NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

Intensification of concerns about the spread of the COVID-19 coronavirus culminated in new 11-year lows for AUD/USD at 0.6435 on the last day of the month.

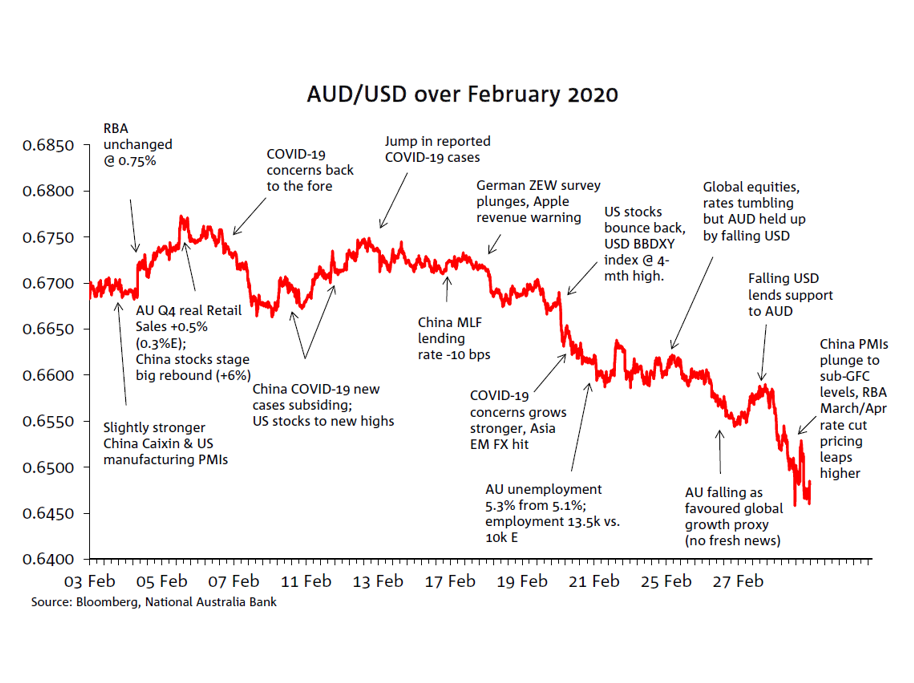

Intensification of concerns about the spread of the COVID-19 coronavirus and what this likely means for Chinese and global growth, dominated market risk sentiment and volatility in all things AUD during February. This culminated in new 11-year lows for AUD/USD at 0.6435 on the last day of the month. The high, of 0.6774, was seen on February 5.

COVID-19 related AUD volatility in the first half of the month was generated mostly from the news flow related to developments inside China (where the reported slowing in the rate of new COVID-19 cases was greeted positively). This gave way in the latter half of the month to news reports on the spread of the virus globally, both in terms of the numbers of those infected and the number of countries reporting outbreaks (which had risen to 50 by month-end). The latter focussed market attention on to the negative demand shock to the global economy that efforts to contain the spread of COVID-19 entails, as well as the supply shock from dislocations to China’s manufacturing economy and intermediate supply chains.

Hard data on the extent to which COVID-19 was impacting directly on Australia was in short supply, though awareness of the impact of the ban on Chinese citizens travelling to Australia from mainland China on the loss of income from overseas tourism, and potentially from student fee income – was palpable.

As for hard local economic news, the Q4 real retail sales report on February 6 was better than expected (+0.5%) and mildly AUD supportive, while the rise in the unemployment rate from 5.1% to 5.3% in January reported on 20 February was a negative. The latter lifted expectations for an early resumption of RBA policy. However, it was not until the last day of February that pricing for 3 March rate cut ratcheted sharply higher and indeed became fully priced, following Friday-night comments from a noted Australian media commentator.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.