We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

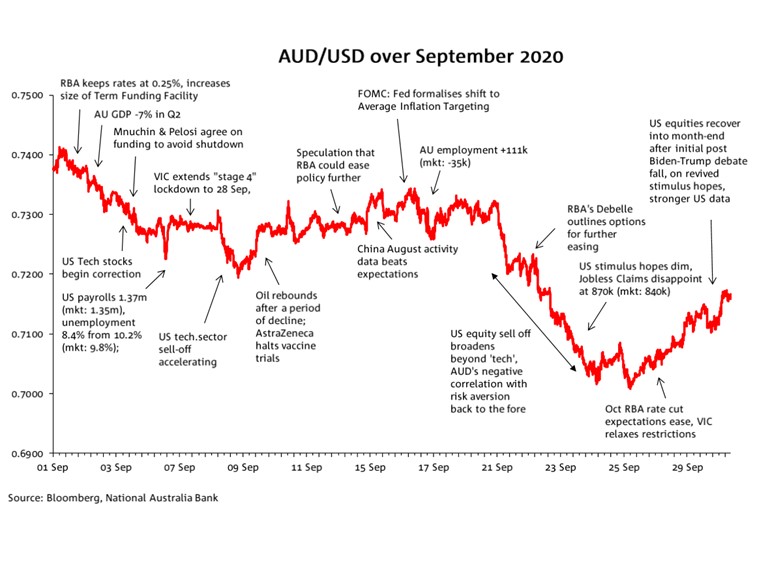

It was quite a fall from grace for AUD/USD in September.

Having just hit 74 cents on the end of August, gains were slightly extended to a high of 0.7414 on the first day of the month, giving way to a low of 0.7006 on 25 September.

It was the reversal in the hitherto strong performance of US equities in prior months that accounted for most of the fall, which only became pronounced when the equities sell-off extended beyond the US technology sector to the broader market – the former having increasingly exhibited ‘bubble’ characteristics in prior weeks and the sell-off here mostly described in terms of stock rotation. Only with the broader risk asset sell off did the AUD’s status as one of the most risk-sensitive major currencies come firmly to the fore.

Heightened expectations of additional RBA easing steps, particularly after a speech from RBA deputy governor Debelle, contributed a little to AUD underperformance, while a recovery in risk sentiment in the last few days of September helped AUD pull-up off the lows to end the month at 0.7162.

Download a copy of the chart: AUD annotated chart September 2020

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.