The AUD/USD spot exchange rate in H2-2020 & 2021 outlook

In July last year, NAB’s FX Strategy team revised our G10 currencies spot forecasts to reflect increased conviction that the US dollar’s decline had much further to run.

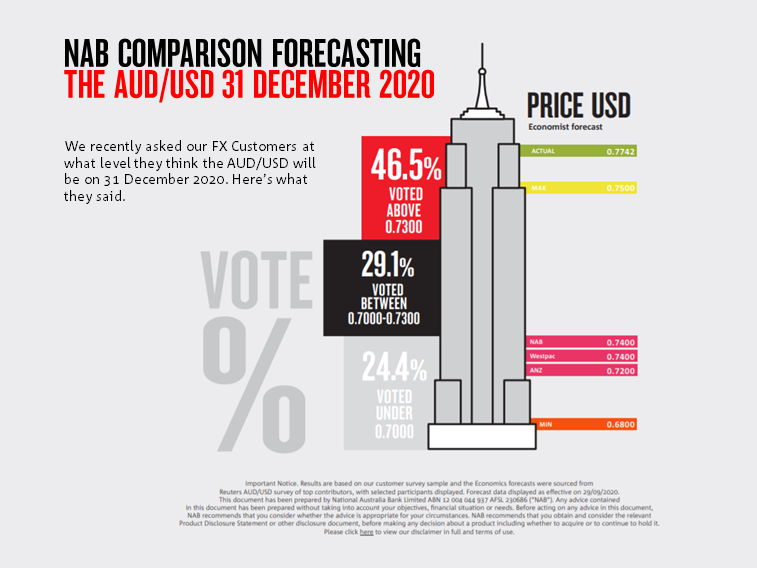

Download a copy of the chart: NAB comparison forecasting the AUD/USD 31 December 2020

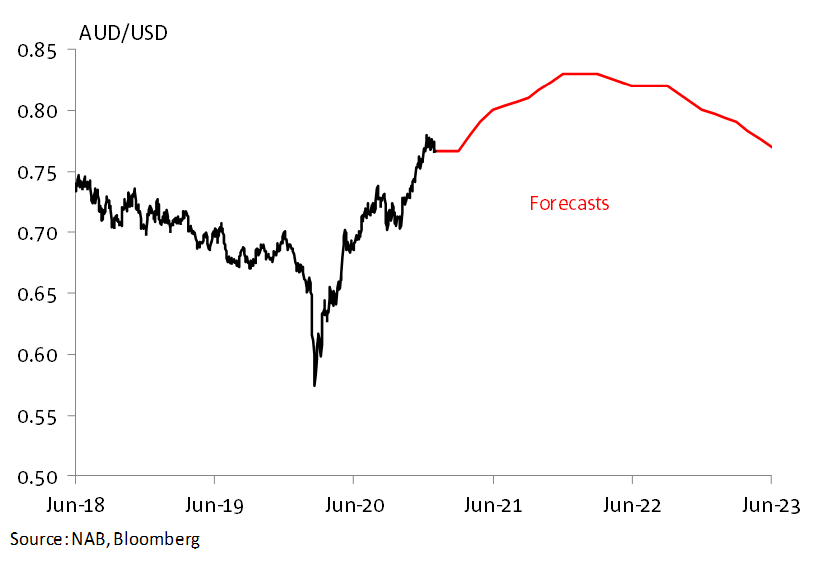

Forecast revisions extended to the AUD/USD spot rate, with our end-2020 forecast revised up to 74c, up 2 cents from the previous iteration, alongside reach 80 cents first half of 2022.

A crucial argument for our expectation of a lower USD in 2020 and beyond is the sharp compression in previously USD-favouring interest rate differentials. This yield compression was and still is more apparent in real rather than nominal terms, an important distinction, as ultimately it is interest rate differentials adjusted for relative inflation rates in different countries that matters most for currencies. Historical analysis also shows the leading relationship from changes in real interest rates to changes in currencies tends to play out with long and variable lags.

We also backed our softer US dollar view with our assessment the USD was overvalued in the order of 10% on a Purchasing power Parity (PPP) basis, together with our sense that the United States’ abject failure to contain the spread of COVID-19 relative to the much of the (developed) world would mean that the global economic revival underway from mid-2020 was one where the US would lag not lead the rest of the world, a phenomenon historically associated with a weaker USD.

Against a softer USD backdrop

We likewise argued that a stronger AUD/USD was likely to be supported by an improvement in risk sentiment and higher commodity prices, the latter helped by a nascent global economic recovery, initially led by an infrastructure-heavy (and so commodity intensive) rapid China economic revival.

How good were our forecasts?

Well, it depends how you measure them.

The AUD/USD spent the first 10 days of December 2020 trading ’74-point something, leaving us ready to declare victory, but then continued to climb through the remainder of December to end the year almost three big figures higher very close to 77 cents!

On this basis our AUD/USD forecast fell short of the mark. But, when compared to a survey conducted on 18th September 2020, where our customers were asked where the AUD would be on December 31, less than half the survey group thought the AUD would end the year any higher than 73 cents.

Looked at another way

NAB’s forecasting ability has been vindicated in the latest Bloomberg quarterly survey of all FX forecasters. Their poll results adopt a ranking system using three criteria: margin of error, timing (for identical forecasts, ones made earlier in the year receive more credit) and directional accuracy (movements with the currency’s overall direction).

Based on this approach, NAB was the number one forecaster across all major currencies in Q4-20, including a top-three ranking for AU/USD (and top-two for NZD/USD). 50 Global financial institutions, including all the major global banks, qualified for inclusion in the rankings.

Looking at 2021

We’ve made no changes to our AUD forecasts set out in mid-December. We continue to see AUD/USD hitting 0.80 in H1 2021 and trading within a 0.80-0.85 range in H2 2021.

Risk sentiment the main risk to our higher AUD forecast

Risk sentiment

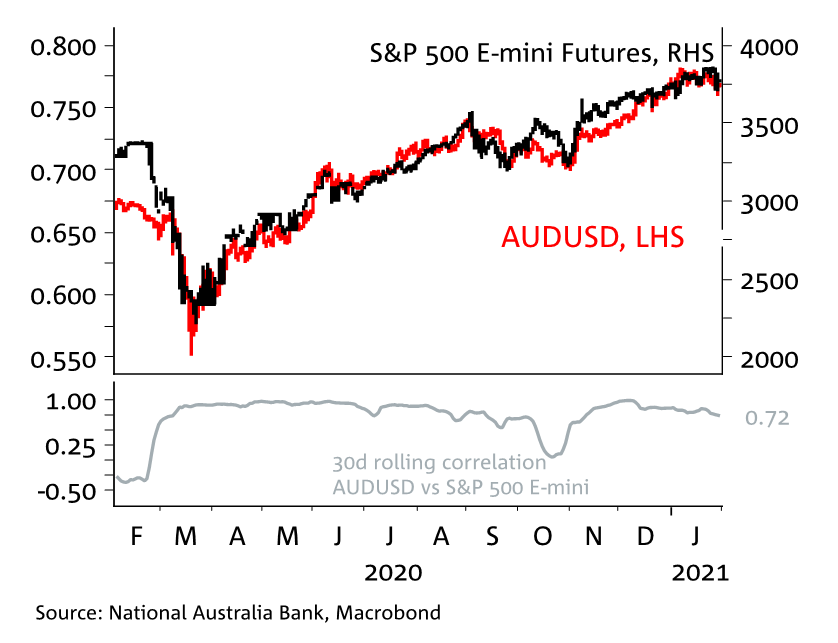

Much of the year-to-date volatility in AUD/USD (as was the case through much of 2020) is directly linked to swings in risk sentiment, in which respect the negative correlation between AUD/USD and the S&P500 remains extremely tight (see chart above). Set-backs in risk sentiment, for whatever reason, are therefore likely to be the main source of AUD/USD pullbacks. Yet other than in the event of a challenge to the view that vaccine roll out in major economies will be reasonably rapid (and effective) allowing fuller economic re-openings come H2 2021, set backs are apt to prove inherently temporary.

We still think medium term USD headwinds need to run their course. For one, the rise in US bond yields seen so far this year has been accompanied by a similar rise in inflation expectations, meaning there has been little to no change in real US yields and as noted above, real yield differentials tend to impact on currencies with lags, such that last year’s sharp fall still has some play out on the USD. Furthermore, notwithstanding the extent of the 2020 fall in the USD, it remains overvalued in real exchange rate, or PPP-type terms, by at least 5%.

Meanwhile

Real time proxies for Australia’s terms of trade are already consistent with higher AUD levels, albeit when commodity prices are incorporated with interest rate and risk factors, AUD/USD looks fairly valued here. If as we go through 2021 current optimism regarding vaccine roll-out and economic re-opening is vindicated, this promises to further support commodity prices and lift AUD fair value accordingly (the flip side of which will likely be further USD depreciation). Should the incoming Biden administration look like being able to secure funding for big infrastructure and ‘Green New Deal’ initiatives, this can only add support for (industrial) commodity prices. China demand is assumed to remain strong, the main risk here being from a significant new covid wave, necessitating wider and more protracted lock-downs.

To eighty and beyond

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

Important Notice. Results are based on our customer survey sample and the Economics forecasts were sourced from Reuters AUD/USD survey of top contributors, with selected participants displayed. Forecast data displayed as effective on 29/09/2020. This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please click here to view our disclaimer in full and terms of use.