Robust growth for online retail sales observed in June

Insight

Strong issuance volumes underpinned by extremely robust levels of investor liquidity and improved economic conditions.

The Australian dollar primary market had a record start to 2024, with A$61.1 billion raised in financial institution (FI) and A$7.9 billion in corporate sectors, an increase of around 20% and 85% respectively, compared with the same period in 2023.

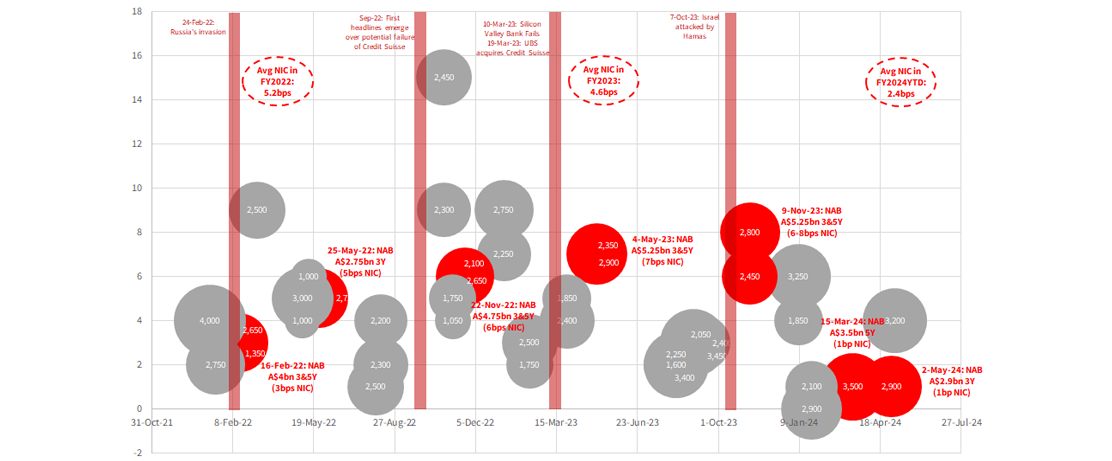

Investors were attracted to the A$ market’s resilience in primary and secondary markets, despite a volatile 2023-24, including numerous geopolitical and/or macro headlines.

For corporate issuances, stale secondaries saw Australia lag the 2023 rally. However, primary deals are coming, with flat to negative new issuance concessions suggesting investors recognise this trend in 2024. Broad order books are helping drive these outcomes, with more investors supporting transactions, delivering power to issuers.

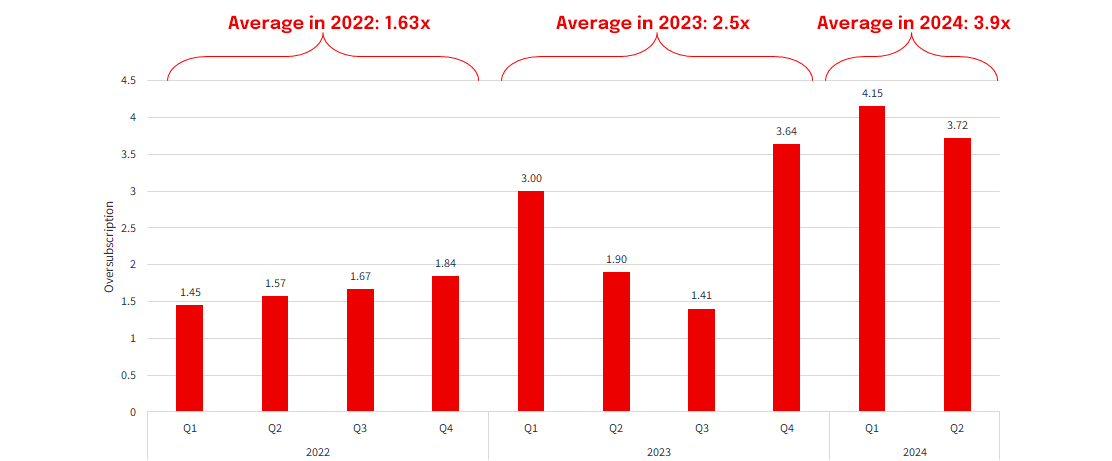

For FI, A$ oversubscription ratios reflect growth in oversubscription ratio averages and record order books achieved in quick succession from investors seeking A$ paper. Tightening Initial Price Thoughts (IPT) to reoffer has also allowed borrowers to leverage strong order books to price aggressively at final guidance.

In a similar vein, major bank A$ senior new issue concessions crunched tighter as investors sought the most liquid, high-quality, repo-eligible A$ paper.

Source: NAB Syndicate, Bloomberg as of 10 May 2024

Source: NAB Syndicate, Bloomberg as of 10 May 2024Corporates have enjoyed robust funding conditions with an increased growth in liquidity supporting corporate issuers.

While price discovery remains heightened for some sectors because of stale secondaries, airport and utility issuers have seen a moderation of pricing discovery because of the steady supply of trades.

The domestic investor landscape continues to grow as the competitive landscape for super fund flows increases.

Drivers of outcomes in A$ primary markets this year:

Investor liquidity in A$

Reduced US$ bond volumes in Asia ex-Japan

Growing investor universe and granularity in A$ order books

It remains to be seen. Geopolitics, interest rates, economic stimulus and sector resilience will all potentially drive bond market appetites and portfolio allocations in the second half of 2024. Globally, headlines from Iran/Israel and the US election are all potentially yet to weigh in on sentiment. Economic rebound/stimulus in China may also lead to a further rebound in issuance volumes, while more global stability should continue to drive lowering of credit spreads and the confidence to lock in longer spreads over time.

Within the rates outlook, expectations of a Federal Reserve rate cut have also been pushed back given recent strong inflation in the US. This may impact the relative attractiveness of AUD for regional investors. In Australia, apart from investors forced to buy during the pandemic, fund managers have reduced tenor in their portfolios because of the current interest rate environment. A return to a more normalised rates environment may allow more duration in portfolios in FI and Corporates.

But the question is: if supply and appetites continue to grow, how high will these levels be maintained, particularly when the world is debt-saturated?

At NAB, we are closely monitoring these influences to continue to provide clients with quality advice based on global and regional market experience and our world economic view.

Important Note

The information contained in this article is intended to be of a general nature only, it is not research. It has been prepared without taking into account any person’s objectives, financial situation or needs. NAB does not guarantee the accuracy or reliability of any information in this article which is stated or provided by a third party. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article. You may be exposed to investment risk, including loss of income and principal invested.

You should consider the relevant Product Disclosure Statement (PDS), Information Memorandum (IM) or other disclosure document and Financial Services Guide (available on request) before deciding whether to acquire, or to continue to hold, any of our products.

All information in this article is intended to be accessed by the following persons ‘Wholesale Clients’ as defined by the Corporations Act. This article should not be construed as a recommendation to acquire or dispose of any investments.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.