Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

Equity markets bounce back. The trade war was yesterday’s news. On #TheMorningCall Phil Dobbie talks to @NAB’s Tapas Strickland about the sharp turn around in risk sentiment.

Phil Dobbie talks to NAB’s Tapas Strickland in London about the rebound and the impact on the Aussie and Kiwi dollars.

https://soundcloud.com/user-291029717/trade-war-fears-ease-stocks-bounce-back-risk-sentiment-eases

US equities rebounded overnight boosted by “cautiously hopeful” comments from US Treasury Secretary Mnuchin over the weekend. The risk positive mood has seen the USD weakened against most currencies while UST yields are higher led by the 5y part of the curve. After the “Wrecking Ball” title in yesterday’s note , The Cardigans’ “Erase/Rewind” narrowly beat my temptation to steal my rates strategist colleague’s “Reverse Swing” title for today’s note.

US equities opened the week on a positive mood aided by Steve Mnuchin FOX TV interview on Sunday in which he expressed optimism the US can reach an agreement with China that will forestall the need to impose trade tariffs. Overnight comments from White House trade advisor Peter Navarro also helped as he confirmed the US and China are “are already at the negotiating table” while Chinese Premier Li Keqiang made conciliatory comments around opening up the Chinese market. All major US equity indices closed over 2.5% stronger, more than reversing the sharp losses recorded on Friday. Technology shares led the rebound, despite the fact that Facebook was under pressure after the Federal Trade Commission confirmed it has an open non-public investigation into Facebook’s privacy practices. Facebook shares closed 0.67% higher, after dipping more than 5% overnight.

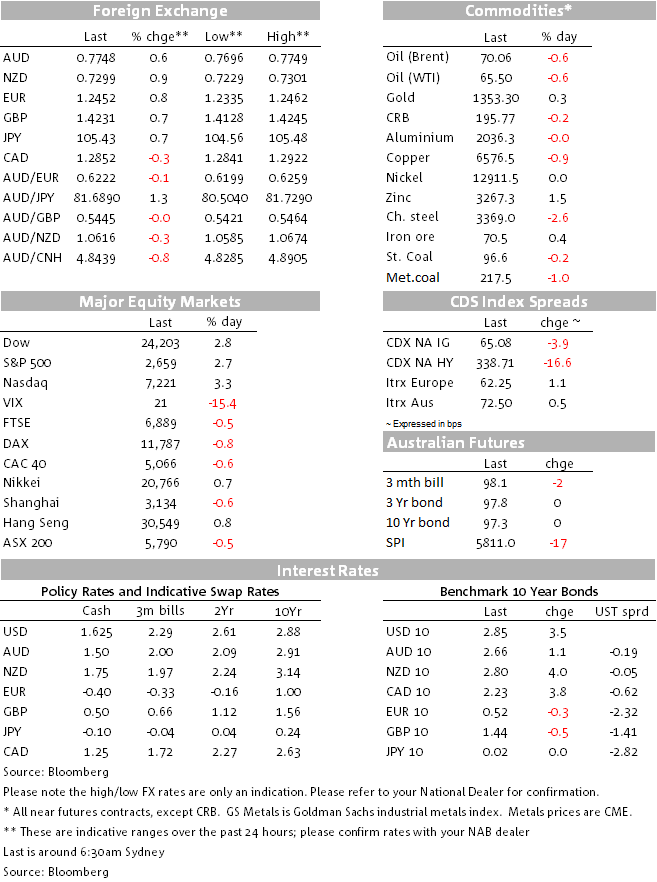

European equities on the other hand opened the week with a negative tone. The Stoxx 600 index closed 0.72% down on Monday and just over 10% lower since its highest close of 2018 on January 23. The index now trades at its lowest level since February 2017. After the softer than expected PMI prints last week, the rebound in the euro, up 0.86% over the past 24hrs appears to be weighing on sentiment and raising concerns over the growth outlook for the region. The euro is currently trading at 1.2451 after trading to a low of 1.2240 mid last week.

USD weakness was also evident in risk sensitive currencies with NOK (1.04%) and NZD ( 0.90%) leading the way in the G10 group. NZD is now knocking on the 73c mark, after trading to a low of 0.7154 last week, a level which at the time raised the prospect for a swift move sub 70c. The AUD ( 0.48%) has also benefited from the improvement in risk sentiment and after briefly trading sub 77c yesterday morning, the pair now trades at 0.7745. NZD’s outperformance has weighted on the AUD/NZD cross, the pair currently trades at 1.0611, a new 8 month low, after briefly trading to a low of 1.0585 overnight.

GBP has continued its steady ascendency against the USD, trading above the 1.42 mark for the first time since the brief spike above the level on March 22. Cable now trades at 1.4233, after reaching an overnight high of 1.4245, the 1.4345 high on January 25 is now well within sight. UK politics have not really contributed to the GBP strength overnight, however it is worth noting that Labour is said to be proposing amendments to ensure a hard Brexit is avoided in the case Parliament rejects the negotiated Brexit deal. Meanwhile, former PM Tony Blair has also reiterated his calls for a referendum on the final Brexit deal.

Ease in trade tensions has lifted almost all currencies against the USD, but JPY is the G10 exception. The yen retains its preeminent safe haven characteristics and unsurprisingly the improvement in risk sentiment has seen USD/JPY on a steady rise over the past 24hrs. The pair now trades at ¥105.41, up 0.62% over the past 24hrs.

In other news, Russia is facing a wave of diplomatic expulsions with the US and many European allies announcing a coordinated decision to expel Russian diplomats in response to the poisoning of a former Russian spy in the UK.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.