21 August 2025

Capital Markets

April 7, 2025

$A market diversifies Kiwi funding arsenal

Conditions in the Australian Medium-Term Note (AMTN) market on both price and tenor are providing a compelling funding alternative for New Zealand corporates.

By Brad Peel

The rise of Australian debt markets is a story of perfect timing for the New Zealand corporate issuer, offering an alternative funding source and a release valve for any pressures arising from a potential crowding out from NZ government issuance.

Kiwi borrowers have already established a presence in the Australian Medium-Term Note (AMTN) market, with 30 outstanding lines from NZ issuers.

The strong interest has come at a time of record issuance for the AMTN market overall, with NAB internal data showing a rolling 12-month corporate issuance peak of A$27.5 billion in December 2024. This is a full A$7.5 billion above the previous record levels in April 2021[i].

To allay concerns on oversupply, it’s worth noting that corporate issuance still only represents about 15% of total non-sovereign issuance in the AMTN market, with bank issuance making up the majority of supply at ~65%[ii].

Investor rise

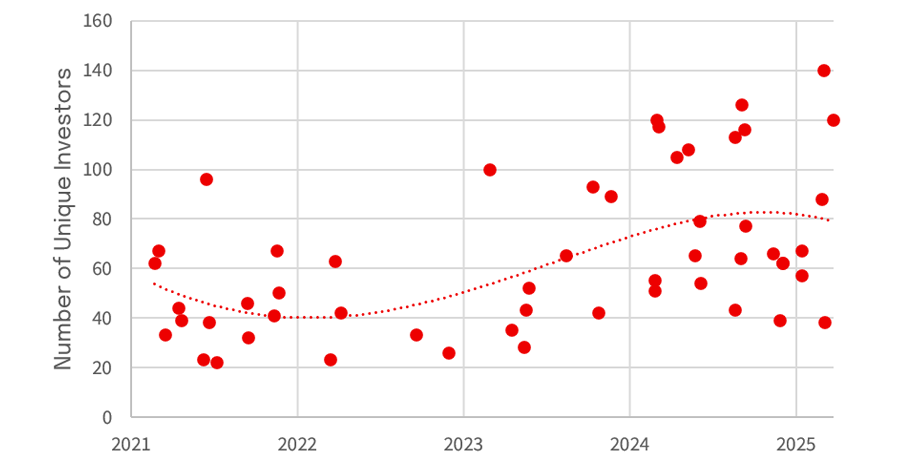

Looking back at 2024, it wasn’t just a story of growth in funds being deployed into the domestic market. The year also saw a step change in the number of investors participating in trades, with more broker and private bank accounts increasing their familiarity with the AMTN market and deploying funds accordingly (see graph below).

Source: NAB order book data

The initial thought is that the surge must have come from the Asia market for a number of reasons.

Late 2023 saw a significant increase in the number of Asia buyers as the reduction in loan growth for the region, coupled with reduced Reg S issuance, turned investors towards an expanding AMTN market as an opportunity in the region[iii].

The potential for trade wars to boost demand may also have been a driver, as was the case in 2019 when trade and geopolitical tensions hit the emerging market economies in south-east Asia more than Australia.

However, despite the Asia demand jumping ahead, the allocations of the record amounts of issuance on offer were still weighted heavily towards the Australian buyer. This must mean that somehow there has been a huge increase in the funds deployed by Australian accounts in the period.

Super demand

This dynamic is where the most interesting stat for the market in 2024, in our view, comes to the fore. According to Australian Prudential Regulation Authority (APRA) data, the amount of superannuation investment allocated to domestic fixed income increased by ~$90 billion, or 35%[iv]. That is an unbelievable 35% growth demand from the core “real money” investors in a developed market, without a significant risk sentiment catalyst.

So yes, 2024 was a banner year for issuance volumes, and for many of the measures of functionality, such as price progression and the cost for extending tenor.

However, the investor base today almost needs that type of issuance year to become somewhat typical going forward simply to satisfy that on-shored demand.

So how does this contrast with the drivers facing Kiwi borrowers in their domestic market, historically one of the most dependable in the world?

NZ market factors

On the face of it, the NZ market remains a very reliable source of retail investor demand, almost irrespective of market volatility. This is almost unique among global funding markets, which are often heavily skewed to institutional money that can be far more sensitive to global headlines.

However, in the past two years ongoing and historically sizeable issuance by New Zealand Debt Management[v] – the part of treasury which oversees government borrowing requirements and associated activities – has made buying NZ government bonds more attractive to investors as their relative yield has widened.

In contrast, this has lessened the appeal of other NZ$ issuance, given the historically smaller yield pickup on offer compared with government bonds.

This dynamic, along with a challenging economic backdrop, has made buying NZ corporate paper less attractive than it has been in the past for investors. We have seen this play out with NZ credit spreads underperforming relative to global credit, particularly since the start of 2025 where NZ spreads have remained rangebound despite the limited issuance supply.

With these spreads unable to keep up with the tightening offshore, we are seeing an increasing number of NZ issuers focus on markets such as AMTN, USD and CHF to achieve all-in pricing that is competitive, or even tighter than NZ$ domestic pricing. In recent times we’ve seen highly-rated entities like the New Zealand Local Government Funding Agency (NZLGFA), Auckland Council and Transpower all access these markets[vi]. Furthermore, we’ve seen Mercury, Contact and Chorus all issuing in this period and Genesis Energy and Fonterra have undertaken roadshows (one a non-deal, one a deal roadshow)[vii].

The other benefit NZ issuers have found in accessing the AMTN market is the ability to lengthen their portfolio durations well past seven years. The consistent, deep pools of investor demand out to 10 years (or longer) has aligned with increasing funding requirements by many NZ borrowers (and a desire to extend their borrowing duration), making such markets particularly appealing.

With A$ pricing continuing to prove compelling for NZ corporates, along with their desire for deal certainty on longer dated issuance, we expect the trend for NZ corporates to access the primary debt markets in Australia will continue for the foreseeable future.

Brad Peel is NAB Executive Director, Debt Capital Markets

[i] NAB Corporate Originations data

[ii] NAB Credit Research data

[iii] NAB internal data

[iv] APRA Superannuation Statistics September 2024 APRA releases superannuation statistics for September 2024 | APRA, opens in new window

[v] Debt management | The Treasury New Zealand

[vi] NAB internal data

[vii] Ibid

Capital Markets Corporate and Institutional Corporate Bonds Debt Capital Markets