Firmer consumer and steady outlook

Insight

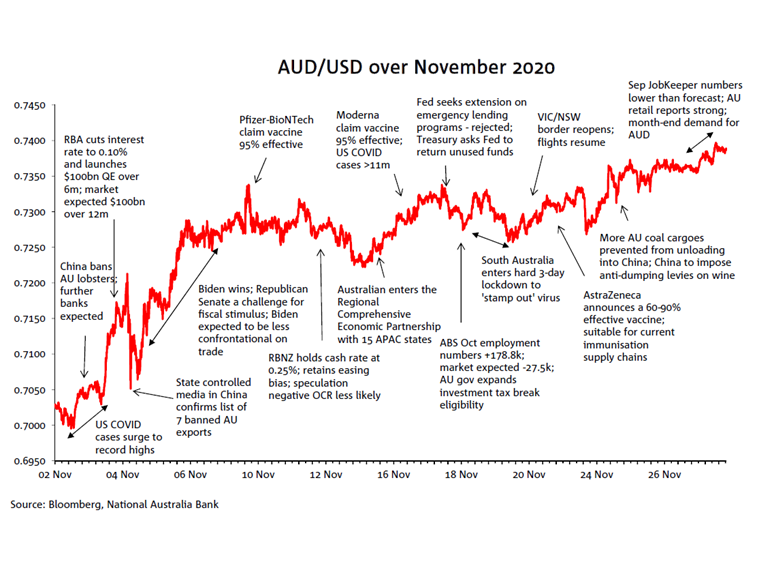

It’s hard to recall a month when AUD/USD made its low point on the first trading day of the month and its high on the last.

In November the AUD low of 0.6992 came on Monday 2nd November and the high of 0.7407 on the 30th – a range that neatly encapsulated our ongoing characterisation of AUD/USD as a likely ’70 to 74 currency’ over the remainder of 2020 since early July.

The starting point for AUD/USD in November, languishing near 0.70, followed back-to-back down months for US equities and risk sentiment more broadly, after the currency had reached a peak of 0.7414 back at the end of August/start of September. Early in the month, concerns over the global economic impact of worsening COVID-19 infection rates in many parts of the world were triumphing over optimism toward early proof of a vaccine. Markets were also contending with uncertainty over the outcome of the November 3rd US Presidential elections, alongside anticipation of rate cuts and QE from the RBA out of its November meeting. In addition, AUD/USD also had to grapple with increasingly fraught Australia-China relations and more specific trade actions (e.g. against cotton).

Ahead of the US elections, markets were convinced of – and comfortable with – the notion of Joe Biden winning, which duly materialised. Failure by Democrats to secure the ‘blue wave’ was cheered by risk markets (on the view that higher corporate taxes and tighter regulations across many sectors wouldn’t now eventuate). Midway through the month, markets also embraced the positive vaccine trial news from Pfizer BioNTech followed by Moderna. Oil and base metals were subject to strong upward pressures as markets discounted a much stronger global demand backdrop in 2021 on the premise of mass roll-out of vaccines.

This pro-growth and risk positive backdrop propelled the AUD higher, with the final push above 0.74 at the end of November encompassing expectations of strong month-end USD supply/AUD demand from local asset managers to maintain strategic hedge ratios or desired currency exposures.

As for local influences, the AUD having been sold on the rumour of what the RBA would do on 3rd November, the market duly ‘bought the fact’.

Download a copy of the chart: AUD annotated chart November 2020

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.