Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

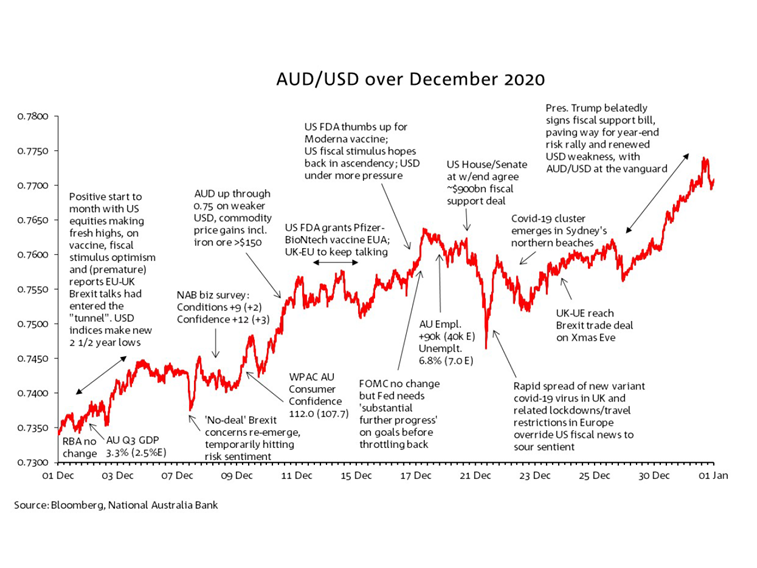

A month ago, we remarked that it was hard to recall a month where AUD/USD made its low point on the first trading day of the month and its high on the last, as was the case in November.

Lo and behold, AUD/USD repeated the trick in December, making its low of 0.7340 on December 1st and its high of 0.7740 on the 31st (latter the highest since April 19th 2018). This 5.4% lo-to-hi gain was however only the third largest intra-month gain of the year, surpassed both by the 6.0% November gain and 9.9% rise in April following the March slump to the 0.55-area low.

Domestic data and events were largely ignored by the FX market, save that there seem to be a belated positive response to the surge in Consumer Confidence reported a third of the way through the month and a bit of underperformance in the lead-in to Xmas Day, following the emergence of a covid-19 cluster in NSW centred on one suburb in Sydney’s northern beaches.

For the most part, December was characterised by AUD drawing support from the largely uninterrupted rise in risk sentiment at least as proxied by US equities, related USD weakness encompassing new two-and-a-half year lows and still-surging commodity prices. The relentless rise in iron ore – and many non-ferrous metals – received more and more attention with spot pricing surpassing $150 a tonne on December 10th and making a high of $176 on the 21st (Singapore futures).

Support for risk sentiment was drawn from optimism toward early-roll out of both Pfizer-BioNTech and Moderna’s covid vaccines and the US Congress agreeing a fiscal support deal before year-end. This they did a week before Xmas but which was only signed off by President Trump a few days before year-end, after he (unsuccessfully) agitated in favour of larger ($2,000) one-off payments to households.

Sentiment toward a post-Brexit UK-EU trade deal being agreed by year-end fluctuated during the month and was a cause of some (global) volatility in risk sentiment, but the one significant UK-related ‘risk-off’ move and slippage in AUD derived from news of a rapidly spreading covid-19 variant and related lockdowns and travel restrictions across Europe.

Download a copy of the chart: AUD annotated chart December 2020

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.