Conditions in the Australian Medium-Term Note (AMTN) market on both price and tenor are providing a compelling funding alternative for New Zealand corporates.

Article

Conditions in the Australian Medium-Term Note (AMTN) market on both price and tenor are providing a compelling funding alternative for New Zealand corporates.

Article

NAB Executive, Capital Markets, Sarah Samson shares her insights after appearing as a special guest panellist at the recent 2024 Australian Sustainable Finance Summit held in Sydney.

Strong issuance volumes underpinned by extremely robust levels of investor liquidity and improved economic conditions.

A rapid escalation in volumes and additional liquidity in the A$ financial institution (FI) bond market for 2023 have come at just the right time, creating opportunities for the funding task in 2024.

Article

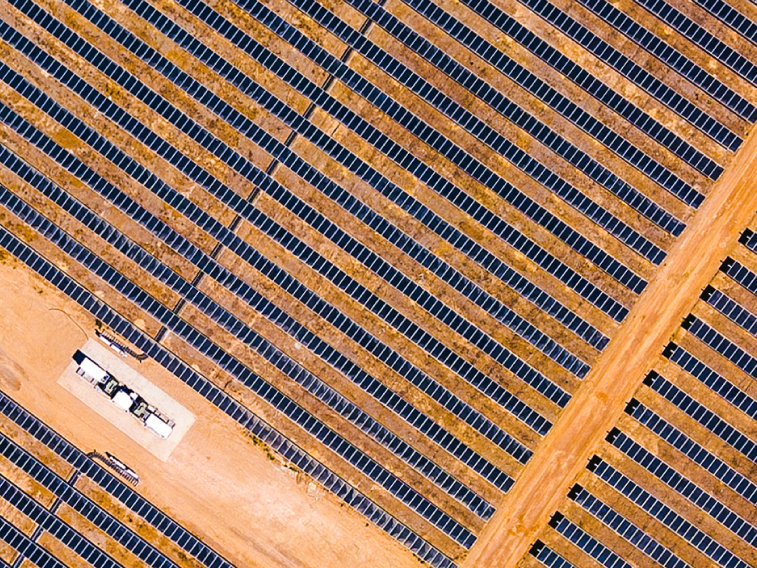

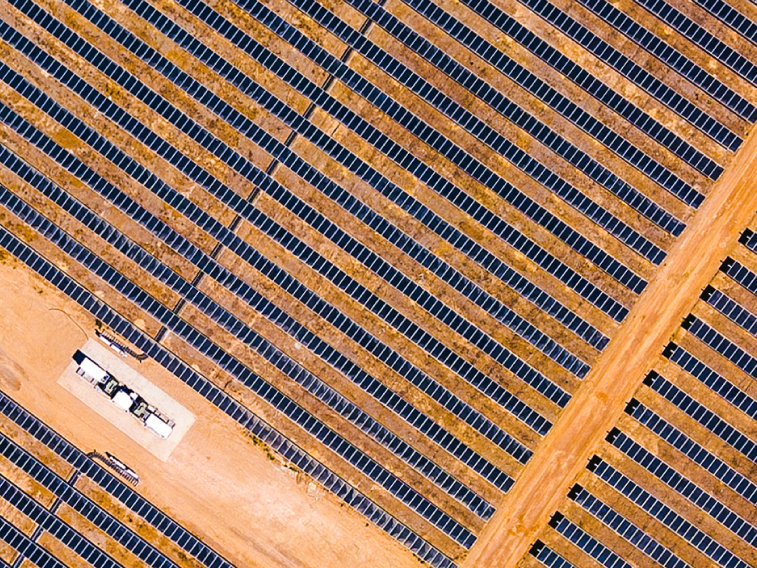

Australia needs a vast amount of capital to build out the utility-scale wind and solar projects to power a net-zero future by 2050. NAB’s Executive, Specialised Finance, Andrew Smith and Executive, Capital Markets, Sarah Samson explore potential debt funding options in market.

Article

A look at what’s been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what’s been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what's been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what's been happening in the sustainable finance market in Australia and abroad.

Newsletter

A look at what’s been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

A look at what's been happening in the sustainable finance market in Australia and abroad.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.