Online retail sales growth slowed in May following a fairly strong April

Insight

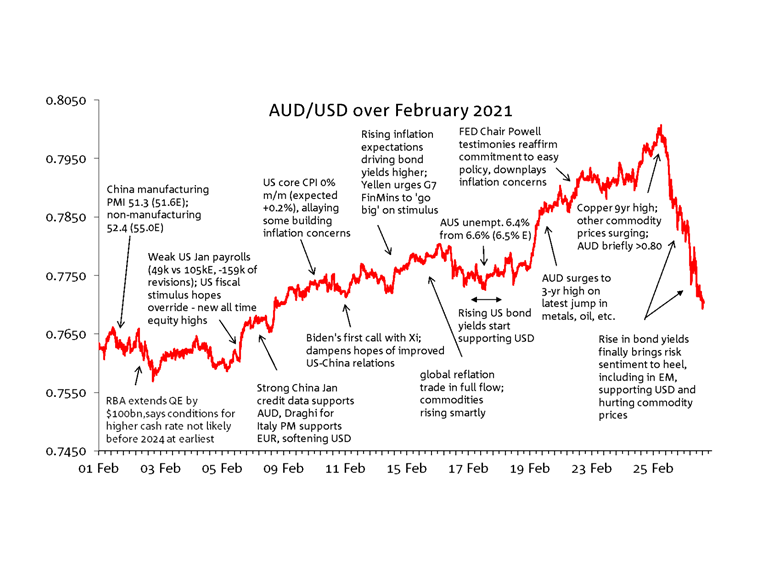

After what in the end turned out to be a month of consolidation for the AUD in January, with a monthly range of a little over two cents and the close only about half a cent lower than the open, February proved to be a much more volatile month.

The range was over 4 cents, from a low of 0.7564 on 2 February to a high of 0.8007 on 25 February (the latter the highest since 2 February 2018). AUD began February with a modicum of weakness on the back softer than expected China PMI prints and then a generally unexpected announcement from the RBA that it would be replicating its $100bn QE bond buying programme as soon as the existing one completed in April, a more aggressive move than many had expected.

Yet from then on, the ‘global reflation trade’ took a firmer and firmer grip on market sentiment and price action. Confidence that the $1.9tn American Rescue Act covid relief bill proposed by the Biden administration would be approved, or something close to it, added to expectations for a vigorous global economic rebound in H2 2021, already supported by declining covid infection rates and successful large-scale vaccine rollouts, allowing for much fuller economic re-openings, in the US and Europe in particular. This boosted both risk sentiment and commodity prices in the face of rising US bond yields. The latter was initially mostly via higher inflation expectations, and later in real yields, with markets starting to question whether central banks in some countries would necessarily abide by their public commitments to keep rates near zero for a very long time, if the economic assumptions underlying their policy forecasts proved too conservative vis-a-vis growth, the pace of labour market improvement, and inflation.

Through the course of February up until the last day of the month, commodity prices provided the major tailwind driving AUD higher, exemplified by a 20% rise in crude oil prices and 15% rise in the LMEX index of base metals (the latter led by fresh 9+ year highs for copper). By the end of the month, the speed and extent of the sell-off in bond markets, whether or not fundamentally justified, proved too much for risk markets to bear, higher yields bringing equity markets to heel, seeing the USD’s safe haven attributes back on show and in turn helping pull commodity prices lower, and with that AUD/USD – by a full three cents in little over 24 hours.

Download a copy of the chart: AUD annotated chart February 2021

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.