Big batteries will be installed at the Sapphire wind project, Uralla renewable energy hub in New England and along the South Coast.

PM urged to plan socially just and green recovery

A group of 48 signatories, including finance and corporate heavyweights, have urged the Australian government to invest in health, education, clean energy and urban infrastructure consistent with the UN’s Sustainable Development Goals to help the economy recover from the Covid-19 pandemic.

BHP latest to plan exit from thermal coal

BHP confirmed plans to exit thermal coal and instead expand in commodities used for low carbon power generation.

Suncorp continues retreat from fossil fuels

Suncorp announced an immediate end to insurance of new oil and gas projects and phase out of financing and underwriting for all oil and gas exploration or production by 2025.

ESG assets outperform and now top US$1 trillion

Q220 saw inflows of more than US$71bn to ESG funds and pandemic bonds while 56% of sustainable funds outperformed their peers.

Meanwhile FTSE Russell have found that 60% of global asset owners are looking to apply ESG considerations to smart beta strategies.

IGCC highlight priorities for climate related reporting

The Investor Group on Climate Change report highlights investor priorities including better communication on actions, more evidence for claims, coherent disclosure and ongoing disclosure improvements.

Industry heavyweights launch energy transitions initiative

BHP, Woodside, BlueScope Steel, BP Australia, Orica, Wesfarmers CEF, APA Group and Australian Gas Infrastructure Group, together with NAB, Schneider Electric and Australian Super have signed on to the Australian Industry Energy Transitions Initiative (ETI).

The ETI aims to accelerate action towards achieving net zero emissions in supply chains for hard to abate sectors including steel, aluminium, LNG, metals and chemicals.

KKR invests in GreenCollar

Private equity firm KKR has invested in Australian environmental markets platform GreenCollar through its US$1.3bn Global Impact Fund.

EU coronavirus recovery fund deal to boost green bonds

The EU coronavirus recovery fund has agreed to allocate 30% of its €750 billion budget toward ‘green’ projects with S&P estimating €225 billion could be funded via green bond issuance, boosting global issuance by 89%.

Wealthy investors spur growth of sustainable investments

Capgemini’s World Wealth Report 2020 shows wealthy investors plan to allocate 41% of their portfolio to businesses pursuing ESG policies by end of 2020.

Asia’s lacklustre green recovery response to pandemic

ING research highlights the lacklustre green response of the APAC region to the Covid-19 pandemic.

Despite the APAC region contributing around 47% of global carbon emissions, New Zealand stands out as the only Asia Pacific country to have reinforced its environmental commitment through Covid-19 pandemic recovery stimulus measures.

New Zealand Government Fund invests in IoT telco

New Zealand Green Investment Finance has invested in Thinxtra, an Internet of Things (IoT) telco, encouraging local firms to deploy IoT to reduce costs and emissions.

World first framework developed for net zero emissions

Through the IIGCC, a group of 70 global investors representing US$16 trillion in assets have developed the first Net Zero Investment Framework. The framework is intended to act as a blueprint for investors on strategies to pursue net-zero emissions portfolios while ensuring sustainable returns.

Lower default risk for sustainable project finance loans

A Moody’s report shows project finance bank loans for sustainable projects exhibit a lower default risk than project finance bank loans for non-sustainable projects.

Download a PDF version of this update: NAB sustainable finance update: August 2020

1 Bloomberg NEF: 2H 2020 Sustainable Finance Market Outlook – July 29, 2020

2 Bloomberg NEF: Sustainability Outlook: Covid19 Scenarios, Build Back Better – August 4, 2020

| Important notice |

| This publication has been prepared by National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) or one of its affiliates or subsidiaries (collectively, “NAB”), for NAB clients who are wholesale clients and professional investors. It is for information purposes only. In Australia, it is issued by National Australia Bank Limited. This report is compiled by the NABs Corporate Finance Division and is based on market trading activity and other public information which has been obtained from sources internal and external to NAB. Any views/opinions herein are based upon, sources believed to be reliable. These view/opinions are subject to change without notice. This is not independent investment research and is not a product of NABs Research division. The views of the author/s may not necessarily reflect the views of the NAB Group. So far as the law and applicable rules and regulations allow, NAB disclaims any warranty or representation as to the accuracy, reliability completeness or currency of the information and statements in this document. NAB shall not be liable for any errors, omissions, defects or misrepresentations in the Information or for any loss or damage suffered by persons who use or rely on such Information (including by reason of negligence, negligent misstatement or otherwise). This is not an offer or solicitation of securities or financial products. The NAB does not intend to create legal relations on the basis of the information contained herein. This publication does not purport to contain all matters relevant to any particular investment or financial instrument. Any statements as to past performance are not representations as to future performance. This publication does not purport to contain all matters relevant to any particular investment or financial instrument. Recipients should independently verify and check the accuracy, completeness, reliability and suitability of the information herein. Recipients should make their own assessment and obtain independent and specific advice from appropriate professionals or experts relevant to their circumstances.

Whilst NAB is not subject to any legal prohibition on dealing ahead of the dissemination of this report, NAB takes reasonable steps to identify and manage conflicts of interest which may arise in the production of this publication. NAB maintains an information barrier between the NAB’s Debt Markets origination business and the public side of the NAB’s business (eg. Markets). Part of the compensation of the author/s may be tied to transactions in financial services offered by NAB and/or trading fees including fees, margins or other revenue received from transactions connected with a recommendation or view included in the information. The author/s also receives compensation based upon, among other factors, the overall profitability of the Corporate Finance Division of NAB. NAB may have proprietary positions in the products described in this document. NAB, its affiliates and employees may hold a position, deal or act as a price maker in the financial instruments of any issuer discussed within this document or act as an underwriter, placement agent, adviser or lender to such issuer. NAB and/or its affiliates may hold or transact derivative instruments, including options, warrants or rights with securities, or may act as a market maker in the securities and other financial products discussed herein and may sell such securities or financial products to or buy from customers on a principal basis. It is not for publication in the press or elsewhere. No part of this document may be distributed, published or reproduced without the prior permission of the NAB. Hong Kong: In Hong Kong this document is for distribution only to “professional investors” within the meaning of Schedule 1 to the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) (“SFO”) and any rules made thereunder and may not be redistributed in whole or in part in Hong Kong to any person. Issued by National Australia Bank Limited incorporated in Australia with limited liability, a licensed bank under the Banking Ordinance (Cap. 155, Laws of Hong Kong) and a registered institution under the SFO (central entity number: AAO169). Japan: In Japan this document is for distribution only to “Qualified Institutional Investors” (as defined under Financial Instruments and Exchange Act) only. This material is provided for information purpose only and may be amended, superseded or replaced in its entirety by subsequent material. Although the information contained herein has been compiled or arrived at from sources believed to be reliable, no representation is made as to its accuracy or completeness. Neither NAB nor any of its affiliates shall be held responsible for any misunderstanding arising from this material. You may not copy, reproduce, distribute or incorporate into the other document all or any part of this material without our written consent. New Zealand: In New Zealand, this publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. Bank of New Zealand strongly recommends readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. Neither Bank of New Zealand nor any person involved in this publication accepts any liability for any loss or damage whatsoever may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. National Australia Bank Limited is not a registered bank in New Zealand. Singapore: In Singapore this document is distributed in Singapore to institutional investors (as defined under the Financial Advisers Regulations) only. If this document is distributed in Singapore, it is made available to you in Singapore by NAB, Singapore branch, through general information circulation only and does not take into account of your specific investment objectives, financial situation or particular needs. If you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable. Recipients of this material in Singapore should contact NAB, Singapore branch at 12 Marina View, #20-02 Asia Square Tower 2, Singapore 018961, Tel (65) 6419 6875 for any matter arising from, or in connection with, this material. The contents of the Materials have not been reviewed by any regulatory authority in Singapore. If you are in any doubt about any of the contents of the Materials, you should obtain independent advice. United Kingdom: The content of this document is not intended to form the basis of any investment decision and does not constitute or contain any recommendation. If this document is distributed in the United Kingdom, such distribution is by National Australia Bank Limited, 52 Lime Street, London EC3M 7AF. Registered in England BR1924. Head Office: 800 Bourke Street, Docklands, Victoria, 3008. Incorporated with limited liability in the State of Victoria, Australia. Authorised and regulated by the Australian Prudential Regulation Authority. Authorised in the UK by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. United States: If this document is distributed in the United States, such distribution is by nabSecurities, LLC. This document is not intended as an offer or solicitation for the purchase or sale of any securities, financial instrument or product or to provide financial services. It is not the intention of nabSecurities to create legal relations on the basis of information provided herein. Other jurisdictions: the distribution of this document may be restricted by law in certain jurisdictions and persons into whose possession this document or other information referred to in it comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. Neither this document nor the information contained in this document is for publication, distribution or release, in whole or in part, directly or indirectly, in or into or from any jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction.

|