Long-term signal vs. Short-term noise

Insight

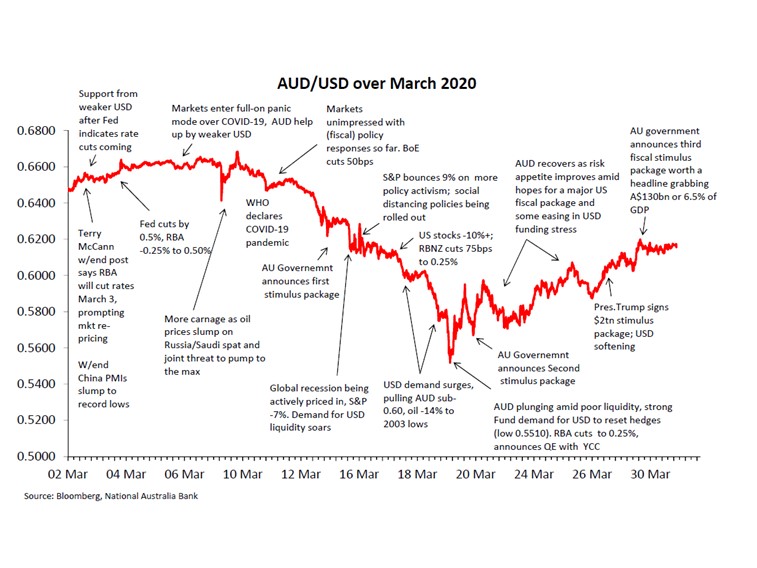

The AUD/USD collapsed in March to its lowest levels since 2003. Read our summary of what impacted the course of the AUD/USD during the month.

After posting new 11-year lows at 0.6435 at the end of Feb, AUD/USD collapsed in March to its lowest levels since 2003, making a low of 0.5510 on March 19 before staging a recovery and ending the month at 0.6131.

The fall in AUD/USD was readily explained by one of the fastest and deepest global stock market sell-offs in history and associated spike in risk aversion across various asset markets – always an enemy of the AUD. This was as investors were forced to price the reality of a deep – and immediate – global recession as COVID-19 related social distancing strictures brought large swathes of the Australian and global economy to a sudden stop.

Augmenting downward pressure on the AUD/USD was the fall in commodity prices not just because of the demand shock from the unfolding global economic contraction but the collapse in oil prices from positive supply shocks. Saudi Arabia and Russia fell out at the OPEC+ meeting, resulting in the world’s 2nd and 3rd largest oil producers committing to maximise oil production, viewed as an attempt to satisfy various geopolitical ambitions.

From a flows perspective, the abrupt fall in AUD/USD from the 0.60 region to the 0.5510 lows owed something to Australian asset managers scrambling to get FX hedges back onside after the US stock market falls reached a point where mandates necessitated immediate buy-backs of US dollars to bring hedges back in line with benchmarks. This occurred at a time when liquidity was significantly impaired as the various ramifications from COVID-19 globalisation were only just coming into effect.

RBA actions in March, including cutting the Cash Rate to 0.25% and introduction of Japan style QE with Yield Curve Control (0.25% target on the 3y tenor), had minimal impact on AUD as the Fed alongside other central banks matched, or exceeded RBA actions.

The recovery in AUD/USD in the last ten days of the month came in conjunction with improved risk sentiment as governments – including Australia and the US – agreed massive fiscal support packages and central bank actions served to alleviate US dollar liquidity demands that had earlier propelled the USD to new record highs.

Download a copy of the chart: AUD Annotated chart March 2020

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.