Coming in for landing in a heavy cross wind

Insight

Offshore events dominated AUD movements in August as the US-China trade war escalated again and pressure for the Fed and other Central Banks to do more also increased.

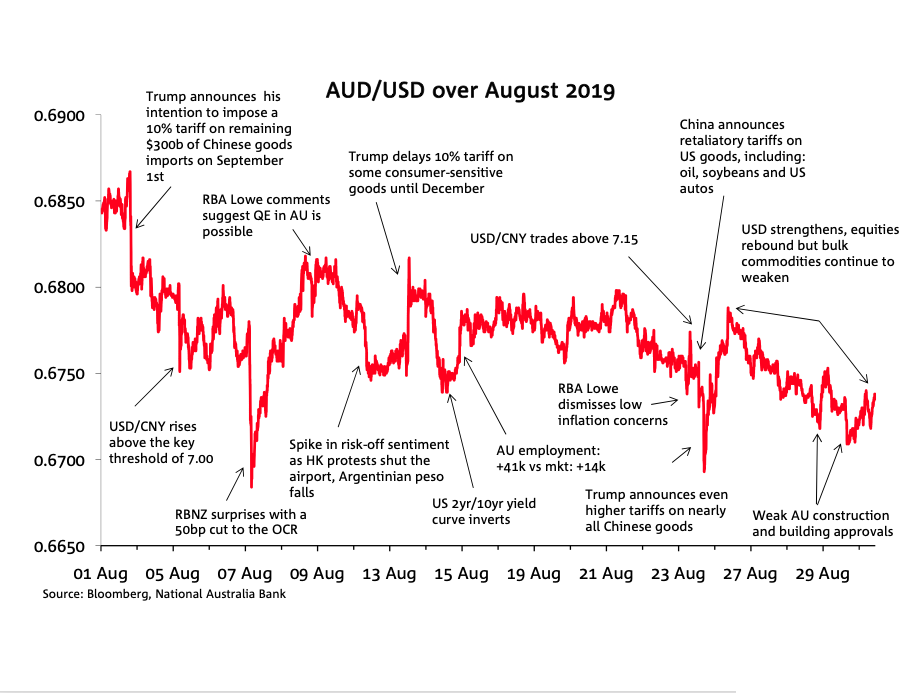

Offshore events dominated AUD movements in August as the US-China trade war escalated again and pressure for the Fed and other Central Banks to do more also increased. Starting the month at 0.6844, the AUD quickly hit its monthly high of 0.6868 on 2 August, before US President Trump’s announcements of further tariffs on Chinese imports saw the currency fall to 0.680. Over the rest of the month the AUD was largely contained in a 0.67 to 0.68 range while a couple of risk-off events saw the AUD briefly break below the 0.67 mark – including the surprise 50bp cut from the RBNZ. That saw the AUD reach a fresh low of 0.6677 on the 7th, a level last seen in March 2009.

Early in August, President Trump announced his intention to impose a 10% tariff on the remaining $300bn of Chinese imports not yet subject to any duties, sparking an almost ½-cent fall in the AUD to 0.6801 and setting the scene for a month dominated by US-China trade war headlines. A few days later, as the USD/CNY broke above the key 7-cents threshold the AUD weakened further, to 0.6748 on 5 August.

Over the next fortnight, spikes in risk aversion caused by the RBNZ’s surprise 50bp cut, HK protests, a collapse in the Argentine peso and the inversion of the US yield curve each saw the AUD fall. On the back of the RBNZ’s move, the AUD touched its lowest level since 2009 at 0.6677.

Amid the increase in risk aversion, on 13 August, some reprieve was granted as Trump appeared to backpedal: delaying some of the new 10% tariffs until December to protect some consumer sensitive goods – that caused the AUD to jump around 0.6 cents to 0.6817. However, later in the month, another round of US-China trade tensions erupted, yet again, weighing on the AUD. The USD/CNY weakened some more, China announced retaliatory tariffs on US goods (including, soybeans, oil and cars) and Trump announced higher tariff rates on nearly all Chinese goods. Collectively, these developments saw the AUD fall to 0.6691 on 26 August.

Global equities recovered a bit of lost ground on the last week of August, but the AUD/USD was unable to fully benefit from this improvement in risk sentiment as concerns over the global growth outlook weighed on bulk commodities. After trading in a range of 1.91 cents, the currency ended the month at 0.6733 around a cent lower than where it began.

The AUD/USD lost just over one cent during August and unlike what we saw during June and July, our Short-Term Fair Value (STFV) model estimate did not follow the AUD/USD lower. Indeed, our model estimate edged up a little (1.26c) closing the month at 0.6995, 2.6c higher than spot.

On Face value, this deviation suggests the AUD/USD is now approaching an oversold position given the spot to model deviation is just below the +/-3.1c fair value range (Chart 2). Unfortunately, US-China trade uncertainties are not fully captured by our model, thus for now caution is warranted on the model’s signalling. CNY weakness and its high correlation to the AUD/USD a case in point.

The 1.26c rise in the model estimate during August came about by a 1.12c positive contribution from the 25bps widening in the 1y AU-US OIS spread while the 0.5c contribution from commodities was largely driven by the 6.7% gain in gold during the month. The 1.1 rise in the VIX Index (our model proxy for risk sentiment) detracted 0.48c of the model estimate.

For more detailed information download the The full report.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.