Online retail sales growth slowed in May following a fairly strong April

Insight

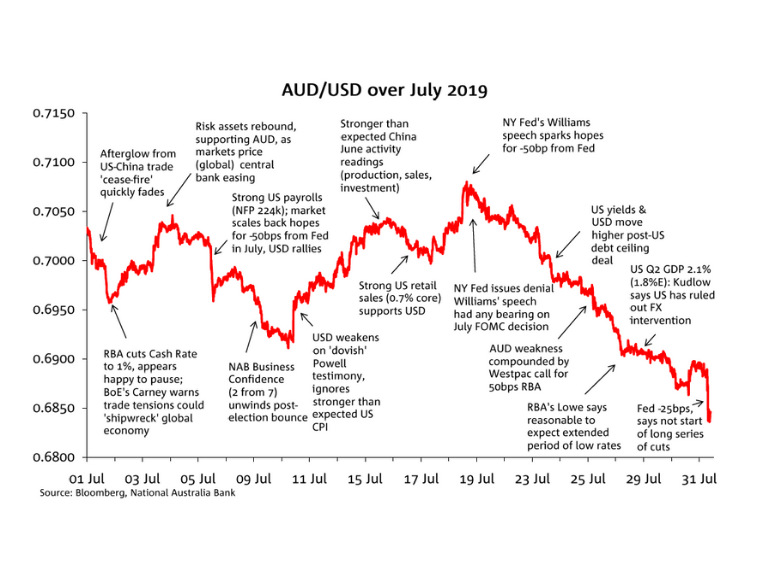

After making a high of 0.7081 on July 19th it was pretty much one-way traffic south for AUD/USD from then until month end.

The AUD/USD made an intra-day (and intra-month) low of 0.6832 on July 31st so just about back to the January 2016 and June 2019 lows, before ending the month at 0.6845.

AUD began July losing a bit of the gloss that had been painted via optimism towards a Sino-US ‘trade truce’ being agreed at the end of month Osaka G20 meeting and which duly materialised. Yet the agreement to restart talks and for President Trump to desist from further tariff action for the time being, failed to inspire confidence that an early resolution to the trade dispute was likely.

The strong US payroll data in early July – dampening hopes the Fed might cut by 50bps at month-end – and then more signs of a soft Australian economy courtesy of the NAB Business Survey, revealing the post-election bounce in business confidence failing to hold, pressured AUD via a combination of USD strength and explicit AUD weakness.

The AUD drew some fresh support at mid-month from a softening USD following ‘dovish’ testimony from Fed chair Powell and then a speech from NY Fed President John Williams, which the market (wrongly) interpreted as implying the Fed was gearing up to cut rates by 50bp on July 31st. As these hopes were replaced by confidence the Fed would only cut by 25bps, the USD resumed its early-month rally, aided too by a US debt ceiling deal and better than expected Q1 GDP data (2.1%).

A late-month speech from RBA Governor Lowe, in which he re-iterated a strong commitment to the inflation target and said it was reasonable to expect an extended period of low rates, further undermined the AUD. These moves extended after the end-of-month Fed action and accompanying commentary which failed to provide any succour for market pricing that was still seeing the best part of 100bps of Fed rate cuts in 2019-20.

Similar to June, our Short Term Fair Value (STFV) model estimate tracked the AUD/USD quite closely during the month of July.

The 1.75 cent decline in the spot rates over the course of the month to 0.6845 was matched by a 1.49 cent fall in the STFV model estimate, which ended July at 0.6883. Thus as has been the case for essentially the whole of 2019, AUD/USD continues to do what it ‘should’ relative to the fundamentals denoted in our fair value model (Chart 2).

A narrowing of 17.5bps in the 1y AU-US OIS spread contributed to a 0.64c decline in the STFV model estimate in July. Commodities as a whole subtracted another 0.67c with declines in Brent oil (-$2) and coking coal (-$20) prices the main culprits. The move up in the VIX index (our model proxy for risk sentiment), from 15 to 16, detracted another 0.19c.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.